Bank reconciliation is a difficult process to carry out regularly for the finance team. Simplify this process by using a reconciliation software to conduct the bank reconciliation process. To help you out we have listed a few bank reconciliation software alternatives in this article.

Manual Reconciliation is a difficult process hence many businesses are shifting to automation. With automation, the finance team can save time and effort in the reconciliation process so that they get accurate results which help make better strategic plans.

To pick the right software, it is necessary to know the benchmarks the software should fulfil. It is important to set certain parameters and then check how many of those parameters the software fulfils before making the purchase. This helps you pick a software that is the perfect fit for your business.

We have listed some features to look for in bank reconciliation software

Automated matching:

The main function a reconciliation software should have is automatic transaction matching with the respective reports. This helps reduce the manual effort spent in transaction matching, saving time and eliminating human errors.

Multiple account reconciliation:

The reconciliation software should let you reconcile multiple accounts together such as bank, payment gateway, Cash-on-Delivery and ERP etc

User-defined rules

Another important thing to look at in a software is if it lets you create custom rules for transaction matching. This helps make the results most suitable to your business as it includes your business rules/ policies.

Reconciliation reporting

The reconciliation results should give a detailed view of transactions and analytics along with highlights for discrepancies or mismatches so that you can view the summary of reconciliation easily without much effort.

Integration with other systems:

The reconciliation software should seamlessly integrate with your other systems in place such as accounting software, ERP etc. This saves time as manual work is not required and you get an overall view of all financial transactions.

Exception handling:

A feature that would be important in reconciliation is exception management. The software lets you add exceptions in case of transactions that could not be matched automatically or if payments were settled and could not be recorded. This promotes accuracy and reduces the possibility of errors.

Security and access control:

It is important to ensure that the confidential financial data uploaded to the software is protected to do so the software should have the necessary encryptions, access blocks etc.

Overall, Bank reconciliation softwares should help you streamline and get an automated approach towards reconciliation helping you get accurate reports while making analytics easier.

However, it might be difficult to choose a bank reconciliation software with many alternatives available in the market.

So we have covered our top five bank reconciliation software picks in this article so that you can choose the correct fit for your business.

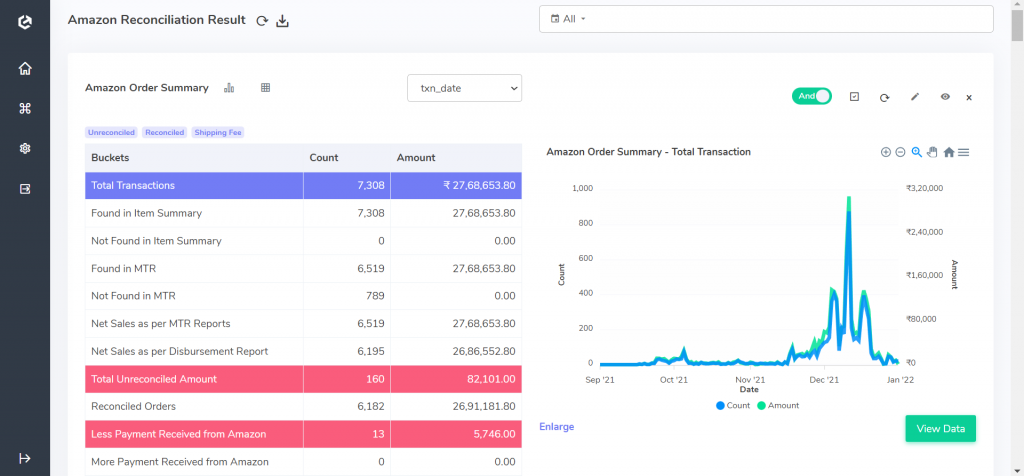

1.Cointab:

Cointab is a web-based reconciliation software. It automates the reconciliation process so the finance team can reduce the time spent in identifying errors, discrepancies and duplicates in the financial data. The software carries out bank reconciliation with any report such as payment gateway, COD remittance, invoices, ERP, OMS, internal reports etc. Due to the software’s flexible nature, it accepts any file format to load data while also letting to export data with selected fields, and columns in your preferred format directly to another software. It also enables you to customize the rules engine so that the logic conditions can be set as per your business rules or policies. The final reconciliation results are produced by the software which highlights the amount mismatches so that you can track the missing payments or the orders on which less amount is paid. This way you know on which order you can raise disputes with vendors or online marketplaces. To maintain complete accuracy the software also lets you add exceptions if some settlements are made. It further simplifies this process by letting you schedule the reconciliation to run weekly, bi-weekly or monthly so that reconciliation can run automatically without any effort on your part. Get reconciliation insights and improve the efficiency of the reconciliation process with Cointab.

