Streamline Your Payments with Adyen and Automated Reconciliation

Adyen isn’t just another payment processor; it’s a global powerhouse for mid-sized and large businesses. Imagine accepting payments from anywhere in the world, with a unified platform that minimizes fees and ensures PCI compliance. That’s the Adyen advantage.

Beyond Acceptance: A Financial Powerhouse

Adyen doesn’t stop at accepting payments. It lets you receive funds in your preferred currency, safeguards your business with advanced risk management tools, and optimizes your revenue. Plus, you get top-notch sales support and robust security features.

The Challenge: Reconciliation Takes Time

While Adyen empowers your transactions, manual reconciliation can leave your finance team drowning in data. Sorting through countless transactions is a recipe for wasted time and potential errors.

The Solution: Automate and Breathe Easy

Here’s where automated reconciliation software steps in. It simplifies the process, delivering accurate results efficiently. Imagine a world where reconciliation is no longer a chore, but a breeze. That’s the power of automation.

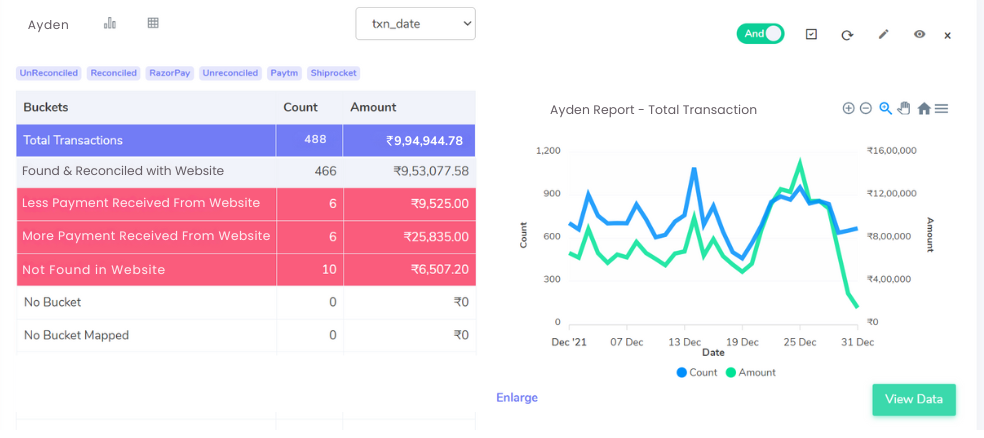

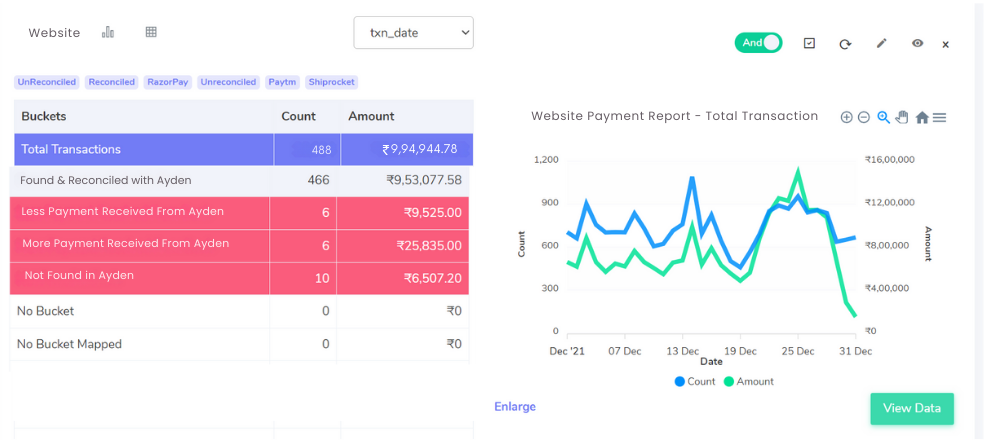

Adyen Payment Gateway Reconciliation Results:

Demystifying Your Reports for Seamless Reconciliation:

Adyen Settlement Reports:

Think of these as the receipts for your successful orders. They detail all the completed transactions and corresponding payments.

Adyen Refund Reports:

These reports track the orders that got cancelled and the refunds issued to your customers.

Website Report:

This report acts as a record of all customer orders placed on your website.

