Efficient Reconciliation of FedEx Shipping Invoice with Cointab

Effecient Reconciliation of FedEx Shipping Invoice with Cointab

In today’s interconnected world, businesses need a reliable partner for efficient worldwide product delivery. FedEx stands at the forefront as an international courier service, facilitating seamless transportation of goods and services across borders. With a proven track record of reliability and punctuality, FedEx has earned the trust of millions of customers worldwide.

Expanding your business globally requires a logistics partner that offers flexibility and efficiency. FedEx steps in seamlessly, enabling companies to reach their customers anywhere in the world. Our comprehensive network and advanced tracking systems ensure that deliveries are made on time, every time.

Managing the transportation of numerous products globally comes with its challenges, particularly in financial matters. Any discrepancies in fees or miscalculations can result in significant losses for businesses. This is where our expertise comes into play.

Introducing Cointab’s cutting-edge software solution, designed to streamline the reconciliation process for FedEx transactions. By analyzing various data points including invoices, ERP reports, rate cards, SKU reports, and pin code information, Cointab’s software identifies potential overcharges or undercharges, safeguarding your financial interests.

.

Key Reports for FedEx Reconciliation:

Invoice Verification Process:

Ensuring accuracy in financial transactions is crucial. Our software meticulously verifies the calculations in all aspects of FedEx invoices to prevent financial discrepancies.

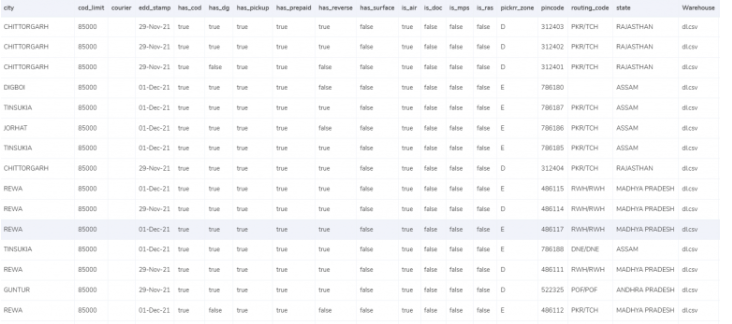

Pin Zone Report:

This report provides valuable insights into the geographic locations of deliveries, facilitating efficient tracking and recording.

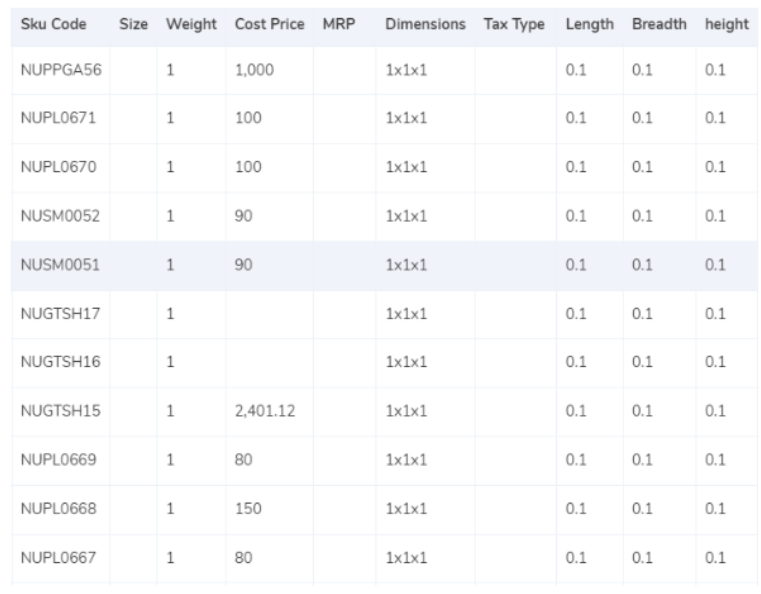

SKU Report:

Keeping track of products with SKU numbers allows for precise monitoring of product weight and dimensions, ensuring accurate billing.

