Organizations today are looking for powerful software platforms that can help them manage their financial reporting, ESG reporting, audit, and risk management processes efficiently. While Workiva is a popular choice, there are other alternatives available in the market that offer similar features and benefits. In this article, we’ll take a closer look at some of the top Workiva alternatives, their unique features, and how they can help organizations streamline their reporting processes. Whether you’re looking for cloud-based technology, real-time collaboration, or centralized reporting capabilities, these alternatives offer a range of solutions to fit your specific needs.

When considering alternative options to Workiva, it’s important to look for financial software solutions that offer similar functionality and features. These alternatives should also provide automation capabilities to improve the efficiency of reconciliation processes, as well as tools for data analysis and reporting. By exploring different options and comparing their features and pricing, businesses can find a financial reconciliation solution that best meets their specific needs and budget.

Businesses can discover a financial reconciliation solution that fits their requirements and budget by examining various options and comparing their characteristics and costs.

Here are some examples of alternative financial reconciliation software solutions to Workiva:

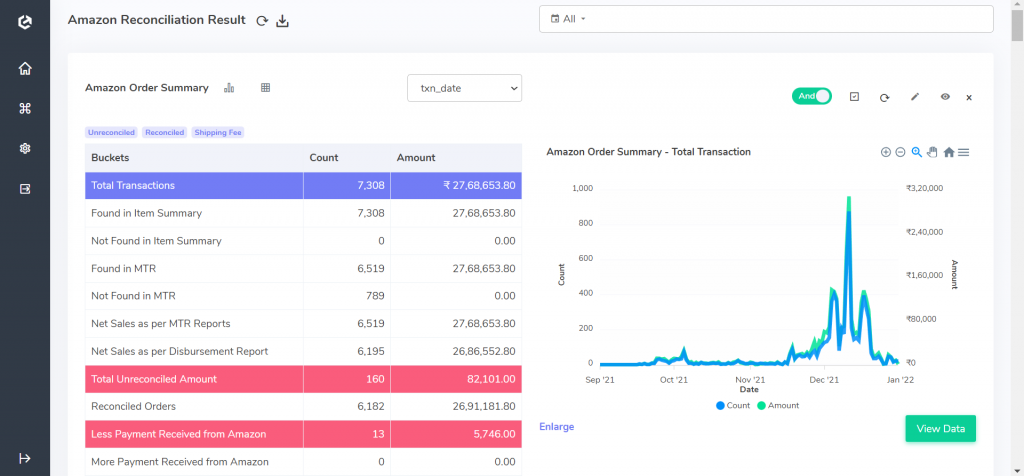

Cointab Reconciliation

Cointab Reconciliation, with advanced technology, can automatically input data, clean it up, and execute rules to identify reconciled and unreconciled transactions.

The software is highly versatile and can handle various file formats and data structures, and our rules engine can be customized to fit your specific requirements. This ensures that the software is maximally beneficial to your business.

Once the reconciliation process is complete, Cointab Reconciliation presents the findings and generates reports on a universal dashboard, making it easy to analyze financial data and maintain an accurate audit trail. Our software also integrates seamlessly with other accounting, ERP, and banking software, resulting in a smooth user experience.

The web-based architecture makes Cointab Reconciliation highly adaptable and user-friendly, allowing you to access the software from a variety of devices, including desktops, laptops, tablets, and smartphones. The software can also be easily integrated with various enterprise resource planning systems, internal systems, and other platforms, making it a highly flexible and scalable solution that can be tailored to meet the needs of different businesses.

By scheduling reconciliation to run automatically in real-time, hourly, weekly, or monthly, you can enhance your productivity and reduce manual work. With Cointab Reconciliation, you can streamline your financial reconciliation processes and manage your finances more efficiently than ever before. Try Cointab Reconciliation today and experience the benefits for yourself!

