The gaming industry is the most sought-after market, especially in India. As of 2021, India was considered to be among the top five markets for mobile gaming. The revenue generated from this industry is massive. This industry itself is said to be worth around ₹ 22,300 crores. As you see, the gaming industry sounds really promising. For the gaming industry to work at such a level, they have to deal with various customers and transactions. For example, if you take a gaming company, where people can play games on which you can make money. Then the number of transactions a company like that has to process is incomprehensible. Keeping track of each transaction made by a player would be tedious. Also, checking if the company itself has received the correct amount from the respective payment gateway partner is very difficult.

Cointab’s automated reconciliation system provides a solution to these problems. It helps verify the company’s internal data report with the payment gateway report and bank statement. After this, the software produces a result table showing if payments are received correctly from the payment gateway partner or not. This way company can easily verify the deposit transactions.

Reports Required for Deposit Transactions Verification

Internal / Deposit Report

This report consists of order IDs and details of all the transactions for which the amount is deposited by the customers.

Payment Gateway Report

This the report shared by the company’s payment gateway partner.

Bank Statement

Here the details of the transactions that reach the company’s bank account are shown.

Cointab Result

The process starts when the software reconciles the internal data report of the deposit report with the Payment Gateway. This is done to check if the payment gateway has taken the correct amount from customers and has then paid the correct amount to the company. Finally, the software compares the payment gateway report with the bank statement. This helps determine if the amount the payment gateway partner claims to have paid actually reaches the company’s bank account. The reconciliation results are displayed by the software as given below.

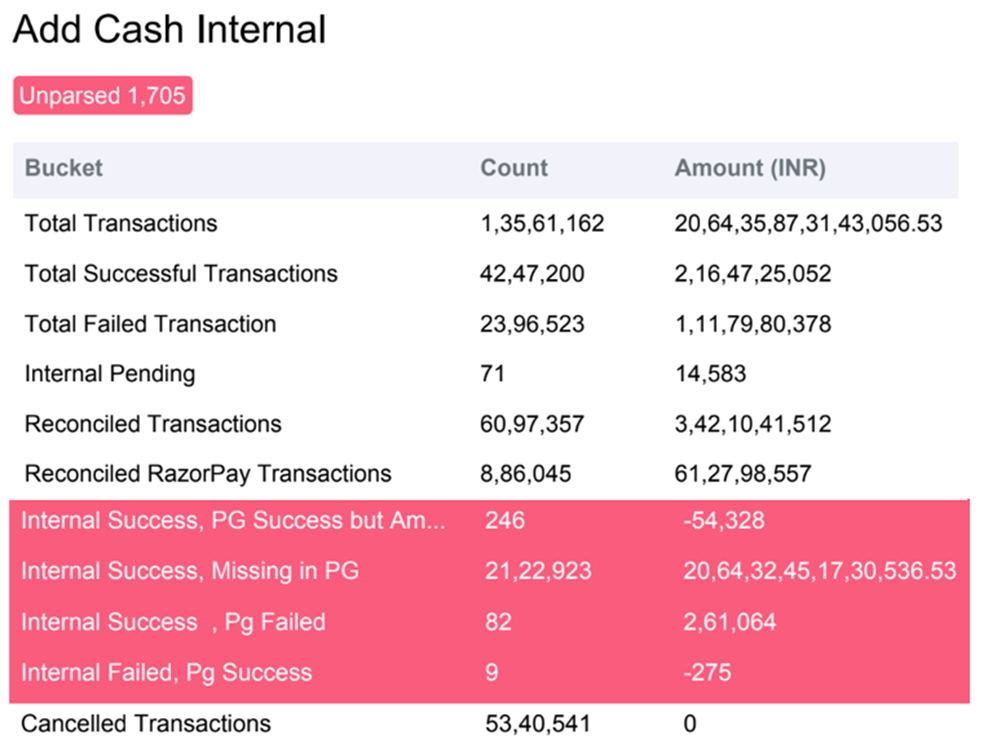

Internal Report-Payment Gateway

Total Successful Transactions

These are the total number of transactions that were completed and paid correctly.

Total Failed Transactions

These are the total number of transactions that were not completed or the payment gateway has not paid the amount on these orders

Reconciled Transactions

In the Internal report and in the Payment Gateway report these are the transactions that match.

Internal Success, PG Success but Amount Mismatch

These transactions are completed and the payment is received at the company’s end and at the Payment Gateway end too. But the amounts in both the reports do not match.

Internal Success, Missing in PG

These transactions are completed and the payment is received at the company’s end. But these transactions’ data are not present at the Payment Gateway end.

Internal Success, PG Failed

Here, these transactions are completed and the payment is received at the company end. But the at Payment Gateway end, these transactions are either not completed or not paid

Internal Failed, PG Success

Here these transactions are not completed or payment is not received at the company end, hence it shows failed. But the at the payment gateway end these transactions are completed and paid.

Cancelled Transactions

These are the transactions that were first going to be completed but then later cancelled.