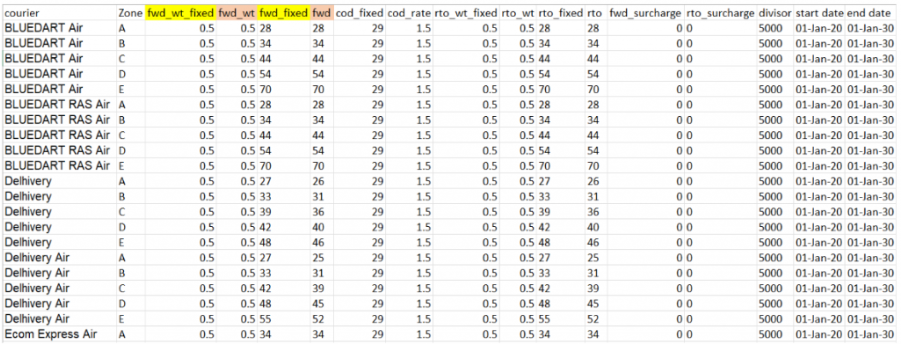

Rate Card:

Stay updated with the latest rates applicable for different shipping scenarios, ensuring transparency and fair pricing.

FedEx Invoice Analysis:

Our software dissects FedEx invoices to examine order IDs, billing zones, product types, weights, rates, and other crucial details, ensuring accuracy and transparency in billing.

In-depth Analysis:

SKU Report:

SKU reports play a pivotal role in ensuring accurate billing by providing detailed information on product weight and dimensions. This enables businesses to verify the charges applied by FedEx accurately.

The software algorithm integrates the weight data provided in the ERP report, alongside the Item SKU, which furnishes essential information such as gross weight and product dimensions.

In scenarios where product dimensions are absent, the software cross-references the expected weight column in the invoice to ascertain the gross weight.

Alternatively, when product dimensions are available, the volumetric weight is computed using the formula “Length x Width x Height”. It’s imperative for these dimensions to be in centimeters for accurate computation. The resulting value is then divided by the divisor stipulated in the divisor card. If the divisor isn’t specified, a default divisor of 5000 is applied.

Subsequently, all computed values are integrated into the ERP report before being transferred to the FedEx invoice.

Finally, the computed weight undergoes rounding to determine the final weight classification.

Zone

The concept of “zone” in the context of deliveries encompasses the precise geographical location where the delivery is conducted. The determination of the accurate zone entails a meticulous process involving the utilization of the billing pin code. This pin code serves as a crucial reference point, meticulously matched with the expected zone field within the invoice framework, facilitating the precise allocation of zones.

Pin codes, delineated into distinct tiers such as local, regional, national, and more, play a pivotal role in zone assignment. Each tier is associated with its unique identifier, typically denoted by letters such as a, b, c, and so forth, contributing to the comprehensive zoning system’s efficiency and accuracy.

The process of zone determination, relying on such meticulous pin code categorization and matching, forms an integral part of the logistics framework, ensuring streamlined and precise delivery operations.

