Eway is a leading global payment gateway, which allows businesses to accept secure credit card payments 24/7 from customers worldwide. Eway tends to make e-commerce easy for their merchants, and customers and makes online payments effortless.

As a reputable payment gateway, when your business establishes a connection with Eway, a series of transactions ensues, involving interactions between the payment gateway, customer transactions, and your business account. Within this intricate process, there can be instances of transactional miscalculations as funds traverse from the payment gateway and finally settle into your business account. Detecting and rectifying these discrepancies holds paramount importance to ensure the accuracy of financial records.

Enter Cointab’s reconciliation software, a robust solution designed to effortlessly validate transactions with minimal manual intervention. This software revolutionizes the verification procedure by harnessing the power of automation. It offers the convenience of data upload in a format of your preference, whether it’s API, SFTP, emails, or other methods. Moreover, Cointab’s software empowers you to craft a tailor-made workflow that aligns precisely with your unique business needs. Through this adaptable framework, the software adeptly identifies and highlights any anomalies residing within the generated report, enabling you to promptly address and reconcile these discrepancies.

Eway Payment Gateway Reconciliation Results:

Eway settlement reports:

These reports include the order which has been placed, and for which payments are also processed.

Eway refund reports:

It consists of the amounts that have been refunded after the order has been cancelled.

Website reports:

The website reports include the orders that have been placed by customers through the website.

ERP reports:

It is the internal report of the company, where the information is placed item-wise.

Bank Statement:

These include the reports of transactions in which the bank has received payment via Payment Gateway.

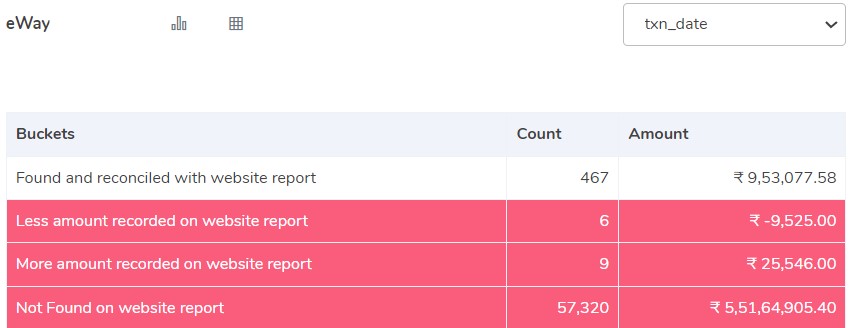

Eway with website Reconciliation:

Found and reconciled with website report:

These transactions are found and reconciled in the Eway settlement reports and the website report.

Less amount recorded on website report:

The amount recorded on the website report is less than the Eway settlement report.

More amount recorded on website report:

The amount recorded on the website report is more than the Eway settlement report.

Not found in the website report:

These transactions are missing in the website report but are recorded on the Eway settlement report.

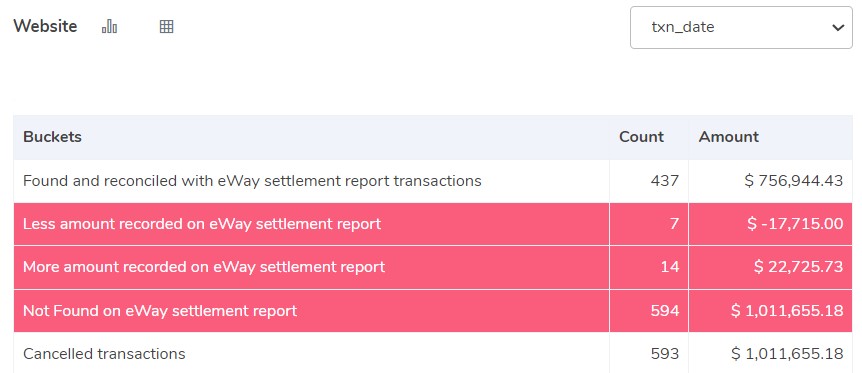

Website with Eway Reconciliation:

Found and reconciled with Eway settlement report transactions:

The transactions are found and reconciled on Eway reports as well as on the website report.

Less amount recorded on the Eway settlement report:

The amount recorded on the Eway report is seen to be less than the website report.

More amount recorded on the Eway settlement report:

The amount recorded on the Eway report is more than the website report.

Cancelled transactions:

These consist of the orders that have been cancelled by the customers and are recorded on the website report but have not been recorded on the Eway settlement report.

