The Bank Reconciliation Statement (BRS) is one of the most critical financial processes for any organization, ensuring that a company’s internal financial records match its bank account statements. However, performing this task manually can be challenging and prone to errors, especially for businesses dealing with high volumes of transactions daily.

That’s where Cointab’s reconciliation software steps in, providing a powerful solution to automate and streamline the BRS process, ensuring accuracy, reducing manual workload, and improving financial transparency. In this article, we’ll explore how BRS reconciliation with Cointab works and the advantages it offers for businesses.

What is a Bank Reconciliation Statement (BRS)?

A Bank Reconciliation Statement (BRS) is a financial document that compares the bank’s records with the company’s internal records. The goal is to identify any discrepancies between the two, such as outstanding checks, unrecorded deposits, or bank fees that might not yet be reflected in the company’s books.

Traditionally, businesses have had to handle BRS manually by cross-referencing data from the bank and accounting records—a process that is not only time-consuming but also prone to human errors. As transaction volumes increase, this manual approach becomes even more cumbersome. This is where automated reconciliation tools like Cointab bring significant value.

The Challenges of Manual BRS Reconciliation

Without automation, businesses often face several challenges when managing BRS reconciliation:

- High Manual Effort: Manual reconciliation requires sifting through hundreds or thousands of transactions, often involving Excel spreadsheets and multiple versions of bank statements. The sheer amount of data makes it difficult to keep up with the process.

- Risk of Human Error: Manual reconciliation leaves room for errors such as missed transactions, incorrect data entries, or mismatches that can lead to inaccuracies in financial reporting.

- Time-Consuming: Manually reconciling transactions is a lengthy process. Businesses may spend days or even weeks on reconciliation, delaying critical financial insights.

- Limited Scalability: As businesses grow, transaction volumes increase, making manual reconciliation increasingly unmanageable without a system in place to handle larger datasets efficiently.

Cointab’s reconciliation software automates the BRS process, offering a range of features that help businesses of all sizes handle their bank reconciliations with ease. Let’s take a closer look at how Cointab transforms the reconciliation process:

1. Automated Data Ingestion

Cointab automatically imports bank statements and accounting records from various sources, eliminating the need for manual data entry. It supports multiple file formats, including CSV, Excel, and other formats commonly used by banks and accounting software. This means that businesses can upload their bank and ledger data with minimal effort, allowing the reconciliation process to begin without delays.

2. Advanced Matching Algorithms

At the heart of Cointab’s reconciliation software is its intelligent rule-based matching engine. The software uses advanced algorithms to automatically match transactions between the company’s internal records and the bank’s statements. The system can identify common discrepancies, such as missing entries, unrecorded bank fees, or timing differences, and present them to the user for review.

3. Customizable Matching Rules

Cointab gives businesses the flexibility to customize their matching rules according to their specific requirements. For instance, companies can define rules based on transaction amounts, dates, or unique transaction identifiers, allowing for more accurate and tailored reconciliation. This customization ensures that businesses can align the software’s functionality with their unique financial processes.

4. Real-Time Reconciliation and Reporting

Cointab’s software offers real-time reconciliation, meaning that businesses can run reconciliations as often as needed, whether it’s daily, weekly, or monthly. This real-time capability ensures that any discrepancies between the bank statement and internal records are caught early, reducing the risk of long-standing issues. Additionally, the software provides instant reports that detail the status of the reconciliation process, showing matched and unmatched transactions for review.

5. Automated Error Detection

One of the most significant benefits of using Cointab for BRS reconciliation is its ability to detect errors automatically. Whether it’s duplicate entries, missing transactions, or incorrect amounts, Cointab flags these issues and highlights them for review. This feature greatly enhances accuracy, as it minimizes the risk of overlooked errors that could lead to financial misstatements.

6. Scalability for Growing Businesses

Cointab’s reconciliation software is built to scale. As your business grows and transaction volumes increase, the software is fully equipped to handle higher data loads without compromising performance. This scalability is a game-changer for companies that are expanding and need a reconciliation tool that can keep up with their growth.

7. Streamlined Audit Trail and Compliance

Maintaining a clear audit trail is essential for compliance and financial reporting. Cointab generates detailed reports that provide a transparent view of the reconciliation process, showing every matched and unmatched transaction. These reports can be shared with auditors or stakeholders, ensuring that your financial records meet regulatory standards.

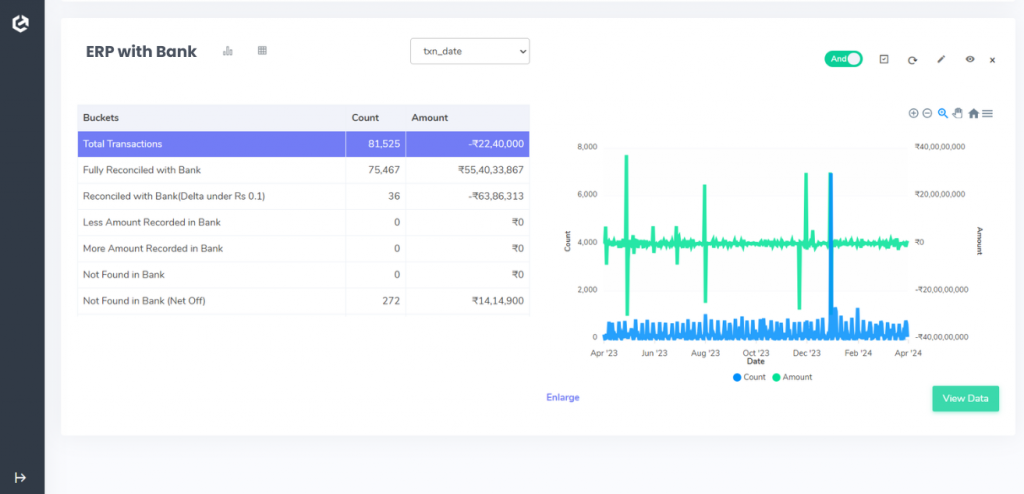

ERP with Bank

Fully Reconciled with Bank:

The amounts recorded in both ERP and the bank statement match exactly, indicating a complete reconciliation.

