AutoRek is a financial reconciliation software solution that can help businesses automate and streamline their financial reconciliation processes. The software provides an end-to-end solution for financial data management, including data integration, validation, and transformation.

The reconciliation software is designed to help businesses improve the accuracy and efficiency of their reconciliation processes. It automates the matching, grouping, and categorization of financial transactions across multiple systems and data sources. It is also capable of identifying and flagging discrepancies, allowing users to quickly resolve issues and maintain data accuracy. The software also provides tools for data analysis and reporting to help businesses identify trends, patterns, and anomalies in their financial data. This can help businesses make better-informed decisions and improve overall financial performance.

Overall, AutoRek can help businesses save time and reduce the risk of errors in their financial reconciliation processes, ultimately leading to more accurate financial reporting and better decision-making.

When considering alternative options to AutoRek, it’s important to look for financial reconciliation software solutions that offer similar functionality and features. These alternatives should also provide automation capabilities to improve the efficiency of reconciliation processes, as well as tools for data analysis and reporting. Businesses can find a financial reconciliation solution that best meets their specific needs and budget by exploring different options and comparing their features and pricing.

Businesses can discover a financial reconciliation solution that fits their requirements and budget by examining various options and comparing their characteristics and costs. Here are some examples of alternative financial reconciliation software solutions to AutoRek:

1. Cointab Reconciliation

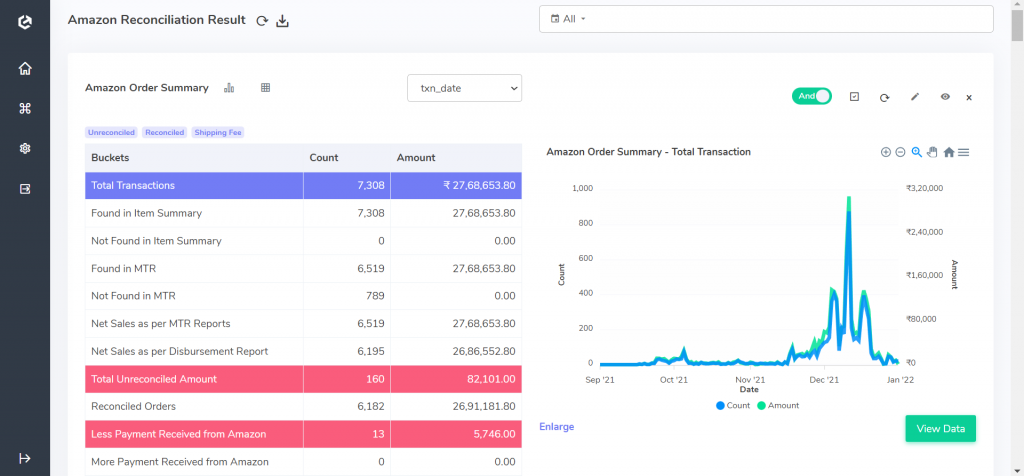

Cointab Reconciliation is a highly efficient financial reconciliation software solution that automates and simplifies reconciliation processes for businesses using advanced technology. By leveraging the automated data input, data cleaning, and rule execution features of Cointab Reconciliation, businesses can easily identify reconciled and unreconciled transactions.

One of the most significant benefits of Cointab Reconciliation is its versatility, as it can handle various file formats and data structures, and companies can customize the rules engine to fit their specific requirements. This customization guarantees that the software is maximally beneficial to businesses.

Upon completion of the reconciliation process, Cointab Reconciliation presents the findings and generates reports on a universal dashboard, making it simple to analyze financial data and maintain an accurate audit trail. The software also integrates seamlessly with other accounting, ERP, and banking software, resulting in a smooth user experience.

The web-based architecture of Cointab Reconciliation makes it highly adaptable and user-friendly, allowing users to access the software from a variety of devices, including desktops, laptops, tablets, and smartphones. The software can also be easily integrated with various enterprise resource planning systems, internal systems, and other platforms, making it a highly flexible and scalable solution that can be tailored to meet the needs of different businesses.

