The meteoric rise of mobile wallets has transformed the financial landscape, offering businesses a convenient and secure way to accept payments. Google Pay, a frontrunner in this domain, empowers businesses and consumers with a seamless platform for sending and receiving money. However, with a burgeoning volume of daily transactions, ensuring their accuracy becomes paramount. This comprehensive guide delves into the world of Google Pay reconciliation, equipping you with the knowledge and strategies to streamline your financial operations and maintain impeccable record-keeping.

The Pitfalls of Manual Reconciliation:

A Time-Consuming and Error-Prone Endeavor

Traditionally, businesses relied on manual methods for reconciling payment gateway transactions. This laborious process involved meticulously comparing data from a multitude of sources, including:

Google Pay settlement reports:

These reports provide a detailed breakdown of customer payments for orders.

Google Pay refund reports:

These reports list refunds issued to customers by the payment gateway.

Website reports:

These reports contain information on customer orders placed through your website.

ERP (Enterprise Resource Planning) reports:

ERP reports are internal documents that house detailed item-wise information.

Bank statements:

Bank statements reflect transactions where your bank received payment via the payment gateway.

Manual reconciliation is not only exceptionally time-consuming but also susceptible to human error.

Discrepancies can have a cascading effect, leading to:

Overpayment:

You might end up paying more than the actual amount received.

Underpayment:

You might unintentionally undercharge customers.

Inventory inaccuracies:

Inconsistent transaction records can wreak havoc on your inventory management.

Delayed financial reporting: Delayed reconciliation can hinder timely financial reporting and impede informed decision-making.

Harnessing the Power of Automation: Streamlining Reconciliation with Software

Fortunately, technological advancements have ushered in a new era of efficiency with automated reconciliation software like Cointab Reconciliation. This innovative software streamlines the entire process, eliminating the need for manual data entry and painstaking comparisons.

Here’s how Cointab Reconciliation empowers your business:

Effortless Data Upload:

Upload your data in various formats, ensuring seamless integration with your existing systems.

Customizable Workflows:

Tailor the reconciliation process to your specific needs and preferences for maximum efficiency.

Automated Matching:

The software automates the process of matching transactions across different reports, saving you valuable time and resources.

Detailed Reports:

Generate comprehensive reports highlighting discrepancies for further investigation and swift resolution.

By embracing automated reconciliation software, you can achieve significant improvements in your financial operations:

Enhanced Accuracy:

Eliminate human error and ensure the accuracy of your financial records for a clear picture of your financial health.

Increased Efficiency:

Free up valuable time and resources previously dedicated to manual reconciliation, allowing you to focus on core business activities.

Improved Cash Flow Management:

Gain a clear understanding of your cash flow for better financial planning and strategic decision-making.

Faster Financial Reporting:

Generate accurate reports on time, facilitating informed financial decisions based on up-to-date data.

Website with Google Pay Reconciliation:

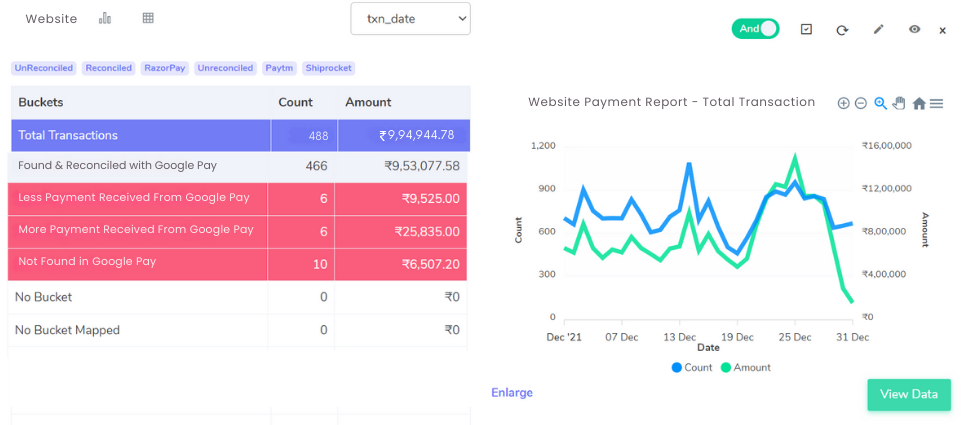

Google Pay Reconciliation with Website Report:

Identifying Discrepancies

Reconciling your Google Pay transactions with your website reports ensures your financial records align perfectly. This section dives into common discrepancies you might encounter and their potential causes.

