In today’s interconnected world, where commerce transcends physical boundaries, businesses require robust payment processing solutions to thrive. Among the myriad of options available, Opayo emerges as a beacon of reliability and innovation, renowned as the United Kingdom’s foremost payments provider. Formerly known as Sage Pay and now a part of the esteemed Elavon family, Opayo offers a comprehensive suite of services designed to facilitate seamless transactions for businesses of all sizes.

Whether conducting transactions online or in-store, Opayo provides a seamless platform for accepting Chip & PIN card payments, supported by a diverse array of standalone and integrated terminals. This versatility ensures that businesses can cater to the evolving needs of their customers while maintaining the highest standards of security and efficiency.

However, amidst the convenience offered by Opayo’s payment processing services, businesses often encounter the challenge of navigating through a complex landscape of fees and taxes. The intricate process of reconciling these charges can pose a significant burden on finance departments, consuming valuable time and resources.

In response to this challenge, the adoption of automated reconciliation software emerges as a transformative solution. By leveraging technology to streamline the verification process, businesses can achieve greater accuracy and efficiency in reconciling transactions with Opayo. This not only enhances operational efficiency but also instills confidence in financial management practices.

In the following discourse, we delve into the intricacies of Opayo payment gateway charges verification, exploring the reports required for accurate reconciliation and the role of automated software solutions, such as Cointab, in simplifying this critical aspect of financial management. Through this exploration, businesses can gain valuable insights into optimizing their payment processing workflows, ultimately driving growth and success in an increasingly competitive marketplace.

These reports serve as valuable tools for businesses to analyze their payment activities and understand the breakdown of fees associated with using Opayo’s services.

Opayo Payment Report:

This report provides comprehensive insights into total transactions processed through the Opayo payment gateway. It offers detailed information on the volume of transactions, including the total number and value of transactions conducted within a specified period. Additionally, the report categorizes transactions based on their respective modes, such as online payments, in-store transactions, or other channels supported by Opayo. By examining this data, businesses can gain a clear understanding of their transaction volume and distribution across different payment channels, enabling them to make informed decisions regarding their payment strategies.

Opayo Rate Card:

The Opayo Rate card is a detailed document that outlines the various payment modes supported by Opayo, along with the associated fees and percentages. This includes fees charged for different types of transactions, such as card-present transactions, card-not-present transactions, international payments, and other specialized services offered by Opayo. Additionally, the rate card provides clarity on the percentage-based fees applied to transactions, ensuring businesses are fully aware of the cost implications associated with using Opayo’s payment gateway.

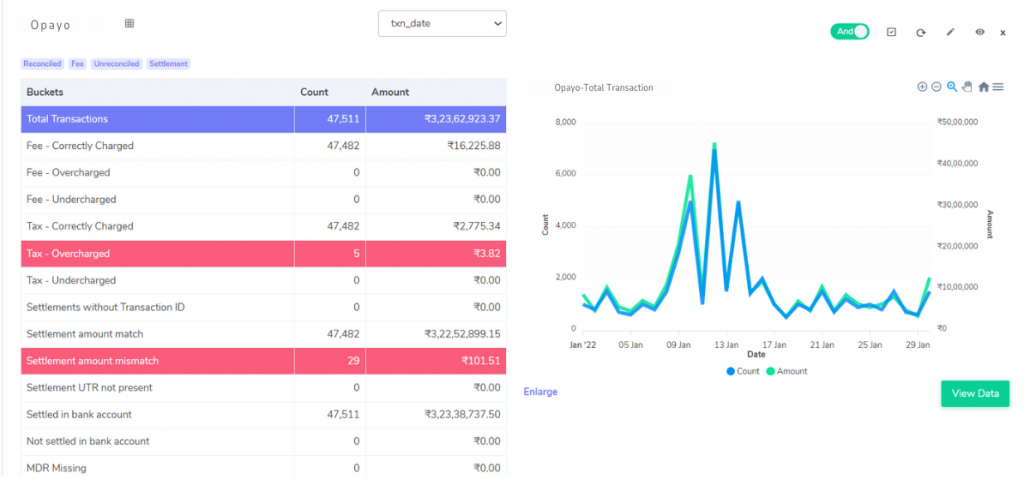

RESULT

Fee Correctly Charged:

Ensures that Opayo’s fees align with the calculations based on the Rate Card.

Fee Overcharged:

Highlights instances where Opayo’s fees exceed the calculated amount based on the Rate Card.

Fee Undercharged:

Identifies situations where Opayo’s fees fall short of the calculated amount based on the Rate Card.

Tax Correctly Charged:

Verifies that the tax recorded in the Payment Report adheres to GST guidelines.

Tax Overcharged:

Flags cases where the tax recorded in the Payment Report surpasses the calculated amount as per GST guidelines.

Tax Undercharged:

Identifies discrepancies where the tax recorded in the Payment Report is lower than the calculated amount per GST guidelines.

Settlement UTR Not Present:

Indicates instances where the Settlement report lacks a UTR (Unique Transaction Reference) number.

Settlement Amount Match:

Ensures consistency between the settlement amount mentioned in the report and the calculated amount post-deductions.

Settlement Amount Mismatch:

Identifies disparities between the settlement amount mentioned in the report and the calculated amount post-deductions.

Settled in Bank Account:

Verifies that the UTR present in the settlement report corresponds to entries in the Bank Statement.

Not Settled in Bank Account:

Flags transactions where the UTR present in the settlement report does not match entries in the bank statement.

the utilization of Cointab reconciliation software not only simplifies the complexities of Opayo payment processing but also signifies a proactive approach towards financial management. By harnessing the power of automation, businesses can transcend the limitations of manual reconciliation, reducing errors and enhancing operational efficiency.

Moreover, the seamless integration of Cointab streamlines the verification process, providing real-time insights into transactional discrepancies and empowering businesses to take prompt corrective actions. This proactive stance not only safeguards financial integrity but also fosters trust among stakeholders, bolstering the reputation of the business in the competitive landscape.

Furthermore, the time and resources saved through automation can be redirected towards strategic initiatives, driving innovation and growth. By optimizing financial processes, businesses can unlock new avenues for expansion while maintaining a strong foothold in the market.

In essence, Cointab reconciliation software emerges as a catalyst for transformation, enabling businesses to navigate the intricacies of Opayo payment gateway charges with precision and confidence. Embracing this innovative solution not only elevates operational efficiency but also paves the way for sustained success and resilience in an ever-evolving business environment.