Purplle’s app offers a highly personalized beauty experience, leveraging rich user personas, virtual try-on capabilities, and product recommendations powered by a unique combination of personality traits, search history, and purchase behavior. This positions Purplle as a prime platform for beauty brands seeking to reach a vast and engaged audience. However, managing record-keeping and ensuring transaction accuracy can be a challenge for sellers due to the complexities of Purplle’s marketplace fees, which are levied on every order to facilitate the platform’s numerous features and extensive reach. Verifying these fees amidst a high volume of transactions can be an extremely tedious task.

Cointab’s automated reconciliation technology tackles this challenge. The system empowers sellers to efficiently record and analyze transactions, promptly identify discrepancies in fees or other charges, and initiate swift corrective actions or disputes with Purplle. This translates to maximized profitability for brands by minimizing the risk of financial losses due to errors or inconsistencies within the Purplle marketplace.

Reports for Streamlined Purplle Reconciliation with Fee Verification

Effective Purplle reconciliation with fee verification hinges on a comprehensive set of reports:

Purplle Order Report: This report serves as the foundation, offering a detailed record of all transaction orders between the seller and the Purplle marketplace. It encompasses vital information such as order IDs, product details, quantities purchased, and order values.

Purplle Payment Report: The Purplle Payment Report delves into the financial aspects of each order. This report details all payments made by Purplle, including the breakdown of fees charged (e.g., commission fees) for each order. Additionally, it provides a crucial UTR ID that facilitates bank reconciliation.

Rate Card: The rate card acts as a reference point for fee calculations. It outlines the various rates used by Purplle to determine the commission fees applicable to different categories or types of items sold on the platform.

SKU Master: The SKU Master serves as a comprehensive product database, containing detailed information for each Stock Keeping Unit (SKU) within the seller’s inventory. This data encompasses critical parameters like weight, size, and most importantly, the item price. These parameters play a vital role in calculating the applicable commission fees based on the established rate card.

Fee Verification in Purplle Reconciliation

Commission Fee Calculation: For each order, the system leverages the item details from the Purplle Order Report and the corresponding SKU data from the SKU Master. Based on the pre-defined rates outlined in the rate card, the system calculates the expected commission fee for each item within the order.

Fee Discrepancy Identification: Following the calculation of expected fees, the system meticulously compares these values with the actual fees charged by Purplle as reflected in the Purplle Payment Report. Any discrepancies between the calculated and charged fees are highlighted for further investigation.

Simplified Analysis: The results of the fee verification process are presented in a user-friendly and organized format. This allows sellers to effortlessly analyze any discrepancies, facilitating swift identification and resolution of potential errors.

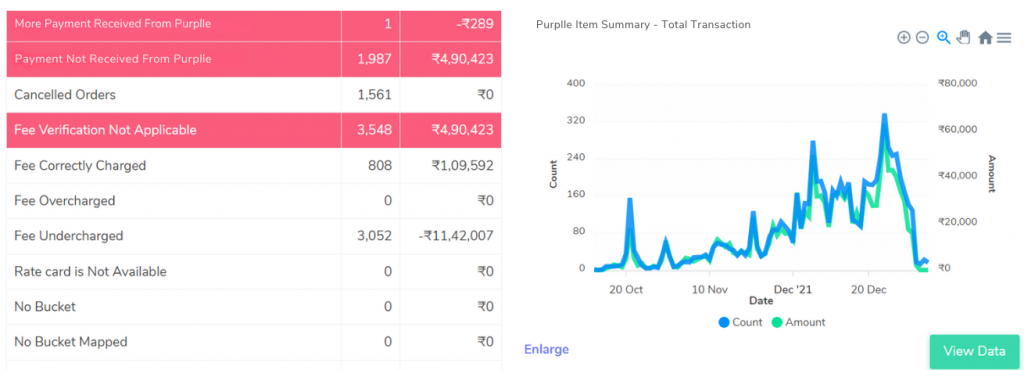

The result is displayed as follows:

Correctly Charged Fee: This category signifies transactions where the commission fee is calculated based on the seller’s SKU data and the rate card perfectly aligns with the fee charged by Purplle. These transactions represent a successful match, indicating an accurate fee application.

Overcharged Fee: These transactions highlight discrepancies where the fee charged by Purplle surpasses the calculated fee based on the pre-defined rates. This could potentially indicate errors in Purplle’s fee application or require further investigation into the specific rates used for these orders.

Undercharged Fee: Conversely, this category showcases transactions where the calculated fee based on the seller’s SKU data and the rate card exceeds the fee charged by Purplle. This might be due to potential discounts or promotions offered by Purplle that weren’t initially factored into the fee calculation.

Due to systematically categorizing these results, Cointab’s reconciliation system empowers Purplle sellers to gain a clear understanding of any fee mismatches between their pre-determined rates and the fees levied by Purplle.

By implementing a streamlined approach with the help of advanced reconciliation technology, sellers can gain valuable insights into fee structures, minimize financial discrepancies, and make informed decisions that drive growth within the Indian e-beauty market. Unlock seamless finance management with Cointab today!