Skrill: Powering Global Transactions

Skrill has carved a dominant niche in the online payments and money transfer landscape. Businesses and individuals worldwide leverage its secure and efficient virtual wallet system for swift and convenient transactions. Integrating Skrill as a payment gateway unlocks a global customer base while offering a seamless payment experience.

Unveiling the Skrill Fee Structure

Every benefit comes at a cost, and Skrill is no different. When utilizing it as a payment gateway, your business incurs transaction fees and taxes. These fees fluctuate based on factors like transaction amount, currency used, and sending/receiving regions. Maintaining transparency and guaranteeing accurate charges become paramount, especially with high transaction volumes.

The Manual Verification Labyrinth: Time-Consuming and Prone to Errors

Manually verifying Skrill payment gateway charges can be a convoluted and error-prone process. Businesses need to meticulously scrutinize individual transactions, compare them against Skrill’s ever-evolving rate card (which outlines fees based on various criteria), and pinpoint any discrepancies. This process can be particularly daunting for businesses with a high daily transaction volume.

Cointab: Your Automated Reconciliation Champion

Thankfully, innovative solutions like Cointab exist to streamline this arduous task. Cointab automates the verification process, acting as your reconciliation hero:

Cross-referencing Transactions:

Cointab automatically compares your transaction data against established records and the latest Skrill rate card. This eliminates the need for manual review, saving you valuable time and resources.

Discrepancy Detection:

Cointab flags any inconsistencies it encounters during the cross-referencing process. This allows you to swiftly identify potential errors in fees or taxes charged.

Detailed Insights:

Cointab goes beyond simply highlighting discrepancies. It provides in-depth insights into the nature of the issues, such as mismatched currency conversions or outdated rate card applications.

Actionable Reporting:

Cointab generates comprehensive reports that summarize transaction data, fees charged, and any identified discrepancies. These reports provide valuable insights for optimizing your financial management with Skrill.

Beyond Cointab: Essential Reports for Verification

While Cointab simplifies the process, two key reports from Skrill are still vital for a thorough verification:

Skrill Payment Report:

This report offers a detailed breakdown of all transactions processed through your Skrill account. It includes information like the total transaction amount, currency used, payment method, and corresponding fees charged.

Skrill Rate Card:

The rate card outlines the specific fees and percentages charged for different transaction types (e.g., sending money, receiving payments, currency conversion). Having the latest rate card readily available is crucial for accurate verification.

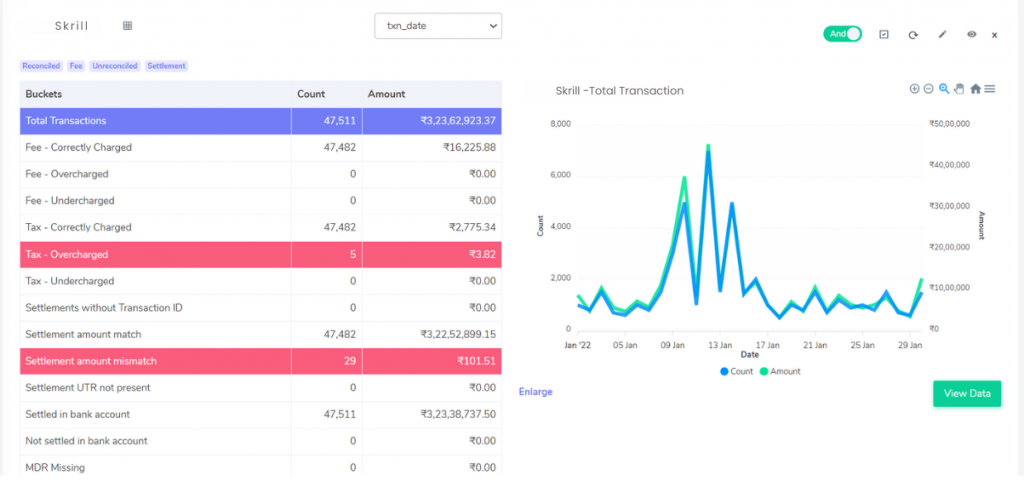

Results:

Mastering Skrill Payment Reconciliation:

A Comprehensive Guide

Reconciling your Skrill payment gateway transactions can be a daunting task. This guide simplifies the process by breaking down key areas for verification, ensuring accurate accounting and efficient management.

Understanding Fee Accuracy:

Fee Correctly Charged:

This occurs when the fees on your Skrill report match the amount calculated using their official rate card. Regularly checking the rate card ensures you’re not incurring unexpected charges.

Fee Overcharged:

If the fees on your report exceed the calculated amount based on the rate card, you might have been overcharged. Investigate discrepancies and contact Skrill for clarification.

Fee Undercharged:

In rare cases, Skrill might undercharge you. While seemingly beneficial, this can lead to discrepancies later during tax filing.

Verifying Tax Calculations:

Tax Correctly Charged:

The tax amount on your Skrill report should align with the tax calculated based on your region’s Goods and Services Tax (GST) guidelines.

Tax Overcharged:

If the tax amount seems higher than the expected GST rate, investigate the discrepancy. Referring to GST regulations or contacting Skrill can help resolve the issue.

Tax Undercharged:

Similar to fee undercharges, undercharged taxes can cause issues during tax filing. Ensure the reported tax amount aligns with your GST calculations.

Settlement Amount and UTR Verification:

Settlement UTR not Present:

The Unique Transaction Reference (UTR) number acts as a receipt for settled transactions. If the UTR is missing from your report for specific transactions, contact Skrill for clarification.

Settlement Amount Match:

The settlement amount is the final amount you receive after deducting fees and taxes. It should match the calculation: Settlement Amount = Total Amount – Fees – Tax.

Settlement Amount Mismatch:

Discrepancies between the calculated and reported settlement amounts indicate an error. Investigate the cause and contact Skrill for rectification.

Reconciliation with Bank Statements:

Settled in Bank Account:

A perfect scenario! If the UTR on your settlement report matches a corresponding entry in your bank statement, the transaction is successfully reconciled.

Not Settled in Bank Account:

Even though the UTR is present on the settlement report, its absence from your bank statement indicates a discrepancy. Investigate with your bank or Skrill to resolve the issue.

Embrace Automation with Cointab:

Manually reconciling transactions can be a time-consuming and error-prone process. Consider using automated reconciliation software like Cointab. It streamlines the process, reduces errors, and saves you valuable time.

Revolutionize Your Reconciliation Process:

By implementing these steps and leveraging automation tools, you can achieve efficient and accurate reconciliation of your Skrill transactions. This ensures financial transparency, simplifies accounting, and minimizes the risk of discrepancies.

Step into the future of reconciliation. Fill out the form to request your demo now!