Optimize Reconciliation of Canpar Express Shipping Invoice with Cointab

Optimize Reconciliation of Canpar Express Shipping Invoice with Cointab

Canpar Express: A Reliable Canadian Courier Service

Canpar Express, a leading Canadian courier company, boasts a vast network of over 55 terminals strategically located across the country, including major hubs in Toronto, Montreal, and Vancouver. They prioritize innovation and adaptability, consistently creating unique solutions to meet their clients’ ever-changing needs.

Reduce Errors in Canpar Invoices with Automated Verification

Millions of deliveries are handled by Canpar Express daily. While occasional errors can occur in delivery fee calculations, manually verifying these charges can be a tedious and error-prone process. Cointab’s Reconciliation software offers an automated and precise solution.

Effortless Invoice Verification with Cointab Reconciliation

Cointab Reconciliation streamlines the invoice verification process by seamlessly comparing your ERP reports, shipping invoices, pincode master data, SKU reports, and rate cards with your Canpar invoices. This eliminates manual effort and ensures accuracy.

Reports Needed for Canpar Invoice Verification

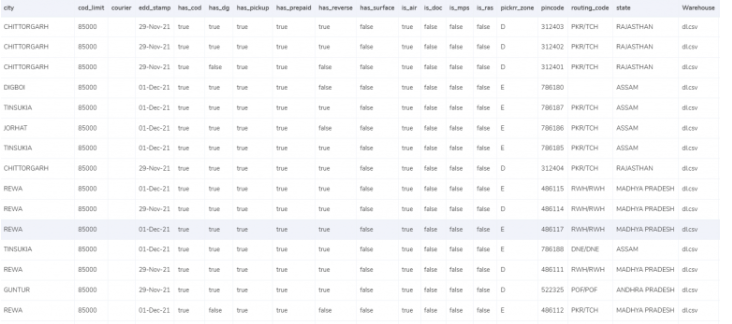

Pincode Zone Report:

This report identifies the zone based on the origin and destination postal codes.

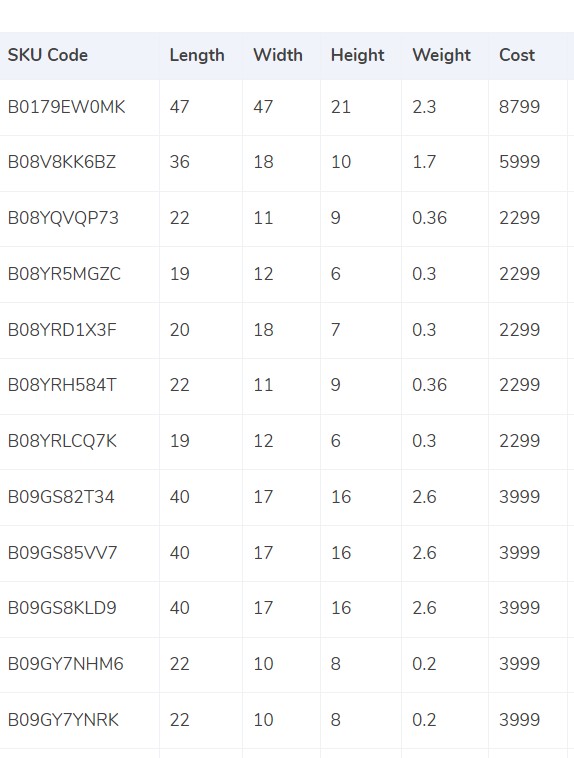

SKU Report:

This report contains unique product identifiers that help determine weight and dimensions.