Found in Both Reports:

These transactions appear seamlessly in both Google Pay settlement reports and your website reports, indicating successful payment processing.

Amount Discrepancies:

Lower Amount in Google Pay:

A lower amount recorded on Google Pay compared to your website report could signify.

Website Order Modifications:

Perhaps the website order underwent modifications after the initial Google Pay authorization, resulting in a reduced final amount.

Processing Fees:

Google Pay or your bank might have levied a processing fee that’s reflected on the Google Pay report but not the website report itself.

Higher Amount in Google Pay:

A higher amount on Google Pay compared to your website report might be due to:

Cancelled Orders:

The website report might reflect a cancelled order that wasn’t yet processed by Google Pay, leading to a temporary discrepancy.

Missing Transactions:

Transactions on Google Pay Missing from Website:

These transactions might represent.

Manual Website Orders:

Orders placed manually on your website without Google Pay integration might not show up in Google Pay reports.

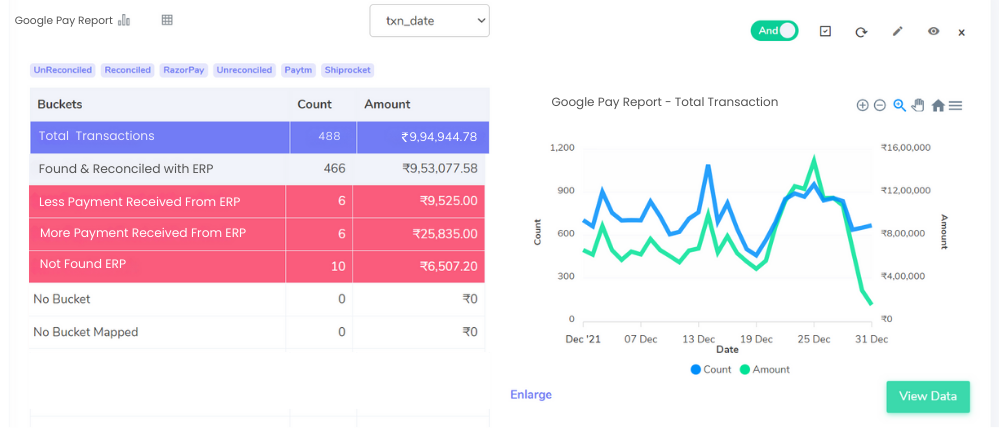

Google Pay Reconciliation with ERP:

Reconciling your Google Pay transactions with your Enterprise Resource Planning (ERP) reports ensures your inventory data remains accurate and reflects real-time sales.

Let’s explore potential discrepancies that might arise during this process.

Matched Transactions:

Found in Both Reports:

These transactions appear seamlessly in both Google Pay settlement reports and your ERP reports, indicating a successful sale with accurate financial recording.

Amount Discrepancies:

Lower Amount in ERP:

A lower amount recorded on your ERP report compared to Google Pay could signify:

Inventory Price Adjustments:

Perhaps the product price was manually adjusted in the ERP after the Google Pay transaction, leading to a discrepancy.

Discount Codes:

Customers might have applied discount codes at checkout that aren’t reflected in the initial ERP data.

Higher Amount in ERP:

A higher amount on your ERP report compared to Google

Pay could be due to:

Shipping or Tax Charges:

The ERP report might include additional charges like shipping or taxes not reflected in the base Google Pay transaction amount.

