Shopping online is all about convenience these days, and nobody likes a checkout that feels like an obstacle course. That’s where MobiKwik comes in. MobiKwik is more than just a payment service – It centralizes all your online financial needs in a single platform. It is an innovative payment service provider that simplifies the online transaction process for both businesses and their customers. Businesses love MobiKwik for its ease of use and wide range of payment options, and customers love it for its convenience and features.

MobiKwik is a powerhouse payment solution for businesses, but every transaction is associated with fees. Partnering with MobiKwik sure streamlines the payment process, but keeping track of all those fees, taxes, settlement amounts, and final deposits can feel like an impractical endeavor, especially if you’re processing hundreds or even thousands of orders daily. That’s where our automated reconciliation software comes in. Cointab ensures everything is accurate and identifies any discrepancies, so you can focus on building your business.

MobiKwik Payment Report: Your Transaction Ledger:

This report serves as your comprehensive transaction log, providing a detailed breakdown of each processed payment. Key data points include,

- Transaction Amount: The total amount collected from your customer.

- Transaction Date: The precise date and time the transaction occurred.

- Fee & Tax Percentage: A clear breakdown of the percentage charged for both fees and taxes.

- Mode of Payment: The payment method used by your customer (e.g., debit card, credit card, UPI).

With this information readily available, you can easily reconcile your transactions and verify if the deducted fees and taxes align with your MobiKwik agreement.

MobiKwik Rate Card: Staying Up-to-Date on Fees & Taxes:

The MobiKwik rate card is your end-to-end report for understanding the current fee and tax structure. It clearly outlines,

- Fee & Tax Percentages: The specific percentage charged for various transaction types.

- Validity Dates: Crucial information to ensure you’re referencing the most recent fee and tax structure.

By keeping the rate card handy, you can stay informed and ensure accurate verification of charges applied to your transactions.

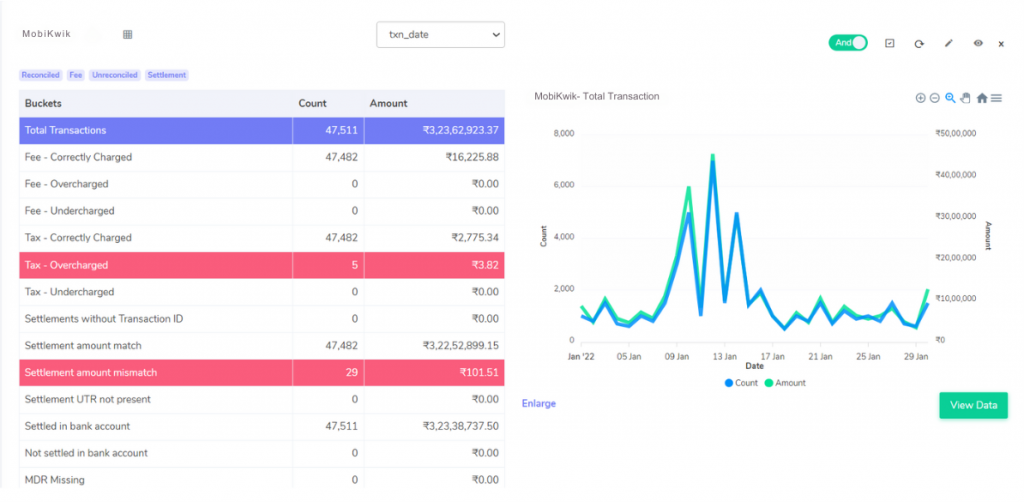

Fee Verification:

Fee – Correctly Charged: This category displays transactions where the software-calculated fee amount matches the fee charged by MobiKwik, as reflected in the MobiKwik report.

Fee – Overcharged: Transactions where the fee charged by MobiKwik exceeds the calculated fee are displayed here. This allows for quick identification of potential discrepancies.

Fee – Undercharged: Conversely, transactions where MobiKwik charged a lower fee than the calculated amount are displayed here, enabling you to use the results to claim any potential refunds.

Tax Verification:

Tax – Correctly Charged: This category showcases transactions where the 18% GST (Goods and Services Tax) on the fee, calculated by the software, aligns with the tax amount charged by MobiKwik.

Tax – Overcharged: Transactions where the tax charged by MobiKwik surpasses the calculated 18% GST are highlighted here, allowing for a swift investigation of potential overcharges.

Tax – Undercharged: This category identifies transactions where MobiKwik charged less tax than the calculated 18% GST, potentially leading to tax underpayment on your end.

Settlement Amount Verification:

Settlement Amount Match: This section displays transactions where the settlement amount deposited by MobiKwik (calculated as Amount Collected from Customer – Fee Charge – Tax Charge) matches the software’s calculated settlement amount.

Settlement Amount Mismatch: Here, the software flags transactions where the settlement amount deposited by MobiKwik differs from the calculated amount, indicating a potential discrepancy that requires further examination.

Transaction Completion Verification:

Settlement UTR not present: UTR (Unique Transaction Reference) serves as a crucial bank transaction identifier. Transactions lacking a UTR are displayed here, raising a alert as their completion cannot be confirmed.

Settled in Bank Account: Transactions found in both the MobiKwik report and your bank statement are displayed here, indicating successful settlement in your bank account.

Not Settled in Bank Account: This category highlights transactions present in the MobiKwik report but missing from your bank statement, signifying a potential settlement issue that requires investigation.

Our Cointab automated reconciliation software offers a robust solution, transforming your MobiKwik charge verification process. Imagine waving goodbye to time-consuming manual calculations and error-prone spreadsheets. Leveraging cutting-edge technology, this software offers a comprehensive review of your MobiKwik transactions. It methodically verifies fees, taxes, settlements, and final deposits, promoting financial transparency and streamlined recordkeeping. The software identifies any discrepancies in your MobiKwik charges, ensuring accurate settlements and fostering optimal financial health for your organization. Cointab boosts businesses to achieve effortless MobiKwik fee reconciliation, streamline financial operations, and eliminate extra costs. Contact us today to schedule a demo and discover how Cointab can revolutionize your MobiKwik reconciliation process!

Step into the future of reconciliation. Fill out the form to request your demo now!