By scheduling reconciliation to run automatically in real-time, hourly, weekly, or monthly, businesses can enhance their productivity and reduce manual work. With Cointab Reconciliation, businesses can streamline their financial reconciliation processes and manage their finances more efficiently.

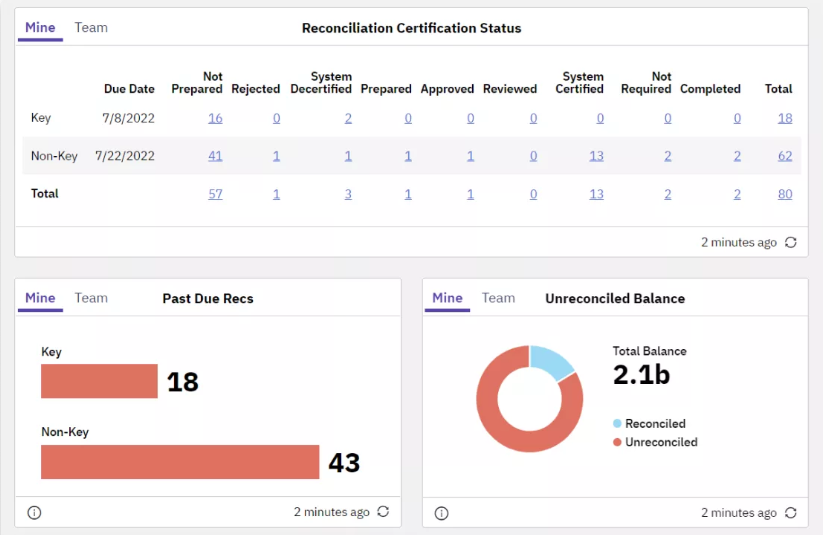

2. BlackLine

BlackLine is an all-in-one financial reconciliation software solution that offers a wide range of account reconciliation services to manage financial close activities. By providing real-time dashboard views and automated features, Blackline can significantly enhance the efficiency and transparency of the reconciliation process, reducing the workload of finance teams.

One key benefit of Blackline is its capacity to streamline various business processes by providing standardized templates for different documents, workflows for preparation and review, and integration with policies and documentation storage. This feature makes Blackline a powerful ERP (Enterprise Resource Planning) solution that can assist businesses in managing their resources more efficiently by grouping different functions together and providing a centralized platform for managing data and workflows.

Overall, Blackline provides a comprehensive and efficient solution for financial reconciliation, making it a strong alternative to AutoRek. Its ability to streamline various business processes and provide a centralized platform for managing data and workflows can help businesses optimize their financial operations and improve productivity.

3. ReconART

If you’re looking for an alternative to AutoRek, ReconART could be a viable option. Like AutoRek, ReconART is a powerful financial reconciliation software that simplifies various reconciliation processes. It offers advanced technology and features that provide users with a comprehensive solution to manage and reconcile financial transactions across multiple accounts, platforms, and devices.

One of ReconART’s key features is its various reconciliation functionalities, which include credit-card reconciliation, bank reconciliation, account reconciliation, posting, holdings and trades reconciliation, intercompany reconciliation, and enhanced journal entries. These functionalities enable businesses to match and compare transactions, detect discrepancies, and resolve errors in a timely and efficient manner.

Another advantage of ReconART is its web-based architecture, which allows users to access and use the software from any device, such as laptops, desktops, tablets, and smartphones. This flexibility allows users to stay on top of their finances and reconciliation processes at all times.

ReconART also provides seamless integration with various enterprise resource planning (ERP) systems, internal systems, and other platforms. This makes it a highly flexible and scalable solution that can be easily customized to meet the unique needs of different businesses, just like AutoRek.

