GLS is a logistics company in Europe that offers parcel and express services all over the world. Their delivery services are dedicated to companies and

individuals specially focusing on B2B and B2C parcel sectors.

It gets challenging to track and verify the fee verification process when a company is in charge of millions of deliveries around the globe, especially when planning for no errors or miscalculations. Use the Cointabs software to stop the mistakes from becoming bigger blunders.

The Cointabs software streamlines reconciliation by comparing ERP reports, shipping invoices, Pincode master, SKU reports, and Rate card. It ensures accurate verification of GLS charges and eliminates discrepancies. This tool seamlessly helps you load any kind of data, providing efficient and accurate reconciliation of the mentioned reports.

Required Reports for GLS Invoice Verification Process

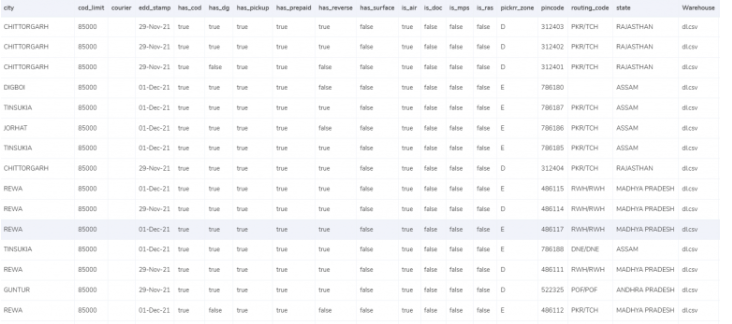

Pincode zone Report

The pincode zone report consists of the location where the delivery is to be made, so it can be tracked with ease.

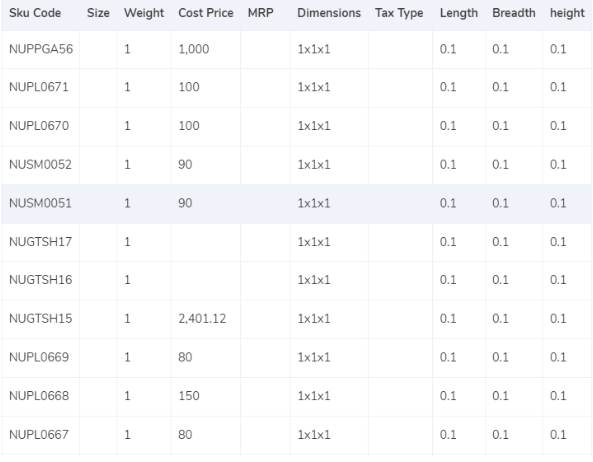

SKU Report

Each product has its own SKU number that helps in denoting the weight and dimensions of the product.

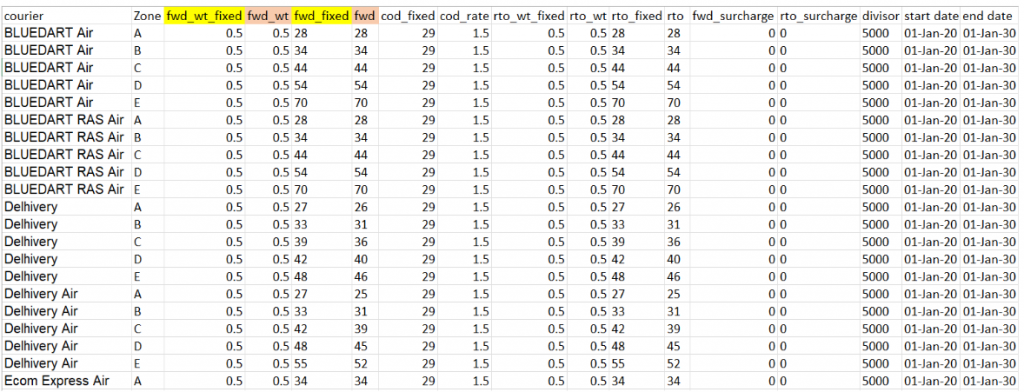

Rate Card

On the basis of weight and dimensions, a particular rate is assigned to each product which is shown in the rate card.

GLS invoice

GLS invoice helps us in getting the further result as it includes essential reports like order ID, Billing zone, Product type, weight, RTO, Billing pincode, applied weight slab and the amount charged.

