Looking for a replacement for BankRec reconciliation software? Need a more advanced software that caters to many reconciliation processes? In the article, we have mentioned our recommendations for the top 5 BankRec alternatives

The reconciliation process when carried out manually is tedious and time-consuming. This has caused many businesses to use an automated reconciliation software to simplify the process. With the system, businesses can get accurate reconciliation results without much effort

BankRec is a software especially built by treasury software to simplify the process of bank reconciliation. The software easily and quickly matches transactions between the bank statement and ledger with an audit trail number so these transactions can be analysed if needed. Furthermore unmatched transactions are forwarded to a subsequent period until matched. The software also gives you the option to use the built-in rules to conduct matching and in case users want a more custom approach it has the option to create custom matching rules. BankRec has a unique feature that also shows you why a transaction did not match so managers can track high-exposure items and avoid any frauds or errors.

If you want a software for reconciliation processes other than bank reconciliation or with added features or you just want to evaluate other alternatives then we have listed our top 5 recommendations for alternatives to BankRec software.

1.Cointab:

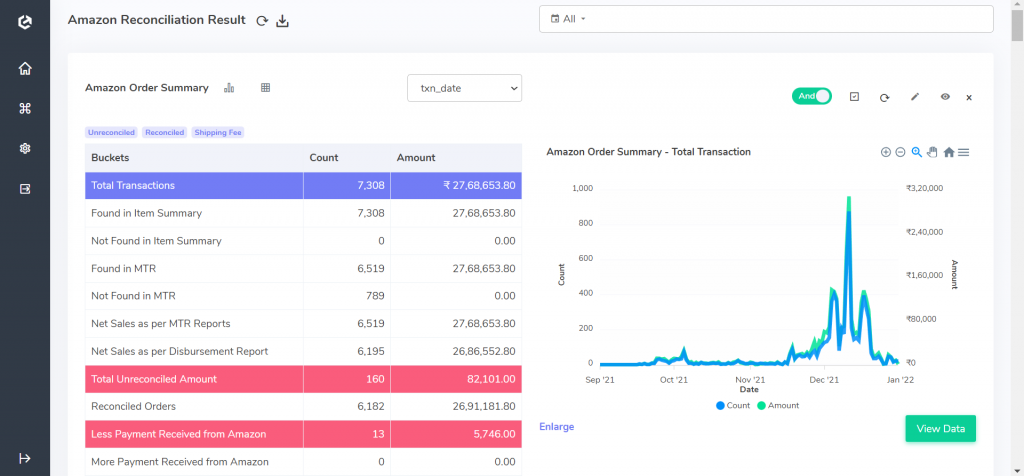

Cointab reconciliation is a software designed to automate the reconciliation process, allowing finance teams to save time and effort on repetitive tasks. The software automates the data loading process, eliminating the need for individual file uploads. Furthermore, the reconciliation process can be scheduled to run at any time, ensuring that the results are always available on time

One of the standout features of the software is its ability to be customized to suit the unique needs of each business. Users can choose from a variety of file formats, including XML, CSV, PDF, and JSON, making file uploads and exports easy and convenient. A custom rules engine can also be defined by users to set match conditions according to their own company rules and policies.

The system produces results that are easy to interpret, complete with graphs for analysis. Transactions, where amounts show mismatches, are highlighted, allowing the finance team to focus on those transactions more closely. Moreover, exceptions can be added to transactions that require manual settlement. With Cointab reconciliation, businesses can automate their reconciliation processes with ease.

2. BlackLine:

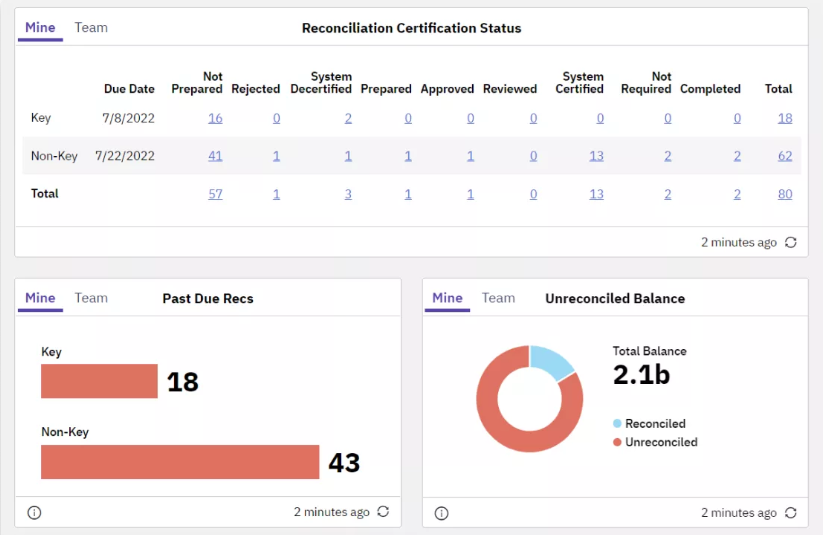

BlackLine offers a variety of financial close solutions, including task management, financial reporting analysis, accounts reconciliation, and credit management. Automating reconciliation with BlackLine simplifies the process, improves accuracy, and enhances control. The software provides standardized templates and workflows for preparation, approval, review, and internal documentation storage, thereby promoting improved collaboration. The rule-based workflow allows for quick identification of discrepancies, reducing the risk of manual errors.

