Why Automate Reconciliation?

Manual reconciliation is a time-consuming and error-prone process. Finance teams spend countless hours poring over reports, calculating discrepancies, and manually applying formulas. Automated reconciliation software offers a powerful solution, delivering:

- Increased Efficiency: Free up your finance team’s valuable time for more strategic tasks.

- Enhanced Accuracy: Reduce the risk of errors with automated data handling and calculations.

- Simplified Workflows: Eliminate tedious manual tasks like data entry and discrepancy identification.

- Improved Visibility: Gain a clearer understanding of your financial data with insightful reports and dashboards.

Redwood offers a comprehensive suite of automation tools encompassing various business functions. While its capabilities extend beyond reconciliation, it does provide features to automate this crucial financial process.

While Redwood offers a broad range of automation features, including reconciliation, some businesses may seek software focused solely on this critical process. This article highlights top alternatives specifically designed to streamline reconciliation tasks.

These alternatives excel in automating end-to-end reconciliation workflows, allowing users to reconcile transactions across various reports. This eliminates time-consuming manual tasks like bank reconciliation and invoice handling, freeing up valuable time for your finance team to focus on higher-level analysis.

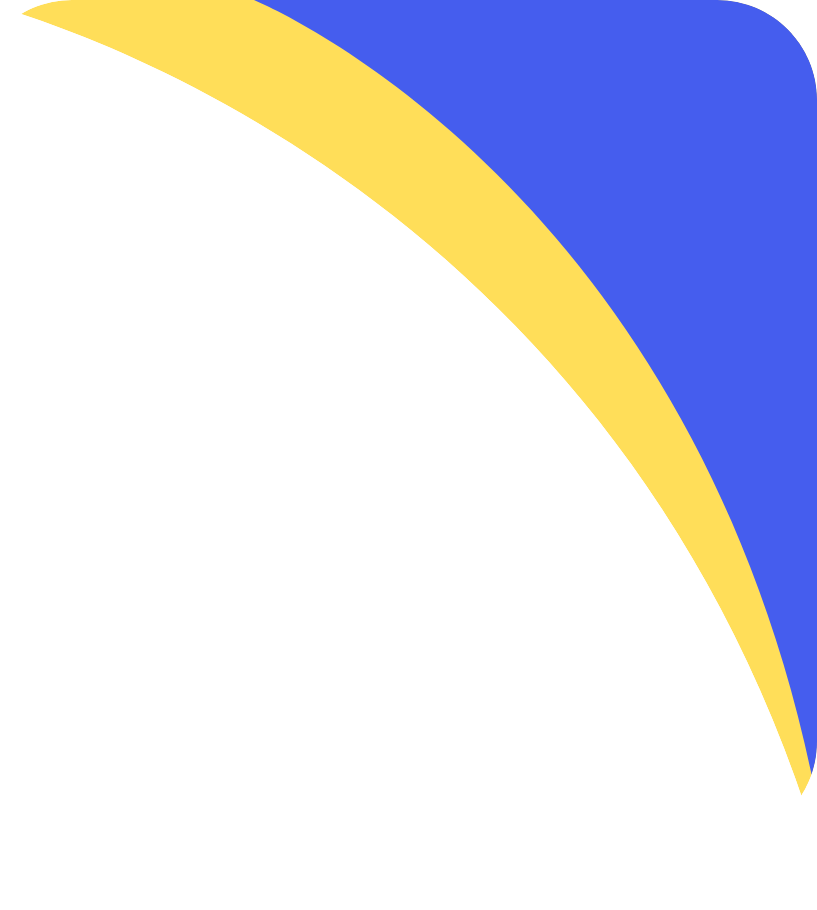

Cointab

Streamline your financial reconciliation processes and empower your finance team with Cointab. This innovative software automates repetitive tasks, reduces manual errors, and provides valuable insights to improve financial accuracy and efficiency.

Key Features:

Automated Data Loading: Eliminate manual data entry by uploading files in various formats (PDF, XML, JSON) directly into the system.

Scalability: Cointab can handle large data volumes, ensuring it grows alongside your business needs.

Customization Options:

- Input Format: Choose a format that best suits your data source.

- Matching Rules: Define custom logic for data matching to align with your specific business requirements.

- Export Format: Select the exact data fields and columns needed for your reports.