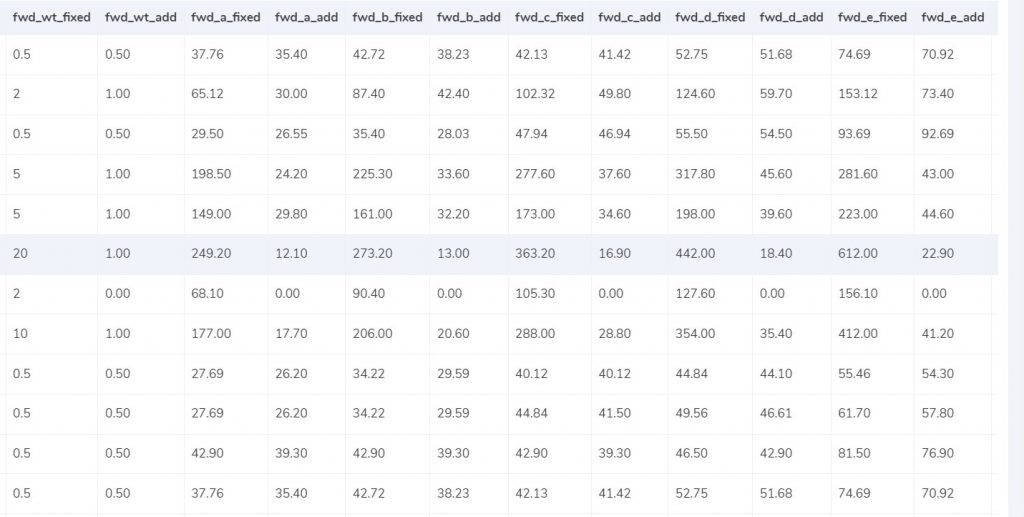

Rate Card:

The rate card outlines the shipping costs based on weight and zone.

Canpar Delivery Invoice: The invoice includes crucial details like order ID, billing zone, product type, weight, and applied weight slab for cost calculation.

Automated Invoice Verification Process

Cointab Reconciliation software leverages the SKU report, pincode master data, and rate card to calculate the expected weight, location, and delivery cost. This facilitates easy identification of any discrepancies in the Canpar invoice.

SKU Report:

Cointab Reconciliation streamlines Canpar invoice verification by intelligently determining product weight and dimensions.

SKU-Based Weight Lookup:

The software references the SKU code in your ERP report to automatically retrieve the product’s weight from your database.

Invoice Weight Consideration:

If the weight isn’t available in the ERP report, Cointab uses the value provided in the Canpar invoice.

Volumetric Weight Calculation:

When product dimensions are present, Cointab calculates the volumetric weight using the industry-standard formula: Length x Width x Height (all values must be in centimeters).

Divisor Application:

The calculated volumetric weight is then divided by the divisor specified in your rate card. If the divisor is missing, a default value of 5000 is applied.

Data Consolidation:

After weight determination, Cointab seamlessly integrates the calculated values into both the Canpar invoice and your ERP report.

Final Weight Rounding:

Finally, the software rounds off the final weight to determine the appropriate billing slab.

Charges:

Cointab Reconciliation simplifies understanding Forwarding (FWD) and Return-to-Origin (RTO) charges on your Canpar invoices.

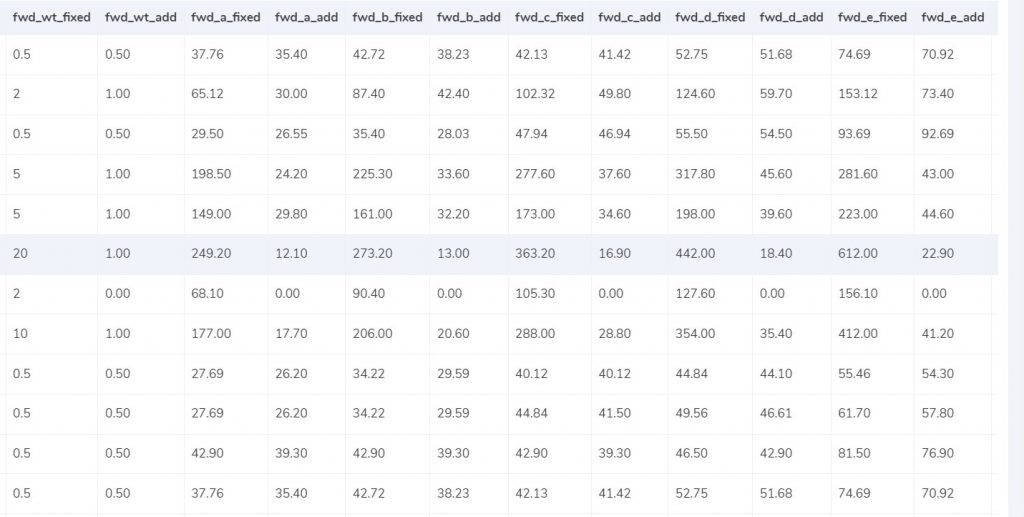

FWD Charge Calculation:

Cointab analyzes the final weight slab from the invoice.

If the weight is less than or equal to the “fwd_wt_fixed” limit in the rate card, the charge is set to “fwd_fixed” for the corresponding zone.