Reconciled with Bank (Delta under Rs 0.1):

Transactions have been reconciled between ERP and the bank statement, but there is a minor discrepancy of Rs 0.1.

Less Amount Recorded in Bank:

The amount recorded in the bank statement is lower compared to the amount recorded in ERP.

More Amount Recorded in Bank:

The amount recorded in the bank statement exceeds the amount recorded in ERP.

Not Found in Bank:

Transactions appear in the ERP report but are missing from the bank statement.

Not Found in Bank (Net Off):

There is a positive entry in the ERP report that is offset by a negative entry in the bank statement.

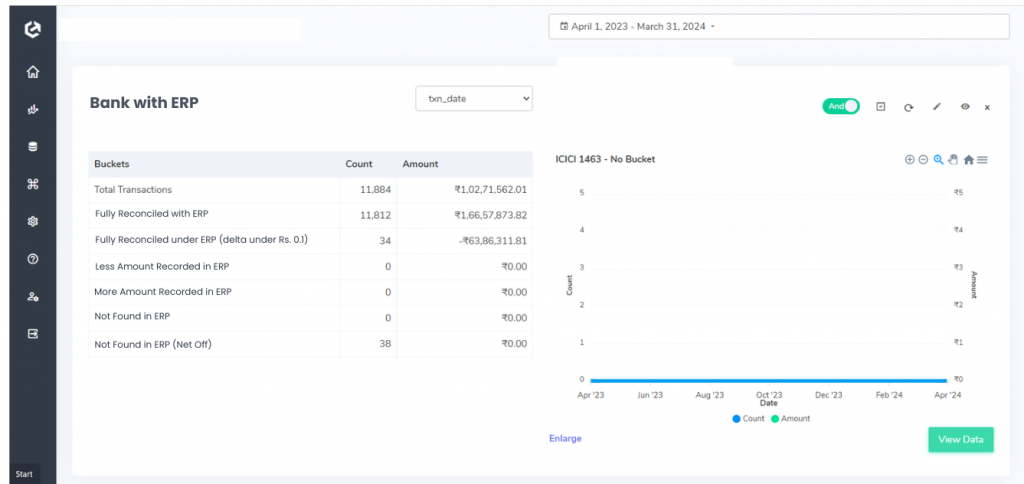

Bank with ERP

Fully Reconciled with ERP

The amount in the Bank Statement exactly matches the amount in ERP.

Reconciled with ERP (Delta under Rs 0.1)

The transactions are reconciled between the Bank Statement and ERP, with a minor discrepancy of Rs 0.1.

Less Amount Recorded in ERP

The amount recorded in ERP is less compared to the Bank Statement.

More Amount Recorded in ERP

The amount recorded in ERP is more compared to the Bank Statement.

Not Found in ERP

Transactions are present in the Bank Statement but not found in ERP.

Not Found in ERP (Net Off)

There’s a positive entry in the Bank Statement and a corresponding negative entry in ERP.

The Benefits of Cointab for BRS Reconciliation

Using Cointab for BRS reconciliation provides several significant advantages:

- Reduced Manual Effort: Automating the data ingestion and transaction matching processes frees up valuable time for finance teams, allowing them to focus on more strategic tasks.

- Increased Accuracy: By automating the matching process and highlighting errors, Cointab significantly reduces the risk of human error and ensures more accurate financial data.

- Time Savings: Businesses can perform reconciliations faster, ensuring that financial statements are up-to-date and providing timely insights for decision-making.

- Improved Cash Flow Visibility: With real-time reconciliation, businesses gain better visibility into their cash flow, allowing them to make informed decisions based on accurate financial data.

- Enhanced Compliance: The software’s detailed reporting and audit trails make it easier for businesses to stay compliant with financial regulations and meet audit requirements.

- Cost Efficiency: By automating a traditionally labor-intensive process, Cointab helps businesses reduce the operational costs associated with manual reconciliation.

- Customization and Flexibility: With customizable rules and matching algorithms, businesses can tailor the reconciliation process to meet their unique financial needs.

Why Choose Cointab for BRS Reconciliation?

Cointab’s software stands out from other reconciliation tools on the market due to its comprehensive feature set, user-friendly interface, and scalability. It’s designed to work for businesses of all sizes, whether you’re a small company with a few transactions or a large enterprise handling thousands daily. With Cointab, BRS reconciliation becomes a streamlined, efficient, and accurate process, helping you maintain precise financial records with ease.

Don't waste time on manual financial reconciliation. Let our Reconciliation software do the work for you.

Conclusion

Bank Reconciliation Statements (BRS) are crucial for ensuring financial accuracy, but manual reconciliation can be time-consuming and error-prone. By leveraging Cointab’s powerful reconciliation software, businesses can automate this essential process, improving accuracy, saving time, and gaining valuable financial insights. Cointab’s advanced matching algorithms, automated error detection, and customizable rules make it an ideal solution for businesses looking to streamline their financial operations. Whether you’re managing daily transactions or preparing for audits, Cointab simplifies BRS reconciliation, ensuring your financial records are always accurate and up-to-date.