In the modern world of business, maintaining precise financial records is essential for strategic growth and expansion of any company. With numerous transactions occurring regularly, it can be a daunting task to ensure that all the records are accurate and free from errors. The solution to these problems is a reconciliation software.

Reconciliation software is a powerful tool that helps businesses automate and streamline the process of comparing financial records. These programs use algorithms and machine learning to identify and resolve discrepancies, allowing businesses to save time and reduce the risk of errors.

For large companies, reconciliation can be a particularly daunting task, with thousands or even millions of transactions to reconcile. This is where specialized reconciliation software can make a big difference. In this article, we will take a closer look at five top reconciliation software solutions that are specifically designed for big companies.

Whether you are in the finance department of a large corporation, a CFO of a multinational company, or an accounting firm, this article will provide you with valuable insights into the most effective reconciliation software options available on the market today. By the end of this article, you will have a better understanding of which software solution might be the right fit for your business needs.

Cointab Reconciliation

Cointab reconciliation offers an advanced technology that automates and streamlines reconciliation processes for businesses. The software automates data input, data cleaning, and rule execution to quickly identify reconciled and unreconciled transactions.

The software’s flexibility is a significant advantage as it can accept various file formats and data structures, and businesses can customize the rules engine to suit their specific needs. This customization ensures that the software provides maximum value to businesses.

After completing the reconciliation process, the software displays the results and reports on a universal dashboard, making it easy to analyze financial data and maintain an accurate audit trail. Additionally, the software seamlessly integrates with other accounting, ERP, and banking software, providing a smooth user experience.

The web-based architecture of Cointab’s reconciliation software makes it highly adaptable and user-friendly. Users can access the software from a range of devices, including desktops, laptops, tablets, and smartphones, allowing businesses to manage their finances and reconciliation processes effectively from anywhere.

Moreover, the software can be easily integrated with various enterprise resource planning systems, internal systems, and other platforms, making it a highly flexible and scalable solution that can be tailored to meet the needs of different businesses.

By scheduling reconciliation to run automatically in real-time, hourly, weekly, or monthly, businesses can improve their productivity and avoid manual work. With Cointab’s reconciliation software, reconciling transactions has become more manageable than ever before.

Black line

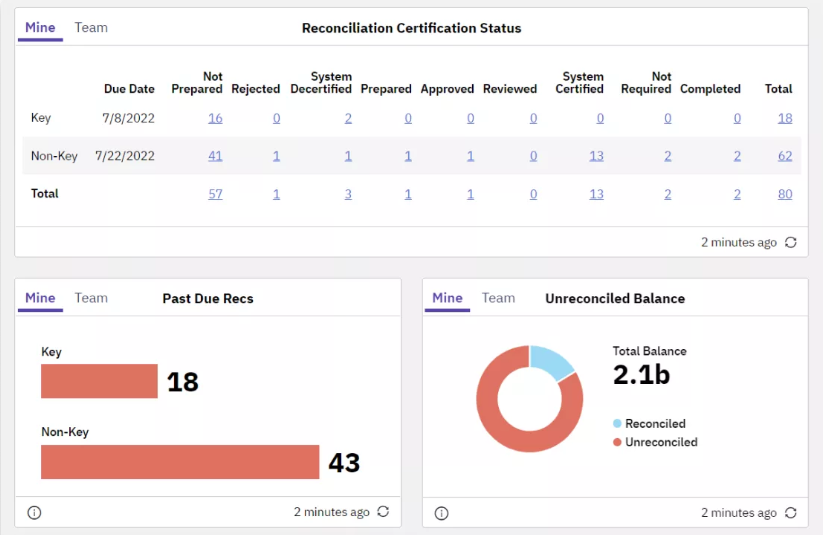

Blackline is a software that offers end-to-end account reconciliation services for managing financial close activities. Its real-time dashboard view and automated features improve the efficiency and transparency of the reconciliation process, reducing the workload of the finance team.

Moreover, Blackline is a comprehensive tool that can streamline various business processes by providing standardized templates for different documents, workflows for preparation and review, and integration with policies and documentation storage. It appears to function as an ERP (Enterprise Resource Planning) solution that can help businesses manage their resources more efficiently by grouping various functions together and providing a centralized platform for managing data and workflows.

ReconART

ReconART is an innovative and effective financial reconciliation software solution that simplifies various reconciliation processes. With its advanced technology and features, it provides users with a comprehensive solution to manage and reconcile financial transactions across multiple accounts, platforms, and devices.

This software offers various reconciliation functionalities, including credit-card reconciliation, bank reconciliation, account reconciliation, posting, holdings and trades reconciliation, intercompany reconciliation, and enhanced journal entries. It enables businesses to match and compare transactions, detect discrepancies, and resolve errors in a timely and efficient manner.

ReconART’s web-based architecture is a significant advantage, as it can be accessed and used from any device, such as laptops, desktops, tablets, and smartphones. Users can log in from anywhere and at any time, allowing them to stay on top of their finances and reconciliation processes at all times.

Apart from its reconciliation capabilities, ReconART provides seamless integration with various enterprise resource planning (ERP) systems, internal systems, and other platforms. This makes it a highly flexible and scalable solution that can be easily customized to meet the unique needs of different businesses.

Xero

Xero is a cloud-based financial management system that provides businesses with a variety of tools and functionalities to enhance their financial management efficiency. Its features make it easy to manage financial tasks such as bill payments, reimbursements, claiming expenses, tracking cash flow, and bank reconciliation.

One of the key features of Xero is its robust reconciliation tool, which simplifies the process of matching bank transactions with accounting records. Users can import transactions directly from their bank accounts, and the system automatically compares them with the records in Xero’s cashbook. Any discrepancies or differences in balances are presented to the user, allowing them to quickly identify and resolve issues.

Xero’s transaction matching process is automated, freeing up valuable time and resources that would otherwise be spent manually reconciling accounts. Additionally, the system allows users to grant access to clients, who can view the results of the reconciliation process directly, streamlining the accounting process even further.

Overall, Xero is a powerful and user-friendly financial management system that provides businesses of all sizes with a range of tools and functionalities to streamline their accounting processes and improve their financial management capabilities.

OneStream

OneStream offers a comprehensive suite of financial management solutions that cover financial close, compliance, reporting, account reconciliation, and transaction matching. To support these functions, the software provides a range of reporting and analytics tools. Instead of using spreadsheets for reconciliation, OneStream’s software offers a more efficient and accurate approach, replacing them entirely. The reconciliation tool is designed to maintain the precision and integrity of financial data while automating the reconciliation process. This empowers finance managers with a statistical view of the data, allowing them to make data-driven decisions. The software allows for easy updating of results as needed, while also keeping a complete audit trail. Additionally, it updates reconciliation results directly from bank accounts, enabling managers to view high-risk unreconciled transactions in a centralized location. Furthermore, alerts are triggered for any changes in the trial balance, streamlining the reconciliation process for managers.In conclusion, reconciling financial records is a critical task for any business, and it becomes even more challenging for large companies with high transaction volumes. Fortunately, there are specialized software solutions available that can help automate and streamline the reconciliation process, saving businesses time and reducing the risk of errors.

We have discussed five top reconciliation software solutions that are specifically designed for big companies. Each of these software solutions has its strengths and weaknesses, and businesses should carefully consider their specific needs before making a choice.

Ultimately, the right reconciliation software solution can make a significant difference in a company’s financial reporting, ensuring accuracy and reliability. By taking advantage of the latest reconciliation software technology, businesses can free up time and resources to focus on other critical areas of their operations, helping them to stay ahead of the competition and achieve their goals.