Optimize ATS Invoices with Cointab’s Automated Software

ATS Invoices: Automated Verification with Cointab

ATS Courier Service stands out as a reliable partner for businesses looking to streamline their deliveries. They offer a comprehensive suite of services, including domestic and international shipping, door-to-door delivery, and even logistics solutions for complex supply chains. This versatility makes ATS a valuable asset for companies of all sizes.

However, the efficiency of any delivery service hinges on accurate billing. Reconciling invoices, the process of verifying charges against agreed-upon rates can become a tedious and error-prone task, especially with large volumes of shipments. This is where Cointab steps in to provide the solution.

Cointab acts as a powerful automation tool

eliminating the need for manual invoice review. It accurately verifies crucial billing components, ensuring fair charges from ATS This includes factors like shipment type, weight, destination, and any additional services requested. By automating these checks, Cointab eliminates human error and streamlines the reconciliation process, saving both time and resources.

Cointab’s capabilities go beyond simply ensuring accurate billing, it delves deeper by providing valuable data-driven insights. By analyzing invoice data, Cointab identifies discrepancies and potential cost savings. This empowers businesses to optimize their deliveries and increase efficient utilization of resources. Imagine the efficiency gains! With Cointab handling the reconciliation process, businesses can free up valuable resources, focus on core activities, and enjoy a smoother workflow with ATS.

Effortless Invoice Verification with Cointab:

Cointab automates invoice verification, eliminating manual errors and discrepancies. Here’s how it works:

Weight Verification:

- Cointab uses the SKU report to determine the correct weight for each shipment.

- If dimensions are unavailable, the gross weight is considered.

- For documented dimensions, the volumetric weight is calculated using the formula “Length x Width x Height” and divided by the specified divisor.

- The final weight is rounded off to determine the final slab used for billing.

Zone Verification:

- Cointab matches pin codes from your deliveries with the Pincode Master report to assign the appropriate zone (local, regional, national). These zones have corresponding identifiers like A, B, C

Rate Card Verification:

- Cointab compares rates listed on the Rate Card with those applied by ATS on your invoice.

Understanding Your ATS Invoice Charges: A Breakdown

This guide simplifies the breakdown of charges on your ATS invoice, helping you understand how delivery costs are calculated.

Forward Charges:

These represent the core cost of transporting your shipment. Here’s a closer look:

- Fixed Slab: This weight threshold signifies a fixed rate charged per shipment. Think of it as a base price for deliveries within a specific weight range.

- Additional Weight Slab: When your shipment surpasses the fixed slab weight, an additional rate applies to the excess weight. This ensures a fair cost structure for heavier packages.

- Expected Forward Charge Formula: This formula calculates the total forward charge by adding the fixed charge (fixed_charged) to the product of the additional weight slab (extra_weight_slab) and the additional charge per unit (add_charged).

RTO (Return To Origin) Charges:

These come into play when a shipment cannot be delivered and needs to be returned to you. Here’s the breakdown:

- RTO Fixed Slab: Similar to forward charges, this defines a weight limit for a fixed RTO rate. Think of it as a base return cost for packages within a specific weight range.

- RTO Additional Slab: If the returned package exceeds the RTO fixed slab weight, a separate rate applies to the exceeding weight.

- Expected RTO Charge Formula: This formula calculates the total RTO charge by adding the fixed RTO charge (rto_charged) to the product of the additional weight slab (extra_weight_slab) and the additional RTO charge per unit (rto_add_charged).

COD (Cash On Delivery) Charges:

This is a flat rate charged for shipments where the recipient pays for the order upon delivery. It simplifies the collection process and provides a secure payment option for both you and your customers.

GST (Goods and Services Tax):

This is a government-imposed indirect tax applicable to the total value of services, including delivery charges. Your ATS invoice will reflect the GST percentage applied to the sum of forward charges, RTO charges, and COD charges.

Expected Final Amount:

This represents the total amount payable for your delivery, calculated by summing up the forward charge, RTO charge (if applicable), COD charge (if applicable), and the GST amount.

.

Empower your finance team with Cointab's automated reconciliation. Get started today!

Sign Up For Demo

Understanding the Report Output:

Order Management System (OMS):

- Found in EasyEcom: EasyEcom allows weight verification for further calculations. EasyEcom provides valuable details like the number of items per delivery, facilitating weight estimation.

