PayPal’s popularity as a trusted payment gateway makes it a go-to choice for countless e-commerce businesses. While it offers a secure and convenient payment experience for customers, businesses using PayPal must be vigilant about reconciliation accuracy. Transaction fees and taxes can lead to discrepancies if not tracked. Even small miscalculations can accumulate over time, impacting your bottom line.

Manual reconciliation of PayPal transactions is a time-consuming and error-prone process. Fortunately, automated reconciliation software like Cointab offers a powerful solution. Cointab streamlines the entire process, eliminating the need for tedious manual data entry. The software accepts data in any format, seamlessly integrating with your existing workflows. Cointab then intelligently links and reconciles this data using a customizable rules engine that you define, ensuring the utmost accuracy.

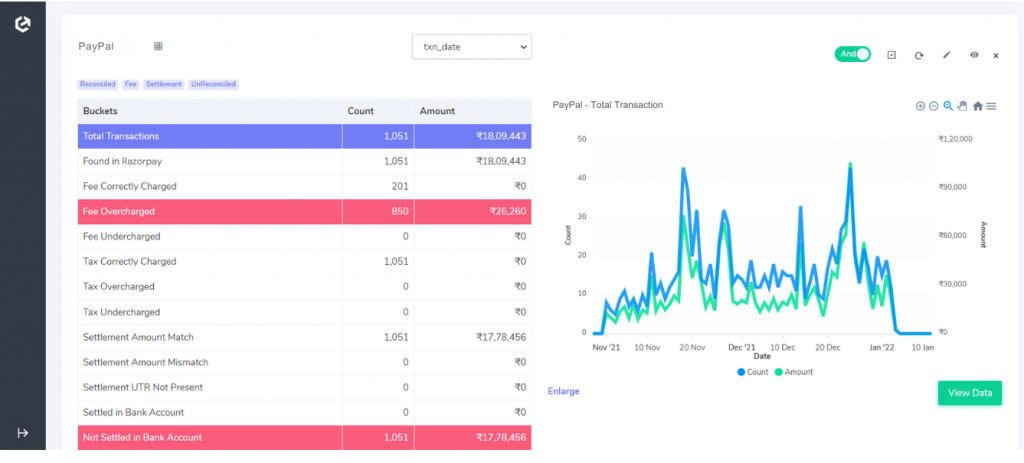

Cointab’s comprehensive results empower your finance team to easily identify discrepancies. Reconciled transactions are clearly displayed, with mismatched amounts highlighted for immediate attention. This allows you to quickly track overcharged or uncharged fees, view the difference amount, and access all relevant transaction details in a single, 360-degree view. By leveraging Cointab’s automated reconciliation capabilities, businesses using PayPal can gain peace of mind, knowing their financial records are accurate and they are not incurring unnecessary losses due to fee miscalculations.

Reports Required PayPal Payment Gateway Charges Verification

PayPal Payment Report: This detailed report serves as a record of all your PayPal transactions. Each transaction entry typically includes the following critical data points:

- Transaction Date: The date on which the transaction occurred.

- Payment Amount: The total amount received for the transaction.

- Tax Percentage: The applicable tax percentage levied on the transaction. This may vary depending on your location and business type.

- Mode of Payment: The method used by the customer to make the payment (e.g., credit card, debit card, etc.).

- Issuing Bank Details: Information about the bank that issued the customer’s payment method (relevant for transactions made using credit cards or debit cards).

By reviewing the PayPal Payment Report, you can verify that all transactions are accurately recorded and that the corresponding amounts have been received. This report also allows you to track tax implications associated with your transactions.

PayPal Rate Card: The PayPal Rate Card outlines the fees associated with using their payment gateway services. This essential resource typically includes the following information:

- Validity Dates: The specific timeframe during which the listed fees and tax percentages are applicable. PayPal may update its rate card periodically, so staying informed about these changes is crucial.

- Applicable Percentage of Tax: The tax percentage that PayPal applies to transactions, depending on your location and business type.

- Fee: The specific fee charged by PayPal for processing a transaction. These fees may vary based on the transaction type, payment method used, and your account tier.

Result:

Fee Analysis:

Fee Correctly Charged: These transactions reflect a perfect match between the fees calculated by Cointab and the fee amount listed on your invoice.

Fee Overcharged: Cointab identifies instances where the invoice lists a higher fee than what Cointab calculates based on the agreed-upon rate card.

Fee Undercharged: Conversely, these transactions highlight discrepancies where Cointab calculates a higher fee than the amount charged on the invoice.

Tax Verification:

Tax Correctly Charged: Transactions in this category represent instances where the tax amount on the invoice (typically 18% GST on the fee) aligns perfectly with Cointab’s calculations.

Tax Overcharged: Similar to fee overcharges, Cointab identifies situations where the tax amount on the invoice exceeds the tax calculated using the correct rate.

Tax Undercharged: These transactions indicate discrepancies where Cointab calculates a higher tax amount than what is reflected on the invoice.

Settlement Amount Breakdown:

Settlement Amount Match: Cointab calculates the settlement amount using the formula: Settlement Amount = Amount Collected from Customer – Fee Charge – Tax Charge. This category signifies transactions where the calculated settlement amount perfectly aligns with the amount reflected in your PayPal report.

Settlement Amount Mismatch: Cointab highlights discrepancies between the calculated settlement amount and the amount in your PayPal report. These require further investigation to identify the source of the mismatch.

Transaction Tracking:

Settlement UTR not present: A UTR (Unique Transaction Reference) number is assigned to every payment sent to the bank. This category identifies transactions where a UTR number is missing, potentially indicating that the payment was not successfully transferred to the bank.

Settled in Bank Account: These transactions represent successful settlements, where the order amount in your PayPal report matches the corresponding amount in your bank statement.

Not Settled in Bank Account: Cointab identifies discrepancies between the amount in your bank statement and the amount in your PayPal report. These require further investigation to resolve any settlement issues.

Streamline your financial reconciliation with Cointab! Our software automates the entire process, eliminating the tedium of manual data loading, linking, and cleaning. This translates to comprehensive reconciliation results delivered efficiently. Cointab empowers you to pinpoint overcharged amounts on specific orders, allowing your business to recoup these funds by raising disputes with PayPal. In short, Cointab automates the entire PayPal charges verification process, saving you valuable time and ensuring accurate financial records.

Step into the future of reconciliation. Fill out the form to request your demo now!