Streamline Global E-commerce with 2Checkout

Formerly known as Avangate and now part of Verifone, 2Checkout empowers businesses to thrive in the world of online commerce. Their all-in-one platform tackles the complexities of modern digital sales, allowing you to:

Sell Globally:

Reach customers in over 200 countries with support for 80+ currencies.

Simplify Payments:

Accept a wide range of payment methods, streamlining the checkout process for your customers.

Optimize Recurring Revenue:

Manage subscriptions and recurring billing effortlessly.

Effortless Transaction Reconciliation

Managing an online store involves a lot of moving parts. 2Checkout eliminates the need for manual transaction reconciliation, a time-consuming and error-prone task. By integrating their platform, you can automate this process, freeing you to focus on growing your business.

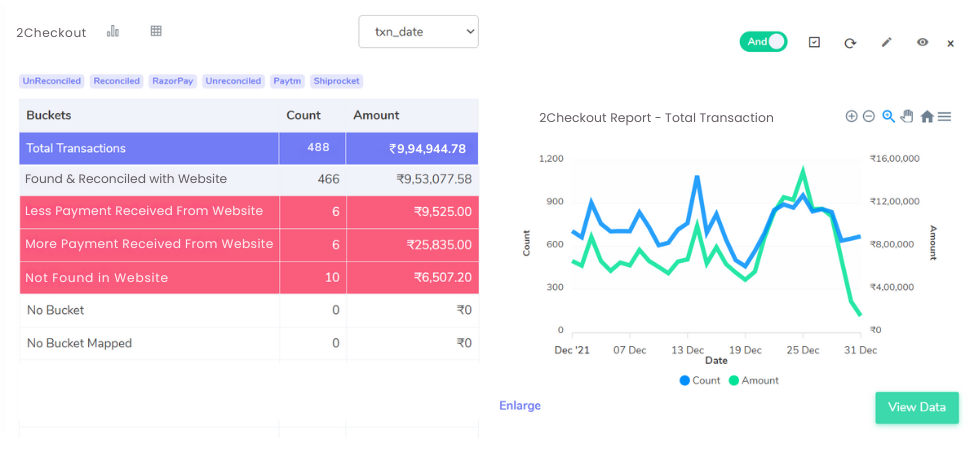

2Checkout Payment Gateway Reconciliation Results:

Understanding Your Online Sales Data

Managing an e-commerce business requires clear insights into your sales activity. 2Checkout and your internal systems provide several reports to help you track your finances:

2Checkout Settlement Reports:

These reports detail completed orders and the corresponding payments received. They offer a clear picture of your revenue.

2Checkout Return Reports:

Track refunded orders and cancellations with these reports. They can help identify any trends or issues related to returns.

Website Reports:

These reports provide data on customer orders placed directly through your website. You can analyze buying patterns and customer behavior.

ERP Reports (Enterprise Resource Planning):

Your internal ERP system likely offers reports with detailed, itemized breakdowns of your sales data. This can be helpful for inventory management and cost analysis.

Bank Statements:

Your bank statements provide a record of all financial transactions, including deposits received through your payment gateway (like 2Checkout). Reconcile these with your other reports for a complete picture.

2Checkout with Website Reconciliation:

Reconciling Your Sales Data

Comparing data from different sources is crucial for accurate financial management. Here’s how transactions might appear when reconciling your 2Checkout reports with your website reports:

Matched Transactions:

These transactions appear in both the 2Checkout settlement report and your website report with matching values. This indicates everything is in order.

Discrepancies:

Lower Website Amount:

The website report shows a lower amount compared to the 2Checkout settlement report. This could be due to factors like discounts or refunds processed directly on your website that haven’t been synced with 2Checkout.

Higher Website Amount:

The website report shows a higher amount compared to the 2Checkout settlement report. This might be caused by accidental overcharging on your website or missing information sent to 2Checkout.

Missing from Website Report:

Transactions appear in the 2Checkout settlement report but are absent from your website reports. This could indicate test transactions, fraudulent orders, or missing data import on your website.

