BankRec is a specialized software designed to streamline the bank reconciliation process. It efficiently matches transactions between bank statements and ledgers, creating an audit trail for easy analysis. Unmatched transactions are automatically carried forward for future reconciliation. The software offers both pre-built and customizable matching rules, allowing users to tailor the process to their specific needs. BankRec also provides insights into why transactions might not match, helping managers identify potential risks and prevent fraud.

Streamlining and optimizing the financial reconciliation process is essential for ensuring the accuracy and integrity of your financial data. While BankRec provides a solid foundation for reconciliation software, businesses seeking a more comprehensive and adaptable approach can unlock even greater efficiencies. This article explores several advanced reconciliation software alternatives designed to empower your finance team and elevate your financial close process.

Explore the comprehensive features of the alternatives highlighted in this article. By embracing advanced automation and customization capabilities, you can unlock a new era of efficiency, control, and data-driven decision-making within your organization.

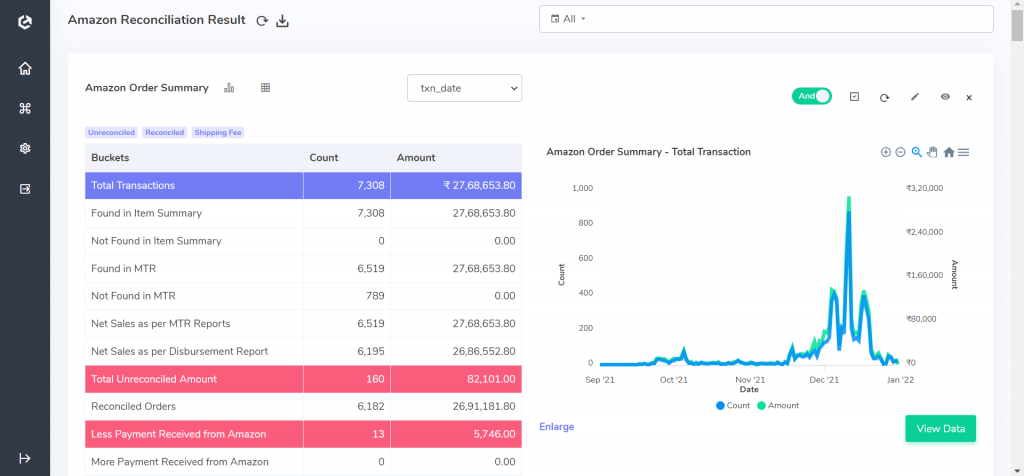

1.Cointab

Is the manual reconciliation process hindering your finance team’s efficiency and productivity? Cointab offers an automated solution designed to alleviate this burden, empowering your team to dedicate more time to strategic financial initiatives.

Key Features:

- Effortless Data Handling: Eliminate manual data entry with automated data loading from various file formats (XML, CSV, PDF, JSON). Schedule automatic uploads for a seamless, time-saving experience.

- Customization at Your Fingertips: Cointab adapts to your specific needs. Choose from a variety of file formats for uploading and exporting data, ensuring compatibility with your existing systems.

- Customizable Rules Engine: Define your own matching conditions using a custom rules engine tailored to your company’s unique business rules and policies, guaranteeing accurate reconciliation results.

- Actionable Insights: Gain clear and actionable insights through easy-to-interpret reports. Mismatched transactions are highlighted with graphs for analysis, allowing your team to prioritize tasks efficiently.

- Exception Handling: Maintain control with the ability to add exceptions for transactions requiring manual review and settlement.

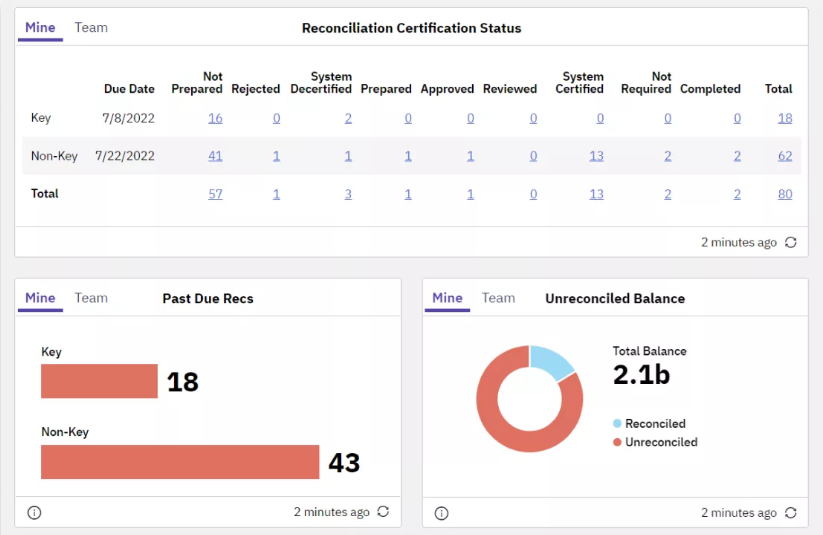

2. BlackLine:

BlackLine goes beyond basic reconciliation software. It’s a comprehensive financial close management solution that streamlines and automates the entire process, empowering your finance team to achieve greater efficiency and control.

