In today’s fast-paced business environment, managing finances efficiently is crucial. Venmo, a popular mobile payment platform, simplifies transactions for both businesses and individuals. However, keeping track of Venmo transactions alongside other financial data like website reports, ERP systems, and bank statements can be a tedious and error-prone manual process. This is where automated Venmo payment gateway reconciliation comes in.

Demystifying Venmo Payment Gateway Reconciliation:

For a clear understanding of Venmo reconciliation, let’s delve into the various reports involved:

Venmo Settlement Reports:

These reports detail completed orders and corresponding payments made through Venmo.

Venmo Refund Reports:

These reports track canceled or refunded orders processed via Venmo.

Website Reports:

These reports encompass all orders placed through your website.

ERP Reports:

These reports contain internal order data maintained by your company’s Enterprise Resource Planning system.

Bank Statements:

These statements reflect all transactions processed through the Venmo payment gateway.

Cointab Reconciliation: Venmo with website reconciliation

We have got the perfect reconciliation solution for you!

Sign up for the Demo!

We have got the perfect reconciliation solution for you!

Sign up for the Demo!

Cointab Reconciliation: The Automated Solution for Accurate Venmo Data

Cointab’s automated reconciliation software eliminates the hassles of manual reconciliation. Our software is designed to adapt to your specific needs, offering a customized approach to verifying your Venmo transactions with unmatched ease and precision.

Cointab’s reconciliation software seamlessly integrates with your existing systems, including website reports, ERP data, and bank statements. It then meticulously compares this information with the invoices provided by Venmo to achieve comprehensive data reconciliation and deliver accurate results. Focus on Growth, Leave Reconciliation to Cointab.

Cointab’s automated solution empowers you to:

Free Up Valuable Time:

Automate the entire reconciliation process, allowing you to dedicate your valuable time and resources to core business activities.

Minimize Errors:

Eliminate the risk of human error inherent in manual reconciliation, ensuring data accuracy and integrity.

Gain Valuable Insights:

Access detailed reports that pinpoint discrepancies, enabling you to promptly address any issues.

Make Data-Driven Decisions:

Confidently leverage reliable financial data for informed business decisions.

Scale with Confidence:

Efficiently handle large volumes of transactions with ease.

Verify Fees:

Verify the accuracy of fees charged by Venmo.

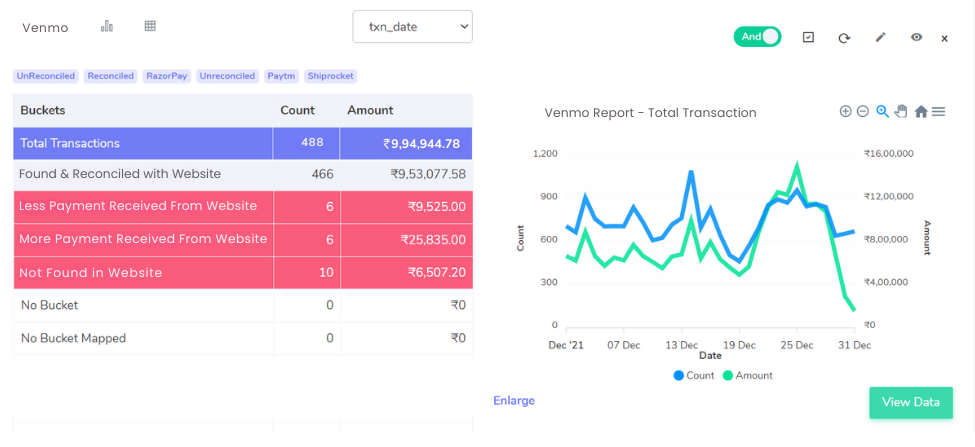

Venmo with website reconciliation

Matched Transactions:

These transactions appear in both your Venmo settlement report and your website report.

Discrepancies in Transaction Amounts:

Higher on Website:

The website report reflects a higher amount compared to the Venmo settlement report. (Consider adding a reason for the discrepancy if known, for example, fees)

Lower on Website:

The website report displays a lower amount compared to the Venmo settlement report. (Similar to above, consider a reason)

Missing Transactions:

These transactions exist only in the Venmo settlement report, not on your website report.