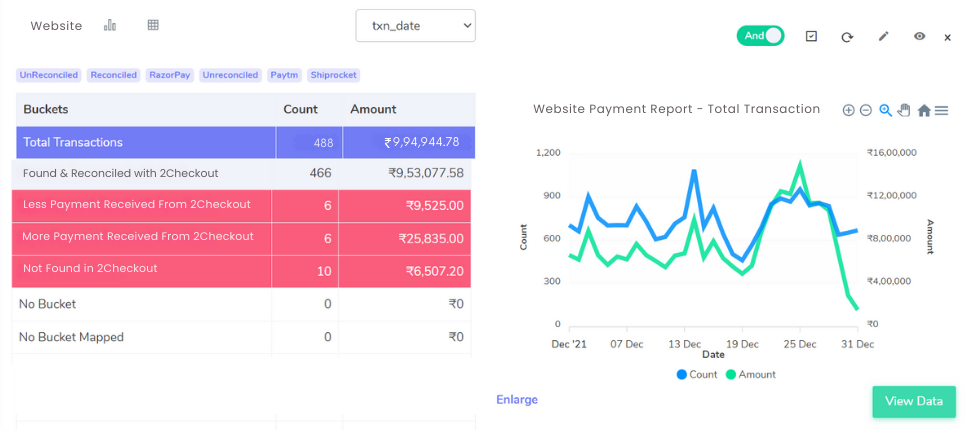

Website with 2Checkout Reconciliation:

Reconciling Transactions with 2Checkout

Matching your sales data across platforms ensures accurate financial tracking. Here’s how transactions might appear when comparing your website reports to 2Checkout’s settlement reports:

Matched Transactions:

These transactions appear in both reports with the same value, indicating everything is reconciled.

Discrepancies:

Lower Amount in 2Checkout Report:

The website report shows a higher amount compared to 2Checkout. This could be due to discounts, refunds, or shipping charges applied on your website that weren’t sent to 2Checkout.

Higher Amount in 2Checkout Report:

The website report shows a lower amount compared to 2Checkout. This might be caused by accidental overcharges on your website or missing information sent to 2Checkout.

Missing from Website Report:

Transactions appear in 2Checkout but not on your website. These could be test transactions, fraudulent orders, or missing data import.

Cancelled Orders:

These transactions appear on your website reports but are absent from 2Checkout because customers cancelled them before payment processing.

Streamline your Financial Reconciliation Now!

Request a Demo!

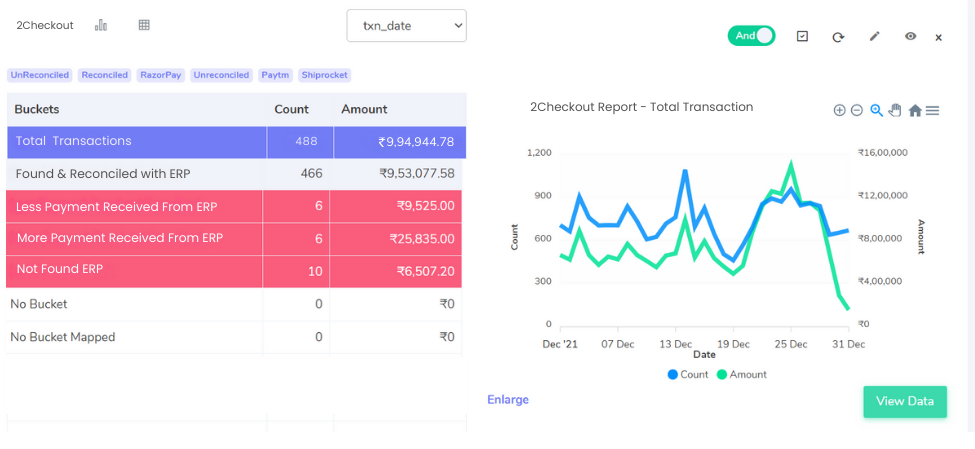

2Checkout Reconciliation with ERP:

Matching Up with Your ERP System

A well-integrated ERP system can streamline your financial management. Here’s how transactions might appear when comparing your 2Checkout reports with your ERP reports:

Matched Transactions:

These transactions appear in both the 2Checkout settlement report and your ERP reports with matching values. This signifies everything is reconciled.

Discrepancies:

Lower ERP Amount:

The ERP report shows a lower amount compared to the 2Checkout settlement report. This could be due to missing data import into your ERP system, incorrect tax calculations, or discounts applied outside the ERP.

