Reconciliation of Australia Post Shipping Invoice With Cointab

Reconciliation of Australia Post Shipping Invoice With Cointab

Managing High-Volume Australia Post Shipments?

Ensuring accurate billing for high-volume Australia Post shipments can be a complex task. Cointab Reconciliation software simplifies this process by automating invoice verification and eliminating manual errors. Here’s how it streamlines your operations:

Australia Post: A Legacy of Reliable Delivery

Australia Post (AusPost), a government-owned entity, has served Australians for over two centuries. However, manually tracking deliveries and associated fees for numerous orders can be cumbersome.

Cointab: Your Automated Verification Solution

Cointab automates invoice verification, ensuring accuracy and saving you valuable time. It seamlessly compares various data points to identify potential discrepancies:

ERP Reports:

Internal data on orders and shipments.

Shipping Invoices:

Invoices issued by Australia Post.

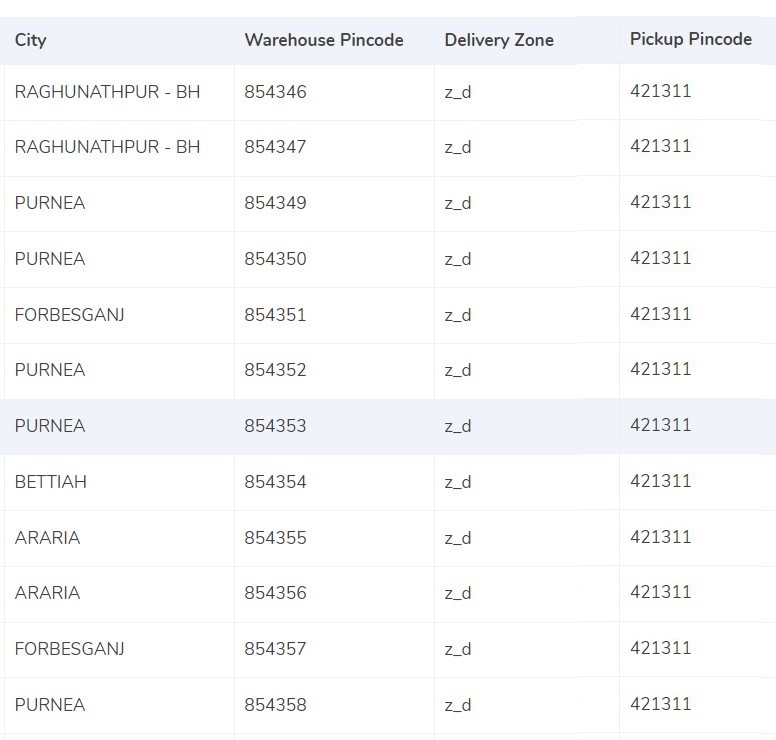

Pincode Master Data:

Information on destination zones for accurate calculations.

SKU Reports:

Product information (weight, dimensions) for precise fee verification.

