Effortless Eway Payment Gateway Reconciliation:

Eway, a leading global payment gateway, empowers businesses to accept secure online payments 24/7. While it simplifies e-commerce for merchants and customers, discrepancies can arise during transaction processing between Eway, your website, and bank accounts. Maintaining accurate financial records necessitates meticulous reconciliation.

Manual Reconciliation:

A Time-Consuming Challenge:

Reconciling various reports – Eway settlements, refunds, website orders, internal ERP data, and bank statements – is a manual process, often a daunting task for finance teams. It’s error-prone and consumes valuable time that could be better spent on strategic initiatives.

Introducing Cointab’s Automated Reconciliation Solution:

Cointab’s innovative reconciliation software streamlines this process with minimal manual intervention. It automates data validation, significantly reducing the workload for your finance team.

Key Features of Cointab’s Reconciliation Software:

Flexible Data Upload:

Upload data seamlessly via your preferred method: API, SFTP, emails, or others.

Customizable Workflows:

Tailor the reconciliation process to your specific business needs.

Automated Anomaly Detection:

Cointab identifies discrepancies across reports, flagging them for quick resolution.

Eway Payment Gateway Reconciliation Results Explained:

Let’s delve into the common reconciliation scenarios you might encounter with Eway:

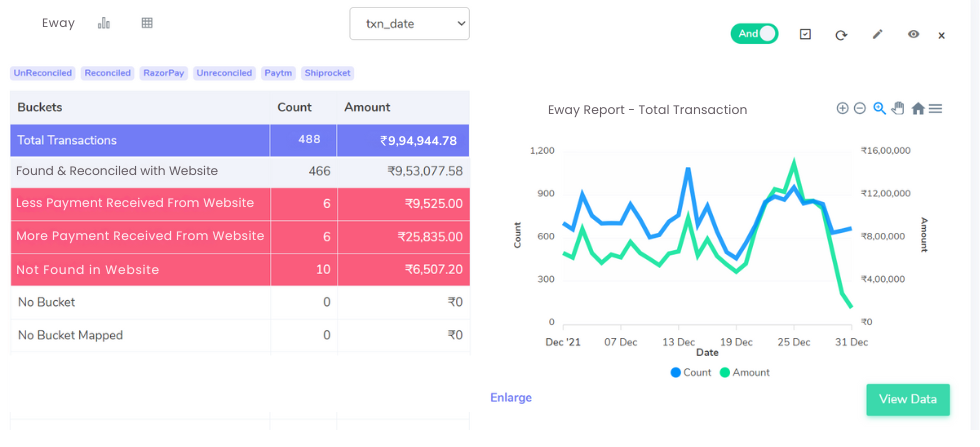

Eway Settlement Reports vs. Website Reports:

Found and Reconciled:

These transactions appear on both Eway settlement and website reports.

Discrepancies:

Less on Website:

The website amount is lower than Eway’s record. This could indicate website order modification or a partial refund.

More on Website:

The website amount is higher than Eway’s. This might be due to a website reporting error or additional charges not reflected in Eway.

Not Found on Website:

Transactions present in Eway reports but missing from the website could signify manual orders or data entry errors.

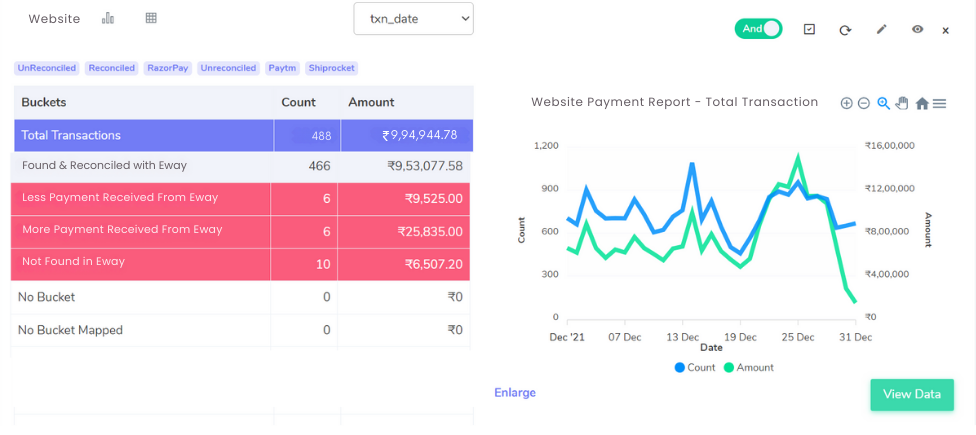

Website with Eway Reconciliation:

Reconciled Transactions:

These transactions match across both reports.

Discrepancies:

Less on Eway:

The Eway amount is lower than the website record. This could be due to discounts or adjustments reflected on the website but not captured by Eway.

More on Eway:

The Eway amount is higher than the website record. This might be due to Eway fees or errors.

