Withdrawal Transactions Reconciliation

Streamlining Withdrawal Transactions Reconciliation with Cointab

Managing withdrawal transactions reconciliation is crucial for businesses handling frequent cash movements, bank transfers, and digital payments. Ensuring that withdrawals match recorded transactions is complex, involving multiple financial accounts, processing fees, settlement delays, and fraudulent discrepancies. Manual reconciliation is prone to errors, leading to financial misstatements, operational inefficiencies, and revenue loss. Cointab’s automated reconciliation solution simplifies tracking and verification, ensuring accuracy, transparency, and efficiency in withdrawal transactions.

The Challenges of Withdrawal Transactions Reconciliation

Withdrawal transactions reconciliation involves matching recorded withdrawals with actual payments, ensuring no discrepancies. However, businesses face several challenges

Manual Errors and Time-Consuming Processes

Traditional reconciliation methods involve spreadsheets, manual entries, and cross-verification, which increase human errors and slow down financial operations. Businesses need automation to eliminate inefficiencies.

Multi-Account and Multi-Platform Complexity

Organizations handle withdrawals across multiple accounts, banks, and payment gateways. Tracking and reconciling transactions across various platforms manually increases the risk of missing data and mismatches.

Fraudulent or Unauthorized Withdrawals

Unauthorized withdrawals, internal fraud, or system glitches can lead to unexpected fund deductions. Without real-time reconciliation, businesses may fail to detect financial discrepancies in time.

Processing Fees and Hidden Deductions

Banks and payment processors deduct transaction fees, foreign exchange charges, and other processing costs. Identifying incorrect deductions or overcharges without an automated system is difficult and time-consuming.

Settlement Delays and Missing Withdrawals

Withdrawals often undergo batch processing, scheduled settlements, or bank holidays, leading to delayed or missing transactions. Businesses must track whether funds have been properly transferred or lost in processing.

