Every day, numerous businesses and companies leverage Flipkart, a prominent e-commerce platform, to market their products, expanding their reach across a vast consumer base. While the advantages of selling on Flipkart are significant, businesses often encounter challenges concerning payment processing and the accuracy of settlements.

With millions of transactions occurring daily on Flipkart, businesses operating at such a scale struggle to manage the extensive data involved. The intricacies of Flipkart’s data necessitate meticulous and time-consuming analysis to ensure accuracy and facilitate reconciliation.

Reconciliation becomes imperative due to potential issues such as payment failures, technical glitches, or verification delays on Flipkart’s end. Errors in calculations, whether from Flipkart or the company itself, can lead to substantial losses if left unresolved.

Enter Cointab, offering an Automated Reconciliation System tailored to simplify the arduous task of data processing and reconciliation. This adaptable system requires minimal configuration to handle various data types efficiently. Once configured, businesses load the relevant data for reconciliation, allowing the system to generate outputs highlighting accurately reconciled transactions and identifying errors.

Upon completion, businesses can task their finance teams with reviewing the information and initiating disputes with Flipkart to rectify any discrepancies and recover funds for disputed transactions.

Flipkart payment reconciliation process:

Flipkart’s payment reconciliation procedure involves the following essential data sets:

- Flipkart Order Report

- Flipkart Sales Report

- Flipkart Settlement Report

- Flipkart Returns Report

Flipkart Order report:

Every time an order is made on Flipkart, it is logged into the Order Report. This report contains detailed information about each item in every order, with separate entries for each item along with its quantity.

Flipkart Sales Report

This document comprises two sheets and may alternatively be referred to as a GST Tax report. It includes:

- Itemized details of the orders.

- Information regarding the number of fulfilled orders.

- The count of canceled orders.

- Customer returns.

The total invoice amount collected from customers.

Additionally, the second sheet, titled “Sales Cashback,” contains data pertaining to the cashback amounts credited or debited to sellers by Flipkart.

Flipkart Settlement Report:

This document consists of multiple sheets:

- Orders

- Ads

- Non-Order SPF

- TDS

The “Orders” sheet provides order-specific settlements detailing charges such as commission fees, fixed fees, shipping fees, collection fees, along with various taxes like TDS, TCS, etc. It also includes the final settlement amount after all deductions for each order.

The “Ads” sheet lists deductions for advertisements run on Flipkart by the business.

The “Non-Order SPF” sheet covers charges for non-order-related services, such as warehousing fees and reparations for damaged inventory.

Lastly, the “TDS” sheet contains information about TDS payments made by Flipkart.

Return report

This document comprises data concerning returned order items collected by Flipkart from customers. It serves the purpose of verifying whether inventory is being returned to the warehouse in cases of RTO and customer returns. These reports are essential for conducting the necessary reconciliation.

Configuration process:

Utilizing the Order report, we generate a summarized report at the Order Number level. Subsequently, for each order, we reference the Sales report to compute the Expected Amount. In the Sales report, the Invoice Amount column is interpreted differently based on the Event Sub Type: rows with “Sale” or “Return Cancellation” are considered positive amounts akin to sales, while rows with “Return” or “Cancellation” are treated as negative amounts akin to credit notes. The Sales Cashback report is also consulted to retrieve Credit Note and Debit Note amounts. By aggregating these rows with positive and negative invoice values, we ascertain the Expected Amount that Flipkart owes to a business for a given Order Number. This process is repeated for all Order Numbers.

Furthermore, for each order, we reference the Settlement report to determine the Payment Amount. From the Settlement report, the sum of the Sale Amount, Total Offer Amount, My Share, and Customer Shipping Amount constitutes Payment Received, while the Refund Amount represents Payment Refunded. These two values are then combined to calculate the Payment Amount.

Reconciled Output

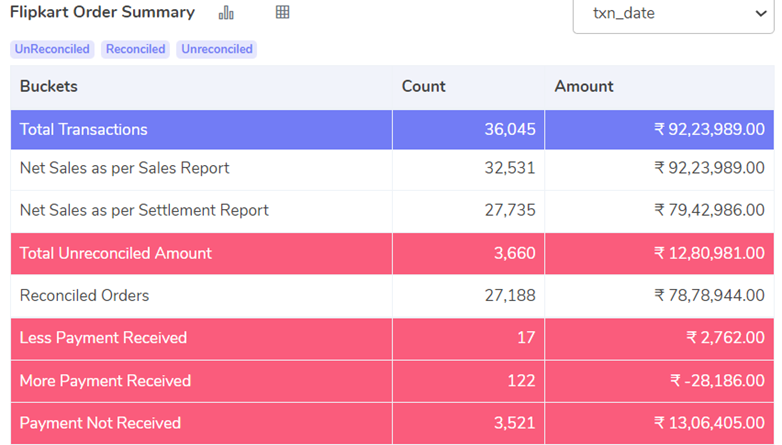

If the Expected Amount matches the Payment Amount in any order, it’s classified as a Reconciled Order. This indicates that Flipkart is paying for the order according to its Invoice Amount from the sales report.

