Eway processes secure credit card payments for its merchants. It is an omnipresent payment provider, which provides its cstomers with all types of payment facilities at their required time and place. It later partnered with major SaaS companies to provide integrated payment services.

When you partner with a payment gateway such as Eway, it charges your business certain fees and taxes. Some cases might arise, where your business has been either overcharged or undercharged by payment gateway. Cointab reconciliation software can help you verify the fees and charges in an automatic manner. In case, you have been overcharged you can make a claim with Eway to rectify the miscalculations.

Reports required for Eway Payment Gateway Charges verification:

Eway payment report:

It provides you with the report of total transactions and from which mode the transaction has been carried out.

Eway Rate card:

The rate card consists of the fee, percentage which are charged and the payment mode, which is used.

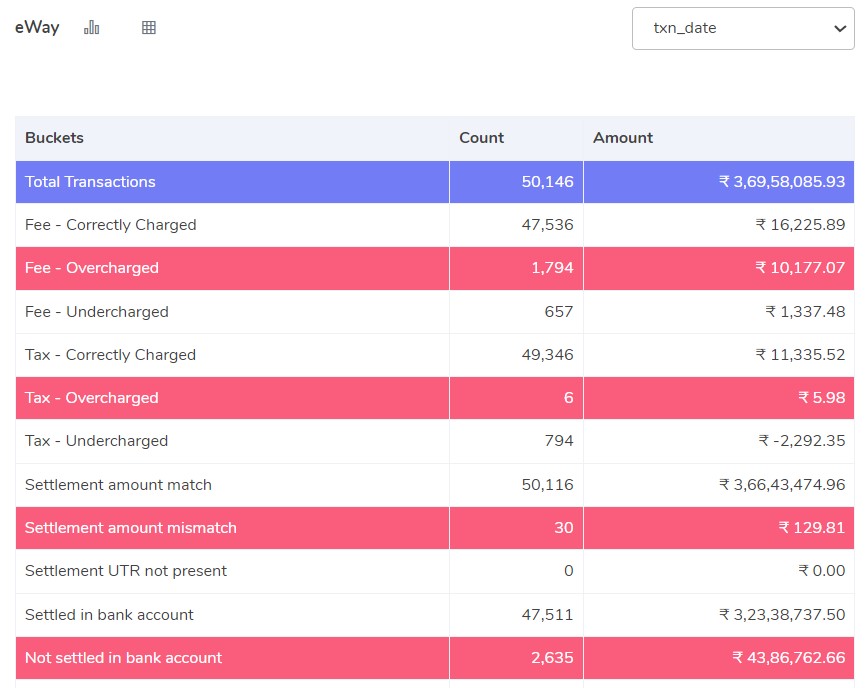

Results:

/*! elementor – v3.15.0 – 20-08-2023 */

.elementor-widget-image{text-align:center}.elementor-widget-image a{display:inline-block}.elementor-widget-image a img[src$=”.svg”]{width:48px}.elementor-widget-image img{vertical-align:middle;display:inline-block}

Fee correctly charged:

The fees charged by Eway correctly match the amount calculated using the rate card.

Fee overcharged:

Here fees have been overcharged by Eway, and are seen to be more than the amount calculated using the rate card.

Fee undercharged:

In this case, the fees charged by Eway are seen to be less than the amount calculated using the rate card.

Tax-correctly charged:

The tax in the payment report matches the tax amount calculated as per the GST guidelines.

Tax- overcharged:

The tax amount in the payment report is seen to be more than the amount calculated using GST guidelines.

Tax- undercharged:

The tax amount recorded in the payment report is seen to be less than the amount calculated using GST guidelines.

Settlement UTR not present:

UTR is not present in the payment report for these given transactions.

Settlement amount match:

The settlement amount is the total amount from which tax and fees are deducted. The settlement amount calculated should match the settlement amount received from the Eway report then it is said that the settlement amount matches.

(Settlement Amount = Total Amount – Fees – Tax)

Settlement amount mismatch:

The settlement amount refers to the total amount from which tax and fees are deducted. If the settlement amount calculated does not match the settlement amount received from the Eway report, it is said that the settlement amount is mismatched.

Settled in bank account:

The UTR is present in the settlement reports and is also found in bank statements.

Not settled in bank account:

The UTR is present in the settlement report but is not found in the Bank’s statements.

After the results have been obtained you can make a claim with Eway in case the fees have been overpaid. Use Cointab Reconciliation software to easily reconcile transactions and save your finance department valuable time and effort. Using the software not only increases your efficiency but also provides you with accurate results. Bid goodbye to manually reconciling the transactions and automate the reconciliation of transactions.