How Cointab Simplifies Withdrawal Transactions Reconciliation

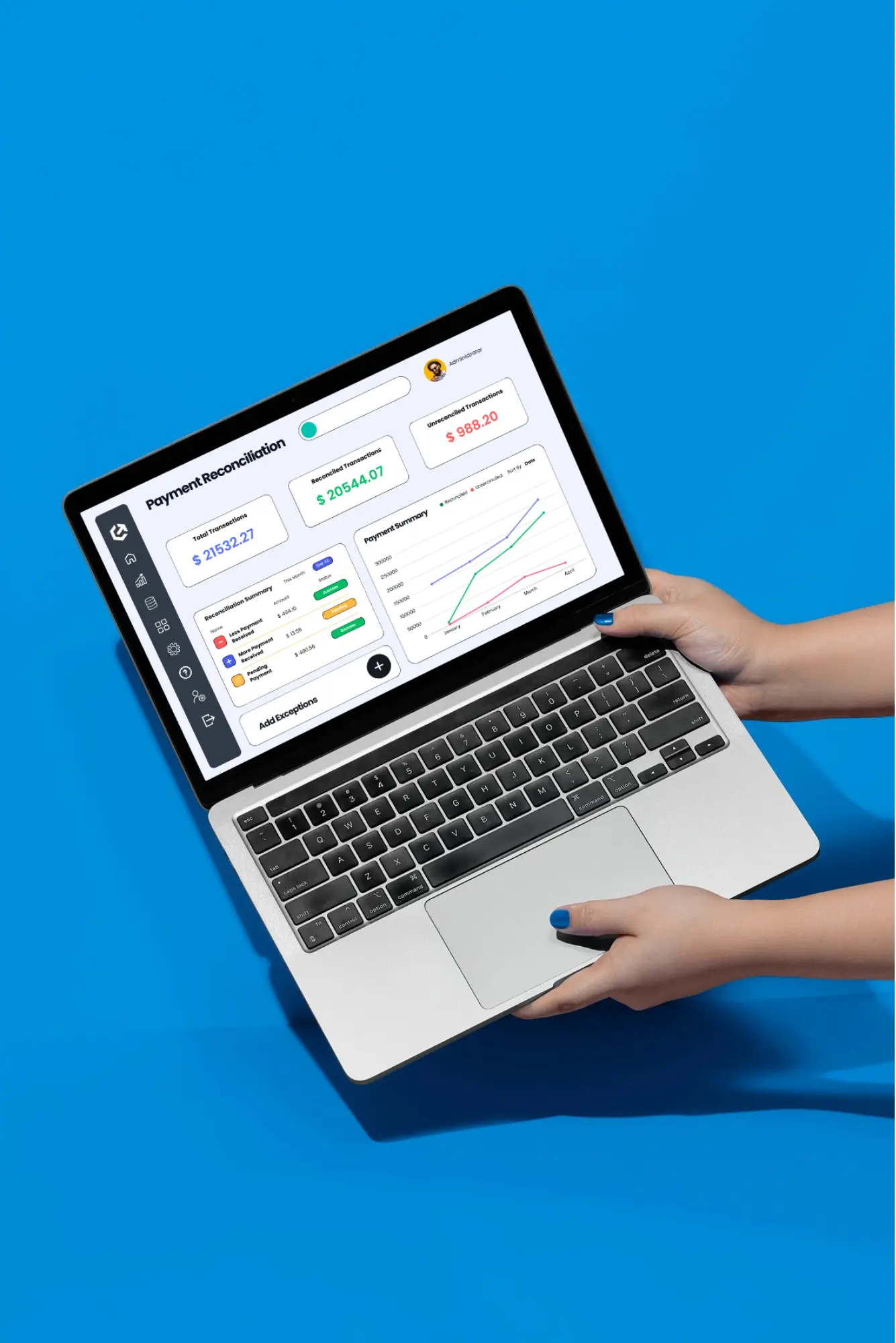

Cointab’s automated reconciliation software provides an end-to-end solution for withdrawal transactions, ensuring efficiency, accuracy, and financial integrity.

Seamless Integration with Banks and Payment Gateways

Cointab integrates directly with banks, financial platforms, and payment processors, fetching real-time withdrawal transaction data to eliminate manual tracking.

Automated Data Matching

Cointab's intelligent matching algorithms automatically reconcile withdrawal transactions, significantly reducing manual effort and minimizing errors.

Customizable Reconciliation Rules

Cointab allows businesses to define custom reconciliation rules based on their specific requirements, ensuring accurate and efficient reconciliation.

Automated Fee and Deduction Verification

Cointab automatically reconciles withdrawal amounts with actual fees and deductions, ensuring that no unauthorized charges are applied.

Comprehensive Reporting

Generate detailed reports providing a transparent view of sales, deductions, refunds, and net earnings.

How Cointab Automates Withdrawal Transactions Reconciliation

Intelligent Matching Algorithms

Using smart and efficient transaction matching, Cointab cross-verifies withdrawal records with bank statements and payment receipts to identify discrepancies.

Direct Integration with Various Systems

Cointab syncs with bank accounts, ERP systems, and payment platforms, ensuring instant data retrieval for accurate reconciliation.

Scheduled Reconciliation

Cointab allows businesses to schedule automated reconciliation processes, ensuring timely and accurate reconciliation without manual intervention.

Detailed Financial Reports for Business Insights

Cointab provides interactive dashboards and detailed financial reports, helping finance teams monitor withdrawal trends and optimize fund management.

Automated Discrepancy Alerts

Cointab helps track pending withdrawals, settlement delays, and incorrect deductions, providing actionable insights for quick resolution.

Key Stats on the Importance of Automated Reconciliation

75% of businesses report experiencing delays or discrepancies in withdrawal processing due to manual tracking

68% of financial teams struggle with mismatched transactions and missing settlements

Automating reconciliation reduces financial discrepancies by 60% and saves up to 65% of time spent on manual tracking

Conclusion

Withdrawal transactions reconciliation is critical for financial accuracy and fraud prevention. Manual methods lead to errors, inefficiencies, and revenue losses. With Cointab’s automated reconciliation, businesses can eliminate discrepancies, reduce manual workload, and maintain financial transparency.

Try Cointab’s withdrawal reconciliation solution today and take full control of your financial transactions!