Cancelled Transactions:

Orders cancelled by customers might be present on the website report but not reflected in Eway settlements.

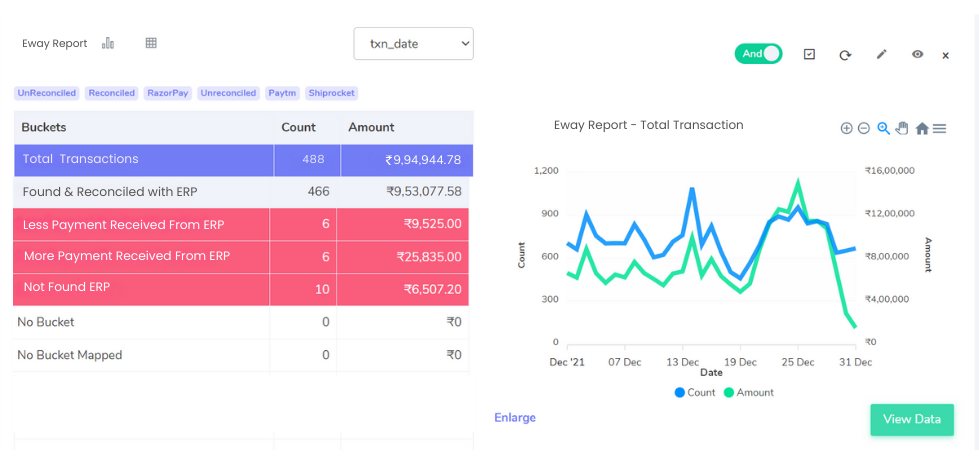

Eway Reconciliation with ERP:

Reconciled Transactions:

These transactions appear on both Eway and ERP reports.

Discrepancies:

Less on ERP:

The ERP amount is lower than Eway’s record. This might indicate missing data entry in the ERP system.

More on ERP:

The ERP amount is higher than Eway’s. This could be due to overstated sales figures in the ERP.

Not Found on ERP:

Transactions present in Eway reports but missing from ERP could signify manual sales not recorded in the ERP system.

Cancelled Transactions:

Orders cancelled by customers might be present on Eway reports but not reflected in ERP data.

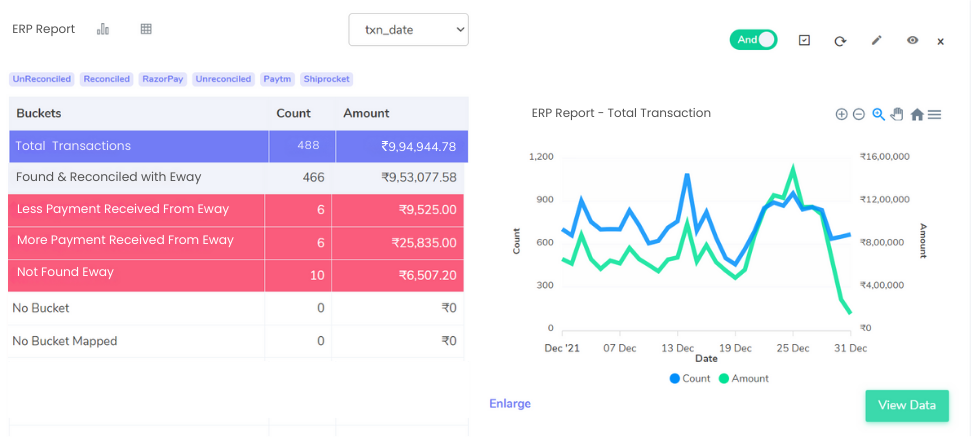

ERP Reports with Eway reconciliation:

Reconciling Eway settlement reports with your ERP system ensures your financial records are accurate.

Let’s explore common scenarios you might encounter:

Matched Transactions:

In the ideal scenario, transaction details perfectly match across both Eway reports and your ERP data. This indicates accurate data capture and processing in both systems.

Discrepancies:

Several discrepancies can arise during reconciliation:

Lower Amount on Eway Report:

This could be due to discounts or adjustments applied in the ERP that aren’t reflected in Eway.

Missing fees or charges in Eway might be present in the ERP.

Higher Amount on Eway Report:

Eway fees associated with the transaction might not be accounted for in the ERP.

Data entry errors in the ERP system could be the culprit.

Missing Transactions on Eway Report:

Manual sales not recorded in Eway might be the reason.

Data entry errors in the ERP that weren’t synced with Eway could also be responsible.

Cancelled Transactions in Eway:

Orders cancelled by customers might be reflected in Eway reports but not captured in the ERP due to delayed synchronization between systems or a manual cancellation process not updating the ERP.

