Nykaa, a leading Indian e-commerce platform specializing in beauty products, offers a vast selection of cosmetics, skincare, and wellness items, connecting sellers with a large and engaged customer base. However, managing seller fees on this dynamic platform can swiftly evolve into a time-consuming and laborious task.

Cointab simplifies this challenge by automating the entire Nykaa reconciliation process. Traditionally, reconciliation necessitates the manual review of multiple Nykaa reports, data extraction, and meticulous comparison to identify discrepancies. This approach is not only tedious but also susceptible to errors. Cointab eliminates this burden by streamlining the process through automation.

Simply upload your Nykaa reports, and Cointab takes care of everything. It automatically compares your data with Nykaa’s records, highlighting any inconsistencies in fees. You’ll receive clear reports outlining potential discrepancies, allowing you to investigate and address them efficiently.

Reports Needed for Nykaa Reconciliation

- Nykaa All Order Report: This comprehensive report provides a detailed record of every single order placed on your Nykaa storefront. It includes information like product details, quantities, and order values.

- Nykaa Sales Report: This report focuses specifically on successful sales transactions. It details each completed order, including the sale price and other relevant information.

- Nykaa Payout Report: This report reveals the nitty-gritty of your Nykaa finances. It outlines all fees charged to every order, taking into account deductions for commissions, returns, and other factors. Additionally, it details any refunds issued for canceled orders.

- Bank Statement: While not directly from Nykaa, your bank statement serves as an external verification source. It reflects the actual funds deposited into your account after Nykaa has processed all the fees and deductions.