- Missing in EasyEcom: Orders absent from EasyEcom reports prevent weight verification and subsequent calculations for those specific orders.

Zone Verification:

- Found in Pincode Master: This enables location verification and zone categorization. Zone categories are crucial for determining the applicable rate.

- Missing in Pincode Master: Orders missing from the Pincode Master report hinder location verification and zone categorization, impacting rate determination.

Rate Card Verification:

- Found in Rate Card: Listed on the Rate Card allows verification of the applied rates.

- Not Found in Rate Card: Rates for orders absent from the Rate Card cannot be verified by the software

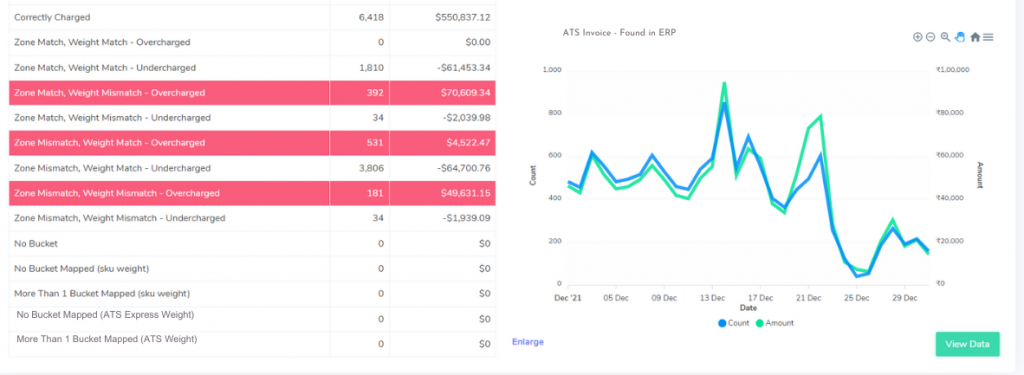

OMS vs. ATS Invoice Reconciliation:

Cointab compares the weight, zone, and rate calculated by itself against the values used by ATS for billing. This comparison reveals:

1. Correctly Charged:

Orders with matching weight, zone, and rate in both reports are deemed reconciled.

2.Discrepancies:

- Overcharged/Undercharged (Weight Match, Zone Match): This category highlights errors in applied rate despite accurate weight and zone.

- Overcharged/Undercharged (Weight Match, Zone Mismatch): These categories reveal zone mismatches leading to incorrect billing, even with accurate weight.

- Overcharged/Undercharged (Weight Mismatch, Zone Match): These categories identify weight discrepancies leading to incorrect billing, even with the correct zone.

- Overcharged/Undercharged (Zone Mismatch, Weight Mismatch): These categories show combined weight and zone errors resulting in incorrect billing.

3. Invoice Verification using ATS Weight:

This section focuses on scenarios where the software verifies zone and rate based on the weight provided by ATS. Potential discrepancies include:

- Correctly Charged: All elements (zone, rate) align with the weight provided by ATS, resulting in accurate billing.

- Overcharged/Undercharged (Zone Match): These categories identify potential discrepancies with the applied rate despite a valid zone and ATS-provided weight.

- Overcharged/Undercharged (Zone Mismatch): These categories highlight zone mismatches leading to incorrect billing, even with the weight provided by ATS.

Join Cointab and Unlock the path to Transparency and Efficiency

Cointab offers a revolutionary solution, transforming the way your finance team handles invoice verification. Our software accurately analyzes each element impacting your final bill – weight, zone, and rate – providing unparalleled clarity. Cointab empowers you with actionable insights, pinpointing discrepancies that might lead to billing errors. This translates to more than just identifying mistakes; it equips your team with the knowledge to address them and optimize costs. With Cointab’s automated verification, confidence and trust are fostered. Your finance team can confidently review invoices, knowing every detail has been analyzed with precision. This eliminates the worry of any missed errors, allowing your team to focus on strategic financial tasks with complete trust in the accuracy of their invoice data. Get started with Cointab today and experience the power of transparency, actionable insights, and a newfound confidence in your invoice verification process!

Step into the future of reconciliation. Fill out the form to request your demo now!