Razorpay is the go-to payment gateway for businesses. They offer payment options like UPI, bank transfers, and QR Code scanning, which makes life easier for the customers. However, to carry out all these payments, Razorpay charges a fee on each order payment they process. As a business, there are lots of orders and payments made every day and with the market demand increasing and a bunch of transactions to handle, keeping track of those fees can be very bothersome. It can be tricky to keep track of the fee charged on every payment. If you’re getting overcharged on many orders, it can add up over time and lead to a big loss.

The Challenge: Keeping Up with Razorpay Fees

Manually tracking individual Razorpay fees on every transaction is a time-consuming and error-prone process. With the growing popularity of Razorpay, businesses are processing more payments daily, further complicating manual reconciliation. Unidentified overcharges can silently accumulate over time, impacting your profitability significantly.

Here’s where Cointab steps in to simplify your financial management:

Automated Razorpay Reconciliation:

Cointab’s automated reconciliation software eliminates the need for manual calculations. It seamlessly integrates with Razorpay to analyze transaction data.

Fee & Tax Accuracy:

Cointab calculates the fees, taxes, and settled amount for each transaction, and then compares this data with Razorpay’s reports. This ensures you’re not being overcharged on fees or taxes.

Discrepancy Identification:

Cointab highlights any discrepancies between your records and Razorpay’s reports. This allows you to identify potential overcharges and take corrective measures quickly.

Save Time & Money:

By automating the reconciliation process, Cointab saves you valuable time and resources. Additionally, by identifying potential overcharges, Cointab helps you recover lost revenue.

Benefits of Using Cointab for Razorpay Reconciliation:

Cost Savings:

Identifies the errors in transactions and alerts the business of potential overcharges on Razorpay fees.

Enhanced Efficiency:

Automate time-consuming manual reconciliation tasks, freeing up your team’s resources for more strategic initiatives.

Improved Financial Accuracy:

Maintain accurate and up-to-date financial records with confidence, ensuring better financial decision-making.

Data-Driven Insights:

Gain valuable insights into your transaction data, empowering you to optimize your payment processing strategy.

Reports Used for Razorpay Charges Verification:-

Razorpay Payment Report:

Razorpay provides a comprehensive report that give an insight into all business transactions processed through the payment gateway.

These reports include:

Transaction Amount & Date:

These reports provide a clear and concise breakdown of the exact amount received for each order, along with the corresponding transaction date.

Fee & Tax Breakdown:

Gain transparency into the applicable fees and taxes levied on each transaction.

Payment Mode:

Identify the specific payment method used (UPI, bank transfer, etc.) for each order.

Issuing Bank Information:

View the issuing bank associated with each transaction for a better understanding of financial transactions.

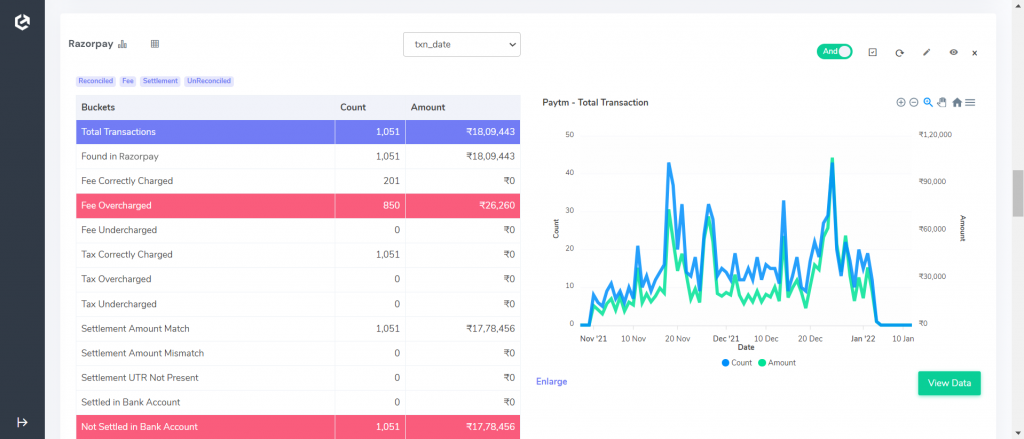

Fee Analysis:

Correctly Charged Fees:

The software confirms a perfect match between Razorpay’s fees and internal calculations.

Overcharged Fees:

If Razorpay’s fees exceed calculated amounts, these orders are flagged for further investigation. This helps identify potential discrepancies and recover any overcharges.

Undercharged Fees:

Conversely, orders with fees lower than Razorpay’s calculations are highlighted.

Tax Verification:

Correctly Charged Tax:

The software verifies if the tax levied (typically 18% GST on fees) matches the calculations. This ensures accurate tax application on each transaction.

Overcharged Tax:

Any orders reflecting tax exceeding the calculations are identified, enabling you to investigate potential tax overcharges.

Undercharged Tax:

Orders with lower than expected tax are highlighted, allowing you to address any undercharged tax liabilities proactively.

Settlement Analysis:-

Settlement without Transaction ID:

These settlements appear in the Razorpay report, but the corresponding transaction IDs are missing.

Settlement Amount Match:

Our software calculates the settlement amount using the formula: Settlement Amount = Amount Collected from Customer – Fee Charge – Tax Charge. Orders with matching calculated and reported settlement amounts are displayed

Settlement Amount Mismatch:

Orders with discrepancies between the calculated and reported settlement amounts are identified for further review to ensure accurate reconciliation.

Settlement UTR not Present:

UTR (Unique Transaction Reference) is crucial for verifying bank settlements. Orders lacking UTR require investigation as they might not be reflected in the bank account.

Settled in Bank Account: Orders with the final settlement amount reflected in the bank statement are categorized here. Not Settled in Bank Account: Orders where the final settlement amount is missing from your bank statement are identified.

Step into the future of reconciliation. Fill out the form to request your demo now!