Pin Payments is a versatile payment method available in Australia that makes the entire transaction procedure for small businesses dependable, effective, and easy. It makes it convenient for small businesses to make transactions on a day-to-day basis.

As millions of transactions are conducted by Pin Payments every day, reconciling these transactions might take a while. However, it is crucial to speed up this process in order to avoid financial inconsistencies.

By streamlining this process for your company, Cointab Reconciliation’s solution improves the efficiency of your finance team. Our software can be customised to meet your unique requirements, automating data entry and comparing Pin Payments invoices with bank statements in ERP reports and other reports on websites and other platforms. This process helps you in identifying any mistakes and overcharges, assuring the accuracy of your financial records and helping you stop further losses.

Pin Payments payment report

This report shows from which payment mode the payment has been done through Pin Payments payment gateway.

Pin Payments rate card

The fee, Percentage charged and rate charged come under this report.

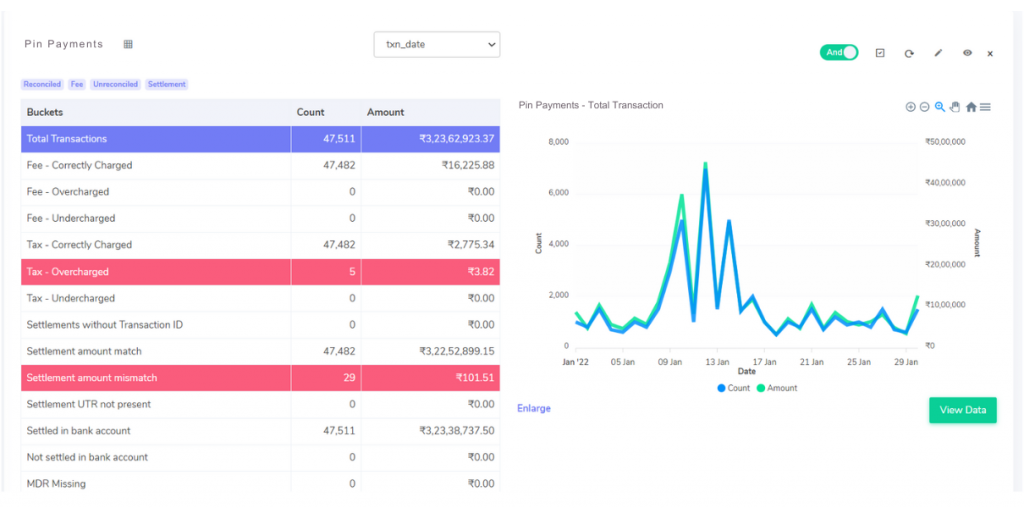

Fee correctly charged

The fee is calculated with the help of the rate card which denotes that in this case the fee is correctly charged as per the rate card in the settlement report.

Fee overcharged

Compared to the calculated amount, the fee charged here is more.

Fee undercharged

In this case, the fee is undercharged compared to the calculated amount.

Tax correctly charged

The tax amount calculated with the help of the rate card matches with the settlement report.

Tax overcharged

Here, the tax present in the payment report is charged more than the calculated amount.

Tax undercharged

In this case, the tax present in the payment report is charged less compared to the calculated amount.

Settlement amount match

The settlement amount is calculated when fee and tax are deducted from the total amount. The settlement amount calculated should match the Pin Payment settlement report, and in this case, they match.

(settlement amount = total amount – fees – tax)

Settlement amount mismatch

The tax and fees are deducted from the total amount which gives us the settlement amount. The settlement amount calculated should match the Pin Payment settlement report, and in this case they do not match.

Settled in bank reconciliation

These transactions are Found in the bank statements as well as the Pin Payment settlement report.

Not settled in bank reconciliation

Transactions that are not settled in bank statements but are present only in the Pin Payment settlement report.

Streamline your data with ease and accuracy with Cointab Reconciliation. Its automated features ensure error-free results, while seamless data processing and loading provide a holistic overview of your transactional activities. Harness the power of Cointab Reconciliation to optimize your operations, ensure accuracy, and enhance the charges verification process.

Don’t delay; start leveraging Cointab Reconciliation today to initiate your journey towards financial efficiency.

Step into the future of reconciliation. Fill out the form to request your demo now!