For weights exceeding “fwd_wt_fixed,” an “extra_weight” is calculated.

The expected FWD charge is then determined using the formula: Expected_fwd_chg = fwd_fixed + (extra_weight) x fwd_add where “fwd_add” is the additional charge per unit weight based on the zone.

RTO Charge Calculation:

Similar to FWD charges, Cointab checks the final weight against the “rto_wt_fixed” limit in the rate card.

If the weight falls within this limit, the charge is set to “rto_fixed” for the zone.

For weights exceeding “rto_wt_fixed,” the “extra_weight” is calculated.

The expected RTO charge is derived using the formula: Expected_rto_chg = rto_fixed + (extra_weight) x rto_add where “rto_add” is the additional charge per unit weight based on the zone.

Expected Final Amount:

Cointab combines the expected FWD charge, RTO charge, and any applicable tax percentage to calculate the expected final invoice amount.

Pincode Master:

Effortlessly assign accurate zones to your Canpar invoices with Cointab Reconciliation.

Origin-Destination Zone Mapping:

The software automatically assigns zones based on the origin (pickup) and destination (delivery) locations specified in your invoice.

Seamless Invoice Linking:

Cointab intelligently links these locations to the corresponding invoice, ensuring the correct zone is applied for each shipment.

Zone Classification System:

Canpar utilizes a multi-tiered zone classification system. This includes categories like regional, international, and global, further subdivided by indicators like a, b, and c. Cointab understands this system and assigns zones accordingly.

Rate Card:

Cointab Reconciliation guarantees you’re billed correctly by verifying rates against Canpar’s zone and weight criteria.

Zone-Based Rate Matching:

The software references your rate card to identify the applicable rates based on the zone (determined from origin and destination) and product weight specified in the Canpar invoice.

Weight-Dependent Charges:

Cointab recognizes that rates change with increasing weight. It verifies if the weight on the invoice falls within the acceptable limit for the applied rate.

Rate Card Column Matching:

Cointab meticulously compares key columns in your rate card (“courier,” “zone,” “fwd_wt_fixed” – additional weight for increased fixed rates, and divisor) against the corresponding data in the Canpar invoice. This ensures accurate charges are applied.

Rate Validity:

Cointab considers delivery dates associated with specific rates. It verifies if the applied rate is valid for the shipment’s delivery date.

Navigating Financial Precision: Cointab Reconciliation Software Metrics

2M

1.6B

$37B

The output is as follows

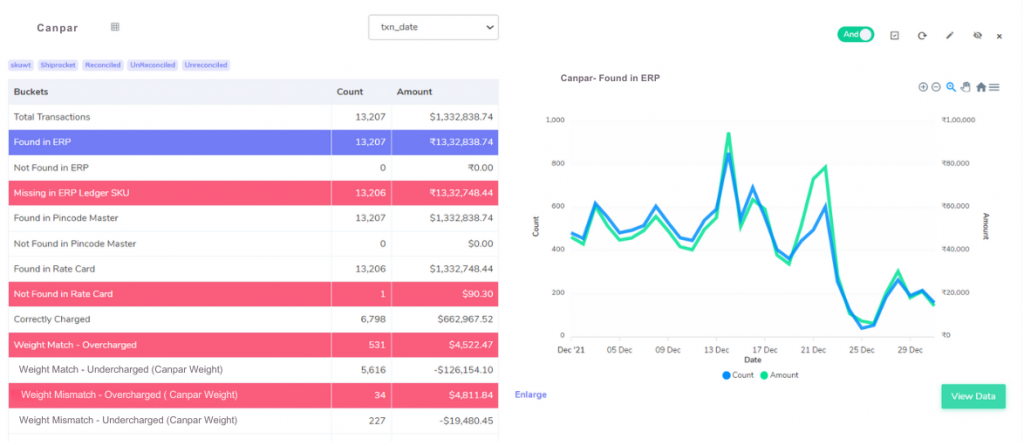

Canpar Invoice- ERP:

Cointab Reconciliation streamlines weight verification for Canpar invoices by seamlessly comparing them to your ERP data.

Matching Orders:

When an order on the Canpar invoice is also found in your ERP report, Cointab retrieves the product weight directly from your system, facilitating effortless verification.

Missing Order Information:

If an order on the Canpar invoice isn’t present in your ERP, Cointab identifies this discrepancy, allowing you to investigate further.