4. Xero

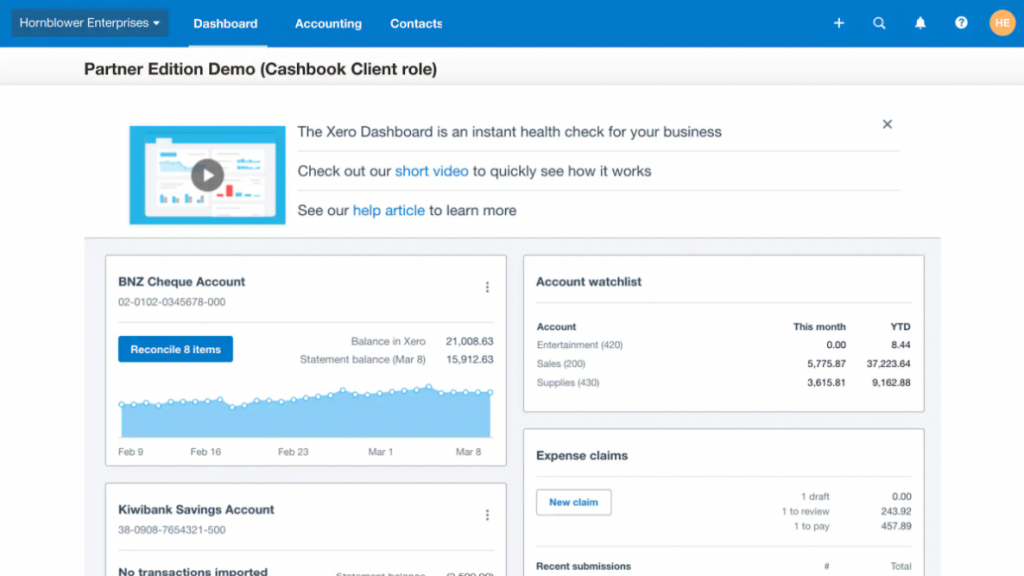

Xero is a cloud-based financial management system that offers a broad range of tools and features to help businesses manage their finances more efficiently. Its features include bill payments, reimbursements, expense claims, cash flow tracking, and bank reconciliation, making it a versatile alternative to AutoRek.

One key feature of Xero is its reconciliation tool, which simplifies the process of matching bank transactions with accounting records. The system automatically imports transactions from bank accounts and compares them with the records in Xero’s cashbook, flagging any discrepancies or differences in balances. The process is automated, freeing up valuable time and resources that would otherwise be spent manually reconciling accounts.

Furthermore, Xero allows users to grant access to clients, who can view the results of the reconciliation process directly, streamlining the accounting process even further. The software is user-friendly and accessible, with a cloud-based architecture that allows users to manage their finances from anywhere, on any device.

Overall, Xero is a powerful financial management system that provides businesses with a range of tools and functionalities to streamline their accounting processes and improve their financial management capabilities. Its reconciliation tool is a significant advantage, making it a strong alternative to AutoRek.

5. OneStream

OneStream is a robust financial management software solution that offers a complete suite of tools for financial close, compliance, reporting, account reconciliation, and transaction matching, making it a viable alternative to AutoRek.

The software provides a range of reporting and analytics tools to support these functions, replacing traditional spreadsheet-based reconciliation processes with a more efficient and accurate approach. OneStream’s reconciliation tool automates the reconciliation process while maintaining the precision and integrity of financial data, saving valuable time and resources for finance managers.

One of the significant advantages of OneStream is its statistical view of data, which enables managers to make data-driven decisions. The software’s reconciliation tool allows for easy updating of results as needed while maintaining a complete audit trail. Additionally, the software updates reconciliation results directly from bank accounts, allowing managers to view high-risk unreconciled transactions in a centralized location. Alerts are also triggered for any changes in the trial balance, streamlining the reconciliation process for managers.

Overall, OneStream is a powerful financial management software solution that offers a comprehensive suite of tools for financial close, compliance, reporting, account reconciliation, and transaction matching. Its automated and statistical approach to reconciliation makes it a strong alternative to AutoRek.

To sum up, AutoRek has several alternatives that businesses can utilize to automate and streamline their reconciliation procedures. Cointab Reconciliation, Blackline, Xero, and OneStream are all financial reconciliation software solutions that offer various features and functionalities to enhance financial management efficiency. These software options provide businesses with a range of benefits, from automated transaction matching and easy updating of results to statistical views of data and alerts for changes in the trial balance. By exploring these alternatives, businesses can identify the best solution to suit their needs and improve their financial management capabilities, depending on their specific needs.