ERP Report:

This internal report provides a detailed breakdown of each order, including individual items and their costs.

Bank Statements:

These reports reflect the actual transactions processed through your bank and the payment gateway, showing the flow of funds

Adyen with Website Reconciliation:

Matching Transactions with Website:

Found in Both:

These transactions appear in both your website report and the Adyen settlement report, indicating a successful match.

Discrepancies in Amount:

Website Understatement:

The website report shows a lower amount compared to the Adyen settlement report. This might require investigation into potential reasons like:

Discounts or promotions offered on the website but not reflected in the Adyen report.

Missing sales entries on the website.

Website Overstatement:

The website report reflects a higher amount than the Adyen settlement report. This could be due to:

Website errors like duplicate orders.

Orders cancelled on the website but still processed by Adyen (potential for chargebacks).

Missing Transactions:

Unrecorded Sales on Website:

These transactions appear in the Adyen settlement report but are missing from the website report. This could indicate missing sales entries that need to be added to the website.

Website Reconciliation with Adyen:

Found in Both:

These transactions appear in both your website report and the Adyen settlement report, indicating a successful match.

Discrepancies in Amount:

Adyen Understatement:

The Adyen settlement report shows a lower amount compared to the website report. This might require investigation into potential reasons like:

Fees charged by Adyen that aren’t reflected in the website report.

Refunds processed by Adyen that haven’t been reflected on the website yet.

Adyen Overstatement:

The Adyen settlement report reflects a higher amount than the website report. This could be due to:

Chargebacks received by the business that haven’t been reflected on the website yet.

Potential errors in the Adyen report (e.g., duplicate transactions).

Missing Transactions:

Cancelled Orders:

These transactions appear on your website report but are missing from the Adyen settlement report because they were cancelled by the customer.

Streamline your Financial Reconciliation Now!

Request a Demo!

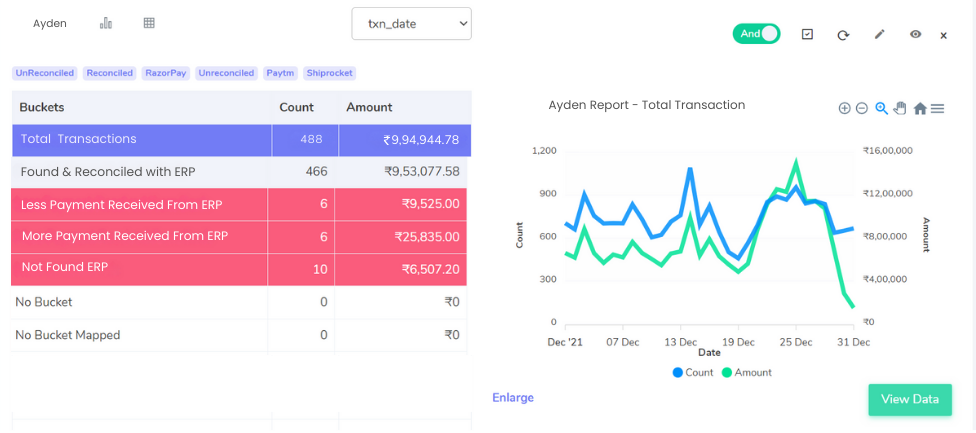

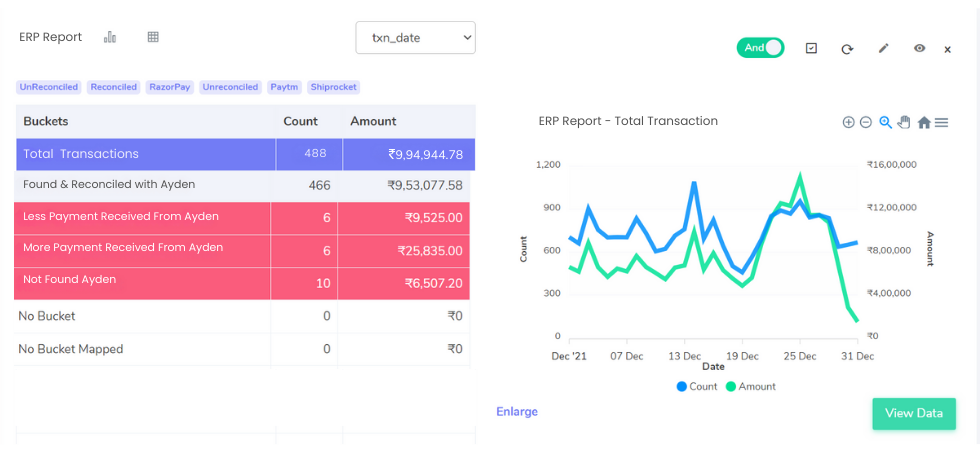

Adyen Reconciliation with ERP:

Matching Transactions with ERP:

Found in Both:

These transactions appear in both your ERP system and the Adyen settlement report, indicating a successful match.

Discrepancies in Amount:

ERP Understatement:

The ERP report shows a lower amount compared to the Adyen settlement report. This might require investigation into potential reasons like: Discounts offered on the website but not reflected in the ERP. Missing sales entries in the ERP.

ERP Overstatement:

The ERP report reflects a higher amount than the Adyen settlement report. This could be due to: Additional charges applied in the ERP (e.g., taxes, shipping) not reflected in Adyen. Rounding differences in calculations.

Missing Transactions:

Unrecorded Sales in ERP:

These transactions appear in the Adyen settlement report but are missing from the ERP report. This might indicate missing sales entries that need to be added to the ERP system.

ERP Reports with Adyen Reconciliation:

Matching Transactions with ERP:

Found in Both:

These transactions appear in both your ERP system and the Adyen settlement report, indicating a successful match.

Discrepancies in Amount:

ERP Overages:

The ERP report shows a higher amount compared to the Adyen settlement report. This might require investigation into potential reasons like:

Discounts offered on the website but not reflected in the ERP. Additional charges applied in the ERP (e.g., taxes, shipping) not reflected in Adyen.Rounding differences in calculations.

Adyen Overages:

The Adyen settlement report reflects a higher amount than the ERP report. This could be due to:

Fees charged by Adyen that aren’t reflected in the ERP.

Missing Transactions:

Unrecorded Sales in ERP:

These transactions appear in the Adyen settlement report but are missing from the ERP report. This might indicate missing sales entries that need to be added to the ERP system.

Cancelled Orders in ERP:

These transactions appear in the ERP report but are not found in the Adyen settlement report because they were cancelled by the customer. The ERP system might still record these for sales tracking purposes.

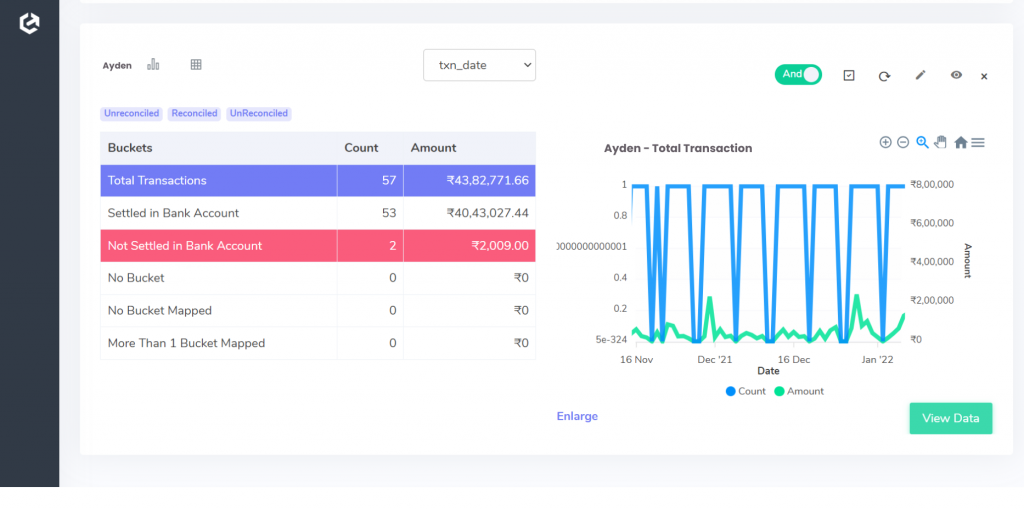

Adyen with Bank reconciliation:

Matching Transactions with Bank:

Found in Both:

These transactions appear in both your bank statement and the Adyen settlement report, indicating a successful match and confirmed receipt of funds.