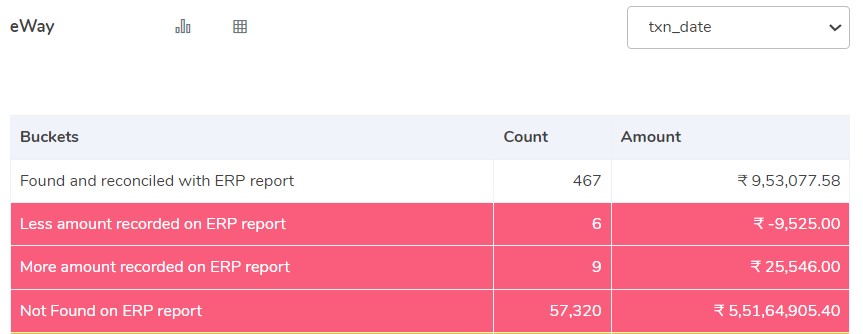

Eway Reconciliation with ERP:

Found and reconciled with ERP reports:

These transactions have been found and reconciled on the Eway report as well as on the ERP report.

Less amount recorded on ERP reports:

The amount recorded on the ERP report is less than the Eway report.

More amount recorded on ERP reports:

The amount recorded on the ERP report is more than the Eway report.

Not found on ERP reports:

The transactions are missing on the ERP reports, but are found on the Eway report.

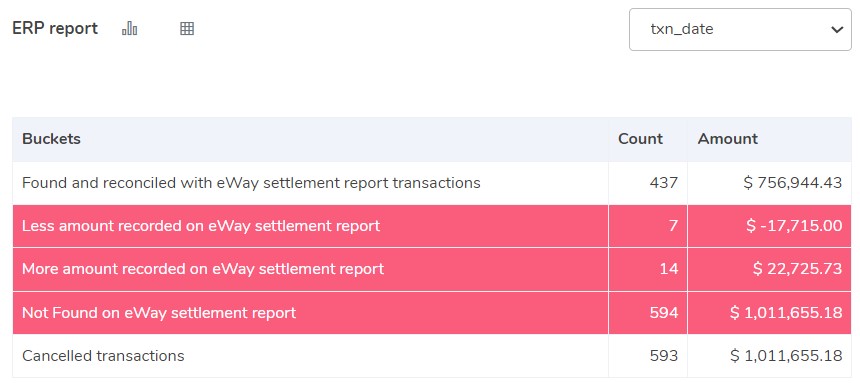

ERP Reports with Eway reconciliation:

Found and reconciled with Eway settlement report:

The transactions are found and reconciled on the ERP reports and also on the Eway settlement reports.

Less amount recorded on Eway settlement report:

The amount recorded on Eway settlement reports is seen to be less as compared to ERP reports.

More amount recorded on Eway settlement report:

The amount recorded on Eway settlement reports is seen to be more than on ERP reports.

Not found on the settlement report:

The transactions are recorded on ERP reports but not on Eway settlement reports.

Cancelled transactions:

The transactions are recorded on the Eway settlement reports, but these orders were cancelled by the customers and hence were not recorded in the ERP reports.

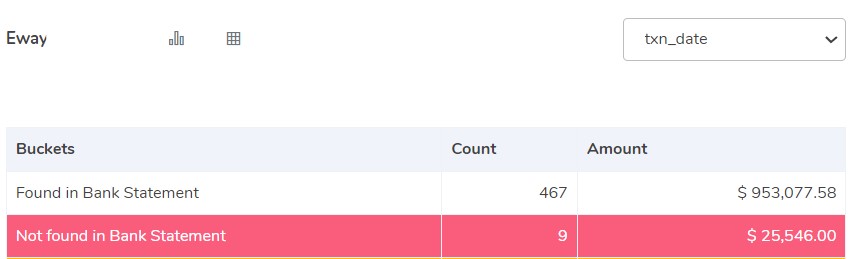

Eway with Bank reconciliation:

Found in bank statement:

The transactions are found on bank statements and on Eway settlement reports.

Not found in bank statement:

These transactions are found on Eway settlement reports, but not on the bank statements.

Bank reconciliation with Eway:

Found and reconciled with Eway settlement report:

The transactions are found and reconciled on the bank statement and the Eway settlement reports.

More amount recorded on Eway settlement report:

The amount recorded on Eway settlement reports is seen to be more as compared to the bank statement.

Less amount recorded on Eway settlement report:

The amount recorded on Eway settlement reports is noticed to be less than the amount on the bank statement.

Not found on the Eway settlement report:

The transactions are not found on Eway settlement reports but are present on the bank statement.

Cointab’s reconciliation software offers the remarkable capability to harmonize an array of reports, encompassing Eway settlement reports, Eway refund reports, website reports, ERP reports, bank statements, and more. While the manual reconciliation of these reports remains an option, it often translates into a laborious undertaking for the finance department.

Embracing Cointab’s Reconciliation software not only mitigates this arduous process but also liberates the finance team to engage more deeply in pivotal tasks and strategic decision-making. End the era of manual transaction reconciliations and usher into a new chapter of precision, productivity, and strategic focus for your business. Connect with our sales team and experience the ease of reconciliation today!