In 2020, Revolut became the UK’s most valuable company. It is a fintech firm, that provides mobile app-based current accounts as an alternative to physical banks. While offering access to a full range of payment and banking services to individuals and businesses. Which further helps you to eliminate the third-party service provider. It also provides competitive pricing without any hidden fees.

Many companies are now shifting their focus from manually reconciling the transactions to automating the transaction process. The software can be used for reconciling the transactions that take place between Revolut and your business. Cointab reconciliation software provides automated integration which helps you to upload data in your preferred format. You can build a custom workflow tailored to your business needs and view the results easily. Save your business valuable time and focus more on the crucial work of your business.

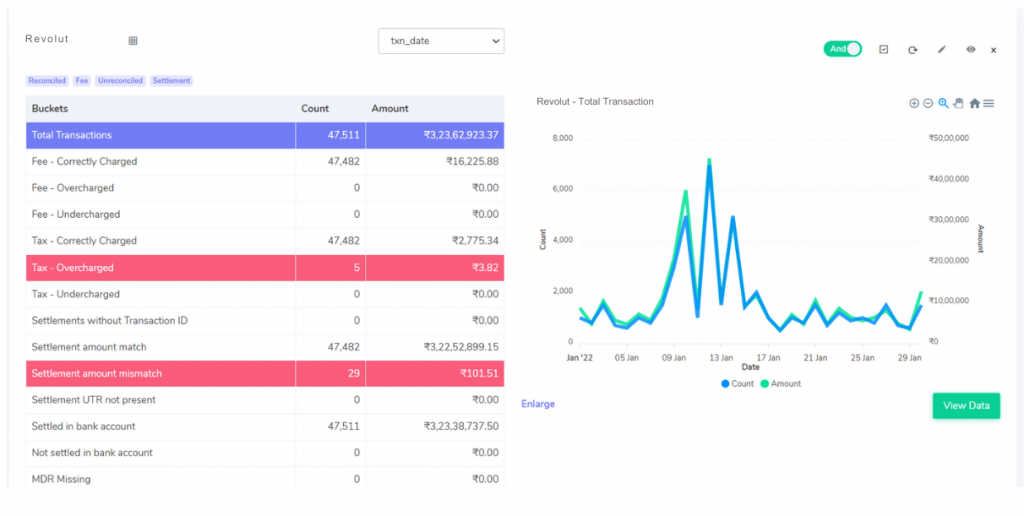

Revolut Payment report:

This report consists of the total transactions and from which payment mode (debit card, credit card, UPI, etc) the transactions are carried out.

Revolut rate card:

The rate card consists of the payment mode which has been used and the fees, and percentage that are been charged.

Fees correctly charged:

In these transactions, it verifies if the fees charged by Revolut are correctly matched with the amount calculated using the Rate card.

Fees overcharged:

Here the fees charged by Revolut are seen to be more than the amount calculated using the Rate card.

Fees under-charged:

The fees charged by Revolut are seen to be less than compared to the amount calculated using the Rate card.

Tax correctly charged:

The tax recorded in the payment report matches the tax calculated as per the GST guidelines.

Tax overcharged:

Tax recorded in the payment report is seen to be more compared to the amount calculated using GST guidelines.

Tax under-charged:

Tax recorded in the payment reports are seen to be less than the amount calculated using GST guidelines.

Settlement UTR is not present:

UTR is not present in the payment report for these transactions.

Settlement amount match:

The amount calculated after deducting the fees and taxes is the settlement amount and in these transactions, it matches the amount in the Revolut report.

(Settlement amount= Total amount- Fees – taxes)

Settlement amount Mismatch:

After the fees and taxes are deducted from the total amount, the settlement amount doesn’t match the amount in the Revolut report. Hence, it is known to be an amount of mismatch.

Settled in bank account:

The amount is present on the UTR report as well as on the Bank statement.

Not settled in bank account:

The amount is present on the UTR reports but not on the Bank statements.

Verification of transactions is important in order to ensure that there is accuracy in the payment which is recieved. There might be an instance, where your business has been either overcharged or undercharged with certain fees and taxes by Revolut. In this case, using Cointab reconciliation software will provide you with results. After the reconciliation process has been completed, these results will help your business to make a claim with Revolut. Easily verify your fees and charges with minimal effort and resources.

Step into the future of reconciliation. Fill out the form to request your demo now!