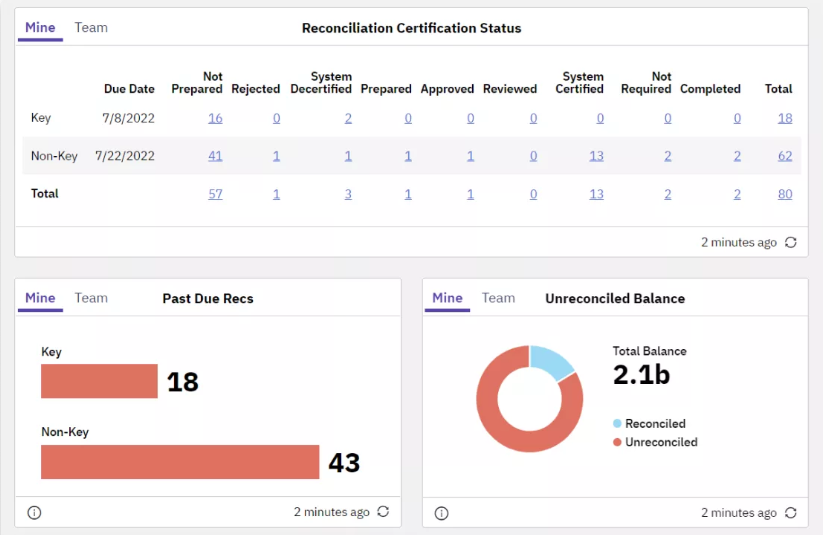

BlackLine

Blackline offers a comprehensive financial reconciliation software solution that can serve as a viable alternative to Workiva. With its wide range of account reconciliation services and real-time dashboard views, Blackline can significantly improve the efficiency and transparency of the reconciliation process, reducing the workload of finance teams.

One key advantage of Blackline is its capacity to streamline various business processes by providing standardized templates for different documents, workflows for preparation and review, and integration with policies and documentation storage. This feature makes Blackline a powerful ERP (Enterprise Resource Planning) solution that can assist businesses in managing their resources more efficiently by grouping different functions together and providing a centralized platform for managing data and workflows.

Overall, Blackline provides an efficient and user-friendly solution for financial reconciliation, making it a strong alternative to Workiva. Its ability to streamline various business processes and provide a centralized platform for managing data and workflows can help businesses optimize their financial operations and improve productivity.

ReconART

ReconART could be a viable option for your financial reconciliation needs. Similar to Workiva, ReconART is a powerful financial reconciliation software that simplifies various reconciliation processes. It offers advanced technology and features that provide users with a comprehensive solution to manage and reconcile financial transactions across multiple accounts, platforms, and devices.

ReconART’s key features include various reconciliation functionalities, such as credit-card reconciliation, bank reconciliation, account reconciliation, posting, holdings and trades reconciliation, intercompany reconciliation, and enhanced journal entries. These functionalities enable businesses to match and compare transactions, detect discrepancies, and resolve errors in a timely and efficient manner.

Moreover, ReconART’s web-based architecture allows users to access and use the software from any device, such as laptops, desktops, tablets, and smartphones, providing flexibility and accessibility to stay on top of their finances and reconciliation processes.

Additionally, ReconART provides seamless integration with various enterprise resource planning (ERP) systems, internal systems, and other platforms, making it a highly flexible and scalable solution that can be easily customized to meet the unique needs of different businesses, just like Workiva.

