In today’s fast-paced e-commerce landscape, managing a high volume of online transactions can be a challenge. SecurePay, a leading payment gateway provider, empowers businesses of all sizes with secure and efficient payment processing solutions. However, reconciling these transactions with your internal records and bank statements can be a time-consuming and error-prone manual process.

This article introduces you to Cointab Reconciliation Software, the ultimate solution for automated SecurePay reconciliation. Say goodbye to tedious manual tasks and embrace the power of automation for seamless and accurate financial management.

The Challenge of Manual Reconciliation

SecurePay processes a significant number of transactions daily. Manually reconciling these transactions with your website reports, ERP systems, and bank statements can be a daunting task.

This process is prone to errors and inconsistencies, leading to:

Wasted Time:

Manual reconciliation diverts valuable resources away from core business activities.

Reduced Accuracy:

Human error can lead to discrepancies and mismatched data.

Delayed Insights:

Manual reconciliation delays access to critical financial information.

Cointab Reconciliation Software: The Automated Solution

Cointab Reconciliation Software offers a robust and automated solution for streamlining your SecurePay reconciliation process.

Here’s how it empowers your business:

Automated Integration:

Upload data from SecurePay, website reports, ERP systems, and bank statements in your preferred format.

Customizable Workflows:

Tailor the reconciliation process to your specific needs and business rules.

360-Degree Analysis:

Gain a comprehensive view of your financial data with clear and insightful reports.

Benefits of Automated Reconciliation

By automating SecurePay reconciliation with Cointab, you can experience significant benefits:

Increased Efficiency:

Free up valuable staff time for more strategic tasks.

Enhanced Accuracy:

Eliminate human error for reliable and consistent financial data.

Improved Cash Flow Visibility:

Gain real-time insights into your finances for better cash flow management.

Reduced Operational Costs:

Save time and resources associated with manual reconciliation.

Streamlined Reporting:

Generate comprehensive reports for internal analysis and audits.

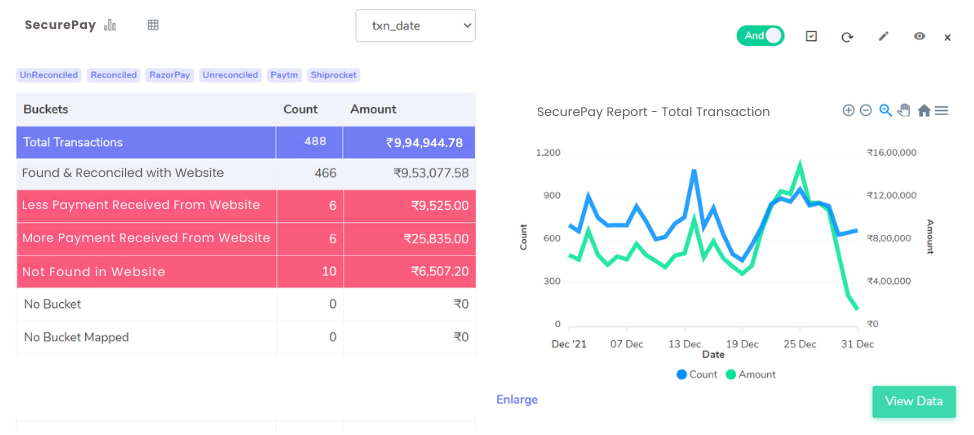

SecurePay with Website Reconciliation:

This reconciliation ensures your website order data matches SecurePay’s settlement reports.

Here are potential discrepancies:

Found and Reconciled:

Both reports reflect the same transaction details.

Less Amount Recorded in Website Report:

The website reports a lower amount than SecurePay. This could indicate a website order discount not reflected in SecurePay.

More Amount Recorded in Website Report:

The website reports a higher amount than SecurePay. This might be due to a website order error or a refunded transaction not yet reflected in the website report.

Not Found in Website Report:

The transaction exists in SecurePay but not on the website. This could signify a fraudulent transaction or a processing error.

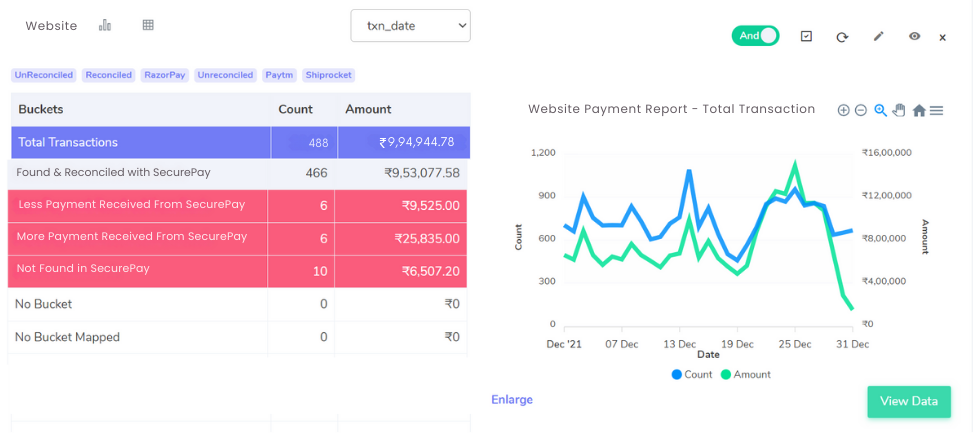

Website with SecurePay Reconciliation:

This reconciliation focuses on matching website orders with SecurePay data. Here’s what you might find:

Found and Reconciled:

Both systems reflect the same transaction details.

