Zettle by PayPal: A mobile point-of-sale solution for small businesses

Zettle by PayPal is a service that allows small businesses to accept credit, debit, and contactless payments. It works in three ways:

Card readers and terminals:

These devices connect to your phone or tablet and allow you to swipe or insert cards for payments.

Mobile app:

You can use the Zettle app on your smartphone or tablet to accept contactless payments, including Google Pay and Apple Pay.

Online payments:

Zettle integrates with your online store to accept payments from customers directly on your website.

There’s a fee for using Zettle, which is deducted from the customer’s payment before the remaining amount is deposited into your business account.

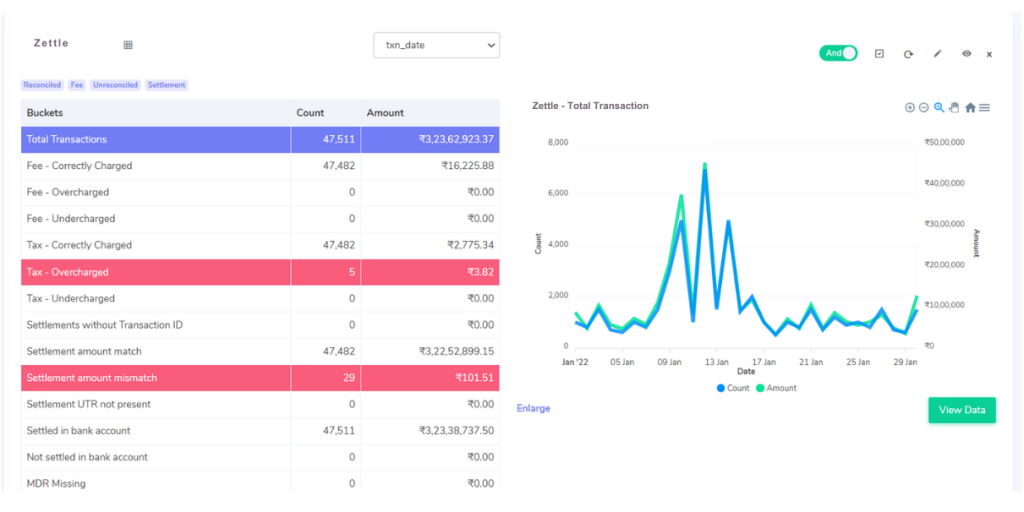

Zettle Payment Reports

Zettle provides detailed reports that give you insights into your business transactions. These reports typically include:

Total transactions:

See the overall number of sales processed during a specific period.

Payment breakdowns:

Analyze how customers paid you, with details on transactions made using debit cards, credit cards, UPI (if applicable), and other accepted payment methods.

Zettle Rate Card:

The Zettle rate card clearly outlines the fees associated with each payment method. This typically includes:

Payment type:

Identify which payment method (debit card, credit card, etc.) the fee applies to.

Fee structure:

Understand how the fees are calculated. This might be a flat fee per transaction or a percentage of the sale amount.

This section provides a clear picture of how your Zettle transactions match up with your expectations.

Fees:

Correct Fees:

These transactions have fees charged by Zettle that match the amount calculated using the Zettle rate card.

Overcharged Fees:

The fees deducted by Zettle are higher than what the rate card specifies for these transactions.

Undercharged Fees:

Zettle has charged a lower fee than what the rate card suggests for these transactions.

Taxes:

Correct Taxes:

The tax amount recorded in the payment report aligns with the tax calculated based on GST guidelines.

Overcharged Taxes:

The tax amount in the payment report is higher than what the GST guidelines dictate.

Undercharged Taxes:

The tax amount in the report is lower than what should be collected according to GST.

Settlement:

These transactions lack a UTR (Unique Transaction Reference) number in the payment report.

Settlement Amount Matches:

After deducting fees and taxes from the total amount, the remaining settlement amount precisely matches the amount reflected in the Zettle report.

Settlement Amount Mismatch:

Discrepancies exist between the settlement amount calculated (total amount minus fees and taxes) and the amount shown in the Zettle report.

Settled in Bank:

The transaction amount is present on both the UTR report and your bank statement.

Not Settled in Bank:

The transaction amount appears in the UTR report but is missing from your bank statements.

Effortless Reconciliation with Cointab

Cointab Reconciliation Software streamlines the process of verifying fees and taxes against your expectations, saving you significant time and resources. This automated solution allows you to:

Upload Data in Any Format:

Simply upload your data, regardless of the format, for reconciliation.

Customizable Rules Engine:

Build rules tailored to your specific needs for accurate matching.

Comprehensive Results:

Gain a complete overview of mismatched or miscalculated amounts after the reconciliation process.

360° View of Differences:

Easily identify discrepancies for a clear understanding of any issues.

By utilizing a tool like Cointab Reconciliation Software, you can gain a deeper understanding of your Zettle transactions and identify any discrepancies in fees, taxes, or settlement amounts. This proactive approach helps you ensure your finances are in order, minimize potential losses, and streamline your accounting processes for long-term success.

Step into the future of reconciliation. Fill out the form to request your demo now!