Missing Transactions:

Transactions on Google Pay Missing from ERP:

These transactions might represent: Offline Sales Processed through Google Pay:

Sales made outside your online store and processed through Google Pay might not be automatically synced with your ERP.

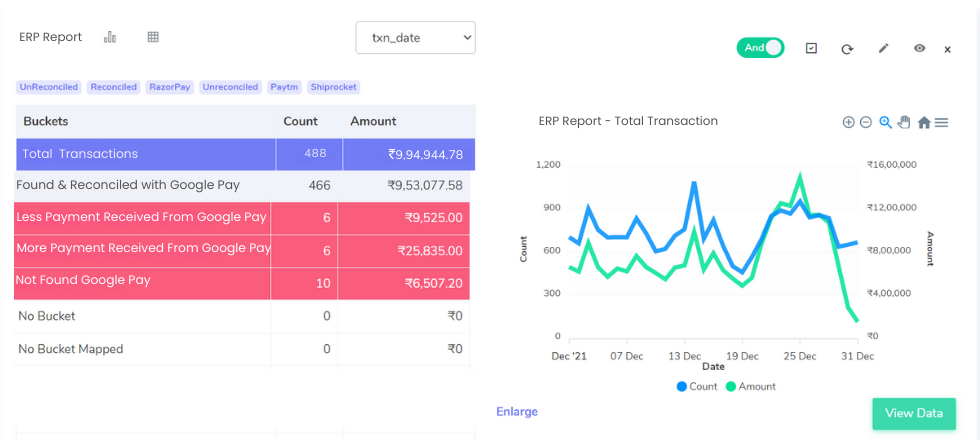

ERP Reports with Google Pay reconciliation:

Reconciling Google Pay transactions with your ERP reports guarantees a seamless flow of financial data between your payment gateway and internal systems. This section delves into common discrepancies that might surface during this process.

Matched Transactions:

Found in Both Reports:

These transactions appear flawlessly in both Google Pay settlement reports and your ERP reports, indicating a successful sale with accurate financial recording within both systems.

Amount Discrepancies:

Lower Amount in Google Pay:

A lower amount recorded on Google Pay compared to your ERP reports could be due to:

Refunds or Discounts:

Perhaps partial refunds were issued to customers or discounts were applied at checkout, leading to a discrepancy between the initial sale amount and the final settlement.

Return Processing:

Returned items processed through the ERP might not be instantaneously reflected in Google Pay settlement reports, causing a temporary difference.

Higher Amount in Google Pay:

A higher amount on Google Pay compared to your ERP reports could be caused by:

Taxes or Shipping Fees:

The Google Pay transaction might include taxes or shipping fees not initially reflected in the ERP data.

Missing Transactions:

Transactions on ERP Missing from Google Pay:

These transactions might represent:

Manual Order Entry:

Orders manually entered into your ERP system might not automatically sync with Google Pay reports.

Cancelled Orders:

Recorded in ERP but Missing from Google Pay:

Transactions appearing in your ERP reports but absent from Google Pay could signify cancelled orders. These orders might have been processed within your ERP before being cancelled, leading to a temporary discrepancy.

