Pepperfry bridges the gap between furniture retailers and a massive online audience in India. Boasting over 4.5 million registered users, this online furniture marketplace acts as a digital showroom for 10,000 sellers. Pepperfry fosters a unique blend of online and offline business models, constantly innovating in delivery services, payment options, and the overall customer experience to create a seamless experience for both sellers and buyers. For furniture businesses, selling on Pepperfry unlocks significant growth potential and expands their reach to a nationwide customer base.

For Pepperfry sellers, getting paid after product delivery requires tedious record-keeping. This involves tracking shipped items, pricing details, and corresponding customer payments. Pepperfry’s extensive reports, coupled with high transaction volumes, can make reconciliation a time-consuming nightmare.

Cointab steps in as a game-changer.

Their automated reconciliation technology tackles this challenge head-on. It eliminates manual data entry with automatic uploads, simplifying the entire process. Additionally, Cointab presents the results in a clear and user-friendly format, allowing sellers to effortlessly review and manage their finances.

Required Reports

- Order Detail Report: This report serves as your order bible, containing every detail of each Pepperfry sale, from product specifics to customer information.

- Shipping Details Report: Once your orders hit the road, this report tracks their journey, providing comprehensive shipping information for easy reference.

- Canceled Order Report: Not all orders make it to the finish line. This report captures details of canceled or returned orders, ensuring nothing slips through the cracks.

- UTR Detail Report: This report acts as your payment confirmation, listing every order Pepperfry has paid you for, complete with UTR (Unique Transaction Reference) IDs for clear record-keeping.

Their automated reconciliation technology tackles this challenge head-on. It eliminates manual data entry with automatic uploads, simplifying the entire process. Additionally, Cointab presents the results in a clear and user-friendly format, allowing sellers to effortlessly review and manage their finances.

Payment Reconciliation

Pepperfry sellers face a waiting game for payments, receiving them only after successful deliveries. With frequent daily transactions, manually tracking these payments becomes a near-impossible feat. This lack of visibility can leave sellers blind to potential financial losses, hindering corrective actions.

Cointab tackles this challenge head-on, streamlining the payment reconciliation process. It acts as a bridge, seamlessly connecting various Pepperfry reports to generate a clear and concise summary. This comprehensive report details every order, including item prices, associated fees, and the final payment amount. After crunching the numbers, Cointab presents the results in an easily understandable and well-organized format. This user-friendly approach empowers sellers to effortlessly analyze their finances and identify any discrepancies.

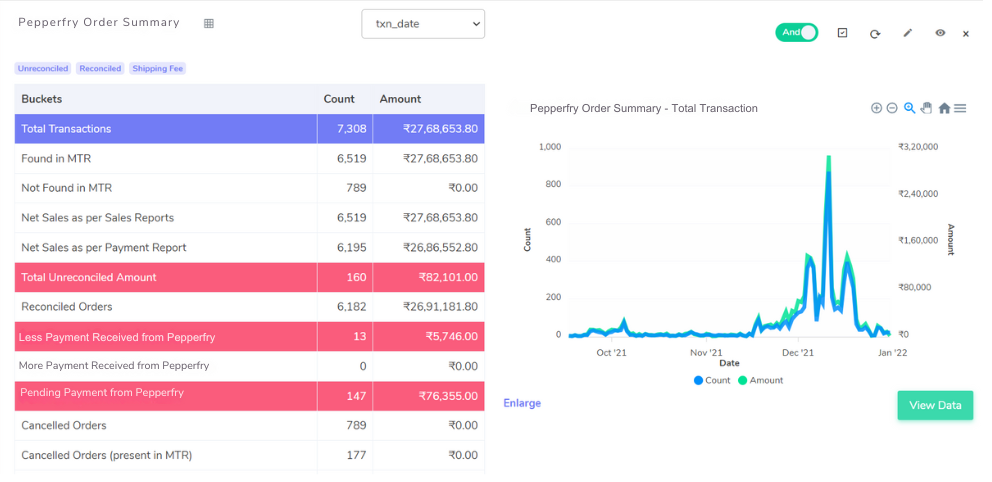

The result are displayed below

- Reconciled Orders: These transactions exhibit perfect concordance between the total amount reflected in your Pepperfry order and the corresponding Unique Transaction Reference (UTR) amount, signifying an unimpeded payment process.