Canpar Invoice -Pincode Master:

Cointab Reconciliation guarantees data integrity by meticulously comparing Canpar invoices with your Pincode master data.

Verified Pincode Match:

When pincode information on the Canpar invoice matches your Pincode master data, Cointab confirms its accuracy, streamlining the verification process.

Missing Pincode Data:

If a pincode on the Canpar invoice is absent from your Pincode master, Cointab flags this discrepancy, prompting further investigation.

Canpar Invoice- Rate card:

Cointab Reconciliation empowers you to ensure accurate billing by meticulously comparing Canpar invoices against your rate card.

Matched Rates:

When service charges on the Canpar invoice correspond to entries in your rate card, Cointab confirms their validity, streamlining verification.

Unidentified Rates:

If charges on the Canpar invoice are not found in your rate card, Cointab flags this discrepancy, prompting you to investigate potential billing errors.

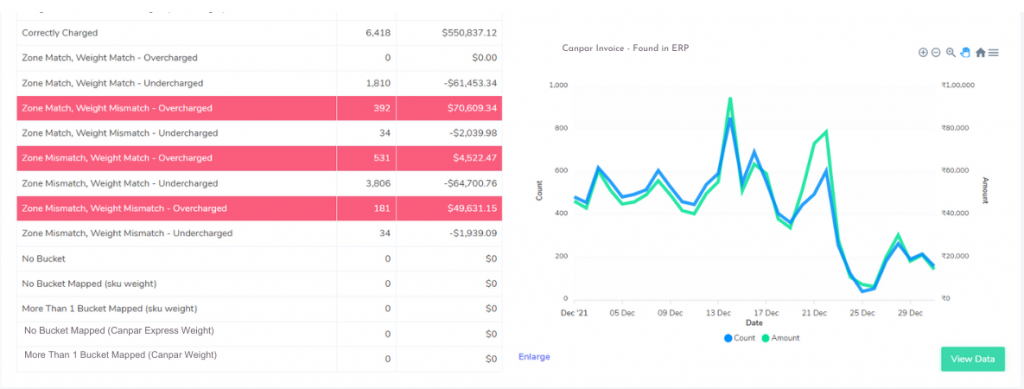

Fee Verification of Canpar Invoice:

Cointab Reconciliation empowers you to identify and rectify potential billing errors in your Canpar invoices.

Here’s how it detects discrepancies:

Correct Charges: When the weight, zone, and rate extracted from your ERP report match the corresponding data on the Canpar invoice and the calculated amount aligns with the invoice total, Cointab confirms a correctly charged invoice.

Zone/Weight Match – Overcharged/Undercharged:

In cases where the zone and weight on both the ERP report and Canpar invoice are identical, but the applied fee differs:

If the Canpar invoice charges more than the calculated amount based on the rate card, it’s flagged as an overcharge.

Conversely, if the Canpar invoice charges less than the calculated amount, it’s identified as an undercharge.

Zone Mismatch – Weight Match:

When the weight on both reports matches, but the zone information in the Canpar invoice differs from your ERP data:

A zone mismatch with a higher charged amount on the Canpar invoice signifies a potential overcharge.

A zone mismatch with a lower charged amount on the Canpar invoice suggests a possible undercharge.

Zone Match – Weight Mismatch:

If the zone information aligns but the weights differ between the ERP report and Canpar invoice:

A weight discrepancy with a higher charged amount on the Canpar invoice might indicate an overcharge.

A weight discrepancy with a lower charged amount on the Canpar invoice might be an undercharge.

Zone Mismatch – Weight Mismatch:

When there’s a complete mismatch between zone, weight, and applied fees on the Canpar invoice compared to your ERP data, Cointab flags it for further investigation. This could potentially be an overcharge or undercharge

Don't waste time on manual financial reconciliation. Let our Reconciliation software do the work for you.

Tired of manually verifying Canpar invoices and worried about overpaying? Cointab Reconciliation software simplifies the process, ensuring accurate billing. Effortlessly upload your Canpar invoices and ERP data, and Cointab’s user-friendly interface guides you through a custom workflow. Discrepancies are highlighted in red for quick identification and rectification. Stop wasting time and money on manual calculations – Cointab Reconciliation automates the process, reduces costs by identifying overcharges, and gives you peace of mind knowing your Canpar invoices are accurate. Start reconciling today and unlock the benefits of Cointab Reconciliation!