Reconciliation of financial data is a task of growing importance as it is highly possible to miss payments, get the wrong amount deducted or pay an extra amount on tax. To avoid these issues and to move forward with technology business need to automate their reconciliation process.

However, to automate the reconciliation process it is necessary to pick the right software for your business. You need to evaluate various softwares, weigh the pros and cons and pick the most suitable one. To do so you need to keep in mind the features needed in the software and how they add value to your business.

Some features to look for:

Compatibility

Pick a software that is compatible with your other systems so that they can seamlessly integrate with your accounting system and you do not waste time converting files manually.

Scalability:

Scalability is an important factor to look at as you need a software that would support you in the future also with a growing business the amount of data would also increase over time.

Customization:

Customizations are necessary in a software especially if your company has unique business rules as you need the results in a custom-made format.

Audit trail:

An audit trail of changes and actions undertaken in the reconciliation software and the history of each transaction should be available on the software.

User access control:

The software should have different levels of user access to ensure that sensitive information is only accessible to authorized users.

Choose a suitable software for your business by setting these parameters and keeping in mind the value proposition of the software. However, when choosing the right software it is necessary to evaluate all the alternatives available in the market.

Given below are our top five automated reconciliation software picks for 2023.

1. Cointab:

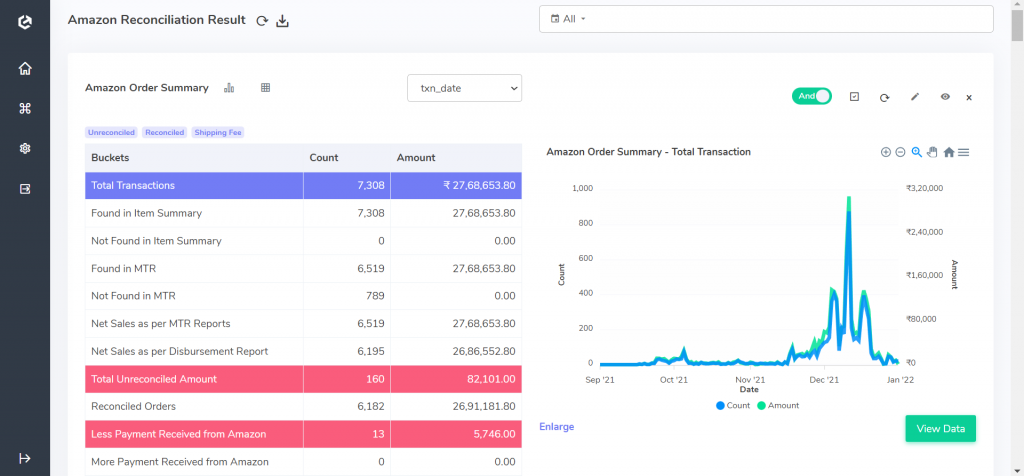

Cointab’s reconciliation software secures and maintains accuracy by automating your financial reconciliation process. It is a highly customizable software that lets you choose any file format to load data via integrations such as API, SFTPs and Email. It can integrate any number of reports as it is a scalable software that can handle huge amounts of data. If you have unique business rules then you have the option to add a custom rules engine to fit your business. To make analysis easier for the finance team as it presents data in an easy-to-read format with graphs. It also highlights the unreconciled transactions so finance managers can keep better track of these transactions. Along with this, they can get a 360-degree view of every transaction consisting of every detail. Finally, in the exporting process, it also lets you select any file format as per your requirement., so that you can directly export the results to another software. To simplify this process even further you can schedule the reconciliation process to run in real-time or hourly, weekly, or monthly to get updated results as frequently as you want.

The Cointab reconciliation software automates various reconciliation processes which include payment gateway reconciliation, bank reconciliation, cash-on-delivery (COD Remittance) reconciliation, Marketplace Reconciliation (Amazon, Flipkart, Myntra, Nykaa, Ajio, TataCliq and many more), fee verification, ERP reconciliation and order management system (OMS) reconciliation. As an online business, you can save time and effort spent on these processes and focus on core functions to increase your business efficiency and productivity.