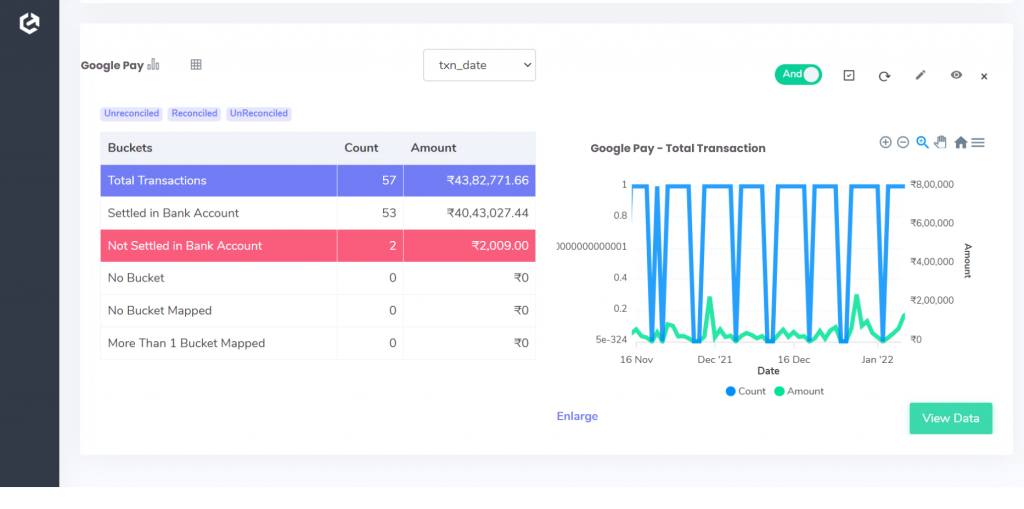

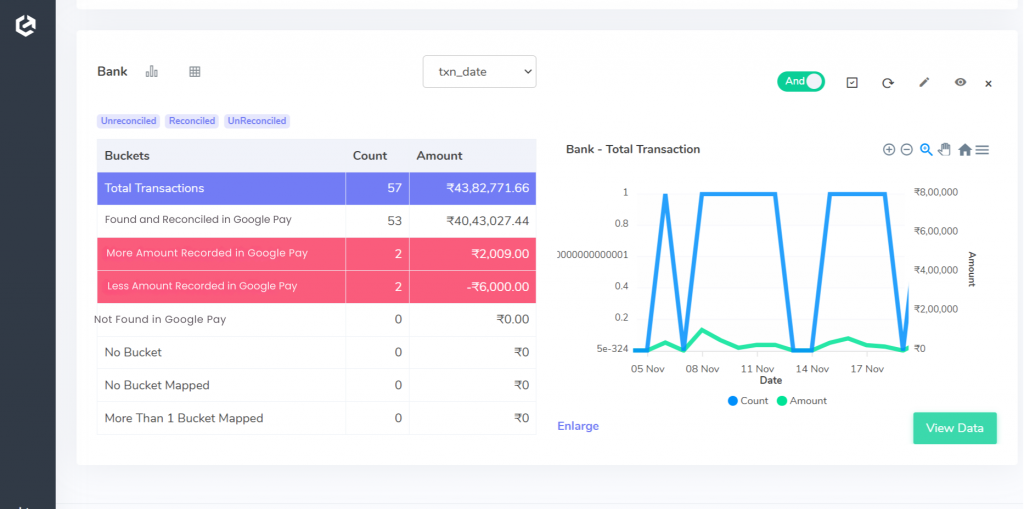

Reconciling your Google Pay transactions with your bank statements is crucial for maintaining a clear picture of your cash flow. This section explores potential discrepancies that might arise during this process.

Matched Transactions:

Found in Both Reports:

These transactions appear seamlessly in both your bank statements and Google Pay settlement reports, confirming successful payment processing and corresponding bank deposits.

Unmatched Transactions:

Missing from Bank Statements:

Transactions present on Google Pay settlement reports but absent from your bank statements could signify:

Pending Transactions:

The transactions might still be pending on your bank’s end and haven’t yet reflected in your statement balance. This could be due to weekends, holidays, or internal bank processing times.

Chargebacks or Disputes:

Customers might have initiated chargebacks or disputes on these transactions, leading to a temporary discrepancy until resolved.

Reconciling your Google Pay transactions with bank statements ensures your cash flow records remain accurate and aligned. This section explores potential discrepancies you might encounter during this process.

Matched Transactions:

Found in Both Reports:

These transactions appear seamlessly in both your bank statements and Google Pay settlement reports, confirming successful payment processing and corresponding deposits into your bank account.

