PayU, a leading payment gateway, offers several payment options for your customers (debit cards, credit cards, net banking, the latest BNPL options, digital wallets, and even QR scanning). But with every payment processed comes fees. PayU charges a certain amount of fees on their customer who avail of their service. Manually tracking PayU fees per transaction is time-intensive and prone to errors. Due to which managing the reconciliation of PayU fees can be a challenge, especially for businesses with high transaction volumes.

Keeping tabs on each transaction by hand is a time-consuming and unreliable task. Failure to identify fee inconsistencies can have a big impact on your profits, making it difficult to pinpoint the cause.

Our automated reconciliation software tackles this pain point head-on, offering a solution to streamline your PayU finances. Here’s how our software simplifies PayU reconciliation:

Effortless Integration: Our software seamlessly integrates with PayU, eliminating the need for manual data entry. This ensures accurate and efficient reconciliation.

Discrepancy Detection & Overcharge Identification: Our software meticulously compares its calculations with PayU reports, highlighting any discrepancies. This proactive approach empowers you to identify potential overcharges and take corrective actions swiftly.

Reconciliation is a crucial process for businesses. It ensures accurate fee application, tax calculation, and timely settlements. This guide breaks down key elements within your reports to empower you with a comprehensive understanding:

Transaction Details: Track the exact amount received for each order, along with its corresponding transaction date.

Fee & Tax Breakdown: Gain transparency into the applicable fees and taxes levied on each transaction, allowing for verification against the PayU’s pricing structure.

Payment Method: Identify the specific payment method used (debit card, credit card, net banking, etc.) for each order.

Issuing Bank Information: View the issuing bank associated with each transaction.

PayU Rate Card: The PayU Rate Card provides a clear picture of the fee and tax percentages applicable to various transaction types

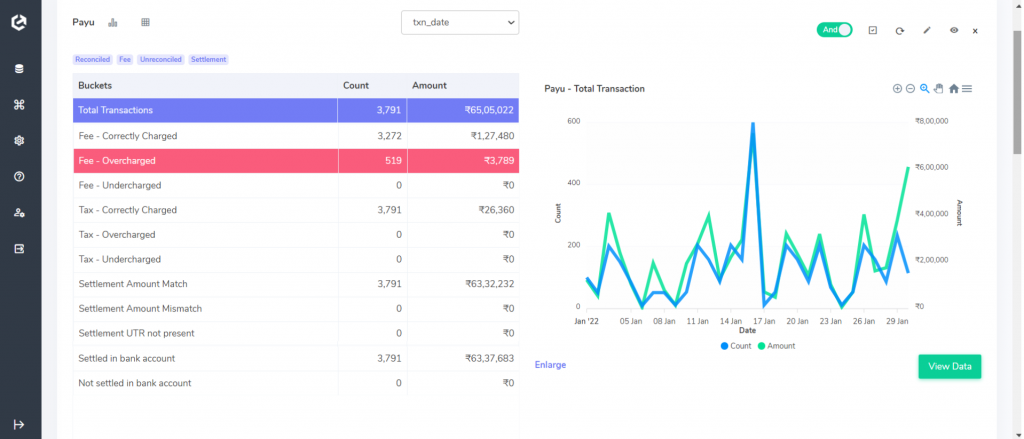

PayU Payment Gateway Charges Verification Result:

Fee Analysis:

Correctly Charged Fees: Orders where the calculated fee amount matches the fee charged by PayU are displayed here. This signifies an accurate fee application on these transactions.

Overcharged Fees: If PayU’s fee exceeds your calculated amount, these orders are pointed out for further investigation. This helps identify potential discrepancies so that you can take action to recover any overcharges.

Undercharged Fees: Conversely, orders with fees lower than your calculations are highlighted. This allows you to proactively address any undercharged transactions.

Tax Verification:

Correctly Charged Tax: Orders where the tax levied (typically 18% GST on fees) matches your calculations are displayed here, ensuring accurate tax application on each transaction.

Overcharged Tax: Any orders reflecting tax exceeding your calculations are flagged, enabling you to investigate potential tax overcharges.

Undercharged Tax: Orders with lower than expected tax are highlighted, allowing you to address any undercharged tax liabilities proactively.

Settlement Analysis:

Settlement Amount Match: Orders with matching calculated and reported settlement amounts are displayed here.

Settlement Amount Mismatch: Orders with discrepancies between the calculated and reported settlement amounts are singled out for further review to ensure accurate reconciliation.

Settlement UTR not Present: UTR (Unique Transaction Reference) is crucial for verifying bank settlements. Orders lacking UTR require investigation as they might not be reflected in your bank account.

Bank Settlement Status:

Settled in Bank Account: Orders with the final settlement amount reflected in your bank statement are categorized here.

Not Settled in Bank Account: Orders where the final settlement amount is missing from your bank statement are flagged. This necessitates further investigation to ensure timely settlements.

As highlighted earlier, our software meticulously cross-references the settled amount with both the PayU report and the Bank statement, identifying any disparities. It conveniently presents a list of orders where the expected settlement amount is not reflected in the bank statement.

Cointab reconciliation software isn’t just software—it’s a game-changer for automation of financial reconciliation. Imagine unlocking a world of streamlined processes, optimized efficiency, and invaluable insights with every reconciliation. By partnering with Cointab, you gain a powerful tool to propel your financial reconciliation to new heights.

Partner with us today and discover the difference for yourself.

Step into the future of reconciliation. Fill out the form to request your demo now!