If the Expected Amount exceeds the Payment Amount, it’s labeled as a Less Payment Received Order. This suggests that Flipkart is paying less compared to the Invoice Amount for the order as per the sales report.

Conversely, if the Expected Amount is less than the Payment Amount, it’s termed as a More Payment Received Order. This implies that Flipkart is paying more compared to the Invoice Amount for the order as per the sales report.

Orders with no payment entry in the Settlement Report despite an expected amount will be highlighted as Payment Not Received.

Lastly, orders with no entry in the Sales Report or a net invoice amount of 0, coupled with no payment received according to the Settlement report, are considered Canceled Transactions.

The result is shown as follows (for a particular date range):

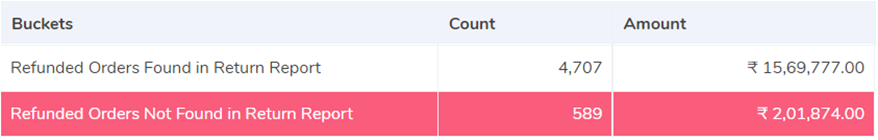

Inventory Return Verification

If a Credit Note appears in the Sales report, we anticipate the return of inventory via the Return report. We’ve implemented a verification process to ensure the retrieval of inventory for RTO/Customer Returns.

Bank Statement Reconciliation:

Upon completing payment reconciliation, we verify whether the amount pledged by Flipkart as the settlement amount aligns with the entries in the bank statements. This reconciliation involves comparing the Flipkart settlement report with the bank statement. Initially, we extract the bank UTR (Unique Transaction Reference) from the NEFT ID column in the settlement report, then similarly identify UTRs from the bank narration column in the bank statement. Subsequently, we correlate both the bank statements and Flipkart settlement reports based on the extracted UTRs.

Next, we introduce a column labeled ‘Partner Amount’ in the bank statement, aggregating all settlement amounts corresponding to the UTRs as indicated in the settlement report. We then simply subtract this ‘Partner Amount’ from the transaction amount to ascertain the variance between the two amounts, thereby determining if Flipkart has credited the correct amount to the bank account.

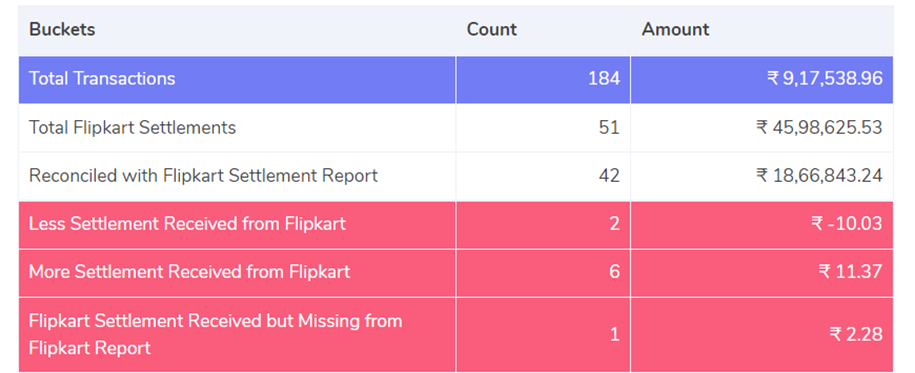

The result is shown as follows:

Total Flipkart Settlements:

Total bank rows where the narration contains the “Flipkart” keyword.

Reconciled with Flipkart Settlement Report:

These denote bank transactions where the settlement amount promised by Flipkart matches the credited amount in the bank.

Less Settlement Received from Flipkart:

These refer to bank transactions where the credited amount is less than the promised settlement amount by Flipkart.

More Settlement Received from Flipkart:

These indicate bank transactions where the credited amount exceeds Flipkart’s promised settlement amount.

Flipkart Settlement Received but Missing from Flipkart Report:

These signify bank transactions where the credited UTR is absent from the Flipkart settlement report.

Flipkart Fee Verification:

For a comprehensive explanation of how Flipkart fees are verified, please refer to this page. Click here

Experience the seamless efficiency of Cointab’s Automated Reconciliation System for your Flipkart marketplace payments. Say goodbye to manual efforts and hello to streamlined reconciliation. Ready to simplify your process? Contact us today for expert assistance.