General Ledger Reconciliation

Automate Accuracy & Streamline Financial Records

Accurate financial records are critical for business success. General ledger (GL) reconciliation ensures sub-ledger transactions align with General ledger totals, maintaining financial integrity. However, over 40% of financial inaccuracies stem from manual reconciliation processes. As transaction volumes grow, manual methods become inefficient, error-prone, and time-consuming, delaying financial reporting and strategic decision-making.

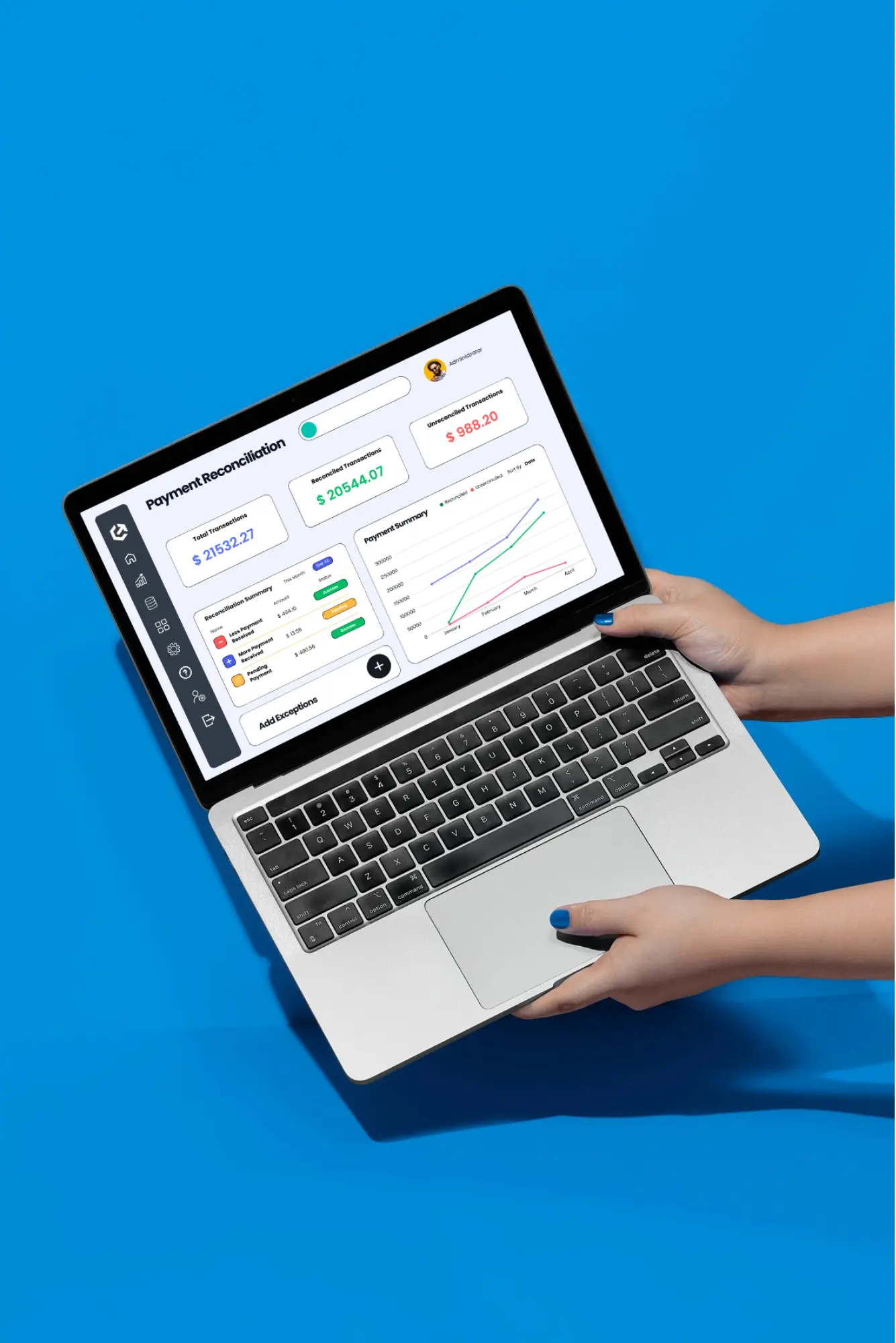

Cointab’s automated reconciliation solution eliminates these challenges, ensuring accuracy, reducing discrepancies, and enhancing financial efficiency for growing businesses.

Challenges of Manual General Ledger Reconciliation

Manual ledger reconciliation creates financial risks and operational inefficiencies. Key challenges include:

Time-Intensive Discrepancy Resolution

Identifying mismatches between sub-ledgers and the general ledger requires extensive effort.

High Transaction Volumes

As businesses scale, manual reconciliation struggles to keep up, causing reporting delays and compliance risks.

Human Error & Data Entry Mistakes

Manual data handling leads to costly errors, impacting financial accuracy.

Lack of Real-Time Financial Insights

Without automation, finance teams cannot detect discrepancies instantly, delaying corrective action.

Time-Intensive Discrepancy Resolution

Identifying mismatches between sub-ledgers and the general ledger requires extensive effort.

How Cointab Automates General Ledger Reconciliation

Cointab’s automation enhances speed, accuracy, and efficiency:

Seamless Data Integration

Connects with bank statements, and financial platforms for automated data fetching.

General Ledger vs. Bank Deposit Matching

Ensures recorded payments align with bank deposits for audit-ready reconciliation.

Customizable Reconciliation Rules

Tailor reconciliation processes to align with internal policies and compliance requirements.

Intelligent Data Matching

Uses algorithms to match financial entries, detecting missing, duplicate, or incorrect transactions instantly.

Comprehensive Reporting

Provides real-time reconciliation status, pending transactions, and detailed audit trails.

How Cointab Automates General Ledger Reconciliation

Intelligent Matching Algorithms

Uses intelligent algorithms to match transactions across different systems, instantly flagging inconsistencies.

Automated Data Ingestion

Eliminates manual data entry by fetching financial records directly from ERP systems, banks, and accounting platforms.

Scheduled Reconciliation

Businesses can schedule automated reconciliation runs, ensuring timely and accurate financial reporting without manual intervention.

Audit-Ready Documentation

Maintains detailed financial trails, supporting regulatory compliance and simplifying audits.

Automated Discrepancy Alerts

Instantly detects and reports reconciliation mismatches, allowing businesses to take corrective action before errors escalate.

Key Stats on the Importance of Automated Reconciliation

75% of businesses report experiencing delays or discrepancies in withdrawal processing due to manual tracking

68% of financial teams struggle with mismatched transactions and missing settlements

Automating reconciliation reduces financial discrepancies by 60% and saves up to 65% of time spent on manual tracking

Conclusion

Manual general ledger reconciliation is inefficient, time-consuming, and prone to errors. Cointab’s automated solution streamlines the process, ensuring accurate financial settlements, real-time discrepancy detection, and seamless integration with financial systems.

Optimize your financial reconciliation process—Schedule a free consultation with Cointab today!