Invoice verification

The software here checks if the charges calculated by the shipping company are expected charges or not. The calculations of the fee charged by GLS depends on weight of the product, zone and the COD percentage. The accuracy of the weight and zone is checked by us. The rate card is used to check if the rate used for the particular zone and weight is right.

Let’s take a deeper dive into these aspects-

SKU report

It gets challenging to track and verify the fee verification process when a company is in charge of millions of deliveries around the globe, especially when planning for no errors or miscalculations. Use the Cointabs software to stop the mistakes from becoming bigger blunders.

The Cointabs software streamlines reconciliation by comparing ERP reports, shipping invoices, Pincode master, SKU reports, and Rate card. It ensures accurate verification of GLS charges and eliminates discrepancies. This tool seamlessly helps you load any kind of data, providing efficient and accurate reconciliation of the mentioned reports.

Required Reports for GLS Invoice Verification Process

Pincode zone Report

The pincode zone report consists of the location where the delivery is to be made, so it can be tracked with ease.

SKU Report

Each product has its own SKU number that helps in denoting the weight and dimensions of the product.

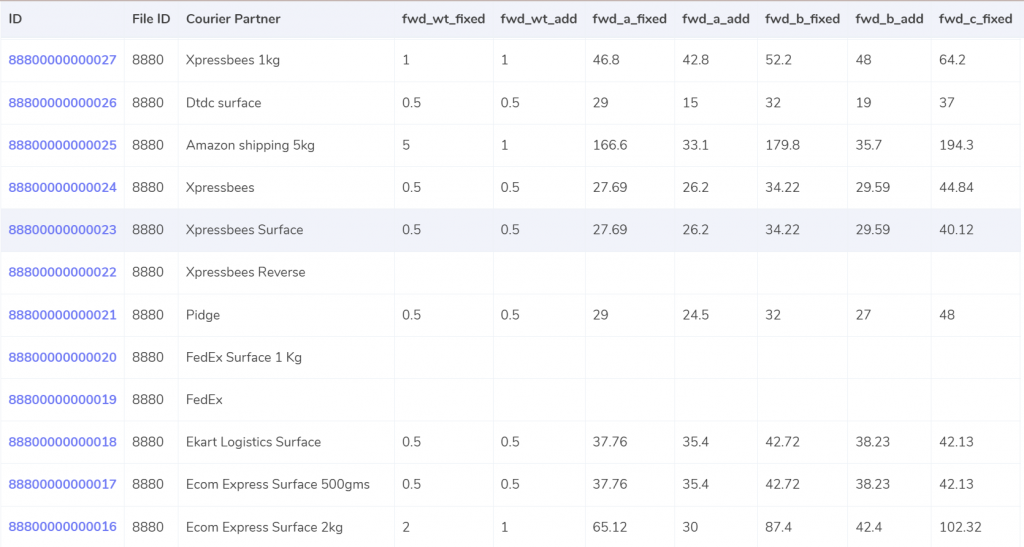

Rate Card

On the basis of weight and dimensions, a particular rate is assigned to each product which is shown in the rate card.

GLS invoice

GLS invoice helps us in getting the further result as it includes essential reports like order ID, Billing zone, Product type, weight, RTO, Billing pincode, applied weight slab and the amount charged.

Invoice verification

The software here checks if the charges calculated by the shipping company are expected charges or not. The calculations of the fee charged by GLS depends on weight of the product, zone and the COD percentage. The accuracy of the weight and zone is checked by us. The rate card is used to check if the rate used for the particular zone and weight is right.

Let’s take a deeper dive into these aspects-

SKU report

- The SKU number is taken into consideration as it gives us the weight and dimension of the product.

- If the weight is not given in the ERP report, the values displayed under the weight column in the invoice is taken into consideration.

- If the dimensions of the product are given then the volumetric weight is calculated with the help of this formula “Length x Width x Height”. In order to make the calculations work, the dimensions of the volumetric weight has to be in centimeters. The calculated value will be divided by the divisor given in the divisor card and if the divisor is not present in the card then it is to be divided by 5000.

- After all the calculations are made, the values are shifted to the ERP report and GLS invoice.

- Lastly, to get the final slab the final weight is rounded off.

- Pincode master report consists of the origin location and delivery location and a zone is assigned to that combination. The origin and delivery location is linked to the invoice to get the desired zone for each invoice.