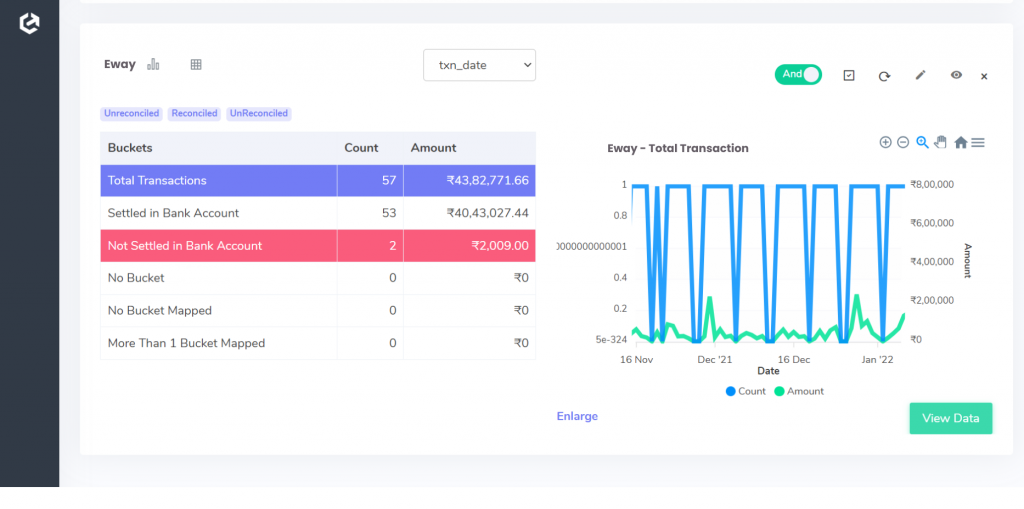

Eway with Bank reconciliation:

Found in Bank Statement:

These transactions appear on both bank statements and Eway settlement reports.

Discrepancies:

Not Found in Bank Statement:

Transactions present in Eway reports but missing from bank statements require investigation. This could be due to bank processing delays or incorrect account information.

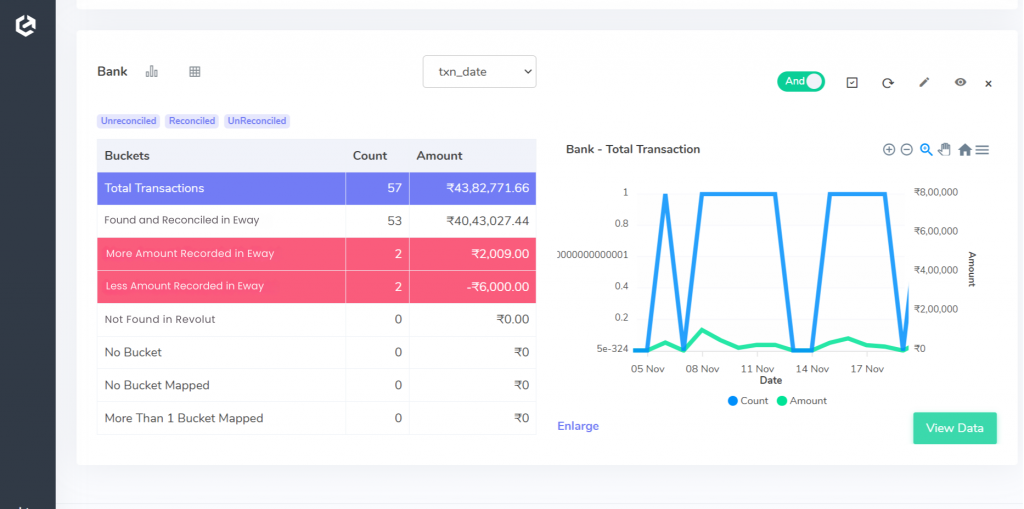

Bank reconciliation with Eway:

Reconciled Transactions:

These transactions match on both the bank statement and Eway settlement reports.

Discrepancies:

More on Eway:

The Eway amount is higher than the bank record. This might be due to Eway fees or chargebacks not yet reflected in the bank statement.

Less on Eway:

The Eway amount is lower than the bank record. This could indicate a bank deposit error or missing transaction details in Eway.

Not Found on Eway Settlement Report:

Transactions present on the bank statement but missing from Eway reports require investigation. This could be fraudulent activity or incorrect gateway configuration.

Achieve Effortless Eway Reconciliation with Automation:

Manually reconciling Eway settlement reports, Eway refund reports, website reports, ERP reports, and bank statements is a time-consuming and error-prone process. This can strain your finance department’s resources and limit their ability to focus on strategic initiatives.

Cointab’s reconciliation software:

offers a powerful solution, enabling you to seamlessly harmonize these reports. Our software automates data matching, discrepancy identification, and reporting, saving you valuable time and ensuring accuracy.

Embrace efficiency and empower your finance team. Contact Cointab today :

to learn more about our software and experience the ease of automated reconciliation. See the difference it can make in your business!