Clear and Actionable Insights: Generate easy-to-understand reports that highlight discrepancies. Identify overpaid/underpaid amounts and missing payments at a glance.

Exception Handling: Maintain accuracy by adding exceptions for transactions that require manual intervention.

Wide Range of Reconciliation Support: Cointab streamlines various reconciliation processes, including:

Payment Gateway Reconciliation

- COD Remittance

- Bank Reconciliation

- Order Management System (OMS) Reconciliation

- Enterprise Resource Planning (ERP) Reconciliation

- Marketplace Reconciliation (Amazon, Flipkart, Myntra, and more)

- Fee Verification

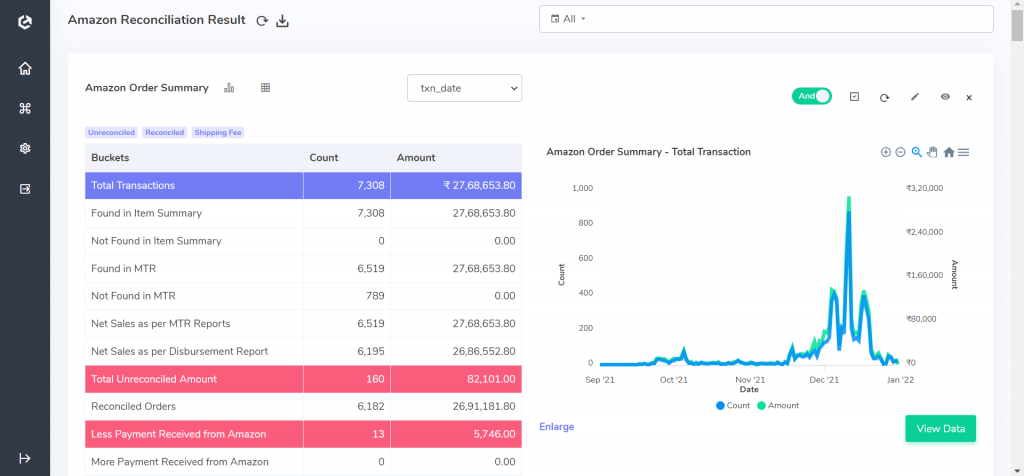

Blackline

Blackline goes beyond basic reconciliation software. It offers a comprehensive financial close management solution designed to enhance accuracy, control, and efficiency throughout your financial processes.

Blackline’s Account Reconciliation empowers your team with:

- Standardized Workflows: Leverage pre-built templates for preparation, review, and approval, ensuring consistency and reducing errors.

- Internal Documentation Storage: Access all relevant documents within the platform, fostering a centralized and organized environment.

- Rule-Based Automation: Identify discrepancies swiftly with automated workflows built on user-defined rules, minimizing manual intervention.

- Real-Time Visibility: Monitor the entire reconciliation process from a centralized cloud-based dashboard, accessible anytime, anywhere.

- Multi-Entity Management: Consolidate data from various ERPs and entities while maintaining consistent procedures across the board.

- Flexible Matching Options: Choose between one-to-one, one-to-many, or bulk data loading to perfectly align with your specific matching needs.

- Configurable Matching Rules: Define custom rules to ensure accurate transaction matching and minimize errors.

- Exception Handling: Address unique situations by adding exceptions for transactions requiring manual review.

- Complete Audit Trail: Maintain complete transparency with a detailed audit trail that tracks all actions and changes made within the system.

