In the dynamic landscape of European e-commerce, Mollie stands out as one of the fastest-growing payment processors, empowering businesses of all sizes to thrive with seamless online transactions. With a strategic focus on facilitating a diverse array of payment methods, including localized options, Mollie effectively dismantles barriers, enabling companies to compete more effectively. By offering convenient and dependable online payment solutions, Mollie ensures a frictionless experience for both merchants and customers alike.

Seamless Transactions, Secure Payments:

Mollie provides a robust platform for websites to engage in secure transactions with customers. By leveraging Mollie’s services, businesses can streamline their payment processes, enhancing user experience and fostering trust among their clientele. However, accessing Mollie’s services entails certain fees and charges, which are deducted from the total transaction amount before the remainder is transferred to the business.

Streamlining Financial Operations with Cointab Reconciliation Software:

In the realm of online transactions, accuracy is paramount. It’s not uncommon for discrepancies to arise, leading to either overcharged or undercharged fees by Mollie. Manual verification of these transactions can be arduous and time-consuming for finance teams. Here enters Cointab Reconciliation software, a powerful tool designed to automate the reconciliation process, swiftly identifying any discrepancies in Mollie’s deductions.

Key Reports for Verification of Mollie Payment Gateway Charges:

Mollie’s Payment Report:

This report provides insights into total transactions and their respective modes, offering a comprehensive overview of payment activities.

Mollie Pay Rate Card:

Detailing payment modes and associated fees, this card serves as a reference point for verifying the accuracy of charges.

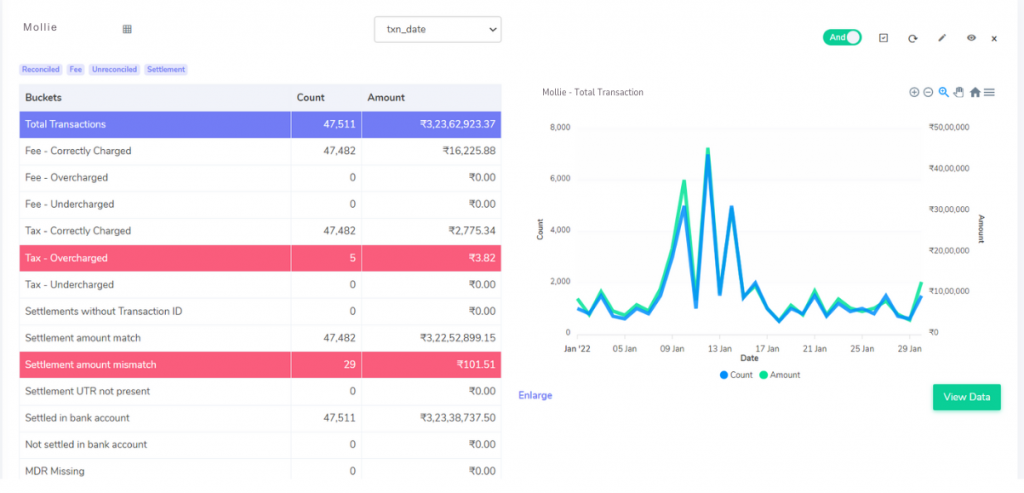

Identifying Discrepancies

Fee Correctly Charged:

Ensures that fees deducted by Mollie align with the amounts specified in the Rate Card.

Fee Overcharged/Undercharged:

Discrepancies between fees charged by Mollie and those specified in the Rate Card are flagged for further investigation.

Tax Correctly Charged/Overcharged/Undercharged:

Similar to fees, discrepancies in tax deductions are meticulously examined against GST guidelines.

Settlement UTR:

Verification of Unique Transaction Reference (UTR) ensures completeness and accuracy of settlement reports.

Settlement Amount Matching/Mismatching:

Compares calculated settlement amounts with those reported by Mollie, identifying any disparities.

Settled in Bank Account/Not Settled in Bank Account:

Discrepancies between settlement reports and bank statements are scrutinized to ensure all transactions are accounted for.

Leveraging Automation for Efficiency:

Cointab Reconciliation software revolutionizes the reconciliation process, offering a swift and accurate means of verifying Mollie’s deductions. By automating this task, businesses can expedite the identification of discrepancies, thereby enabling timely resolution and optimization of financial operations.

Enhancing Efficiency, Ensuring Accuracy:

In the realm of e-commerce, where every transaction counts, the ability to verify payment gateway charges with precision is indispensable. By harnessing the power of Mollie’s payment processing capabilities and augmenting it with Cointab Reconciliation software, businesses can unlock greater efficiency and accuracy in their financial operations. With streamlined processes and timely identification of discrepancies, businesses can not only optimize their revenue streams but also enhance customer trust and satisfaction.

Step into the future of reconciliation. Fill out the form to request your demo now!