Shopify Pay stands as a premier integrated payment gateway within the Shopify ecosystem, streamlining the process of accepting payments online for merchants. Its integration eliminates the complexities associated with setting up third-party payment providers. With Shopify Pay, merchants are seamlessly equipped to accept all major payment methods from the moment their Shopify website is created.

This comprehensive payment solution not only offers convenience but also ensures the security of transactions, providing customers with peace of mind during their online shopping experience. However, it’s essential to note that availing of Shopify Pay services entails certain fees. These costs vary depending on your chosen plan, with a detailed breakdown available on Shopify’s pricing page.

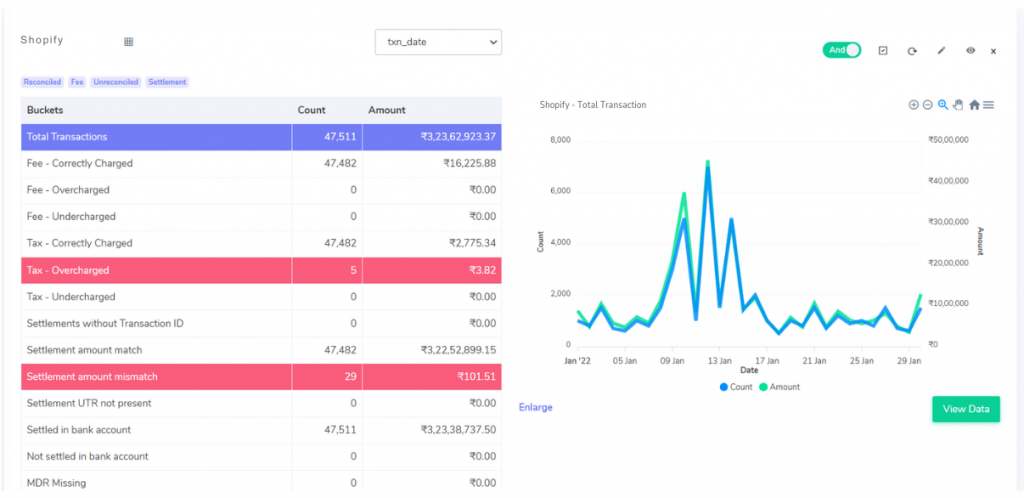

Following the completion of an order and customer payment, Shopify Pay deducts applicable fees and taxes, transferring the remaining amount to the merchant’s enterprise account. Yet, in the course of these transactions, discrepancies may arise, leading to potential overcharges or undercharges.

To pinpoint any such inaccuracies and validate transaction amounts, leveraging automated reconciliation software is recommended. Cointab Reconciliation Software offers a solution tailored to this precise need, facilitating automated verification of transactions. By identifying instances of overcharging, merchants gain actionable insights that can be utilized to initiate claims with Shopify Pay, ensuring accurate financial transactions and maximizing profitability.

Unlocking Insights with the Shopify Pay Payment Report:

Delve into the intricacies of your transactions with the Shopify Pay payment report, where comprehensive data showcases total transactions alongside the breakdown of transaction modes employed.

Navigating the Shopify Pay Rate Card:

Discover transparency in payment modes and associated fees with the Shopify Pay Rate Card. Gain clarity on the fee structures, including percentages charged per transaction mode, empowering informed decision-making for your business.

Fee Correctly Charged:

Rest assured, the fees levied by Shopify Pay align precisely with the rates outlined in the Rate Card, ensuring transparency and accuracy in your financial dealings.

Fee Overcharged:

In some instances, discrepancies may arise where the fees charged exceed the expected amount based on the Rate Card, prompting a closer examination of transaction details.

Fee Undercharged:

Conversely, there are cases where the fees applied by Shopify Pay fall below the anticipated amount per the Rate Card, warranting attention to ensure fair and accurate charges.

Tax Correctly Charged:

Harmonizing with GST guidelines, the tax recorded in the Payment Report corresponds accurately to the calculated amount, fostering compliance and financial integrity.

Tax Overcharged:

Occasionally, the tax recorded in the Payment Report surpasses the expected amount as per GST guidelines, necessitating a thorough review to rectify any discrepancies.

Tax Undercharged:

Conversely, discrepancies may occur where the tax recorded in the Payment Report falls short of the calculated amount based on GST guidelines, necessitating corrective measures.

Settlement UTR Not Present:

In instances where the Settlement report lacks UTR references for transactions, further investigation is warranted to ensure comprehensive record-keeping and reconciliation.

Settlement Amount Match:

Alignment between the calculated settlement amount and the actual amount received from Shopify Pay signifies accurate financial transactions, facilitating smoother reconciliation processes.

Settlement Amount Mismatch:

Instances where the calculated settlement amount differs from the actual amount received highlight potential discrepancies requiring immediate attention to maintain financial accuracy and transparency.

Settled in Bank Account:

Verification of UTR references in the Settlement Report against corresponding entries in the bank statement confirms successful settlement transactions, bolstering financial oversight and control.

Not Settled in Bank Account:

However, if discrepancies arise where UTR references in the settlement report fail to align with entries in the bank statement, further investigation is imperative to ensure seamless fund transfers.

Cointab Reconciliation Software streamlines the verification process for fees and taxes charged by payment gateways, empowering businesses to scrutinize transactions and identify potential overcharges or undercharges. With detailed insights provided by our software, businesses can confidently initiate claims, ensuring financial accuracy and compliance. By automating this process, your team can redirect valuable time towards strategic business initiatives, enhancing productivity and profitability. Experience the efficiency of automated reconciliation and propel your business towards greater financial integrity and success.

Step into the future of reconciliation. Fill out the form to request your demo now!