Payment Gateway Reconciliation

Reconcile payment gateway transactions of website and app.

Overcoming Payment Gateway Reconciliation Challenges with Cointab

In today’s digital-first economy, payment gateways power transactions for businesses worldwide. They handle payments, refunds, chargebacks, and transaction fees across a multitude of sales channels. While they provide unmatched convenience, reconciling payment gateway data with internal systems and bank records is a significant operational challenge.

Payment gateway reconciliation isn’t just an accounting task—it’s a critical function that ensures financial accuracy, operational efficiency, and business growth.

The Complexities of Payment Gateway Reconciliation

Payment gateway reconciliation involves verifying that the transactions processed by your payment gateway match the data in your sales systems, ERP, and bank statements. While the concept is straightforward, the execution is anything but.

Key Challenges in Payment Gateway Reconciliation

Data Discrepancies Across Systems

Payment gateways, ERPs, and banks often use different formats, making it difficult to align data. Settlement delays and processing fees add further complexity to matching amounts

High Transaction Volumes

Businesses with high transaction volumes, such as e-commerce platforms and subscription services, struggle to manually match thousands of transactions daily.

Handling Refunds and Chargebacks

Reconciling partial refunds, chargebacks, and adjustments is complex due to varied processing timelines and fee structures.

Fee Deductions and Currency Conversions

Payment gateways often deduct processing fees or apply currency conversion rates, leading to discrepancies in settlement amounts.

Manual Errors and Inconsistencies

Teams relying on Excel or other manual tools are prone to errors, especially when handling intricate reconciliation rules across multiple gateways.

Lack of Real-Time Visibility

Delays in identifying mismatches or pending settlements can affect cash flow management and decision-making.

The Cost of Ignoring Reconciliation

Recent studies show that:

82% of businesses lose up to 5% of their revenue annually due to transaction errors or fraud caused by reconciliation gaps.

63% of finance professionals say they spend excessive time on manual reconciliation, leaving less time for strategic tasks.

Businesses with automated reconciliation report 90% faster resolution of transaction discrepancies, allowing them to close books significantly faster

Inconsistent reconciliation doesn’t just impact your books it can

Lead to revenue leaks if discrepancies go unnoticed.

Cause delays in cash flow projections, affecting business planning.

Erode customer trust due to unresolved payment issues.

Complicate regulatory compliance, risking fines or penalties.

Why Manual Reconciliation Falls Short

Excel and manual processes have been reliable tools for decades. They’re fantastic for smaller-scale operations and ad-hoc analyses. However, in today’s fast-paced, high-volume environments, manual reconciliation simply doesn’t cut it:

Time-Consuming

Matching transactions across multiple systems can take hours or even days.

Error-Prone

Even a minor mistake in formulas or data entry can cascade into significant financial inaccuracies.

Inconsistent Processes

Different team members may approach reconciliation differently, leading to inconsistencies that confuse reviewers or auditors.

Lack of Scalability

As transaction volumes grow, Excel struggles to handle the load, slowing down operations

We’re not here to eliminate Excel—it’s a tool we respect and admire. But when it comes to payment gateway reconciliation, automation is the only way forward.

The Cointab Solution: Automation at Its Core

Cointab simplifies and automates payment gateway reconciliation, eliminating manual errors and inefficiencies. With our SaaS-based solution, businesses can reconcile transactions seamlessly, even at scale.

How Cointab Solves Your Challenges:

01

Automated Data Integration

- Cointab integrates directly with popular payment gateways like Stripe, PayPal, Razorpay, and Adyen, as well as your ERP systems and bank accounts.

- Automates data fetching, eliminating manual downloads and uploads.

02

Comprehensive Reconciliation Workflows

- Build custom workflows to handle the unique requirements of refunds, chargebacks, and multi-currency transactions.

- Tailor processes to fit your business, whether you operate in e-commerce, SaaS, or marketplaces.

03

Fee and Settlement Management

- Automatically account for processing fees, currency conversions, and settlement delays to ensure accurate reconciliation.

04

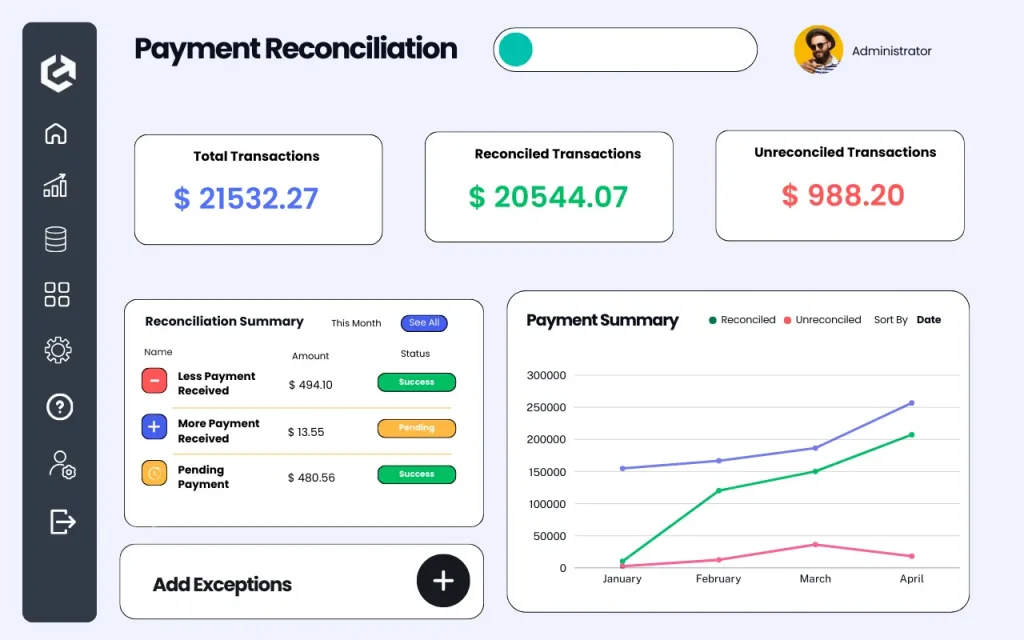

Real-Time Dashboards

- Monitor reconciled and unreconciled transactions in a single view.

- Identify discrepancies and take immediate corrective action.

05

Scalability for Growing Businesses

- Handle millions of transactions effortlessly, ensuring that your reconciliation process grows with your business.

06

Audit-Ready Records

- Maintain a clear, consistent audit trail, simplifying compliance and external reviews.

The Benefits of Cointab’s Payment Gateway Reconciliation

Save Time and Resources

Automating repetitive tasks frees up your team to focus on strategic initiatives rather than transactional headaches.

Achieve Unmatched Accuracy

Minimize errors by automating data matching and eliminating manual interventions.

Improve Cash Flow Management

Gain real-time visibility into pending settlements, refunds, and chargebacks to make informed decisions.

Enhance Operational Efficiency

Streamlined workflows and automated processes speed up your financial close cycles.

Global Scalability

Whether you’re managing multi-currency payments or operating across regions, Cointab ensures consistency and control.

Built for the Modern, Global Business

Whether you’re running a fast-growing e-commerce store, managing a global SaaS business, or handling complex marketplace payouts, Cointab’s payment gateway reconciliation software is designed for you. It’s time to leave behind the limitations of manual tools and embrace the accuracy, speed, and scalability of automation.

Let Cointab Handle the Complexity

Reconciliation doesn’t have to be a bottleneck. With Cointab, you can simplify your payment gateway reconciliation, ensure financial accuracy, and focus on what really matters—growing your business.