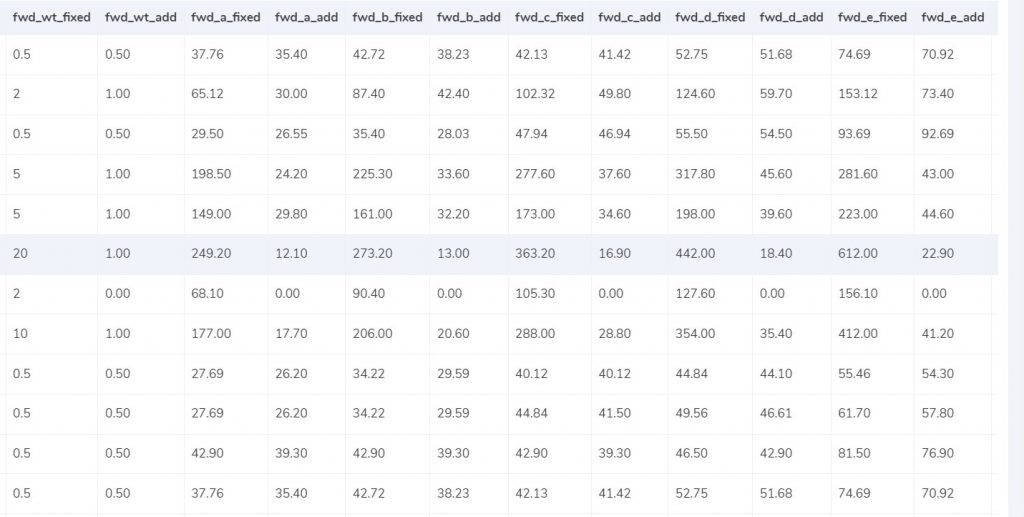

Rate Cards:

Official Australia Post fees based on weight and zone.

Effortless Reconciliation with Cointab

Cointab simplifies the process by utilizing these reports:

Pincode Zone Report:

Defines origin and destination zones for accurate zone-based pricing.

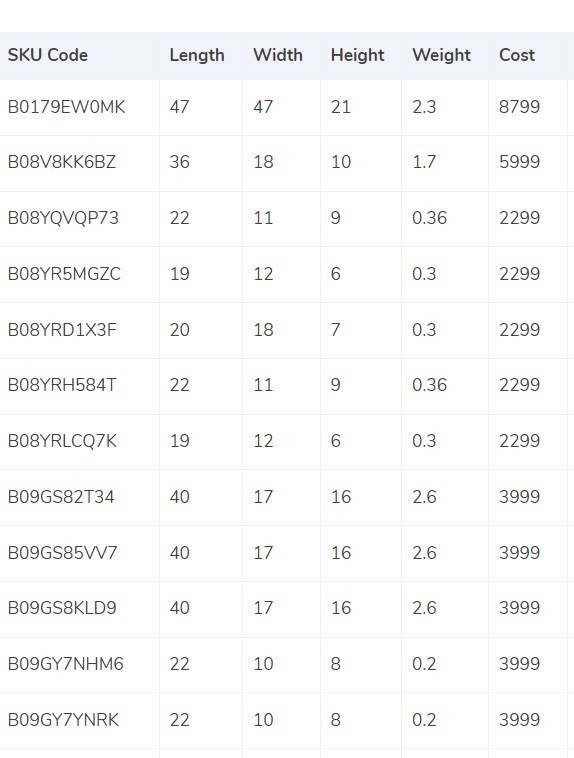

SKU Report:

Provides product weight and dimensions for calculating fees based on weight slabs.

Rate Card:

Lists official Australia Post fees based on weight and zone for comparison.

Australia Post Delivery Invoice:

Contains details like order ID, weight, zone, and charged amount.

Cointab’s Verification Process

Cointab leverages these reports to calculate expected weight, location, and rate. This allows for a data-driven comparison with the invoice, highlighting any discrepancies and potential overcharges.

SKU Report

Cointab Reconciliation software streamlines weight management for Australia Post invoice verification, ensuring accurate billing based on product dimensions. Here’s how it works:

SKU-driven Weight Identification:

Cointab references SKU codes in the ERP report to automatically retrieve product weight and dimensions from your internal database.

ERP Weight Priority:

If the ERP report provides weight data, Cointab prioritizes this value for invoice verification.

Volumetric Weight Calculation (if weight absent):

When weight isn’t available in the ERP, Cointab calculates volumetric weight using the formula: Length (cm) x Width (cm) x Height (cm).

Divisor Consideration:

Cointab applies the divisor specified in the divisor card for volumetric weight calculations. If no divisor is present, a default value of 5,000 is used.

Data Consistency:

The calculated volumetric weight is reflected in both the ERP report and the invoice for seamless reconciliation.

Final Weight Rounding:

Cointab rounds the final weight (actual or volumetric) to determine the appropriate weight slab for billing purposes.