- Potential Shortfall: This category highlights situations where a discrepancy exists between the order amount documented in the Pepperfry report and the UTR amount. This could indicate a missing payment or an inconsistency that necessitates further investigation.

- Unexpected Surplus: This section identifies instances where the order total in the Pepperfry report is lower than the UTR amount. It is prudent to verify these transactions to ensure the complete receipt of payment.

The Reconciliation Process is as follows

Bank Reconciliation

Bank reconciliation serves as the final critical step, guaranteeing the veracity of every payment Pepperfry transmits and its subsequent receipt within your bank account.

Occasional technical malfunctions or human error can introduce discrepancies into the payment process, resulting in missed or incorrect deposits. These seemingly minor inconsistencies, if left unattended across numerous daily transactions, can culminate in substantial financial losses for sellers. Cointab’s capabilities extend beyond internal reconciliation. Its technology seamlessly integrates with your bank statements, thoroughly cross-referencing each transaction amount. This comprehensive approach ensures the complete and accurate settlement of all receivables, fostering peace of mind and safeguarding your financial well-being.

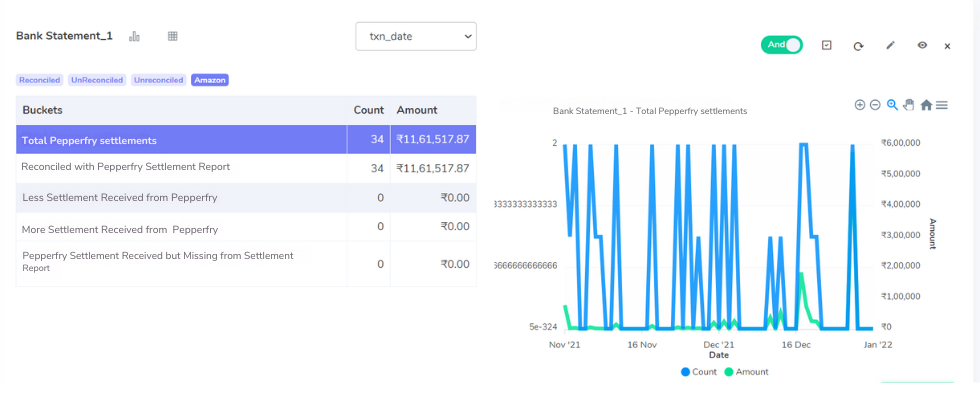

The results are as follows

- Reconciled with Pepperfry: These transactions signify a perfect match between the bank deposit and Pepperfry’s promised settlement amount, indicating a smooth and error-free payment process.

- Potential Discrepancies: This category highlights situations where the bank deposit falls short of the settlement amount reported by Pepperfry. This could indicate underpayment or a processing error that necessitates further investigation.

- Unexpected Deposits: This section identifies instances where the bank deposit surpasses the settlement amount stated by Pepperfry. Verifying these transactions ensures you receive the full and accurate amount owed.

- Missing from Pepperfry Reports: This category highlights bank deposits corresponding to Pepperfry payments that were not reflected in their settlement reports. This ensures you capture all income and identify any potential reporting discrepancies.

Empowering Informed Decisions in a Complex World

In today’s dynamic business landscape, reconciliation is paramount for success. Cointab streamlines this process, allowing you to easily interpret the results, identify underpayments promptly, and gain complete confidence in the accuracy of your financial data. With Cointab by your side, you can make informed business decisions with the clarity and peace of mind you deserve.

Unlock the benefits with Cointab!