Key Features

- Customize data input, rules engine and export

- Schedule reconciliation

- Highlight amount mismatches

- Maintain Audit Trail

- Add exceptions when needed

2. Blackline :

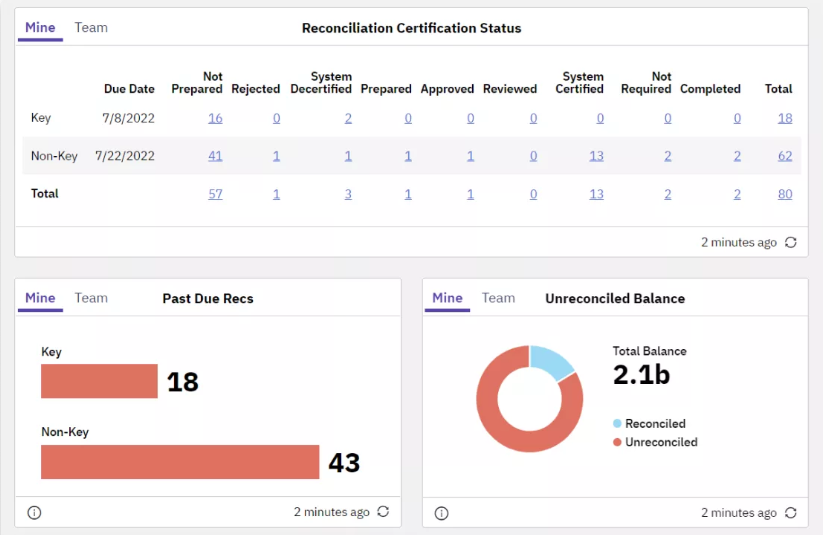

Blackline is a cloud-based software that mainly manages financial close activities. To manage these activities it provides automation of account reconciliation. Its reconciliation functions include standardized templates, workflows for preparation and review etc. and links policies along with the integration of storage for documentation. It enhances efficiency and transparency for the finance team as a real-time cloud-based view of the dashboard with information about the reconciliation is available at any time anywhere. The system also enables users to group ERPs and other accounts easily. It essentially reduces the need to conduct repetitive tasks in manual reconciliation by automating the process

So, in conclusion, blackline automates reconciliation for you along with which it helps you manage the reconciliation process top. This lets you maximize productivity and achieve more accuracy in your financial close activities. To get the pricing you can contact the blackline team and find out more.

Key Features

- Standardize templates

- Workflow management

- Integrate Storage for documentation

- Grouping of ERPs

3.ReconArt

ReconArt is a web-based user-friendly reconciliation software available for end-to-end automation in the reconciliation process. Its main reconciliation process includes credit-card reconciliation, bank reconciliation, account reconciliation, posting, holdings and trades reconciliation, intercompany reconciliation and enhanced journal entries. It improves operational efficiency as can handle a large volume with seamless integration between other systems.

Key Features

- User-friendly

- Seamless integrations

- High volume transactions

- Simplify complex accounts matching process

4. OneStream

The basic functionality of Onestream is to bring financial planning, reporting and analysis to one place. It wants to replace the use of spreadsheets with a better use system. To enable better operation efficiency it automates the reconciliation process. The reconciliation tool lets users get a statistical view of financial data, and a complete audit trail and they can view the account reconciliation as soon as submitted. It helps the user assure accuracy as they can view the status of high-risk reconciled items and know the quality of the report. Onstream is one such software that links the reconciliation system directly to the balance sheet so that the status is updated and all transactions are viewed from a single source. Check alerts are also enabled when there is a change in the reconciliation due to updates in the trial balance. It presents data in graphs, tables, charts, etc., so that finance managers can handle the financial management process more efficiently.

Key Features

- Direct linking from the balance sheet to reconciliation reports

- View the status of high-risk reconciliation items

- Detailed Audit trail

- Alerts for changes in reconciled items

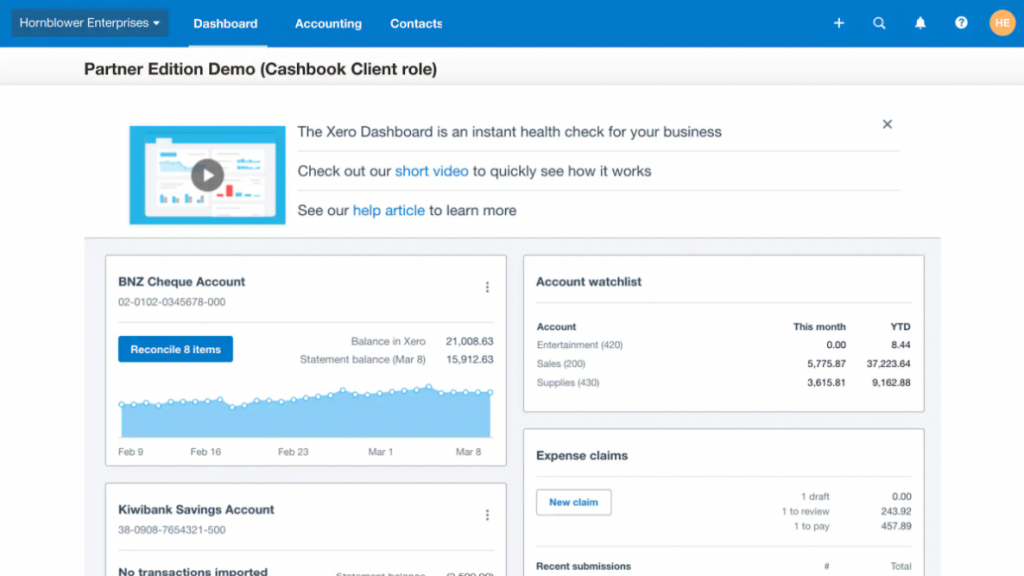

5. Xero

Xero is a software that provides various financial management solutions to businesses. Its main functions include inventory tracking, invoicing, bill payments, bank reconciliation and other accounting functions. Its reconciliation tool directly imports bank transaction details and matches the transactions with other reports to check validity. With the help of automated reconciliation, you can manage fixed assets and prepare budget plans with accurate data. It enables team members to log in and view results when necessary. The software also makes suggestions regarding expenses when reconciling data so managers can make better decisions. Xero is most suitable for mid to large-sized businesses with the highest plan costing 54$ a month for unlimited users.

Key features

- Directly importing transactions

- Expense suggestions

- All-around finance management solutions

Hence, to completely automate the reconciliation process suitable for your business, it is necessary to choose the right reconciliation software. As there are many alternatives available in the market, it is difficult to pick the right fit for your business. Therefore it is necessary to keep in mind every feature, process and function that enables your business to reconcile most efficiently.