Benefits of Cointab’s Weight Management:

Accurate Invoicing:

Ensures accurate billing based on product dimensions, eliminating discrepancies and potential overpayments.

Automated Calculations:

Streamlines the verification process by automating weight identification and volumetric weight calculations.

Improved Efficiency:

Saves time and resources by eliminating manual weight calculations.

Data Consistency:

Maintains consistent weight data across ERP reports and invoices for effortless reconciliation.

Cointab: Effortless Verification, Guaranteed Accuracy

By leveraging Cointab’s weight management features, businesses can achieve efficient and accurate Australia Post in

Pincode master

Cointab Reconciliation software streamlines zone identification for accurate Australia Post invoice verification. Here’s how it simplifies the process:

Origin-Destination Pairing:

Cointab automatically matches origin (sender) and destination (receiver) locations from the invoice.

Zone Assignment:

Based on the location pairing, Cointab assigns the appropriate zone for each invoice. This zone is crucial for determining accurate shipping rates.

Location Classification:

Cointab leverages its database to categorize locations into categories like “regional,” “international,” or “global,” with further sub-classifications (e.g., “a,” “b,” “c”). This comprehensive classification ensures precise zone determination.

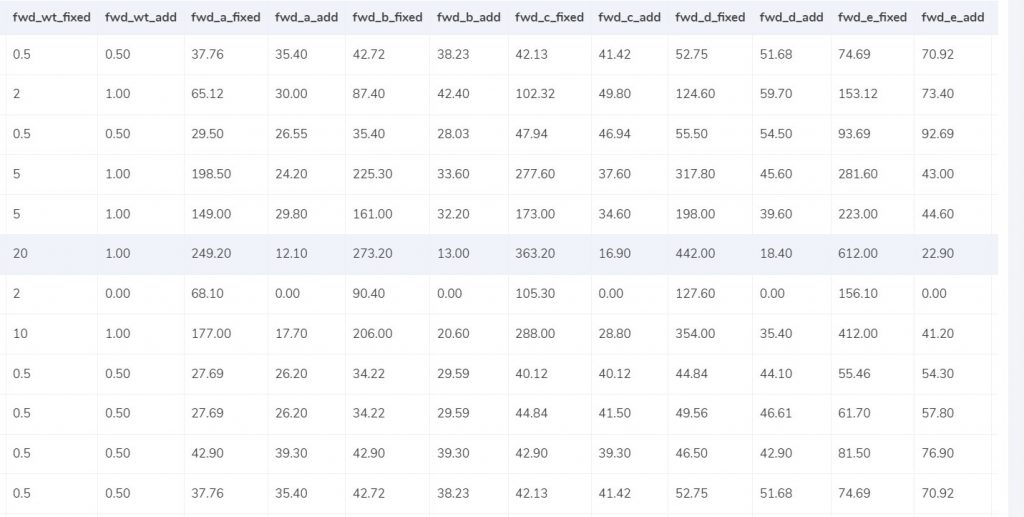

Rate card:

Cointab Reconciliation software streamlines cost verification for Australia Post invoices by guaranteeing accurate rate application. Here’s how it safeguards your costs:

Zone & Weight-Based Rates:

Cointab references the official Australia Post rate card, which specifies shipping charges based on product weight and zone. This ensures you’re billed according to the correct rate structure.

Weight Verification:

Cointab verifies that invoice charges align with the rate card for the product’s weight, preventing discrepancies due to weight fluctuations.

Detailed Rate Card Comparison:

Cointab compares specific columns in the invoice with the rate card, including:

Courier:

Ensures the appropriate courier service is charged for the shipment.

Zone:

Verifies the zone classification aligns with the origin and destination locations.

fwd_wt_fixed: Confirms charges for exceeding the weight limit within a specific zone (applicable rates are clearly defined in the rate card).

Divisor (if applicable):

Ensures the correct divisor is used when calculating volumetric weight for accurate rate determination.