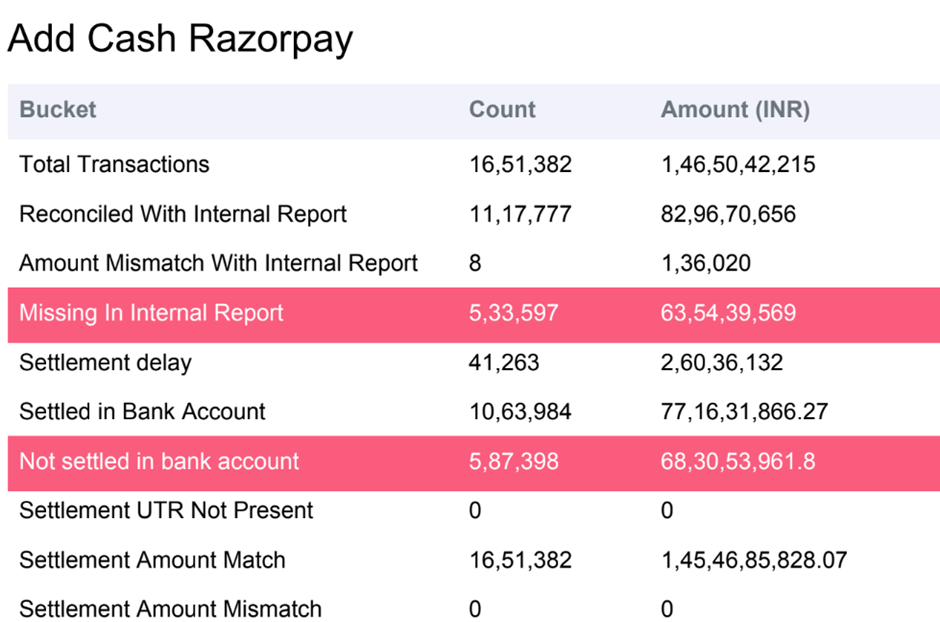

Payment Gateway – Internal Report

Reconciled with Internal Report

These are the transactions that match in the Company’s internal report and in the payment gateway report.

Amount Mismatch with Internal Report

For these transactions, the amount recorded in the payment gateway report does not match the amount recorded in the company’s internal report.

Missing in Internal Report

These transactions are recorded in the payment gateway report. But these transactions data is not present in the company’s internal report.

Settled in Bank Account

Here, the transactions for which the amount paid by the payment gateway partner is found in the bank.

Not Settled in Bank Account

For these transactions, the amount paid by the payment gateway partner does not reach the company’s bank account.

Settlement UTR not present

The UTR on the transactions made by the payment gateway partner is not present, hence these transactions cannot be verified with the bank statement.

Settlement Amount Match

The Settlement Amount is the transaction amount – fee charged – tax charged. When the settlement amount matches the amount paid by the payment gateway it is displayed in this bucket.

Settlement Amount Match

After using the same calculation for the settlement amount as shown above. When the settlement amount does not match the amount paid by the payment gateway it is displayed in this bucket.

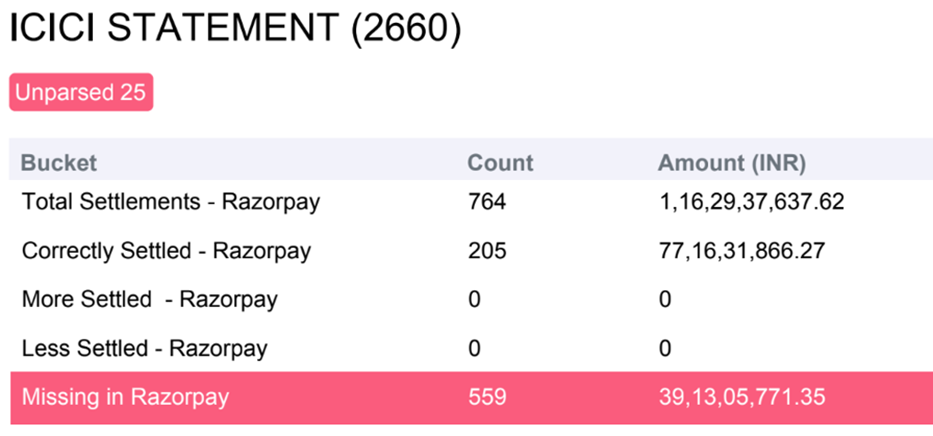

Bank – Payment Gateway

Total Settlements

These are the total number of settlements made by the payment gateway partner that has reached the bank.

Correctly Settled

These are the transactions which match in the payment gateway report and in the bank statement. This means that the correct amount is paid to the company’s bank account by the payment gateway.

More Settled

For, these transactions the amount recorded in the bank statement is more than the amount recorded in the Payment gateway report. That means that the payment gateway paid more than the required amount to the company.

Less Settled

These are the transactions for which the amount recorded in the bank statement is less than the amount recorded in the Payment gateway. This means that the payment gateway paid less than the required amount to the company.

Missing in Payment Gateway

These transaction data are not present in the payment gateway hence these payments cannot be paid to the company

The above-given result shows you that Cointab integrates the company’s internal report, the payment gateway report, and the bank statement to verify the deposit transactions. This verification is necessary to know if gaming companies actually receive the amount paid by customers through the payment gateway. Hence, the result by Cointab is easy to understand and easily analyzed by the finance teams of your company.

So, if you want to make the process of reconciliation of deposit transactions easy, then do try Cointab!

Click here to read about Withdrawal Transactions Reconciliation for the Gaming Industry.