Less Amount Recorded in SecurePay Settlement Report:

SecurePay reports a lower amount than the website. This could be due to a refund issued through SecurePay but not reflected on the website.

More Amount Recorded in SecurePay Settlement Report:

SecurePay reports a higher amount than the website. This might be a processing error or a fee associated with the transaction.

Cancelled Transactions:

Orders cancelled on the website might not be reflected in SecurePay settlement reports.

Streamline your Financial Reconciliation Now!

Request a Demo!

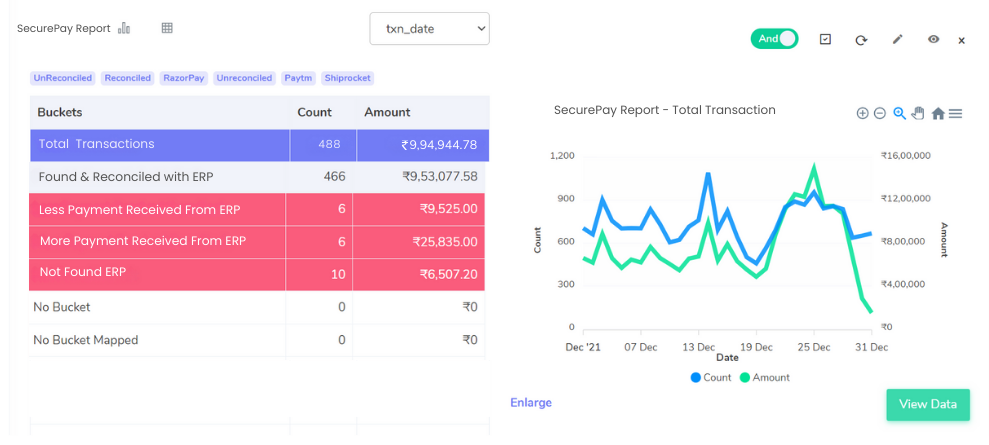

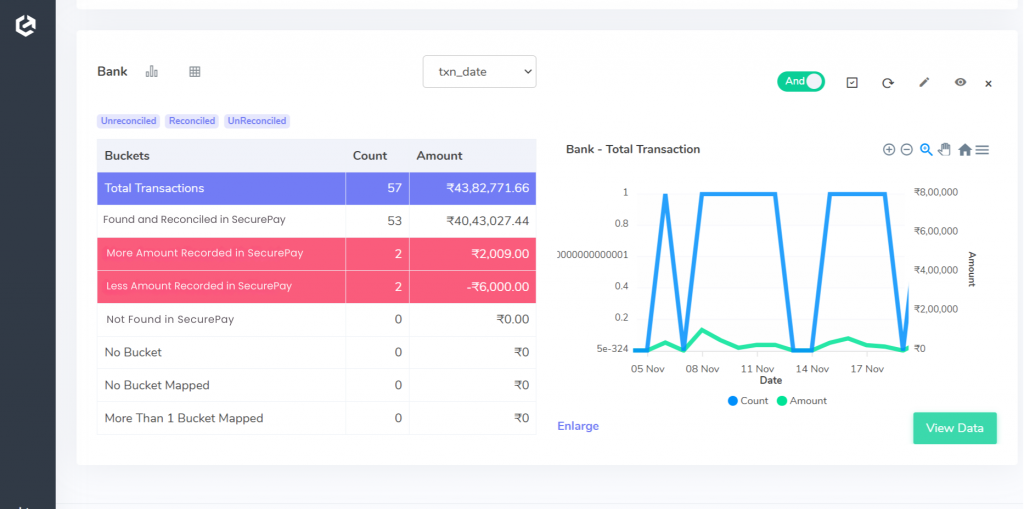

SecurePay Reconciliation with ERP:

This reconciliation ensures consistency between your Enterprise Resource Planning (ERP) system and SecurePay data. Here are the potential discrepancies:

Found and Reconciled:

Both systems reflect the same transaction details.

Less Amount Recorded in ERP Reports:

The ERP reports a lower amount than SecurePay. This could be due to an error in entering the order value in the ERP system.

More Amount Recorded in ERP Reports:

The ERP reports a higher amount than SecurePay. This might be due to additional charges added in the ERP system not reflected in SecurePay.

Not Found in ERP Reports:

The transaction exists in SecurePay but not the ERP system. This could indicate a missing order entry or a processing errors.

ERP with SecurePay Reconciliation:

This reconciliation focuses on matching your ERP data with SecurePay information:

Found and Reconciled:

Both systems reflect the same transaction details.

Less Amount Recorded in SecurePay Settlement Report:

SecurePay reports a lower amount than the ERP system. This could be due to a discount or refund not reflected in SecurePay.