Rate Validity:

Cointab considers delivery dates associated with certain rates, ensuring you’re charged the correct rate based on the applicable timeframe.

Charges

Cointab Reconciliation software simplifies Australia Post invoice verification by explaining key charge components:

Forward Charges:

Weight Slabs: The rate card defines weight limits for different “forward charge” slabs.

Fixed vs. Additional Weight:If the calculated weight falls within the slab limit (“fwd_wt_fixed”), the “fwd_fixed” fee applies based on the zone.

If the weight exceeds the limit, an additional charge (“fwd_add”) per extra kilogram applies based on the zone.

Expected Forward Charge Formula: Expected_fwd_chg = fwd_fixed + (extra_weight) x fwd_add

RTO (Return to Origin) Charges:

Weight Slabs: Similar to forward charges, the rate card defines weight limits for RTO slabs (“rto_wt_fixed”).

Fixed vs. Additional Weight:

If the calculated weight falls within the slab limit (“rto_wt_fixed”), the “rto_fixed” fee applies based on the zone.

If the weight exceeds the limit, an additional charge (“rto_add”) per extra kilogram applies based on the zone.

Expected RTO Charge Formula: Expected_rto_chg = rto_fixed + (extra_weight) x rto_add

Expected Final Amount:

Cointab calculates the final expected invoice amount by combining the expected forward charge, RTO charge, and any applicable GST percentage

Navigating Financial Precision: Cointab Reconciliation Software Metrics

2M

1.6B

$37B

RESULT

Verifying invoices for numerous Australia Post shipments can be a complex task. Cointab Reconciliation software simplifies this process by automating data comparison and ensuring accurate billing based on product weight and zone. Here’s how it works:

Data Integration:

Cointab seamlessly integrates with your existing systems to gather key data points:

ERP Reports:

Internal data on orders and shipments, including product weight.

Pincode Report:

Information on destination zones for precise calculations.

Rate Card:

Official Australia Post fees based on weight and zone.

Effortless Invoice Reconciliation:

Cointab leverages these reports to calculate the expected invoice amount based on:

Product Weight:

Extracted from the ERP report for accurate cost estimation.

Destination Zone: Identified using the Pincode report for zone-specific pricing.

Verifying Against Australia Post Invoice:

Cointab then compares the calculated expected amount with the actual charges listed on the invoice provided by Australia Post. This comprehensive data comparison helps identify potential discrepancies and ensures accurate billing.

ERP:

Cointab Reconciliation software streamlines order verification for Australia Post invoices, guaranteeing accurate billing and cost control. Here’s how it safeguards your business:

Matched Orders:

Verified Entries:

Cointab confirms that order entries listed on the Australia Post invoice are also present in your ERP report. This ensures data consistency and facilitates effortless weight verification based on your internal records.

Unmatched Orders:

Discrepancy Detection:

Cointab flags any orders on the invoice that aren’t found in your ERP report. This discrepancy might indicate missing order information, potentially leading to inaccurate weight or cost calculations.

Benefits of Cointab’s Order Verification:

Enhanced Accuracy:

Minimizes the risk of errors by verifying order details against your ERP system.

Streamlined Workflow:

Automates order verification, saving time and resources.

Proactive Error Detection:

Identifies potential discrepancies for timely correction and cost control.

Data Consistency:

Maintains consistent order data across systems for effortless verification.

Cointab: Your Australia Post Verification Partner

Cointab empowers businesses to achieve efficient and accurate Australia Post invoice verification, optimizing shipping costs and ensuring transparency.

Revolutionize Your Financial Accuracy with Cointab's Reconciliation Software!

Request a Demo!

Revolutionize Your Financial Accuracy with Cointab's Cutting-Edge Reconciliation Software!

Request a Demo!

