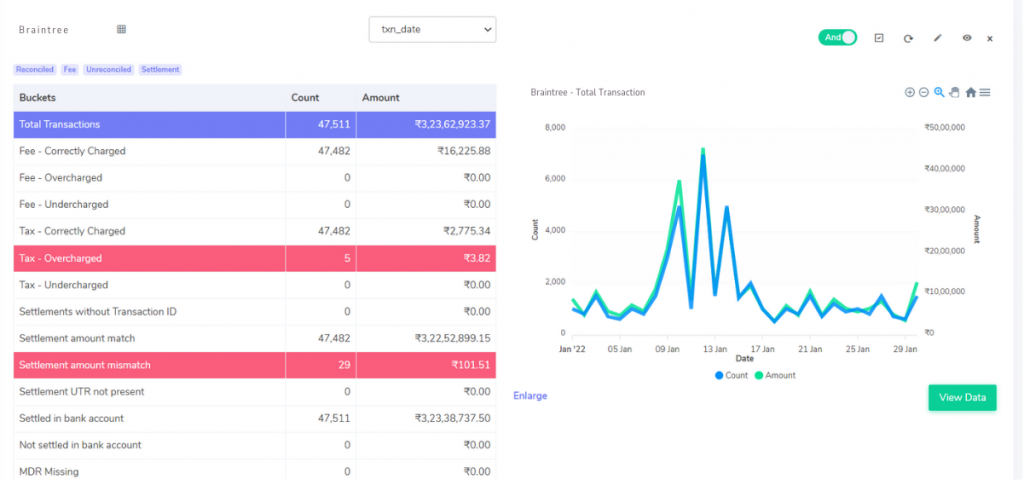

Braintree Payments platform is an online payment gateway for transactions, it allows online businesses to accept payments via app or website. Braintree Payments focuses on online payments which makes it a good fit for any e-commerce business. But to partner with Braintree Payments, it charges certain fees and taxes as a payment gateway service; this fee gets deducted from the payments made by the customer.

Multiple transactions take place frequently and it requires a lot of manual work by the finance team. Using automated software will help to reconcile the transactions efficiently and effortlessly.

Cointab Reconciliation software helps to automate the reconciliation process and checks where exactly you have been overcharged or undercharged by Braintree Payments. Which will further help the business to make claims with Braintree Payments.

Braintree Payments payment report:

Total transactions and from which mode the transactions are carried out are displayed in this report.

Braintree Payments Rate card:

It entails the payment mode and the fee, percentage, which are charged.

Fee correctly charged:

The fees charged by Braintree Payments match with the amount calculated using Rate Card.

Fee overcharged:

The fees charged by Braintree Payments are seen to be more than the amount calculated using Rate Card.

Fee undercharged:

The fees charged by Braintree Payments are seen to be less than the amount calculated using Rate Card.

Tax-correctly charged:

The tax recorded in the Payment Report matches the amount calculated as per GST guidelines

Tax- overcharged:

The tax recorded in the Payment Report is seen to be more than the amount calculated as per GST guidelines.

Tax- undercharged:

The tax recorded in the Payment Report is seen to be less than the amount calculated as per GST guidelines.

Settlement UTR not present:

In the Settlement report, for these transactions, UTR is not present.

Settlement amount match:

After deducting the fees and taxes of the settlement mentioned in the report, the final settlement amount is matching with the amount calculated.

(Settlement Amount = Total Amount – Fees – Tax)

Settlement amount mismatch:

After deducting the fees and taxes the settlement mentioned in the report the final settlement amount is not matching with the amount calculated.

Settled in bank account:

The UTR present in the settlement Report should also be reflected in the Bank Statement.

Not settled in bank account:

In this transaction, UTR is present in the settlement report but is missing in the bank statement.

Step into the future of reconciliation. Fill out the form to request your demo now!