Google Pay, a dominant force in the payment gateway arena since 2013, offers unparalleled convenience for both users and businesses. Its seamless tap-to-pay functionality and secure money transfer options have fueled its global adoption. However, managing payment gateway fees associated with Google Pay can be a complex task. This comprehensive guide empowers businesses to navigate Google Pay charge verification, ensuring accurate fees and preventing financial losses.

Demystifying Payment Gateway Fees:

When businesses integrate Google Pay, customers gain the flexibility to use it for transactions. Similar to other payment gateways, Google Pay levies fees and taxes on customer payments. These fees, calculated based on the chosen payment method (debit card, credit card, UPI, etc.), are deducted from the transaction amount. However, occasional miscalculations can occur, resulting in overcharging or undercharging. Implementing a robust verification system is crucial to safeguard your financial health.

Automated Reconciliation: Efficiency at Your Fingertips

Manually verifying Google Pay charges can be a tedious and error-prone process. Here’s where automated reconciliation software like Cointab steps in. Cointab streamlines the verification process, ensuring accuracy for all transaction types. By leveraging automation, Cointab saves you valuable time and resources, allowing you to focus on core business operations.

Essential Reports for Verification:

Effective Google Pay charge verification hinges on two critical reports:

Google Pay Payment Report:

This report provides a detailed breakdown of total transactions, categorized by the payment method used (debit card, credit card, UPI, etc.).

Google Pay Rate Card:

This card outlines the fee structure and corresponding percentages associated with different payment methods.

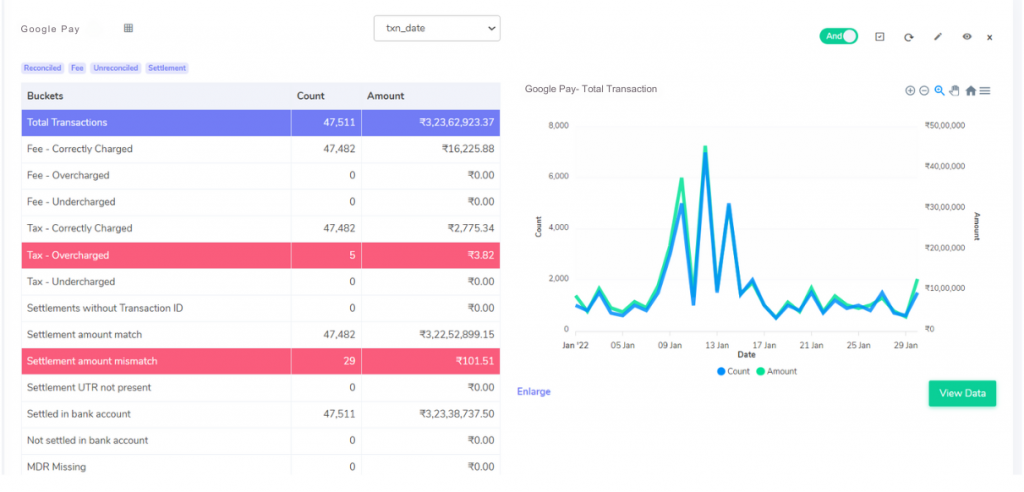

RESULTS

Understanding Verification Results:

The verification process yields a range of outcomes, empowering you to identify discrepancies:

Fees Correctly Charged:

Transactions where Google Pay’s fees align perfectly with the calculations based on the rate card.

Fees Overcharged/Undercharged:

Discrepancies arise when Google Pay’s fees deviate from the rate card calculations (either exceeding or falling short).

Tax Correctly Charged:

Transactions where the tax amount in the payment report matches the calculated Goods and Services Tax (GST).

Tax Overcharged/Undercharged:

Transactions where the tax amount in the payment report differs from the GST calculations (higher or lower).

Missing Settlement UTR:

This outcome identifies transactions lacking a Unique Transaction Reference (UTR) number within the payment report.

Settlement Amount Match:

Transactions where the final settlement amount (total amount minus fees and taxes) corresponds precisely with the Google Pay report.

Settlement Amount Mismatch:

Discrepancies arise when the calculated settlement amount after deducting fees and taxes doesn’t coincide with the amount reflected in the Google Pay report.

Settled in Bank Account:

Transactions where the amount appears on both the UTR report and your official bank statement.

Not Settled in Bank Account:

Transactions where the amount is present on the UTR report but absent from your bank statement.

Cointab Reconciliation Software: Your Trusted Verification Partner

Cointab Reconciliation simplifies the verification process with its intuitive interface, empowering you to take control of your finances.

Here’s a breakdown of its user-friendly approach:

Effortless Data Upload:

Upload your data in a format that best suits your needs.

Custom Workflow Design:

Tailor a custom workflow for efficient and streamlined reconciliation.

Discrepancy Identification: Run the reconciliation process. Cointab automatically highlights discrepancies in red for easy visualization and prompt action.

Actionable Insights:

Gain valuable insights into overcharges, undercharges, tax discrepancies, and settlement mismatches. Armed with this knowledge, you can take corrective measures to maintain financial accuracy.

Start Reconciling Today with Cointab!

Don’t let inaccurate charges erode your profits. Embrace the power of Cointab Reconciliation software and experience seamless verification. Start your free trial today and unlock a robust system for managing Google Pay charges within your business.

Step into the future of reconciliation. Fill out the form to request your demo now!