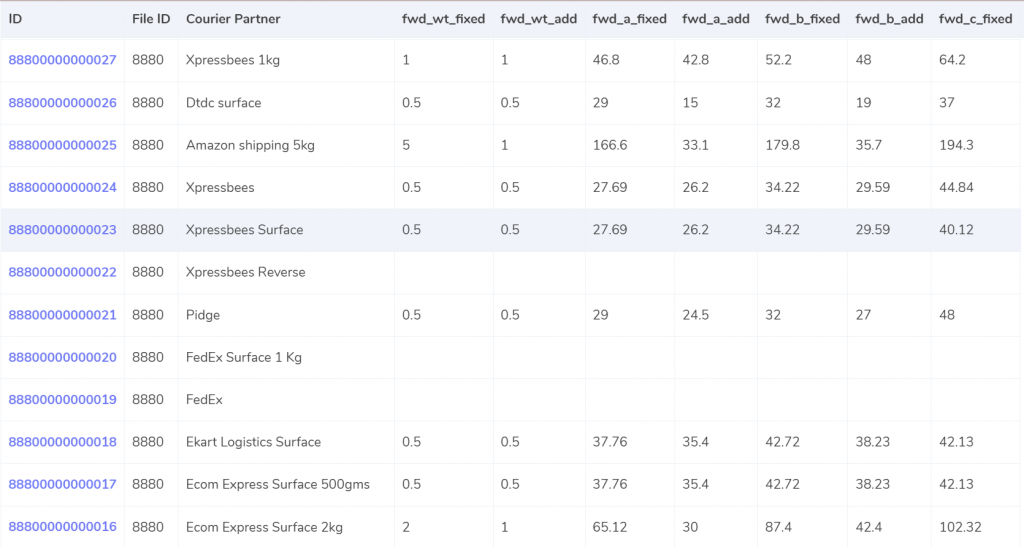

Rate Card:

As elucidated earlier, the rate card serves as a comprehensive reference detailing rates contingent upon both the delivery zone and the weight of the order. Charges are meticulously structured, accounting for products within the permissible weight limit, with variations depending on weight extensions. This dynamic pricing model applies uniformly to both Forward charge and RTO deliveries, ensuring fairness and transparency across transactions.

The columns within the rate card, including “courier,” “zone,” “fwd_wt_fixed” (representing the additional weight triggering fixed rate increases), and the “divisor,” are cross-referenced with their counterparts in the FedEx invoice. This meticulous verification process ensures precise itemization and accurate billing, mitigating discrepancies and ensuring seamless financial transactions.

It’s noteworthy that the rates specified within the rate card are time-bound, applicable only for a specific duration. Consequently, it becomes imperative to ascertain whether the delivery date falls within the specified validity period, ensuring adherence to the agreed-upon pricing terms and conditions.

Charges:

Projected Forward Charge:

In instances where the final slab calculation equates to or falls below the weight threshold (“fwd_wt_fixed”) stipulated in the rate card, denoting equality with “fwd_wt_fixed,” the associated fee is a fixed charge (“fwd_fixed”). Conversely, if the calculation exceeds the “fwd_wt_fixed” value, signifying additional weight, the fee for the excess weight is represented by “fwd_a_add.” Therefore, the anticipated charge can be determined utilizing the following formula:

Expected_fwd_chg = fwd_fixed + (extra_weight) x fwd_a_add

Anticipated RTO Charges:

Should the final slab calculation align with or fall beneath the specified weight limit (“rto_wt_fixed”) in the rate card, coinciding with “rto_wt_fixed,” the corresponding fee is designated as “rto_fixed.” Conversely, if the calculation surpasses the “rto_wt_fixed” parameter, indicating excess weight, the fee for the additional weight is indicated by “rto_wt_add.” Hence, the projected charge can be computed using the subsequent formula:

Expected_rto_chg = rto_fixed + (extra_weight) x rto_add

Projected COD Charges:

The higher of either the “cod_fixed” value or a percentage (“cod_rate”) of the “item_price” is employed as the expected COD charge.

Projected Total Amount:

The summation of the expected forward charge, anticipated RTO charge, projected COD charge, and expected GST yields the final amount.

Navigating Financial Precision: Cointab Reconciliation Software Metrics

2M

1.6B

$37B

Outcome:

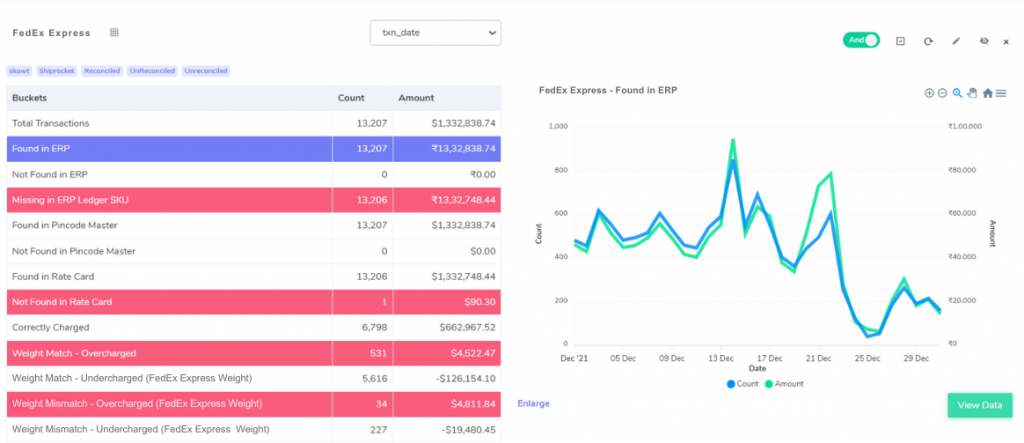

Upon deriving the projected final amount subsequent to zone and order weight computation, Cointab conducts reconciliation of ERP orders, Pincodes, and rate card data with values reflected in the FedEx Invoice.

ERP:

Detected in ERP Report:

The presence of orders within the FedEx invoice is confirmed by their reflection in the ERP report. This synchronization enables a seamless flow of data, wherein the ERP report meticulously records the number of products fulfilled for each order. Such detailed documentation proves invaluable in accurately determining the weight of each product, thereby laying the groundwork for subsequent verification and validation processes.

Not Detected in ERP Report:

In contrast, instances where orders featured in the FedEx invoice fail to find corresponding entries within the ERP report are flagged as “Not Found in EPR report.” This discrepancy underscores the significance of data integrity and completeness. Within the ERP report, the recorded quantity of products dispatched per order serves as a crucial reference point. However, in scenarios where this alignment is absent, the verification of product weight becomes a more intricate task due to the disparity between the two datasets.

Insight into Pin Code Analysis:

Identified in Pincode Master

The deliveries reflected in the FedEx invoice reports align seamlessly with entries in the pincode master documentation. This alignment holds significant importance as deliveries are categorized and charged based on geographical zones, spanning nationally, regionally, and beyond. With the pincode information duly recorded in the master database, comprehensive verification of the report becomes feasible, ensuring accuracy and reliability in zone-wise delivery allocations.

Not Identified in Pincode Master:

Conversely, certain order deliveries featured in the FedEx invoice reports fail to find correspondence within the pincode master documentation. Termed as “Not found in Pincode master,” these instances warrant meticulous attention. Given the zone-specific nature of deliveries, discrepancies between the Pincode and the pincode master database pose challenges in data verification. In such cases, where alignment is lacking, the veracity of the data remains unverifiable, emphasizing the need for thorough investigation and rectification.

Insight into Rate Card Analysis:

Identified in Rate Card:

The presence of order entries within both the rate card and the FedEx statement signifies a harmonious alignment between these crucial documents. This congruence serves as a pivotal indicator, suggesting that the rates assigned to each order can undergo meticulous verification, thereby facilitating seamless progression in the reconciliation process.

Not Identified in Rate Card:

Conversely, instances where order entries featured in the FedEx statement fail to find representation within the rate card are designated as “Not found in Rate card.” This divergence raises pertinent concerns regarding rate verification and subsequent reconciliation efforts. In such scenarios, where discrepancies between the two documents arise, the verification and reconciliation of order rates become challenging, potentially hindering the seamless flow of operations.