Payment Verification

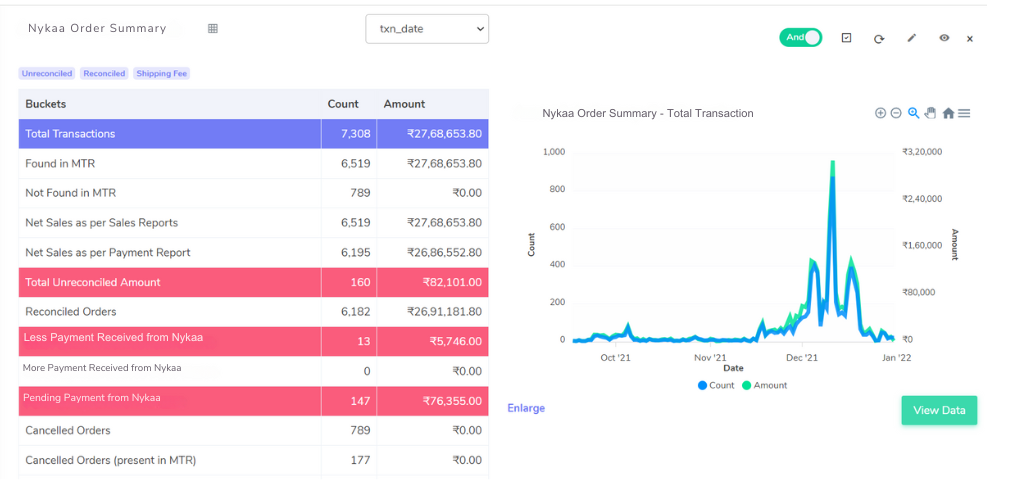

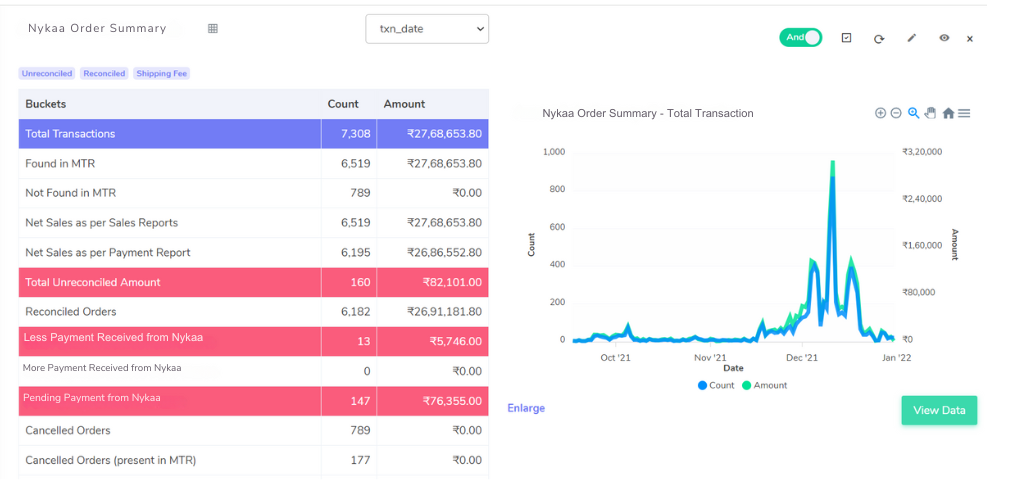

The initial verification involves creating a two-level summary of the order report.

- First Level: This level organizes data based on individual order IDs and corresponding Stock Keeping Units (SKUs).

- Second Level (Nykaa Order Summary): This level focuses on a unique order ID, providing a comprehensive overview for in-depth verification.

Verification Through Report Comparison:

The verification process leverages two key reports:

- Payout Report: This report details all fees deducted from your sales, including commissions, returns, and other charges.

- Sales Report: This report focuses on successful sales transactions, including the sale price for each order.

Nykaa compares the unique order IDs in the Nykaa Order Summary with the corresponding entries in both the Payout Report and Sales Report. This allows them to verify if the expected sales amount (as seen in the Sales Report) matches the final payout received (after deductions reflected in the Payout Report)

The result are displayed as follows

- Reconciled Transactions: This section showcases all orders where the expected sale amount (from the Sales Report) matches the final payout received (after deductions in the Payout Report). These transactions represent clear and accurate settlements.

- Less Payment Received from Nykaa (Discrepancies): This section highlights potential discrepancies where the calculated sale amount is higher than the received payout from Nykaa. These discrepancies warrant further investigation to identify any underlying issues with fees or deductions.

- More Payment Received from Nykaa (Potential Overpayments): This section identifies orders where the received payout from Nykaa exceeds the calculated sale amount. While seemingly favorable, these situations might indicate errors in Nykaa’s system and may require clarification to ensure accurate financial records.

- Pending Payment from Nykaa: This section tracks outstanding payments from Nykaa for any orders where the payout hasn’t been processed yet. This allows sellers to monitor and follow up on any pending dues. .

Bank Statement Reconciliation

- Total Transactions: This section provides a comprehensive overview of all transactions processed through your bank account during the designated reconciliation period.

- Reconciliation with Nykaa Settlement Report: This section identifies transactions where the funds deposited into your bank account precisely match the corresponding settlement amount promised by Nykaa (as detailed in the Payout Report). These reconciled transactions signify accurate financial alignment between your bank records and Nykaa’s settlement data.

- Discrepancy Identification and Analysis:

- Shortfall in Received Payment: This section flags any discrepancies where the amount deposited into your bank account falls short of the promised settlement amount from Nykaa. These shortfalls may warrant further investigation to pinpoint potential causes.

- Excess Payment Received: This section highlights instances where the bank deposit surpasses the promised settlement amount from Nykaa. These situations could indicate potential overpayments by Nykaa and may necessitate communication to ensure future settlements are accurate.

- Unidentified Transactions: This section identifies any transactions reflected in your bank statement that are absent from the Nykaa settlement report. These “unidentified” transactions could represent payments received for orders not yet processed by Nykaa or potentially external deposits unrelated to Nykaa sales.

Experience effective reconciliation with Cointab

Don’t let manual Nykaa reconciliation hold you back from growing your business. Eliminate the tedious tasks of reviewing reports, extracting data, and comparing figures. Cointab streamlines the entire process, automatically comparing your data with Nykaa’s records and highlighting any discrepancies in fees or payments. This allows you to focus on what matters most – building your brand and reaching new customers.

Sign up for a free Cointab trial today and experience the power of automated reconciliation!