More Amount Recorded in SecurePay Settlement Report:

SecurePay reports a higher amount than the ERP system. This might be due to additional fees associated with the transaction.

Not Found in SecurePay Settlement Report:

The transaction exists in the ERP system but not SecurePay. This could be due to a cancelled order or a processing error.

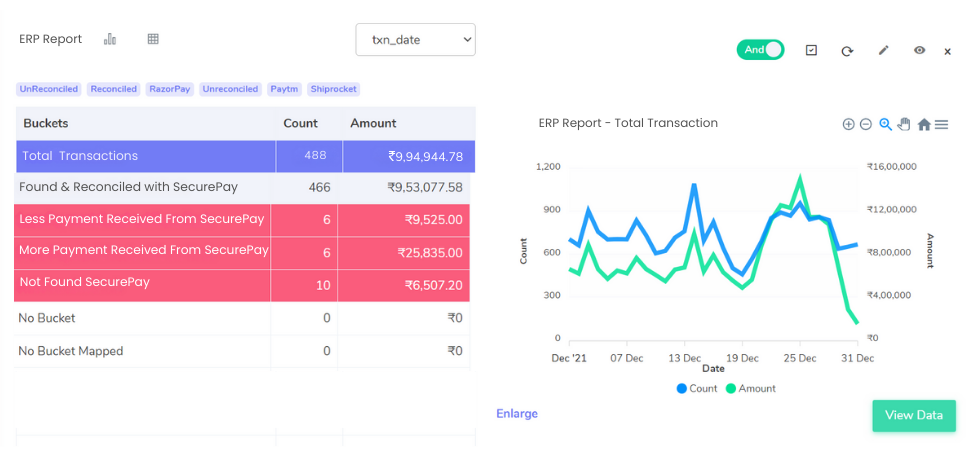

SecurePay with Bank reconciliation:

This reconciliation ensures your bank statements match SecurePay transaction records:

Found in Bank Statement:

Both the bank statement and SecurePay report reflect the transaction.

Not Found in Bank Statement:

The transaction exists in SecurePay but not on the bank statement. This could be due to a pending transaction or a processing error.

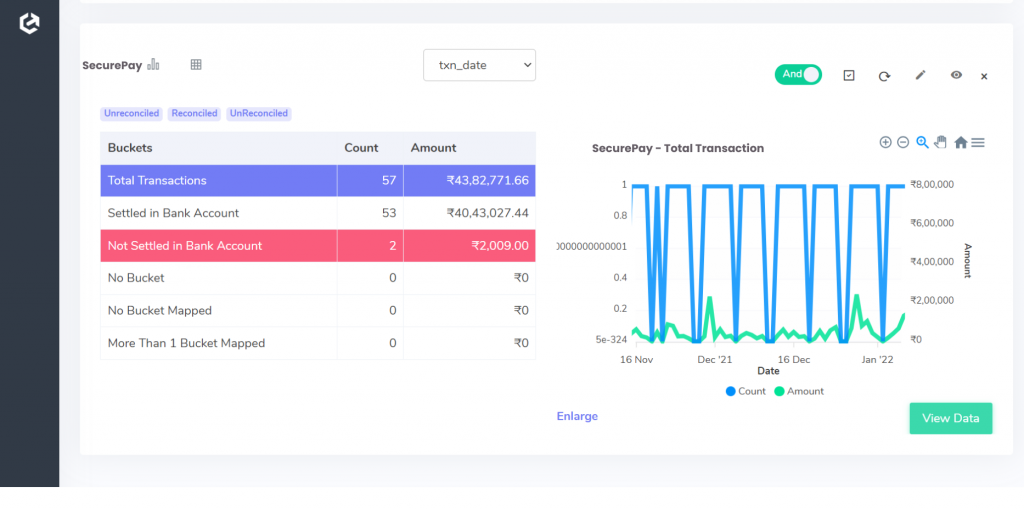

Bank Reconciliation with SecurePay:

This reconciliation focuses on matching your bank statement data with SecurePay information:

Found and Reconciled:

Both systems reflect the same transaction details.

More Amount Recorded in SecurePay Settlement Report: SecurePay reports a higher amount than the bank statement. This could be due to additional fees associated with the transaction.

Less Amount Recorded in SecurePay Settlement Report:

SecurePay reports a lower amount than the bank statement. This might be due to a refund not yet reflected in SecurePay.

Not Found in SecurePay Settlement Report:

The transaction exists on the bank statement but not in SecurePay. This could be a fraudulent transaction or a bank error.

Traditional, manual reconciliation of SecurePay transactions can be a tedious and error-prone process. Cointab Reconciliation Software offers a powerful solution to automate this task entirely. With Cointab, you can upload data from SecurePay, websites, ERP systems, and banks in your preferred format. The software then tailors the reconciliation process to your specific needs, ensuring a perfect match between your financial records. Finally, Cointab provides clear and insightful reports, offering a comprehensive 360-degree view of your finances. Say goodbye to manual reconciliation and hello to efficiency and accuracy with Cointab.