Higher ERP Amount:

The ERP report shows a higher amount compared to the 2Checkout settlement report. This might be caused by accidental overcharges reflected in your ERP or duplicate entries.

Missing from ERP Reports:

Transactions appear in the 2Checkout settlement report but are absent from your ERP reports. This could indicate test transactions, missing data import, or transactions not yet processed in your ERP system.

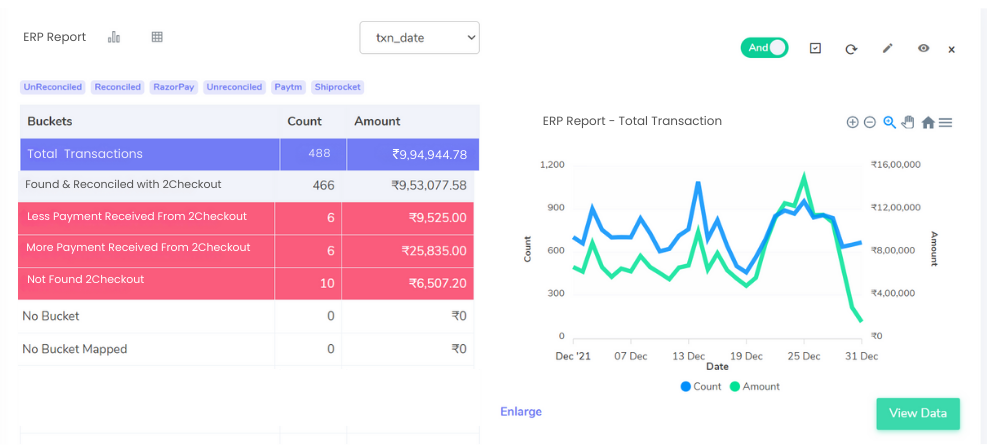

ERP Reports with 2Checkout Reconciliation:

Reconciling Transactions with Your ERP System

A smooth flow of data between your ERP and 2Checkout is crucial for accurate financial records. Here’s a breakdown of how transactions might appear during reconciliation:

Matched Transactions:

These transactions appear in both the 2Checkout settlement report and your ERP reports with matching values. This indicates successful reconciliation.

Discrepancies:

Lower Amount in 2Checkout Report:

The ERP report shows a higher amount compared to 2Checkout. This could be due to:

Missing data import into your ERP system.

Incorrect tax calculations in your ERP.

Discounts or refunds applied outside your ERP.

Higher Amount in 2Checkout Report:

The ERP report shows a lower amount compared to 2Checkout. This might be caused by:

Accidental overcharges reflected in your ERP.

Duplicate entries in your ERP.

Missing from 2Checkout Report:

Transactions appear in your ERP reports but are absent from 2Checkout. This could indicate:

Test transactions in your ERP.

Missing data import into 2Checkout.

Transactions not yet processed in your ERP system.

Cancelled Orders:

These transactions appear on 2Checkout’s settlement reports but are absent from your ERP reports because customers cancelled them before payment processing was complete.

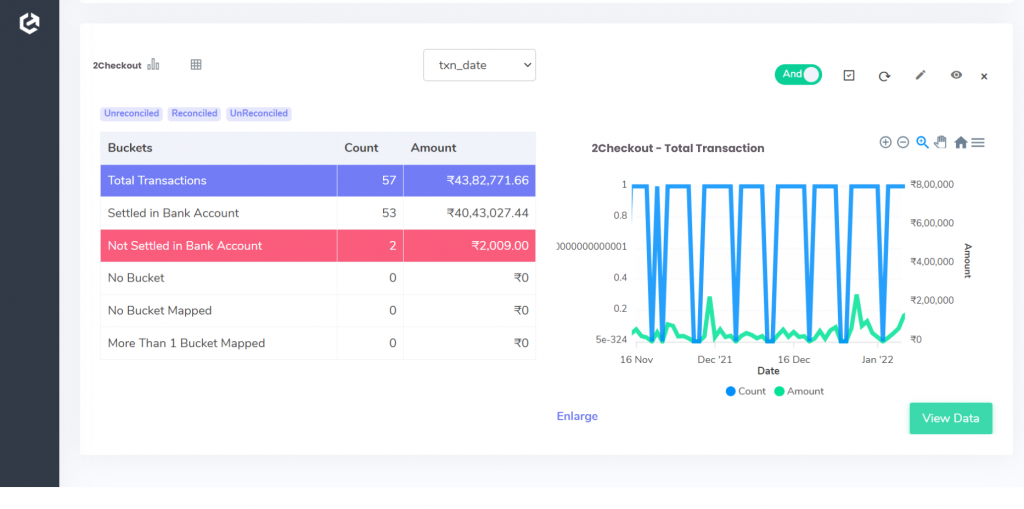

2Checkout with Bank reconciliation:

Verifying Transactions with Bank Statements

Your bank statement serves as the ultimate record of your financial activity. Here’s how transactions might appear when comparing them to 2Checkout’s settlement reports:

Matched Transactions:

These transactions appear in both the 2Checkout settlement report and your bank statement with matching values. This signifies everything is reconciled.

Discrepancies:

Missing from Bank Statement:

Transactions appear in the 2Checkout settlement report but are absent from your bank statement. This could be due to: Delays in bank processing times. Transactions being settled in a different currency (check for foreign transaction fees).

Potential errors in data sent to 2Checkout.

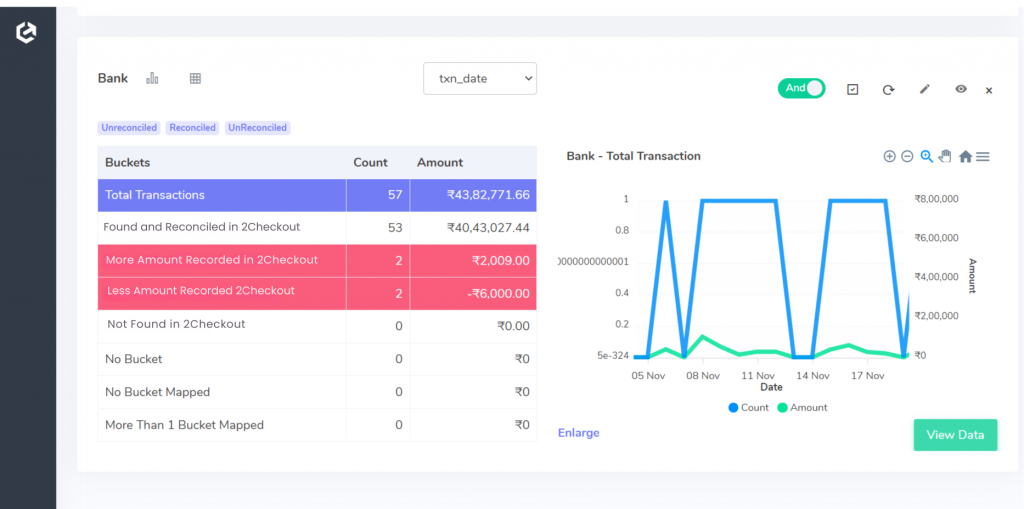

Bank reconciliation with 2Checkout:

Reconciling Transactions with Bank Statements

The final step in reconciliation is verifying your sales data against your bank statement, the official record of your financial activity. Here’s a breakdown of how transactions might appear:

Matched Transactions:

These transactions appear in both the 2Checkout settlement report and your bank statement with matching values. This signifies successful reconciliation.

Discrepancies:

Higher Amount in 2Checkout Report:

The 2Checkout report shows a higher amount compared to your bank statement. This could be due to:

Foreign transaction fees:

Check if 2Checkout reports the gross amount before fees are deducted by your bank.

Data discrepancies:

Investigate any potential errors in the information sent to 2Checkout.

Lower Amount in 2Checkout Report:

The 2Checkout report shows a lower amount compared to your bank statement. This could be due to:

Bank processing delays:

Transactions might take some time to appear in your bank account.

Missing from 2Checkout Report:

Transactions appear in your bank statement but are absent from 2Checkout. This could be a sign of:

Chargebacks:

Customers might have disputed a transaction and received a refund directly from their bank.

Investigate any discrepancies to ensure your financial records accurately reflect your deposited sales.

Streamline Reconciliation with Cointab Software

Manually reconciling reports across multiple platforms can be time-consuming and prone to errors. Cointab Reconciliation software automates this process, saving you valuable resources.