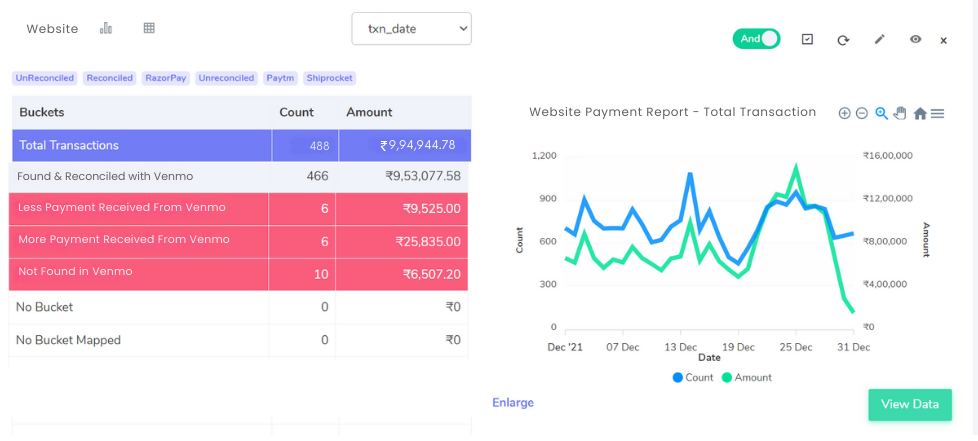

Website with Venmo reconciliation:

Matched Transactions:

Ensuring Accuracy –

These transactions seamlessly match between your Venmo settlement report and your website report, reflecting consistent financial data.

Reconciling Discrepancies:

Lower Received in Venmo:

Identifying discrepancies is crucial. This scenario might occur due to:

Website Reflecting Fees:

Transaction fees applied on your website platform could explain the difference.

Partial Refunds:

If you issued partial refunds to customers, the website report might show the original amount, while Venmo reflects the final amount received.

More Received in Venmo:

Investigate these instances for potential explanations:

Chargebacks Reversed:

If a customer initiated a chargeback that was later reversed, Venmo would reflect the full amount received.

Promotional Adjustments:

Website promotions or discounts might cause a lower reported amount compared to Venmo’s settlement.

Canceled Transactions:

Capturing Complete Data – Canceled transactions initiated by the customer will appear only on your website report, not in the Venmo settlement reports.

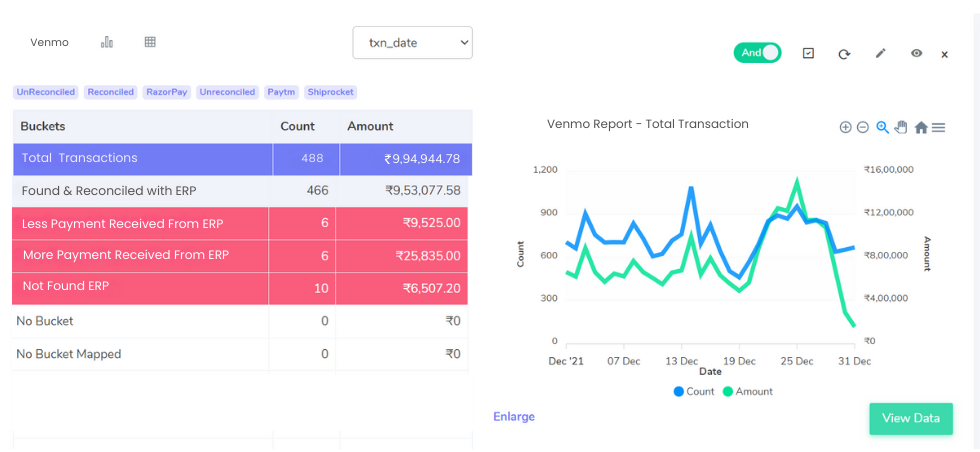

Venmo reconciliation with ERP

Matched Transactions:

Streamlined Data – These transactions seamlessly match between your Venmo settlement report and your Enterprise Resource Planning (ERP) system, guaranteeing data consistency.

Resolving Discrepancies:

Higher Amount in ERP Report:

Investigate these discrepancies to ensure accurate financial records:

Taxes or Fees:

The ERP report might include taxes or fees not reflected in the Venmo settlement amount.

Shipping Costs:

Shipping costs associated with the transaction might be captured in the ERP but not in Venmo.

Lower Amount in ERP Report:

Identify the cause for potential adjustments:

Discounts or Promotions:

Discounts or promotions offered through your website might lead to a lower reported amount in the ERP compared to Venmo.

Partial Refunds:

Partial refunds issued to customers might be reflected in the ERP but not yet settled in Venmo.

Missing Transactions in ERP Report:

Capturing Complete Data – Transactions existing only in the Venmo settlement report, not the ERP report, might indicate:

Manual Venmo Transactions:

These could be manual payments made directly through Venmo that haven’t been integrated with the ERP.