BlackLine’s cloud-based dashboard encourages transparency by allowing consumers to track results whenever they want, from any location, without depending on internal staff. Also keeping business standards, permits the grouping of ERPs and other entities. The system facilitates one-to-one and one-to-many matches, bulk data loading, customizable rules, and an exception-adding capabilities, which helps speed up transaction matching while ensuring accuracy.

The dashboard displays matches of unreconciled and reconciled transactions. Furthermore, the software maintains a complete audit trail to record previous actions, promoting security. Overall, Blackline’s automated reconciliation and simplified transaction matching provide efficiency and accuracy in the financial reconciliation process.

3. ReconArt

ReconArt is a reconciliation software that aims to automate and streamline reconciliation processes for businesses. It provides users with the ability to reconcile accounts, identify discrepancies, and manage exceptions with ease and efficiency.

The software consists of automated transaction matching based on rules, algorithms, or reference data, along with exception flagging for any discrepancies that require attention. The workflow management capabilities of the software enable users to assign and track tasks, set reminders, and add exceptions to reconcile transactions faster. To ensure data accuracy and security, the software maintains an audit trail and helps managers set user permissions.

ReconArt supports the reconciliation of multiple account types, including bank accounts, credit card accounts, and general ledger accounts. It also integrates with various data sources, such as ERPs, banks, payment processors, and other financial systems, allowing users to import data from multiple sources into a single platform for reconciliation. These features make it a suitable solution for businesses of all sizes and industries that require accurate and efficient reconciliation of large volumes of data.

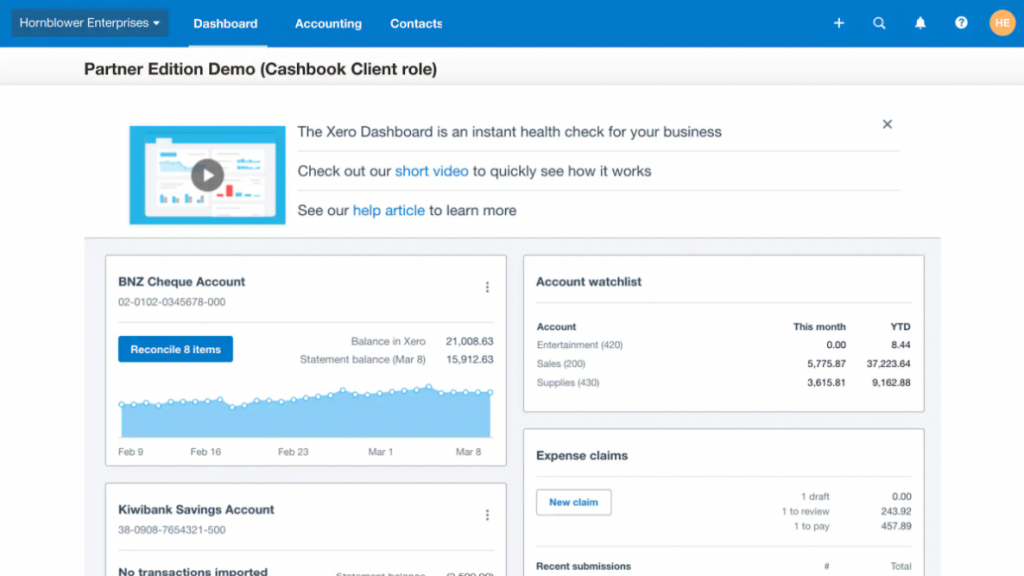

4. Xero

Xero provides a variety of financial services, such as paying bills, reimbursements, claiming expenses, and reconciling bank accounts. In terms of financial reconciliation, the software mainly focuses on bank reconciliation. Users can import transactions straight from their bank accounts and match them with the transaction recorded in the Xero ledger. This makes it convenient and easy for the team to check the reconciled items on the dashboard. Further to assist managers with decision-making and analysis, the outputs include metrics and graphs. Users can therefore evaluate bank reconciliation results daily with the use of Xero bank reconciliation.

The reconciliation tool for Xero categorises transactions automatically, applies rules, and recommends matches that users can accept to reconcile transactions. By enabling users to bundle transactions and apply rules to the group as a whole, these bulk transactions can be matched easily. Clients may access and reconcile transactions while viewing the results due to the integration of Xero’s reconciliation tool with other services like Xero cashbook etc. Streamline bank reconciliation using Xero’s financial services, and manage daily financial transactions effectively.

5. Onestream

Onestream is a versatile financial software that not only facilitates ways to simplify the reconciliation process but also offers a range of other financial services. With its reconciliation tool, transactions can be effortlessly matched, analysed, and reported with ease, eliminating the need for spreadsheets. The software provides managers with a statistical view of financial data, enabling them to analyse and make informed decisions. It also maintains a complete audit trail of all changes, which can be updated as required. By importing data directly from bank accounts, Onestream allows managers to view high-risk transactions in a single location. To help monitor changes in the trial balance, the software includes alert features so nothing is missed out. These features ensure accurate reconciliation of data while maintaining data integrity which in turn enables managers to make informed data-driven decisions.

After careful evaluation of all alternatives for reconciliation softwares along with checking if the softwares fulfils the goals set you will be able to pick the right software for your business. Setting parameters to measure the software against will help ensure that the software has all the necessary features needed along with supporting your business needs