Discrepancies with Bank:

Not Found in Bank Statement:

Transactions listed in the Adyen settlement report are missing from your bank account. This might require investigation into reasons like:

Pending Transactions:

The funds might still be in transit between Adyen and your bank. These transactions will eventually appear in your bank statement.

Bank Fees:

Adyen may have withheld fees that aren’t reflected in the settlement report but will appear as separate debits in your bank statement.

Mismatched Dates:

The transaction dates in Adyen might differ slightly from the date reflected in your bank statement due to processing times.

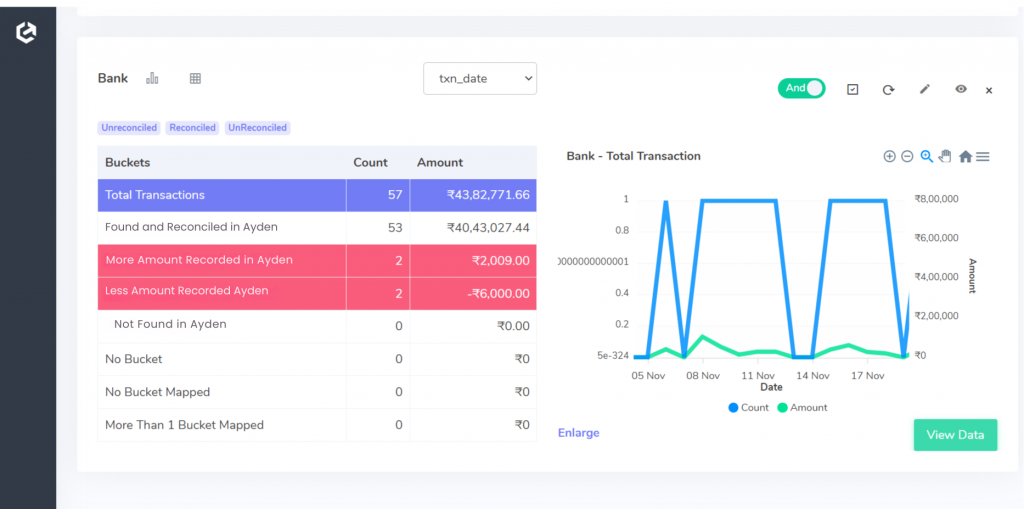

Bank reconciliation with Adyen:

Matching Transactions with Bank:

Found in Both:

These transactions appear in both your bank statement and the Adyen settlement report, indicating a successful match and confirmed receipt of funds.

Discrepancies in Amount:

Adyen Overages:

The Adyen settlement report shows a higher amount compared to the bank statement. This could be due to:

Fees charged by Adyen that aren’t reflected in the bank statement yet (look for separate debits).

Potential errors in the bank statement (missing deposit).

Bank Overages:

The bank statement reflects a higher amount than the Adyen settlement report. This might require investigation into reasons like:

Bank fees deducted from the deposit that aren’t shown in Adyen (look for separate charges).

Delayed reporting:

The transaction might be reflected earlier in the bank statement than in the Adyen report.

Missing Transactions:

Unidentified Bank Transactions:

Transactions appear in the bank statement but cannot be matched to any Adyen settlement report entry. This could be due to:

Incoming transfers from other sources.

Bank fees or refunds not associated with Adyen.

Unveiling the Truth Behind Your Transactions

Cointab simplifies reconciliation by automatically matching transactions across your Adyen settlement report, bank statements, website reports, ERP systems, and even return reports. This eliminates the tedious manual process and ensures all your financial data sings in perfect harmony.

Discrepancies? No Problem!

Cointab doesn’t just match transactions, it highlights any mismatches. This allows you to quickly identify discrepancies, like overpayments or underpayments reflected in the Adyen report compared to your bank statement. With clear insights, you can easily file claims with Adyen if necessary.

Optimize Your Resources, Maximize Efficiency

By automating reconciliation and pinpointing discrepancies, Cointab frees up your valuable time and resources. No more spending hours poring over spreadsheets. Instead, you can focus on what truly matters – growing your business.

In short, Cointab streamlines your reconciliation process, empowers informed decision-making, and allows you to optimize your resources for maximum efficiency.