Recent Transactions:

Newly processed Venmo transactions might take time to sync with your ERP system.

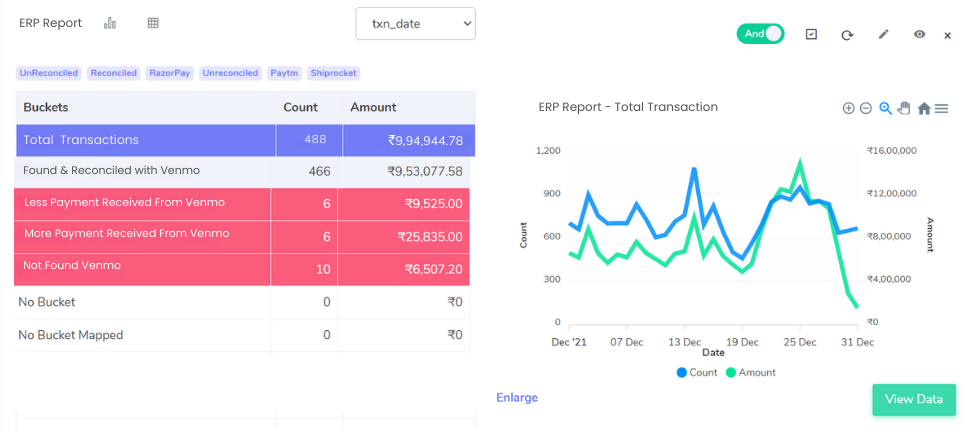

ERP report with Venmo reconciliation:

Matched Transactions:

Ensuring Data Consistency – These transactions seamlessly match between your Venmo settlement report and your Enterprise Resource Planning (ERP) system, guaranteeing data accuracy.

Reconciling Discrepancies in Received Amounts:

Less Received from Venmo:

Investigate these discrepancies to maintain financial clarity:

Website Fees:

Transaction fees charged on your website might be reflected in the ERP but not the Venmo settlement amount.

Refunds Processed:

If you issued refunds to customers, the ERP report might show the original sales amount, while Venmo reflects the final settlement.

More Received from Venmo:

Understand these instances for potential reasons:

Reversed Chargebacks:

If a customer initiated a chargeback that was later reversed, Venmo would reflect the full amount received.

Promotional Adjustments:

Website promotions or discounts might cause a lower reported amount in the ERP compared to Venmo’s settlement.

Identifying Missing Venmo Transactions:

Capturing All Data – Transactions existing only in your ERP reports, not the Venmo settlement report, could indicate:

Manual ERP Entries:

These could be manual sales entries made directly in the ERP that haven’t been integrated with Venmo.

Unlinked Accounts:

Ensure your Venmo account is correctly linked to the ERP system to avoid missing transactions.

Canceled Transactions:

Understanding Customer Actions – Canceled transactions initiated by the customer will appear only on your ERP report, not in the Venmo settlement reports, as they never reached the payment processing stage.

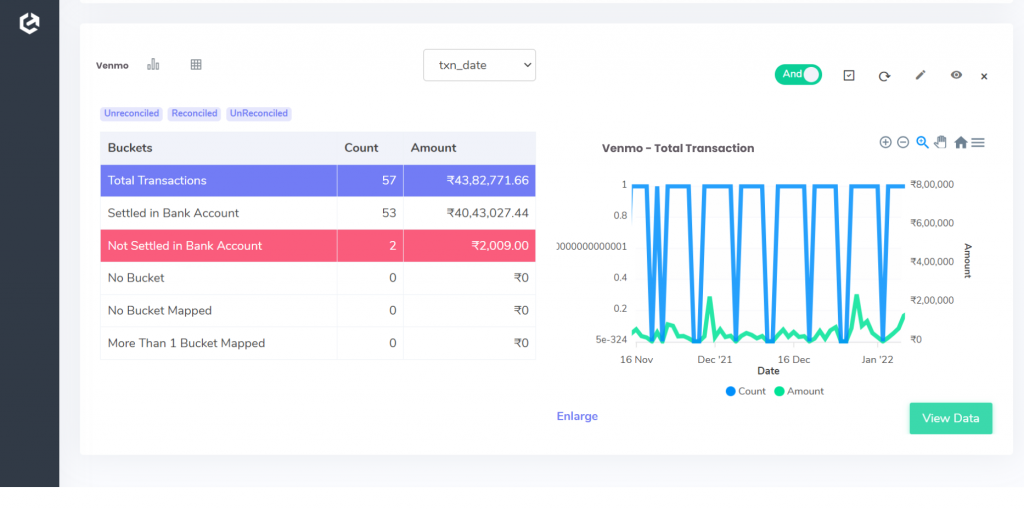

Venmo with Bank reconciliation

Settled in Bank Account:

Green Light for Transactions – These transactions appear in both your bank account and the Venmo settlement report, confirming a successful transfer of funds.