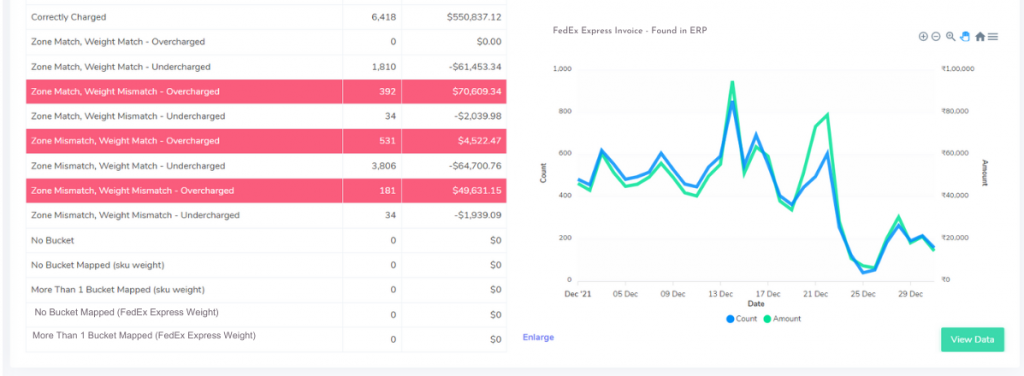

Insight into Fee Verification using ERP – FedEx:

Accurate Charge Verification:

The software conducts a comprehensive comparison between the ERP report and the FedEx invoice, identifying instances where the zone and product weight align correctly. Fees calculated using the rate card seamlessly match those reflected in the FedEx invoice, ensuring precise charge verification.

Zone Match, Weight Match – Overcharged:

In cases where the zone and product weight are congruent across both the ERP report and the FedEx statement, yet discrepancies exist in the fee charged, the software flags it as overcharged. The discrepancy arises from the invoice charges exceeding the calculated amount.

Zone Match, Weight Match – Undercharged:

Similarly, when the zone and product weight align accurately but the fee charged deviates from the calculated amount, it is identified as undercharged. In such instances, the invoice reflects a lesser amount than the expected calculated value.

Zone Mismatch, Weight Match – Overcharged:

Discrepancies arise when the product weight matches across both reports, but the zone and corresponding fee do not align. This mismatch results in an overcharged amount compared to the calculated fee.

Zone Mismatch, Weight Match – Undercharged:

Conversely, when the product weight matches, but discrepancies exist in the zone and corresponding fee, it results in undercharged fees. The invoice reflects a lesser amount than the anticipated calculated value due to this discrepancy.

Zone Match, Weight Mismatch – Overcharged:

Instances where the product weight and zone align, yet discrepancies exist in the corresponding fee, result in overcharged fees. The calculated fee exceeds the amount reflected in the invoice due to this mismatch.

Zone Match, Weight Mismatch – Undercharged:

Similarly, when the product weight mismatches, but the zone aligns, it leads to undercharged fees. The invoice reflects a lesser amount than expected due to this discrepancy in calculated and invoiced fees.

Zone Mismatch, Weight Mismatch – Overcharged:

Discrepancies in zone, product weight, and corresponding fee across both reports result in overcharged fees. The invoiced amount exceeds the calculated fee due to these mismatches.

Zone Mismatch, Weight Mismatch – Undercharged:

Conversely, when discrepancies exist in zone, product weight, and corresponding fee, it leads to undercharged fees. The invoiced amount is lesser than the calculated fee due to these mismatches.

Don't waste time on manual financial reconciliation. Let our Reconciliation software do the work for you.

Cointab’s advanced software not only streamlines the fee verification process but also serves as a robust tool for ensuring accuracy and efficiency in business operations. By meticulously comparing ERP reports with FedEx invoices, the software identifies discrepancies in charges, zones, and product weights, empowering businesses to rectify errors promptly and enhance financial transparency.

Moreover, Cointab’s software goes beyond mere identification of discrepancies by offering actionable insights and recommendations. Whether it’s rectifying errors internally or initiating disputes with FedEx, clients can leverage the software’s results to drive informed decision-making and expedite resolution processes.

Overall, Cointab’s software represents a significant asset for businesses seeking to optimize their invoicing processes, mitigate financial discrepancies, and foster stronger partnerships with logistics providers like FedEx. With its user-friendly interface and comprehensive functionalities, Cointab enables businesses to navigate complex fee verification procedures with confidence and efficiency, ultimately contributing to improved operational performance and sustained growth.

Discover the transformative capabilities of Cointab’s software today, and unlock new avenues for enhancing efficiency, accuracy, and transparency in your invoicing and reconciliation workflows