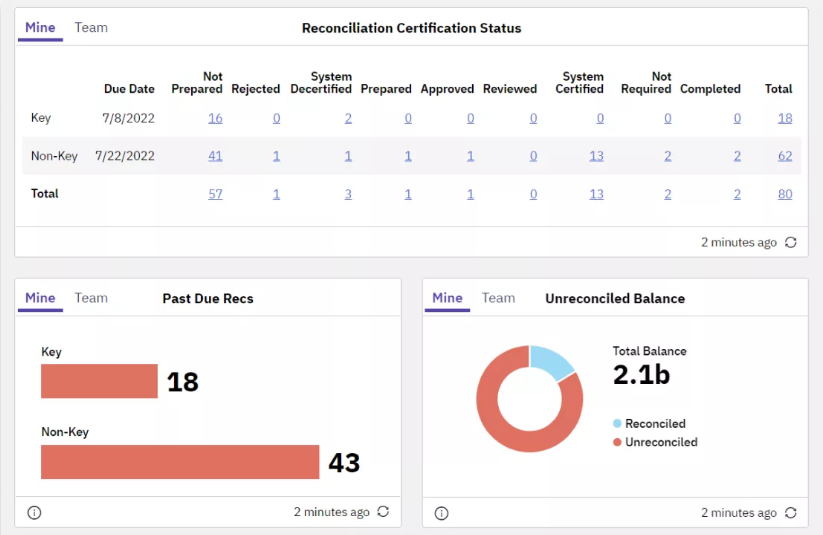

XERO

Simplify your bank reconciliation with Xero. This user-friendly accounting software seamlessly integrates with your bank accounts, automatically importing transactions and streamlining the reconciliation process.

Key Features:

- Automatic Bank Feeds: Eliminate manual data entry by automatically importing transactions directly from your bank accounts.

- Real-Time Reconciliation: Reconcile your bank statements daily for a clear and up-to-date financial picture.

- Smart Matching: Leverage Xero’s intelligent suggestion engine to streamline transaction matching and reduce manual effort.

- Bulk Matching: Save time by applying reconciliation rules to groups of transactions, ideal for recurring expenses.

- Categorization and Rule Management: Define custom rules and categorize transactions for enhanced organization and reporting.

- Integrated Cashbook: Grant clients access to view reconciled transactions and the cashbook for improved collaboration.

- Data-Driven Insights: Utilize intuitive metrics and graphs generated from reconciliation results to support informed financial decisions.

ReconArt

ReconArt empowers finance teams to achieve breakthrough efficiency and control over their reconciliation tasks. This comprehensive automation solution eliminates tedious manual work, freeing your team to focus on higher-level analysis and strategic initiatives.

Key Benefits:

- Effortless Automation: ReconArt automates the entire reconciliation process, saving valuable time and resources for your finance team.

- Enhanced Operational Efficiency: Gain a centralized dashboard for streamlined task management and improved control over the reconciliation process.

- Seamless Integrations: Eliminate time-consuming data transfer by integrating seamlessly with your existing ERPs, internal systems, and platforms.

- User-Friendly Design: Experience a system designed for ease of use, flexibility, and configurability, ensuring a smooth learning curve for your team.

- One-Stop Solution: ReconArt caters to a wide range of reconciliation needs, from bank accounts and financial positions to accounts payable/receivable, intercompany transactions, and journal entries.

FloQast

FloQast goes beyond basic reconciliation software. It’s a comprehensive financial close management solution encompassing various functions, including a powerful reconciliation tool designed to streamline processes, minimize errors, and empower your finance team.

Key Features:

- Centralized Platform: Manage all aspects of your reconciliation process from a single, user-friendly platform, fostering collaboration and reducing the risk of errors.

- Automated Reconciliation: Free your team from time-consuming tasks with automated workflows that handle repetitive aspects of reconciliation.

- Smart Error Detection: Identify and resolve unknown discrepancies efficiently with FloQast’s intelligent tracking system.

- Proactive Alerts: Stay on top of deadlines with automated alerts that notify users when reconciliations are due or require review.

- Customizable Reconciliation Methods: Choose the most appropriate reconciliation approach for each account, ensuring optimal efficiency.

- Centralized Transaction View: Gain a comprehensive perspective of all transactions in one place, allowing for easy analysis, balance checks, and review of sign-offs.

- Automated Sign-off Tracking: Maintain complete control with automated controls that track sign-offs and identify any potential errors in the process.

- Reduced Errors and Improved Accuracy: FloQast’s robust automation and centralized management significantly reduce the risk of errors and ensure the accuracy of your financial records.

Streamline Your Reconciliation with Powerful Alternatives

Ready to transform your reconciliation process? Carefully evaluate your business needs and explore the features of the solutions highlighted in this article. By aligning your software with your unique requirements, you can unlock greater efficiency, accuracy, and financial control for your business.

Optimize your financial operations with Cointab's powerful reconciliation software. Join now!

Sign Up For Demo

Optimize your financial operations with Cointab's powerful reconciliation software. Join now!

Sign Up For Demo

Streamline your Financial Reconciliation Now!

Request a Demo!