Not Settled in Bank Account Yet:

Understanding the Wait – These transactions are visible only in the Venmo settlement report, indicating they haven’t reached your bank account. Here are some possible reasons:

Pending Transactions:

The transfer might still be processing between Venmo and your bank. This usually resolves within a few business days.

Upcoming Deposits:

The settlement date for the transaction might be scheduled for a future date. Check the settlement report for details.

Manual Entries:

In rare cases, transactions might be manually entered into the Venmo settlement report but not initiated through your bank account. Investigate these for accuracy.

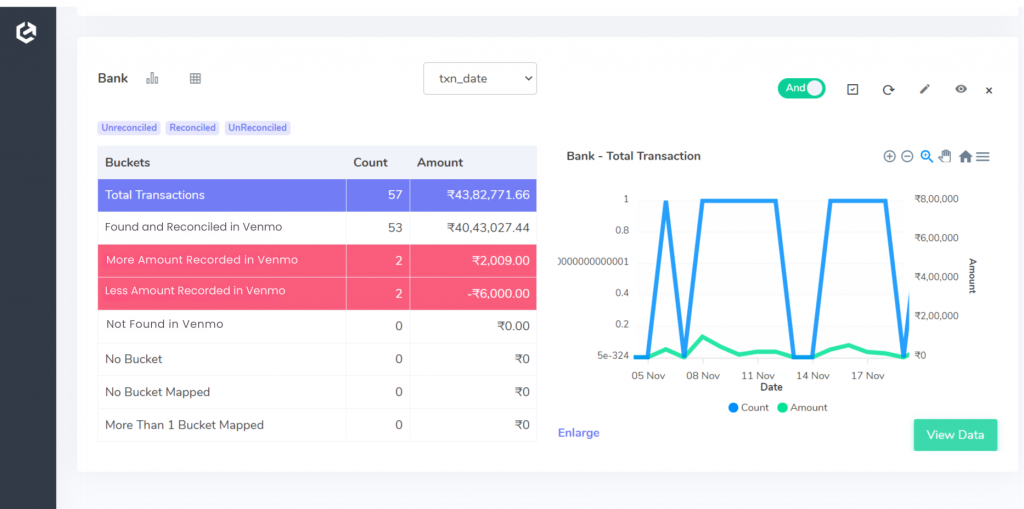

Bank reconciliation with Venmo

Matched Transactions:

Ensuring Consistency – These transactions seamlessly match between your Venmo settlement report and your bank statement, guaranteeing data accuracy.

Discrepancies in Transaction Amounts: Identifying Differences:

More Amount Recorded in Venmo:

Investigate these variations to maintain financial clarity:

Refunds Processed:

If you issued refunds to customers, the Venmo report might show the original sales amount, while your bank statement reflects the final settlement.

Dispute Resolutions:

Resolved disputes in your favor through Venmo might lead to a higher amount in the settlement report compared to the initial bank transaction.

Less Amount Recorded in Venmo:

Understand these instances for potential reasons:

Bank Fees:

Fees charged by your bank for the transaction might be reflected in the bank statement but not the Venmo settlement amount.

Currency Conversions:

If the transaction involved a currency conversion, there might be slight variations due to exchange rates between when Venmo settles and your bank processes the transaction.

Transactions Missing from Venmo:

Capturing All Data – Transactions existing only in your bank reports, not the Venmo settlement report, could indicate:

Unlinked Accounts:

Ensure your bank account is correctly linked to Venmo to avoid missing transactions.

External Deposits:

Deposits made directly to your bank account might not be reflected in Venmo if they weren’t processed through the platform.

Embrace Seamless Reconciliation with Cointab

Cointab’s automated reconciliation software surpasses the limitations of manual reconciliation by effortlessly verifying the reports mentioned above. It streamlines the entire process, guaranteeing accuracy and eliminating the possibility of human error. This empowers you to make critical business decisions based on reliable and trustworthy financial data. Additionally, Cointab efficiently handles high transaction volumes, ensuring scalability for businesses of all sizes.

Experience the Power of Cointab Reconciliation Today!

Don’t let tedious manual reconciliation hinder your business growth. Leverage Cointab’s automated solution to gain valuable time, minimize errors, and achieve financial clarity.

Step into the future of reconciliation. Fill out the form to request your demo now!

Step into the future of reconciliation. Fill out the form to request your demo now!