India’s government actively promotes a shift towards a cashless economy, and Paytm stands as a key player in this movement. As a leading digital payments and financial services company, Paytm empowers both consumers and merchants to embrace cashless transactions. Merchants benefit from Paytm’s QR code technology, allowing them to receive payments electronically. By connecting their bank accounts to the QR code, a seamless transaction occurs. Customers simply scan the code to pay, and the funds are instantly transferred from their account to the merchant’s bank account.

Managing a large number of daily Paytm transactions can be overwhelming. Manually verifying each transaction with your bank statement is not only tedious but impractical.

<h1 style="font-size: 25px; cCointab- automated solution to reconciliation

Cointab offers a revolutionary solution that automates the entire Paytm Instore reconciliation process, saving you valuable time and ensuring accurate payments. Cointab streamlines the verification process and minimizes errors by automatically gathering the necessary data from relevant sources and meticulously comparing it against your pre-defined reports. The system then generates easy-to-understand reports, highlighting any discrepancies that require further investigation. This allows you to quickly identify and address potential issues.

Reports required for reconciliation

- Paytm Offline Reports: This comprehensive report details all transactions processed through Paytm QR codes at your store. It provides a clear record of every customer payment made using Paytm.

- Bank Statement: This serves as your official record of all financial transactions occurring within your bank account. It includes deposits, withdrawals, and any fees or charges associated with your account.

Bank Reconciliation Process:

- Matched Transactions: These transactions appear in both reports, confirming successful deposits from Paytm into your bank account.

- Unmatched Transactions: These transactions are recorded in your Paytm Offline Reports but are missing from your bank statement. This might indicate missing deposits or processing errors. Cointab empowers you to investigate further and ensure you receive all your due funds.

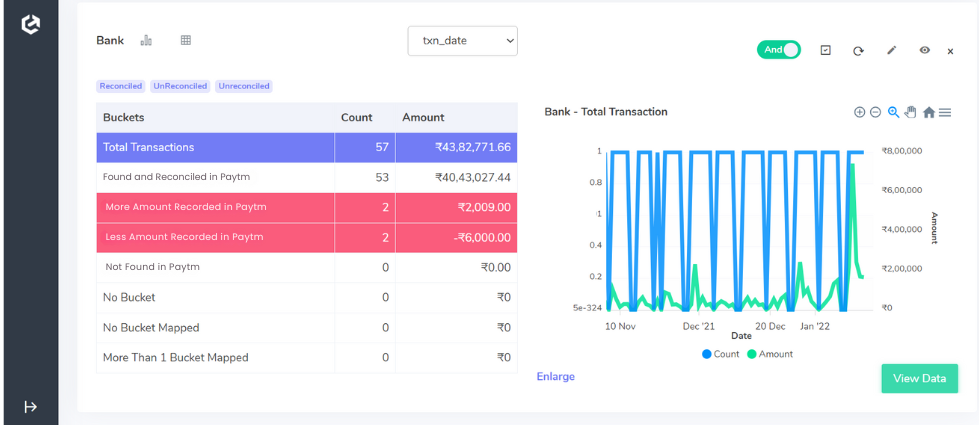

The results are displayed as follows

Paytm Transaction –Bank Settlement Reconciliation

- Total Transactions: This section displays the total number of Paytm transactions recorded in your offline report, offering a comprehensive overview of your sales activity.

- Found in Bank Statement: This section highlights transactions that perfectly match between your Paytm offline report and your bank statement. These transactions represent successful processing and ensure you received the correct payment for these sales.

- Not Found in Bank Statement: This section flags any transactions present in your Paytm offline report but missing from your bank statement. These discrepancies might signify missing deposits or settlement errors. Cointab empowers you to investigate further and ensure you receive all your due funds

Bank Settlement- Paytm Transaction Reconciliation

Total Paytm Transactions: This section displays the total number of Paytm transactions recorded in your bank statement, providing an overview of your overall Paytm activity.

Reconciled with Paytm: This section highlights transactions where the amount in your bank statement perfectly matches the corresponding entry in the Paytm offline report, confirming accurate settlement.

Discrepancies: Cointab identifies any mismatched amounts and categorizes them for easy analysis:

- Less Settlement Received from Paytm: Transactions where the bank statement shows a lower amount compared to the Paytm offline report might indicate missing funds. Cointab flags these for investigation and potential recovery of owed funds.

- More Settlement Received from Paytm: Transactions where the bank statement shows a higher amount compared to the Paytm offline report might signify an overpayment from Paytm. Cointab allows you to review these occurrences and ensure accurate account balances.

Missing Transactions in Paytm Reports:

- Found in Bank, Missing in Paytm Reports: This section highlights transactions found in your bank statement as Paytm transactions, but absent from your Paytm offline reports. These discrepancies might indicate unreported sales or settlement errors, requiring further investigation.

Automate reconciliation with Cointab

Manually reconciling Paytm transactions can be a tedious and error-prone process. Cointab’s automated solution eliminates the hassle, providing clear insights and ensuring accurate settlements. See discrepancies at a glance, maximize profits, and free up valuable time.

Experience the benefits of Cointab today!

Step into the future of reconciliation. Fill out the form to request your demo now!