2. BankRec

Bank Rec makes the bank reconciliation process much more simple while also reducing the time taken to complete the process. The software helps the finance team match transactions with its built-in matching conditions or they can set their own matching conditions. Once the result is produced it shows the mismatches along with the reason for the mismatch. This way the team can track the source of the transaction and resolve the issues. It also gives you the option to add exceptions to the transactions for which settlements were made. This way finance teams do not waste time researching errors and for resolved issues and they can directly resolve payments by adding exceptions to the results.

3. OneStream

Onestream helps in all functions related in the financial close process such as financial reporting, reconciliation, transaction matching etc. It has created various analytical and reporting tools to facilitate these processes. It eliminates the use of spreadsheets by automating the reconciliation process. The results it produces gives a statistical view of the data with an alert for high-risk items. In case any changes are made in any transactions a complete audit trail is also mentioned by the software. To view the transactions from a single source the software directly links the system to the bank account so updates are made as and when required. Since check alerts are enabled for high-risk reconciliation items managers can keep a track of changes made in the result and the balance sheet at the same time. This way managers can maintain a more accurate book of accounts as all items are reconciled in the necessary reports making financial management much more efficiently.

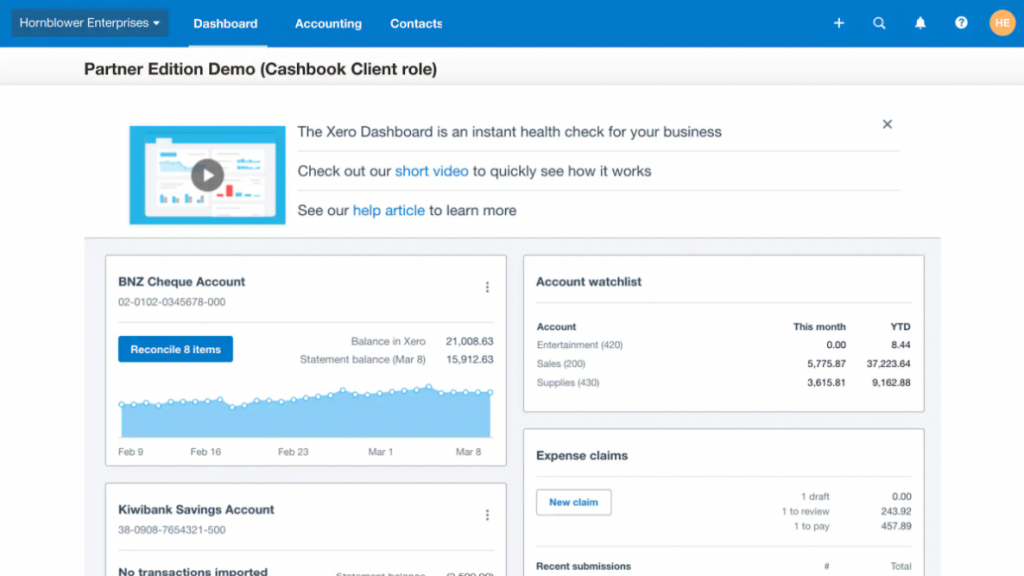

4. Xero:

Xero helps simplify many financial processes which include inventory tracking, invoicing, bill payments, bank reconciliation and other accounting functions. The Xero reconciliation system directly imports bank transactions and reconciles the data It system generates the report which helps the managers prepare budgets and manage fixed assets. With access to Xero Cashbook, the clients can set up their accounts and view the reconciliation result. Another unique feature of the software is expense suggestion which gives suggestions when reconciling data. All these functions facilitate managers in making better decisions when strategizing financial plans.

5. Zoho Books

Zoho Books provides various financial accounting services ranging from invoicing, GST, bills, and expense management to bank reconciliation. The Zoho books reconciliation system imports transactions from the bank accounts and payment gateway to reconcile the transactions and prepare a report. With the help of the reconciliation system managers will be able to check balance mismatches, expected recurring payments and past reconciliations easily. To follow the transactions properly Zoho Books lets you categorize your transactions with bank rules so no transactions are missed out. To make the matching process easier the software suggests the best match and other possible transaction matches so that you have the most accurate data available. To simplify this process even further the software gives you the option to take bulk actions when selecting, categorizing, deleting and restoring multiple transactions at a time.

Analysing the above alternatives will help pick the right software so that you can make the right purchase. Since bank reconciliation is an important process it is even more important to have a good software to support the finance team. Evaluate the alternatives and check the value the softwares adds to the reconciliation process to make the best decision for your team.