Atom is a payment gateway that supplies a large range of payment facilities to customers. It makes various payment methods such as UPI, debit card, credit card, net banking, etc. available to customers who visit your website. It processes payments quickly and efficiently which is why many companies want to partner with Atom as a payment gateway partner.

While, managing payment gateway fees can be a complex task, especially with platforms like Atom that offer a diverse range of payment options. Atom’s efficient processing makes it a popular choice for businesses, therefore ensuring accurate fee calculations is crucial to avoid revenue leakage. This is where our automated Cointab software steps in, helping you to take control of your financial data. Our software applies customizable logic conditions to transform your data, generating a clear and concise reconciliation report. This report provides a comprehensive overview of all fees paid, including transaction fees, taxes, and settlement amounts.

Atom Payment Report:

This comprehensive report serves as the foundation for Atom payment gateway fee verification. It provides a detailed breakdown of each individual transaction, including:

Order Details: Each order within the report is clearly identified, allowing for easy cross-referencing.

Transaction Information: The report displays the exact transaction amount for each order, along with the corresponding transaction date.

Fee and Tax Details: Crucially, the Atom Payment Report specifies the fee and tax percentage applied to each transaction. This allows for verification against the established rate card and identification of any potential discrepancies.

Payment Method Transparency: The report provides clear information regarding the chosen payment method (e.g., UPI, debit card, credit card) for each transaction, offering valuable insights into potential fee variations based on the chosen payment option.

Issuing Bank Data: The report includes the issuing bank details for each transaction, further enhancing data clarity and facilitating potential communication with issuing banks in case of discrepancies.

Atom Rate Card:

The Atom Rate Card serves as a reference point for verifying the fee and tax percentages applied to transactions within the Atom Payment Report. This report typically includes:

Transaction Type Specificity: The rate card outlines the fee and tax percentages applicable to different transaction types (e.g., domestic credit card, international debit card) processed through Atom.

Validity Dates: The rate card specifies the validity period for the listed fee and tax percentages. This ensures you are referencing the correct rates for the specific transaction date.

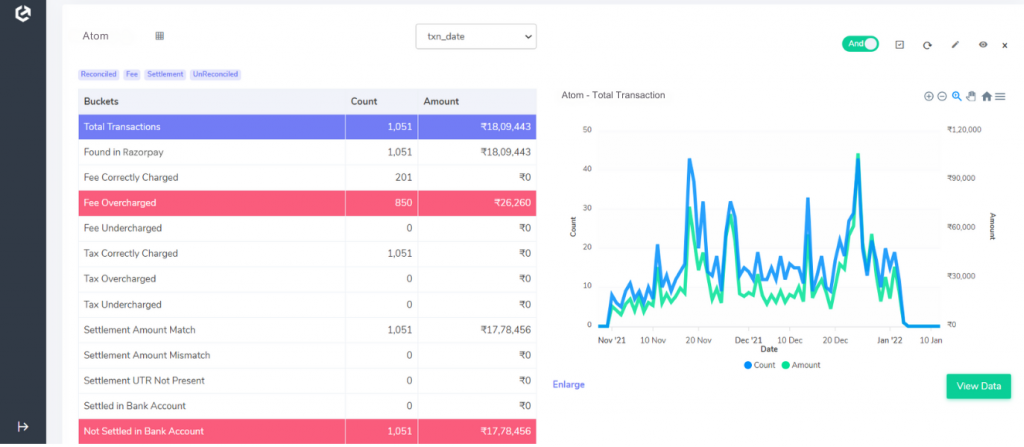

Atom Payment Gateway Charges Verification Result:

Fee Verification:

Fee – Correctly Charged: This category signifies orders where the fee calculated by our software perfectly aligns with the fee amount recorded in the Atom Payment Report. These transactions reflect accurate fee applications based on established rates.

Fee – Overcharged: Discrepancies highlighted here indicate instances where the fee charged by Atom exceeds the amount our software calculated based on the Atom Rate Card. This could potentially signify errors in fee application or require further investigation with Atom.

Fee – Undercharged: Conversely, this category showcases orders where the fee charged by Atom falls short of the amount estimated by our software. This could be due to temporary promotions offered by Atom or potential discrepancies requiring verification with Atom.

Tax Verification:

Tax – Correctly Charged: These orders represent transactions where Atom has applied the appropriate tax amount in accordance with your agreement (e.g., 18% GST on fees). This signifies accurate tax calculations and compliance with regulations.

Tax – Overcharged: This category highlights orders where Atom has charged a higher tax amount compared to the calculation by our software based on the agreed-upon tax rate (e.g., 18% GST on fees). This could potentially indicate errors in tax applications and require investigation with Atom.

Tax – Undercharged: Conversely, this category showcases orders where Atom has charged a lower tax rate than what our software calculates based on the agreed-upon rate. This could signify potential errors in tax calculation by Atom and may require further clarification.

Settlement Amount Verification:

Settlement Amount Match: This category represents orders where the settlement amount displayed in the Atom invoice (calculated as Amount Collected from Customer – Fee Charge – Tax Charge) perfectly aligns with the amount calculated by our software using the same formula. This signifies accurate settlement amount calculation and transparent financial processing.

Settlement Amount Mismatch: Discrepancies highlighted here indicate instances where the settlement amount in the Atom invoice deviates from the amount calculated by our software. This could signify errors in fee or tax calculations and necessitates further investigation with Atom.

Settlement UTR not present: UTR (Unique Transaction Reference) refers to the ID for payments made to the bank. This category identifies orders where the UTR for the corresponding settlement amount is missing in the Atom report. This might indicate a processing delay or require contacting Atom for clarification.

Settlement Status in Bank Account:

Settled in Bank Account: This category signifies orders where the amount reflected in the bank statement matches the amount recorded in the Atom invoice. This confirms that Atom has successfully settled the payment into your designated bank account.

Not Settled in Bank Account: This category identifies orders where the amount expected to be settled in your bank account based on the Atom invoice is missing from your bank statement. This could signify processing delays, bank transfer errors, or require investigation with Atom to ensure proper settlement.

Eradicate manual data entry and streamline your Atom payment gateway fee verification process with our innovative software. The integrated API exhibits exceptional flexibility, effortlessly accepting various file formats like CSV, XML, and XLSX. Our software cleanses your data, eliminating duplicates and inconsistencies to ensure accuracy. Following data cleansing, you can define customizable business logic conditions for a tailored reconciliation experience. The reconciliation results are then generated and can be conveniently exported in various formats (CSV, XML, PDF) to suit your needs. Furthermore, you have the option to schedule the reconciliation process to run automatically on a monthly basis, ensuring a truly automated and efficient solution. This comprehensive approach empowers you to maintain a clear and accurate record of all fees and taxes associated with your Atom transactions, ultimately preventing any inadvertent overpayments. Contact Cointab today!

Step into the future of reconciliation. Fill out the form to request your demo now!