Amount Discrepancies:

Higher Amount in Google Pay:

A higher amount recorded on Google Pay compared to your bank statement could signify:

Pending Fees:

Google Pay might reflect potential future fees (like monthly charges) that haven’t yet been deducted by your bank.

Refunds Processed:

Refunds issued to customers through Google Pay might be reflected there before appearing as a credit on your bank statement.

Lower Amount in Google Pay:

A lower amount on Google Pay compared to your bank statement could be due to:

Transaction Fees:

Bank transaction fees might be deducted from the deposited amount, causing a slight discrepancy.

Deposits in Transit:

Deposits might be in transit between your bank account and Google Pay, leading to a temporary difference.

Missing Transactions:

Transactions on Bank Statement Missing from Google Pay:

These transactions might represent:

Bank Transfers or Deposits:

Direct bank transfers or cash deposits made to your account won’t be reflected in Google Pay reports.

Empower your finance team with Cointab's automated reconciliation. Get started today!

Sign Up For Demo

Managing Google Pay transactions can be a breeze for customers, but for businesses, ensuring those transactions reconcile seamlessly across various platforms can be a different story. Manual reconciliation – the traditional method of comparing data by hand – is time-consuming, prone to errors, and hinders your ability to gain valuable financial insights.

This guide empowers you to overcome these challenges and achieve efficient Google Pay reconciliation. We’ll delve into the pitfalls of manual methods and introduce you to the transformative power of automated reconciliation software like Cointab Reconciliation. Finally, we’ll explore common discrepancies that might arise during reconciliation across various reports (website, ERP, bank statements) and how to address them.

Why Manual Reconciliation Holds You Back:

Time-Consuming:

Manually comparing data from multiple sources is a tedious and labor-intensive process, diverting valuable resources from core business activities.

Error-Prone:

Human error is inevitable in manual data entry and comparison, leading to discrepancies that can impact your financial health.

Limited Insights:

Delayed reconciliation hinders timely financial reporting and informed decision-making based on accurate data.

Embrace Automation: Unlock Efficiency with Cointab Reconciliation

Cointab Reconciliation software streamlines the entire Google Pay reconciliation process, transforming it from a chore into a breeze.

Here’s how it empowers your business:

Effortless Data Upload:

Upload your data from Google Pay, website reports, and bank statements in various formats, ensuring seamless integration.

Customizable Workflows:

Tailor the reconciliation process to your specific needs. Set parameters and automate repetitive tasks for maximum efficiency.

Automated Matching:

Eliminate human error by letting Cointab automatically match transactions across reports, highlighting discrepancies for further investigation.

Detailed Reports:

Gain a clear picture of your finances with comprehensive reports, enabling you to identify and resolve discrepancies quickly.

Benefits of Automated Google Pay Reconciliation:

Reduced Costs:

Free up valuable staff resources previously dedicated to manual reconciliation.

Enhanced Accuracy:

Eliminate human error and ensure the integrity of your financial data.

Improved Cash Flow Visibility:

Gain real-time insights into your cash flow for better financial planning and strategic decision-making.

Faster Financial Close:

Generate accurate reports on time, streamlining your financial closing process.

Conquering Discrepancies: A Guide to Common Issues

This guide explores potential discrepancies that might arise during Google Pay reconciliation across various reports (website, ERP, bank statements) and offers insights into their causes:

Amount Discrepancies:

Differences in transaction amounts might be due to website order modifications, processing fees, discount codes, or return processing.

Missing Transactions:

Transactions missing from specific reports could be due to manual website orders, offline sales processed through Google Pay, or manually entered ERP data.

Cancelled Orders:

Orders cancelled by customers might not be reflected in Google Pay settlement reports until processed by your website or ERP.

By understanding these potential causes and leveraging automated reconciliation software, you can effectively address discrepancies and ensure your Google Pay transactions reconcile seamlessly across all your financial platforms.

Step into the future of reconciliation. Fill out the form to request your demo now!