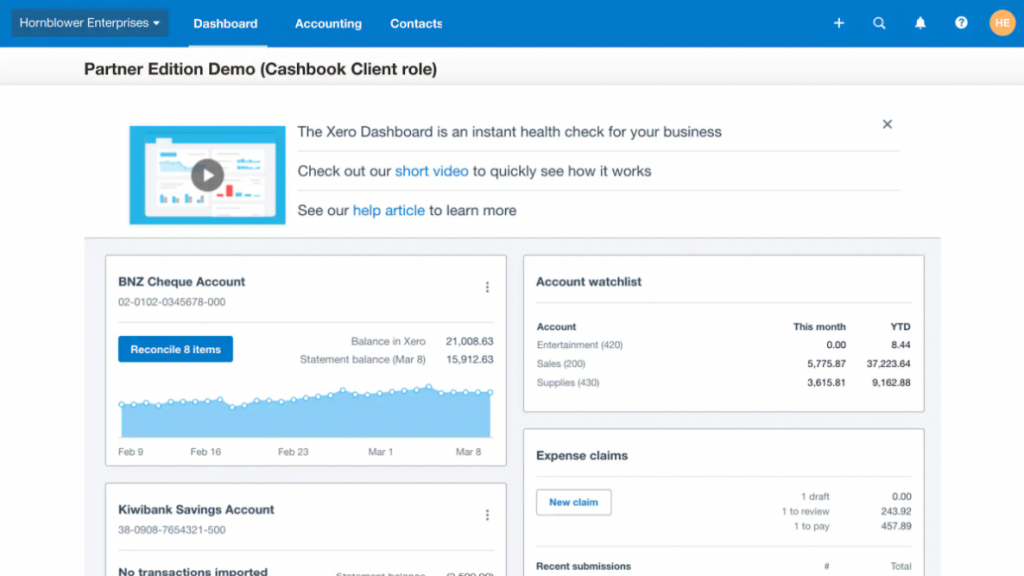

Xero

Xero is an excellent alternative to Workiva, offering a cloud-based financial management system that provides a broad range of tools and features to help businesses manage their finances more efficiently. Its features include bill payments, reimbursements, expense claims, cash flow tracking, and bank reconciliation, making it a versatile option for businesses.

Xero’s reconciliation tool is a key feature, which simplifies the process of matching bank transactions with accounting records. The system automatically imports transactions from bank accounts and compares them with the records in Xero’s cashbook, flagging any discrepancies or differences in balances. The process is automated, freeing up valuable time and resources that would otherwise be spent manually reconciling accounts.

In addition, Xero allows users to grant access to clients, who can view the results of the reconciliation process directly, streamlining the accounting process even further. The software is user-friendly and accessible, with a cloud-based architecture that allows users to manage their finances from anywhere, on any device.

Overall, Xero is a powerful financial management system that provides businesses with a range of tools and functionalities to streamline their accounting processes and improve their financial management capabilities, making it a compelling alternative to Workiva.

OneStream

OneStream is a compelling alternative to Workiva, offering a robust financial management software solution that provides a complete suite of tools for financial close, compliance, reporting, account reconciliation, and transaction matching.

The software provides a range of reporting and analytics tools to support these functions, replacing traditional spreadsheet-based reconciliation processes with a more efficient and accurate approach. OneStream’s reconciliation tool automates the reconciliation process while maintaining the precision and integrity of financial data, saving valuable time and resources for finance managers.

One of the significant advantages of OneStream is its statistical view of data, which enables managers to make data-driven decisions. The software’s reconciliation tool allows for easy updating of results as needed while maintaining a complete audit trail. Additionally, the software updates reconciliation results directly from bank accounts, allowing managers to view high-risk unreconciled transactions in a centralized location. Alerts are also triggered for any changes in the trial balance, streamlining the reconciliation process for managers.

In conclusion, Workiva has numerous alternatives that businesses can explore to automate and streamline their financial reconciliation processes. Cointab Reconciliation, Blackline, ReconArt, Xero, and OneStream are just a few examples of financial management software solutions that provide features and functionalities to enhance financial management efficiency. These alternatives offer a range of benefits, such as automated transaction matching, easy updating of results, statistical views of data, and alerts for changes in the trial balance. By considering these options, businesses can identify the most suitable solution for their specific needs and improve their financial management capabilities.

Ultimately, the right financial reconciliation software can optimize processes, save time and resources, and improve accuracy and transparency, allowing businesses to focus on growth and profitability. While there are several financial reconciliation software solutions available in the market, Cointab stands out as a reliable, efficient, and user-friendly option. Its advanced features make it a valuable tool for businesses seeking to maintain the accuracy and integrity of their financial data.