- Every location is categorized into different zones like regionally, locally, nationally etc and they each have an indicator allotted like a,b,c etc.

- The rates are given in the rate card on the basis of the weight of the product and the zone of the product. The charges might differ if the weight of the products increase, the rates given above are given according to an acceptable limit. The columns “courier”, “zone”, “fwd_wt_fixed” (the additional weight on which the fixed rate increases), and the “divisor” are checked with respective columns present in the GLS invoice to verify if the right items are put in the invoice.

- The rates in the rate card are applicable only for a particular amount of time and it is necessary to check if the delivery dates fall under those dates.

Expected forward charge

If the final slab calculated is lower or equal to the weight limit (“fwd_wt_fixed”) given in the rate card, that means that it is equal to the “fwd_wt_fixed” then the fees charged on it is “fwd_fixed” according to the zone. If it is not equal to the “fwd_wt_fixed” column then it means that the product has more weight. The fee charged for the extra weight is “fwd_add” according to the zone. So the formula for the expected charge is:

Expected RTO charged

If the final slab calculated is lesser or equal to the weight limit (rto_wt_fixed”) given in the rate card, that means that it is equal to the “rto_fixed” and the fee charged on it is “rto_fixed” according to the zone. If it is not equal to the “rto_wt_fixed” column then that means that the product has extra weight. The fee charged for the excess weight is “rto_add” according to the zone . The formula for the expected charge is given as:

Expected_rto_chg = rto_fixed + (extra_weight) x rto_add

Expected COD charges

Whichever value amongst “cod_fixed” or “cod _rate” % of “order Value” is higher, that is used as the expected COD charge.

Expected final amount

The calculation of the forward charge, RTO charge, COD charge and GST % gives us the final expected amount.

ERP

If the final slab calculated is lower or equal to the weight limit (“fwd_wt_fixed”) given in the rate card, that means that it is equal to the “fwd_wt_fixed” then the fees charged on it is “fwd_fixed” according to the zone. If it is not equal to the “fwd_wt_fixed” column then it means that the product has more weight. The fee charged for the extra weight is “fwd_add” according to the zone. So the formula for the expected charge is:

Expected RTO charged

If the final slab calculated is lesser or equal to the weight limit (rto_wt_fixed”) given in the rate card, that means that it is equal to the “rto_fixed” and the fee charged on it is “rto_fixed” according to the zone. If it is not equal to the “rto_wt_fixed” column then that means that the product has extra weight. The fee charged for the excess weight is “rto_add” according to the zone . The formula for the expected charge is given as:

Expected_rto_chg = rto_fixed + (extra_weight) x rto_add

Expected COD charges

Whichever value amongst “cod_fixed” or “cod _rate” % of “order Value” is higher, that is used as the expected COD charge.

Expected final amount

The calculation of the forward charge, RTO charge, COD charge and GST % gives us the final expected amount.

RESULT

After we get the expected amount based on the zone and weight of the product, the software compares the ERP report, Pincode report and the Rate card with the invoice provided by GLS.ERP

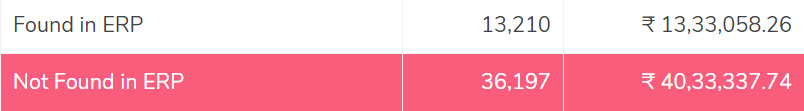

Found in ERP

The number of products present for a particular product is present in the ERP reports. In this case, the orders present in the GLS invoice are also found in the ERP reports which helps in denoting the weight of the product which can be verified later since the records match.

Not found in ERP

In this case, the orders present in the GLS invoice are not found in the ERP reports and hence these reports can not be verified.

Pincode Master

The number of products present for a particular product is present in the ERP reports. In this case, the orders present in the GLS invoice are also found in the ERP reports which helps in denoting the weight of the product which can be verified later since the records match.

Not found in ERP

In this case, the orders present in the GLS invoice are not found in the ERP reports and hence these reports can not be verified.

Pincode Master

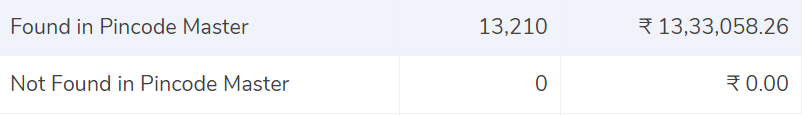

Found in Pincode master

The Pincode needs to be correct as all the deliveries are implemented zone wise. I.e regionally, locally etc. In this case, the orders are present in the GLS invoice as well as the Pincode master.