Pincode Master:

Cointab Reconciliation software streamlines zone verification for Australia Post invoices, ensuring accurate billing based on correct location data. Here’s how it simplifies the process:

Matched Pincode Data:

Verified Zones:

Cointab confirms that destination pincodes listed on the Australia Post invoice are also present in your Pincode Master data. This ensures accurate zone identification, crucial for calculating the correct shipping rates.

Unmatched Pincode Data:

Discrepancy Detection:

Cointab flags any invoice entries where pincodes are missing from your Pincode Master. This discrepancy might indicate incorrect location data, potentially leading to inaccurate zone-based charges.

Fee Verification using ERP- Australian Post:

Cointab Reconciliation software empowers businesses to achieve accurate Australia Post invoice verification, ensuring optimal shipping costs. Here’s how it detects potential discrepancies:

Matched Weight & Zone:

Correctly Charged:

Cointab verifies that invoice charges align with the rate card for the product’s weight and zone, ensuring accurate billing.

Discrepancies:

Cointab flags potential overcharges or undercharges based on mismatches between invoice data and expected charges:

Zone Match, Weight Match:

Overcharged:

Invoice charges exceed the expected rate for the product’s weight and zone, indicating a potential overpayment.

Undercharged:

Invoice charges are lower than expected, potentially resulting in missed revenue for Australia Post.

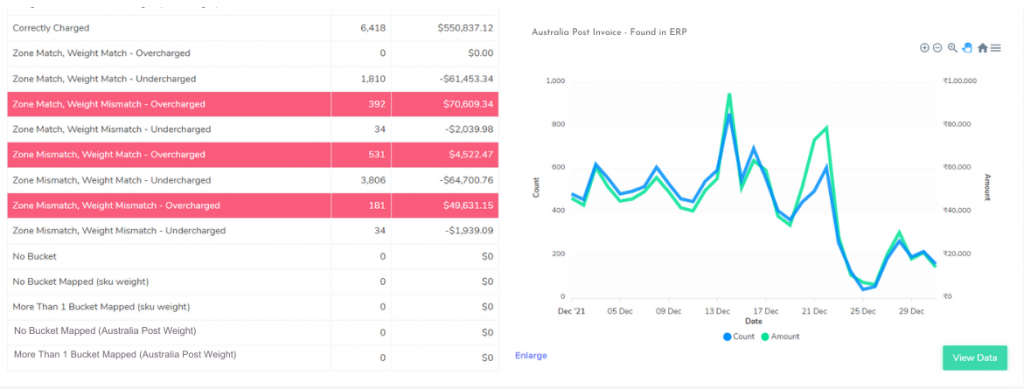

Zone Mismatch:

Overcharged/Undercharged:

Invoice zone and weight don’t match ERP data, potentially leading to over/undercharges.

Detailed Breakdown of

Discrepancies:

Zone Mismatch, Weight Match:

This discrepancy indicates a potential error in zone identification, leading to:

Overcharged:

Invoice charged for a more expensive zone than the actual location.

Undercharged:

Invoice charged for a less expensive zone than the actual location.

Zone Match, Weight Mismatch:

This discrepancy indicates a potential error in weight measurement, leading to:

Overcharged:

Invoice charged for a higher weight than the actual weight.

Undercharged:

Invoice charged for a lower weight than the actual weight.

Zone Mismatch, Weight Mismatch:

This discrepancy suggests significant data inconsistencies, potentially leading to:

Overcharged:

Invoice charged based on incorrect zone and weight information.

Undercharged:

Invoice significantly undercharged due to combined data errors.

Tired of manual Australia Post invoice verification and potential overcharges?

Cointab Reconciliation software streamlines the process, empowering you to:

Automate Fee Verification:

Eliminate manual calculations and ensure accurate invoice verification with ease.

Seamless Data Integration:

Effortlessly upload data in your preferred format for effortless reconciliation.

Proactive Error Detection:

Gain a holistic view of miscalculations highlighted in red for swift correction, preventing overpayments.

Goodbye Manual Tasks:

Say Good-bye to time-consuming manual reconciliation and embrace automated efficiency.