Looking for an automated reconciliation solution like Blackline? To help you out we have picked out our top 5 alternatives for Blackline. In this article, we cover other software similar to Blackline that automates reconciliation so that you can view all the features in one palace and pick the best alternative for your business.

Manual reconciliation of financial data is a difficult task, as it takes a lot of time to complete the process along with that it is open to many errors. This has caused many businesses to look for reconciliation software that quickly gets the job done for them. When choosing a reconciliation it is important for companies to choose the one most suitable for them keeping various considerations in mind.

A reconciliation software automates the reconciliation process and saves the time and effort spent completing the process. It cleans the data and accurately matches records across various reports. Once matching is complete it generates a result which is easy to analyze for the finance teams.

Blackline is end-to-end account reconciliation software which helps you manage financial close activities. Its various features improve the efficiency and transparency of the reconciliation with its real-time dashboard view. Essentially the repetitive tasks in reconciliation get automated thereby saving the finance team a lot of effort

Its functions contain:

- Standardized templates,

- Workflows for preparation and review etc.

- Links policies along

integration of storage for documentation. - Grouping ERP

But in case you want to evaluate other alternatives, in this article you can view other blackline alternatives that are available in the market. It is necessary to consider and evaluate the need, benefits and values offered by the reconciliation

software so that you can pick the software best suited for your business

Let’s take a look at the alternatives:

1. Cointab

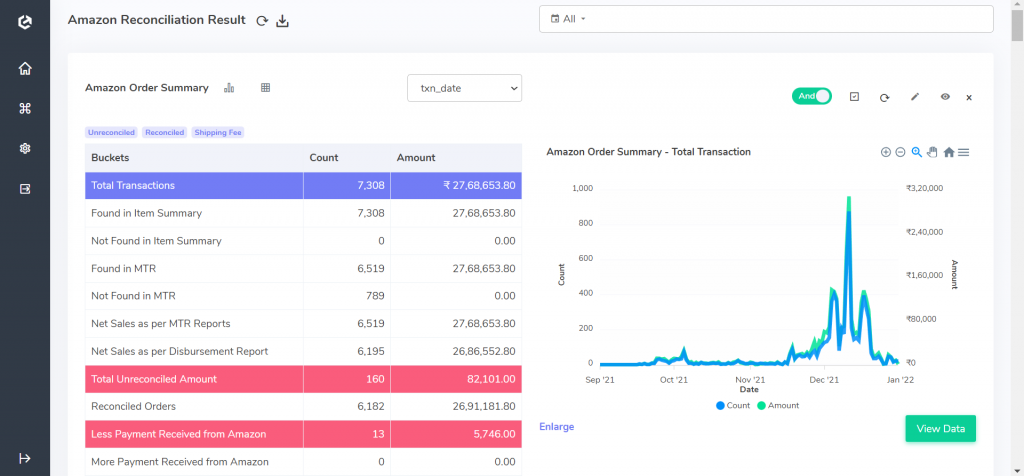

Cointab’s reconciliation software lets businesses automate and manage the complete reconciliation process. It loads data automatically to the software along with that they can choose a custom input format such as PDF, TXT, XML, JSON etc. Since the software can handle a vast amount of data, it can scale with the organization’s growth to fulfil the growing business needs. In this reconciliation software, you can also add custom rules engine so that the logic conditions fit your business rules. Once the reconciliation process is complete, the results are produced, in which amount mismatches are highlighted along with graphs for analysis. If further analysis is required the team can get a detailed view of each transaction. If find some transactions for which offline payment has been made or it is somehow settled, then add exceptions for those transactions. Select the custom format for export along with custom rows and data fields to directly to another software without wasting any effort in converting files. To completely rely on the software, schedule reconciliation to run hourly, weekly or monthly as and when required. To prevent the mishandling of data, a complete audit trail is also maintained by the software. Ensure accuracy and efficiency with Cointab reconciliation.

Some of the main reconciliation processes automated by Cointab are payment gateway reconciliation, bank reconciliation, cash-on-delivery (COD Remittance) reconciliation, Marketplace Reconciliation (Amazon, Flipkart, Myntra, Nykaa, Ajio, TataCliq and many more), fee verification, ERP reconciliation and order management system (OMS) reconciliation. By automating these reconciliation processes you get the transactions checked and hence raise disputes in case of underpayment or overcharged fees.

