In our online gaming industry, around 310 million users are active gamers. The country has further witnessed successful growth rates in the Gaming Market, which is expected to reach 5 billion by 2025. To attract such an immense gaming community, the companies create their website, VR games, mobile gaming, and money-based games and allow other in-app purchases. Due to this gaming companies have to process lots of transactions. Now take for example a money-based card-playing game that has deposited a certain amount to use in the game and when a player wants to exit the game, they withdraw the money they still have left the game. As you see, each person playing the game makes a transaction which adds up to thousands of transactions daily.

Hence you see that gaming companies have to process a tremendous number of transactions on a daily. Now keeping track of each transaction made by each customer and checking if the payment gateway partner has withdrawn the right amount is difficult.

Cointab’s automated reconciliation software can get rid of these issues. The software does this by reconciling the internal/withdrawal report with the Payment Gateway report and reverse the Payment Gateway report. By doing this, the software can point out for which withdrawal transactions the amount withdrawn by the PG for the player is correct or not.

Reports required for Withdrawal Transactions Reconciliation

Internal/Withdrawal Report

Order IDs and information about each transaction in which a client has withdrawn money are included in this report.

Payment Gateway Report

This report consists of details of all the transactions for which the payment gateway withdraws the amount for the client.

Payment Gateway Reverse Report

Here the details of transactions that failed and had to be debited to the client again are recorded.

Cointab Result

First, the software reconciles the Internal/Withdrawal Report with the Payment Gateway Report and the Payment Gateway Reverse Report. After that, the software produces a result showing if the amount withdrawn is correct or not.

Internal / Withdrawal End

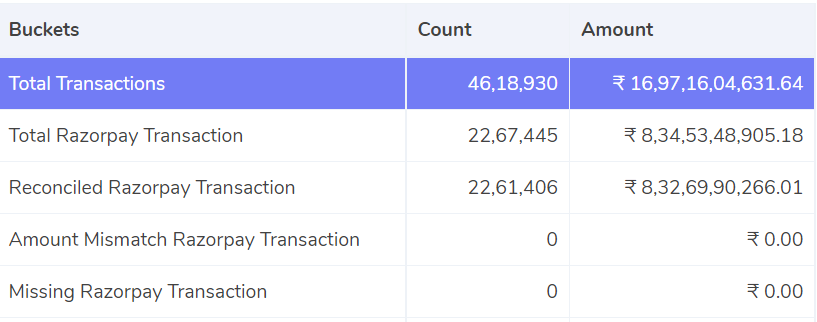

Total Payment Gateway Transactions

Here, all the transactions which are processed through the Payment Gateway are shown.

Reconciled Payment Gateway Transactions

These transactions are the same in the internal withdrawal report and in the Payment Gateway report. It means that the amounts for these transactions are correctly withdrawn.

Amount Mismatch Payment Gateway Transactions

For these transactions, the amount recorded in the Internal Withdrawal Report and the amount in the Payment Gateway report do not match. That means either an extra or lesser amount was withdrawn by the Payment gateway on these transactions.

Missing Payment Gateway Transactions

These transactions are not found in the payment gateway report but they are present in the company’s internal withdrawal report.

Payment Gateway End

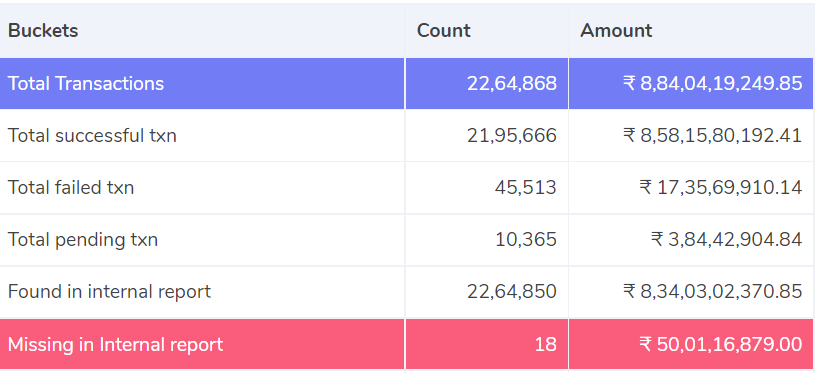

Total Successful transactions

Here the transactions in the Payment gateway and the internal withdrawal report match. These are the transactions that were completed and the amount withdrawn is also correct.

Total Failed transactions

These transactions are the ones that are not completed or the amount withdrawn is wrong.

Total pending transactions

These are the transactions that are still not yet completed, which means that the amount is still not withdrawn.

Found in internal report

Here, the transactions are found in both the payment gateway and the company’s internal report. This means that these transactions are completed and the amount withdrawn is correct.

Missing in internal report

These transactions are not found in the company’s internal withdrawal report but they are present in the payment gateway report. This means that the payment gateway has wrongly withdrawn these transaction amounts as no data for them is present in the company report.

Reverse Payment Gateway

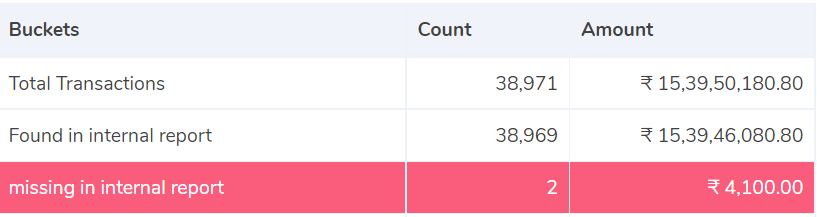

Found in the internal report

These are the transactions that are found in both the Internal report and in the payment gateway reverse report. This basically means that these are the transactions which were failed and money was not sent to the client but then later the amount was reversed by the payment gateway and sent to the client.

Missing in the internal report

These transactions are the ones that failed, so the amount was reversed and sent to the client, but no data for the same has been found in the internal withdrawal report.

As you see in the result given above, the software shows exactly if the withdrawal transactions were correct or not. It demonstrates to you how Cointab integrates the internal report of the company, the report from the payment gateway, and the reverse payment gateway report to verify the withdrawal transactions. This verification is required to determine whether the amount withdrawn by a player in a game is actually given to them correctly. Cointab hence enables your company’s financial departments to comprehend and analyze the result.

Click here to read about Deposit Transactions Reconciliation for the Gaming Industry.