Not found in Pincode master

Here, the orders present in the GLS invoice are not present in the Pincode master. Since it is essential for the orders to be present in both records in order to get the correct zone, these records can not be verified.

Rate Card

The Pincode needs to be correct as all the deliveries are implemented zone wise. I.e regionally, locally etc. In this case, the orders are present in the GLS invoice as well as the Pincode master.

Not found in Pincode master

Here, the orders present in the GLS invoice are not present in the Pincode master. Since it is essential for the orders to be present in both records in order to get the correct zone, these records can not be verified.

Rate Card

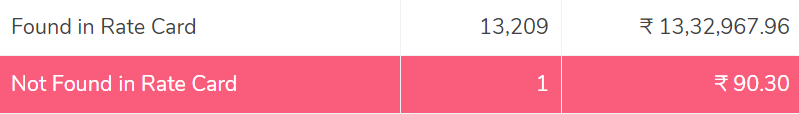

Found in Rate card

The data entries present in the GLS invoice are also present in the Rate card and hence the orders can be verified.

Not found in the Rate card

In this case, The data entries present in the GLS invoice are not present in the Rate card and hence the orders can not be verified.

Fee verification using ERP- GLS

The data entries present in the GLS invoice are also present in the Rate card and hence the orders can be verified.

Not found in the Rate card

In this case, The data entries present in the GLS invoice are not present in the Rate card and hence the orders can not be verified.

Fee verification using ERP- GLS

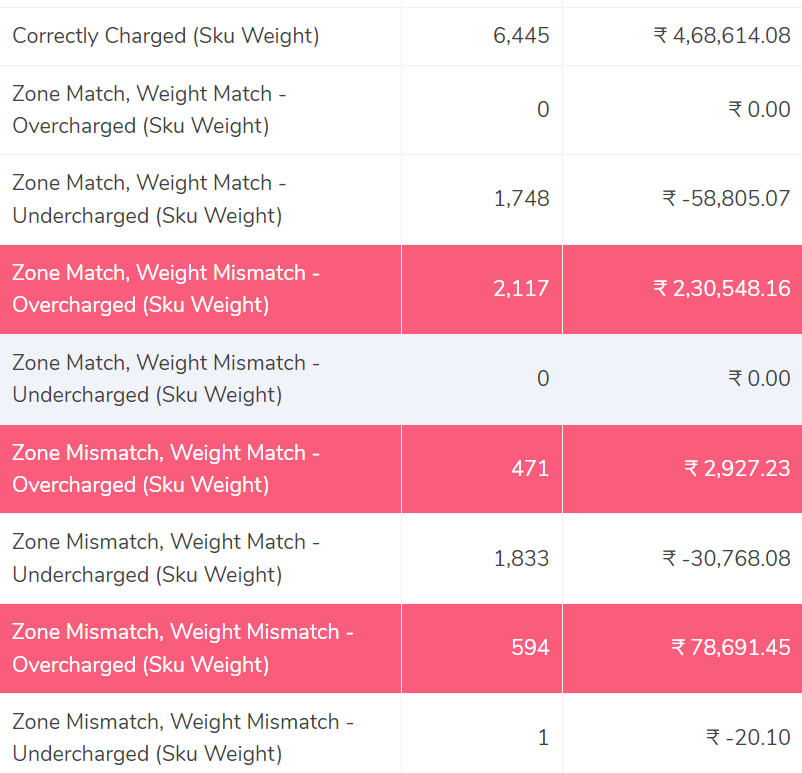

Correctly Charged

The software compares the ERP report and the GLS invoice report and shows the order deliveries where the zone and the weight of the product are correct. This denotes that the fee calculated with the help of the rate card matches the fee present in the GLS invoice.

Zone Match, Weight Match – Overcharged

In this case, the software compares the ERP report and the GLS report and shows that the zone of the product and the weight of the product match and yet the fee charged is wrong. In comparison to the calculated amount the invoice charges are more and hence it is overcharged.

Zone Match, Weight Match – Undercharged.

This denotes that after comparing the ERP report and the GLS report it shows that the zone of the product and the weight of the product match but still the fee charged is wrong. Hence it is seen for these transactions a lesser amount is recorded in the invoice than calculated amount and hence the amount is undercharged.