2. ReconArt

ReconArt is reconciliation software that offers credit-card reconciliation, bank reconciliation, account reconciliation, posting, holdings and trades reconciliation, intercompany reconciliation and enhanced journal entries. It is a web-based software supported on any device. Its main function is to improve operational efficiency as it simplifies the financial close process as it can handle a large volume of transactions along with facilitating seamless integration with ERP, internal systems and other platforms. It saves time of the finance team as it automates the tedious time-consuming reconciliation process.

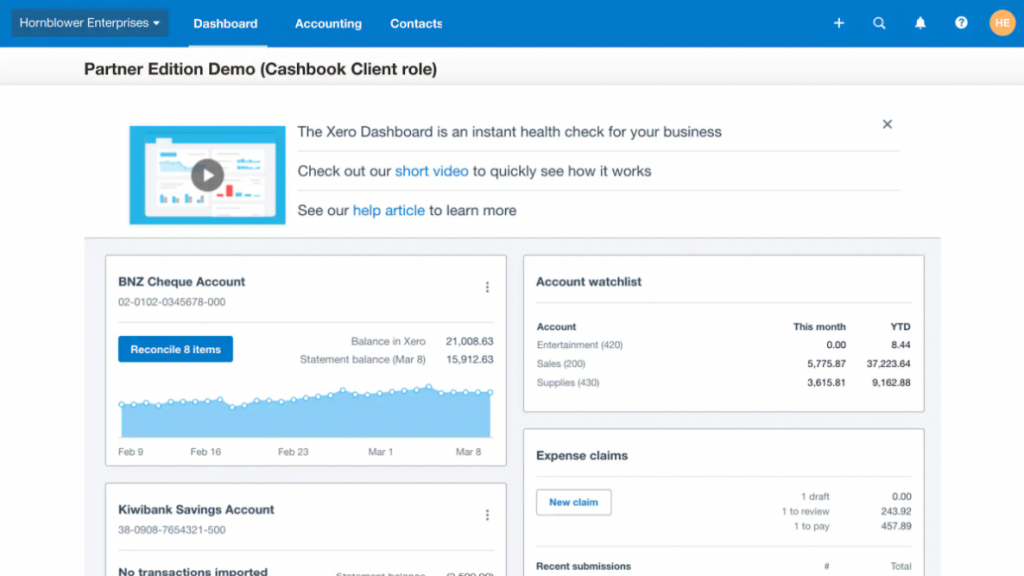

3. Xero

Xero provides businesses with various financial management functions to ease the daily working of an organization. Its functions contain bill payments, reimbursements, claiming expenses, tracking cash flow in and out of bank accounts, bank reconciliation etc. The Xero reconciliation tool imports transactions directly from the bank account and shows the difference in balance present in the bank and the amount present in the Xero cashbook. The Xero system automates the transaction matching process so that accurate results are presented. A benefit from Xero is that access can be given to clients so that they can reconcile transactions and view the result directly. Xero is suitable for small businesses and accounts as it lets them complete all internal accounting procedures with ease.

4. OneStream

Onestream offers various financial management solutions ranging from financial close, reporting, and compliance to account reconciliation and transaction matching. To support these functions it also offers various reporting and analytics tools. It replaces the use of spreadsheets for reconciliation with its software. Its reconciliation tool maintains the accuracy and integrity of financial data while automating the reconciliation process. It gives the finance managers a statistical view of the data so that they can make data-driven decisions. The results can be updated as and when required for which the software maintains a complete audit trail. It updates the reconciliation result directly from the bank account which lets you view high-risk unreconciled transactions in one place. Since alerts are also enabled for changes in trial balance managers can handle the reconciliation process more efficiently.

5. BankRec

BankRec is a software developed by treasury software. It eases the bank reconciliation process making it quicker and easier. The inbuilt automatic rule-matching feature helps finance teams match transactions quickly. Along with that it also gives the option to add custom rules to the predefined matching conditions to create an unlimited number of categories. After the result is produced it also displays the reason for the mismatch so no time is wasted researching the error. With the reason for the mismatch known the finance teams can address high-exposure items and keep up with the payments. It also lets you add exceptions to mismatched items easily. So, finance managers can simply reconcile all bank transactions with BankRec and complete the reconciliation faster and more accurately.

Choosing the right reconciliation software requires proper evaluation. Blackline enables businesses to complete reconciliation quickly along with providing many features that are handy in the reconciliation process. However many similar softwares are available with many other capabilities too, hence it is necessary to pick the software that perfectly match your goals to get the maximum benefit.