Freecharge, a prominent Indian payment gateway, empowers businesses to streamline online transactions, fostering a seamless experience for both themselves and their customers.

Freecharge offers a comprehensive suite of functionalities, including bill payments, recharges, and secure integrations for UPI and card payments. This robust infrastructure allows businesses to accept payments efficiently, anytime and anywhere.

While Freecharge streamlines payments, managing and verifying associated fees can be a challenge. Inaccurate fee calculations can lead to overcharges creating an unnecessary cost burden. Our innovative software tackles this problem head-on by automating the Freecharge payment gateway fee verification process. Simply upload your data files and our software will work its magic. It cleanses your data and analyzes it to provide a clear picture of your Freecharge fees.

Cointab Offers:

Automated Fee Verification: Our software streamlines the Freecharge payment gateway fee verification process, eliminating the need for manual calculations and saving valuable time and resources for your finance team.

Consolidated Fee Analysis: Gain a comprehensive overview of your Freecharge fees through a centralized platform. This simplifies fee review and identification of potential discrepancies, ensuring accurate fee structures and billing.

Enhanced Data Accuracy: Our software cleans the data to highlight errors and inconsistencies often present in financial data. This provides a clear, reliable picture of your fee structure, facilitating informed decision-making.

Improved Financial Tracking: Empower your finance team with detailed insights into Freecharge fee payments. This allows for optimized financial planning, budgeting, and cost-control strategies.

Freecharge Rate Card:

The rate card provides crucial information about Freecharge’s fees and taxes, including:

Fee and tax percentages: Understand the exact charges applicable to the transactions.

Validity dates: Stay informed about any changes in Freecharge’s fee structure.

Empower your finance team with Cointab's automated reconciliation. Get started today!

Sign Up For Demo

Reports used for Freecharge payment gateway charge verification:

Freecharge Payment report:

Fee and Tax Percentage: This column is used to apply the payment gateway fee for each transaction and the tax percentage on the fee that is applied to each transaction.

Mode of Payment: This column identifies the payment methods used by the customers. This could be credit cards, debit cards, UPI payments, or other options offered by Freecharge.

Issuing Bank: This column identifies the transaction involving a debit or credit card. This information can be helpful for reconciliation.

Freecharge Rate Card:

The rate card provides crucial information about Freecharge’s fees and taxes, including:

Fee and tax percentages: Understand the exact charges applicable to the transactions.

Validity dates: Stay informed about any changes in Freecharge’s fee structure.

Cointab reconciliation software uses the information from both the Freecharge payment report and rate card to:

- Calculate the expected fee, tax, and settlement amount for each transaction.

- Highlight any discrepancies where you’ve been overcharged.

- Track all charge payments made to Freecharge for easy reconciliation.

- Identify potential areas to claim refunds for excess fees.

Freecharge Payment Gateway Fee Verification Made Easy

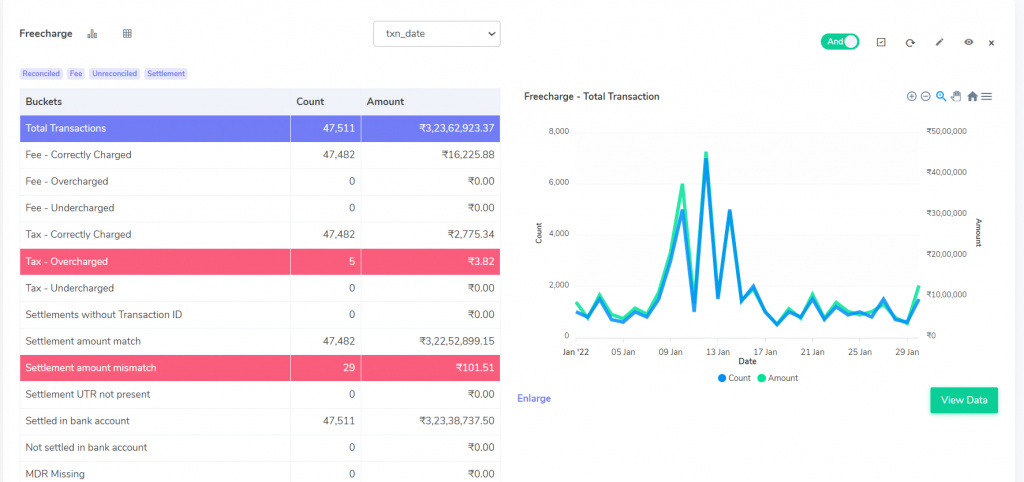

Fee Analysis:

Fee – Correctly Charged: This indicates transactions where the software-calculated fee matches the amount charged by Freecharge in the invoice. It signifies accurate billing and reduces the risk of discrepancies.

Fee – Overcharged: Our software identifies instances where the fee charged by Freecharge exceeds the calculated amount. This allows you to claim potential refunds and prevent future overcharges.

Fee – Undercharged: This case highlights transactions where Freecharge undercharges you. This might be due to potential discounts or promotions offered by Freecharge that weren’t initially factored into the fee calculation.

Tax Analysis:

Tax – Correctly Charged: This signifies that the software’s tax calculation (typically 18% GST on the fee) matches the tax amount in the Freecharge report. This ensures accurate tax reporting and avoids potential tax liabilities.

Tax – Overcharged: Our software identifies situations where the tax charged by Freecharge is higher than the calculated amount. This allows you to investigate potential discrepancies and potentially claim tax refunds.

Tax – Undercharged: These instances highlight transactions where Freecharge undercharged you on tax. While it may seem beneficial initially, it’s crucial to maintain accurate tax records for future tax filings.

Settlement Analysis:

Settlement Amount Match: This indicates that the settlement amount calculated by subtracting fees and taxes from the customer payment matches the amount paid by Freecharge. This signifies a smooth transaction with accurate settlement.

Settlement Amount Mismatch: Our software identifies discrepancies where the calculated settlement amount doesn’t match the amount paid by Freecharge. This highlights potential errors that require investigation.

Settlement UTR not present: Transactions without a UTR (Unique Transaction Reference) are considered incomplete and cannot be definitively identified. This helps you track potential missing or incomplete transactions.

Settled in Bank Account: These transactions are present in both your bank statement and Freecharge report with matching amounts, signifying successful settlement in your bank account.

Not Settled in Bank Account: These transactions are present in the Freecharge report but not reflected in your bank statement. This highlights potential settlement delays or errors that require investigation.

Cointab reconciliation software has a robust API that seamlessly integrates with your existing systems, accepting various file formats (CSV, XML, XLSX, etc.) for easy data upload. Furthermore, it employs advanced data cleansing techniques to identify and remove duplicates or inconsistencies that could lead to reconciliation errors. This allows for effortless data integration between various reports, facilitating a streamlined workflow. Gain complete transparency into every fee and tax charge levied by Freecharge. With accurate calculations and automated reconciliation, you can reduce the risk of overpaying and ensure optimal financial control. By implementing Cointab reconciliation software, you can transform your Freecharge fee verification process from a time-consuming task to an automated one.

Step into the future of reconciliation. Fill out the form to request your demo now!

Step into the future of reconciliation. Fill out the form to request your demo now!