Zone Mismatch, Weight Match – Overcharged

The software here compares the ERP report and the GLS report and shows that the zone of the product and fee does not match whereas the weight matches. Since the zone of the product does not match, the amount is over charged in this case compared to the calculated amount.

Zone Mismatch, Weight Match – Undercharged.

In this case, the software compares the ERP report and the GLS report and shows that the zone of the product and fee charged do not match the report whereas the weight matches, since the zone of the product and rate do not match, the amount is under charged in this case compared to the calculated amount.

Zone Match, Weight Mismatch – Overcharged

This denotes that after comparing the ERP report and the GLS report the weight of the product and fee do not match in both the reports, whereas the zone matches, since the weight of the product and rate do not match, the amount is over charged in this case.

Zone Match, Weight Mismatch – Undercharged.

Here, the software compares the ERP report and the GLS report shows that the weight of the product and fee do not match whereas the zone matches. Since the weight of the product and rate do not match, the amount is under charged in this case compared to the expected amount.

Zone Mismatch, Weight Mismatch – Overcharged

The software here compares the ERP report and the GLS report and shows that the zone,fee and the weight of the product do not match. Hence the amount charged is higher than the calculated amount in this case and so it is overcharged.

Zone Mismatch, Weight Mismatch – Undercharged

In this case, the software compares the ERP report and the GLS report and shows that the zone, fee and the weight of the product do not match. Hence the amount charged is lesser than the calculated amount in this case and so it is undercharged.

To sum it all up, Cointab’s reconciliation software helps in reconciling your data with ease and efficiency. With its cutting edge software and features, it provides you with an overview of your reconciled data and highlights any errors. This can help you save time by automating this tedious procedure and resolve the differences before they become bigger.

Click on the links below to view other Invoice Reconciliation Processes-

The software compares the ERP report and the GLS invoice report and shows the order deliveries where the zone and the weight of the product are correct. This denotes that the fee calculated with the help of the rate card matches the fee present in the GLS invoice.

Zone Match, Weight Match – Overcharged

In this case, the software compares the ERP report and the GLS report and shows that the zone of the product and the weight of the product match and yet the fee charged is wrong. In comparison to the calculated amount the invoice charges are more and hence it is overcharged.

Zone Match, Weight Match – Undercharged.

This denotes that after comparing the ERP report and the GLS report it shows that the zone of the product and the weight of the product match but still the fee charged is wrong. Hence it is seen for these transactions a lesser amount is recorded in the invoice than calculated amount and hence the amount is undercharged.

Zone Mismatch, Weight Match – Overcharged

The software here compares the ERP report and the GLS report and shows that the zone of the product and fee does not match whereas the weight matches. Since the zone of the product does not match, the amount is over charged in this case compared to the calculated amount.

Zone Mismatch, Weight Match – Undercharged.

In this case, the software compares the ERP report and the GLS report and shows that the zone of the product and fee charged do not match the report whereas the weight matches, since the zone of the product and rate do not match, the amount is under charged in this case compared to the calculated amount.

Zone Match, Weight Mismatch – Overcharged

This denotes that after comparing the ERP report and the GLS report the weight of the product and fee do not match in both the reports, whereas the zone matches, since the weight of the product and rate do not match, the amount is over charged in this case.

Zone Match, Weight Mismatch – Undercharged.

Here, the software compares the ERP report and the GLS report shows that the weight of the product and fee do not match whereas the zone matches. Since the weight of the product and rate do not match, the amount is under charged in this case compared to the expected amount.

Zone Mismatch, Weight Mismatch – Overcharged

The software here compares the ERP report and the GLS report and shows that the zone,fee and the weight of the product do not match. Hence the amount charged is higher than the calculated amount in this case and so it is overcharged.

Zone Mismatch, Weight Mismatch – Undercharged

In this case, the software compares the ERP report and the GLS report and shows that the zone, fee and the weight of the product do not match. Hence the amount charged is lesser than the calculated amount in this case and so it is undercharged.

To sum it all up, Cointab’s reconciliation software helps in reconciling your data with ease and efficiency. With its cutting edge software and features, it provides you with an overview of your reconciled data and highlights any errors. This can help you save time by automating this tedious procedure and resolve the differences before they become bigger.

Click on the links below to view other Invoice Reconciliation Processes-