Key Benefits of BlackLine Reconciliation:

- Enhanced Accuracy: Automated workflows and rule-based matching minimize human error and ensure the integrity of your financial data.

- Improved Collaboration: Standardized templates and workflows guide the reconciliation process, promoting seamless collaboration and clear communication within your team.

- Streamlined Process: BlackLine simplifies reconciliation with features like:

- Bulk Data Loading: Efficiently upload large datasets for quicker matching.

- Customizable Rules: Tailor the software to your specific needs by defining custom matching rules.

- Exception Handling: Easily address discrepancies and expedite resolution with exception adding capabilities.

- Real-Time Visibility: Gain instant access to reconciliation progress through a user-friendly, cloud-based dashboard, accessible from anywhere, anytime.

- Increased Transparency: Internal stakeholders have real-time visibility into the reconciliation process, fostering greater transparency and trust.

- Improved Controls: BlackLine maintains a complete audit trail, ensuring a clear record of all actions taken throughout the process.

- Scalability: The software can be configured to accommodate the needs of businesses of all sizes, allowing for easy adaptation as your organization grows.

Streamline your Financial Reconciliation Now!

Request a Demo!

3. ReconArt

Tired of manual reconciliation processes slowing down your finance team and hindering accuracy? ReconArt offers a powerful solution designed to streamline the process, automate repetitive tasks, and empower your team to achieve greater control.

Key Features:

- Automated Matching: Eliminate manual data entry and streamline reconciliation with automated matching powered by user-defined rules, intelligent algorithms, and reference data.

- Exception Management: Focus on what matters most. ReconArt automatically flags discrepancies for your team’s review, ensuring timely identification and resolution of any potential issues.

- Streamlined Workflow Management: Assign tasks, track progress, set reminders, and expedite resolution with user-friendly workflow management tools.

- Enhanced Data Integrity: Maintain confidence in your financial data with a robust audit trail that tracks all user actions and ensures data security through user permission controls.

- Versatility for Various Accounts: ReconArt caters to a broad range of reconciliation needs, supporting bank accounts, credit cards, general ledger accounts, and more.

- Seamless Integrations: Import data from various sources effortlessly. ReconArt integrates with a wide range of ERPs, banks, payment processors, and other financial systems, consolidating your data for centralized reconciliation.

- Scalability for All Businesses: ReconArt adapts to your needs. Whether you’re a small business or a large enterprise, the software accommodates large data volumes and diverse reconciliation requirements.

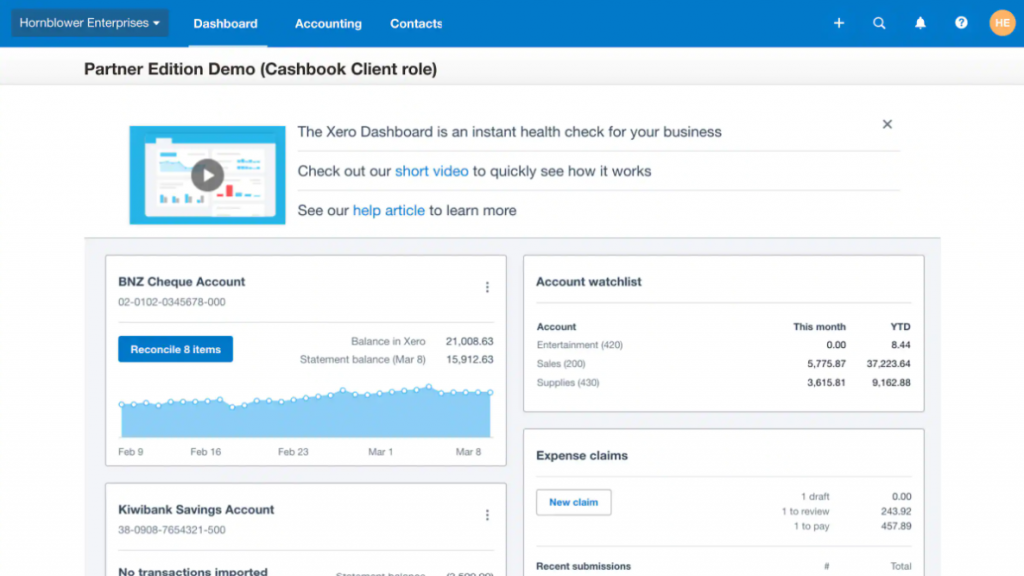

4. Xero

Managing daily financial transactions can be a time-consuming task. Xero’s bank reconciliation tool empowers you to streamline this process and gain valuable insights into your cash flow.

Key Features:

- Effortless Bank Account Integration: Import transactions directly from your bank accounts, eliminating manual data entry and saving valuable time.

- Simplified Matching: Match imported transactions with entries in your Xero ledger for quick and accurate reconciliation. Gain visual clarity on the reconciliation status with clear dashboards.

- Intelligent Automation: Leverage automatic transaction categorization, rule-based matching suggestions, and bulk reconciliation capabilities to expedite the process.

- Enhanced Reporting and Analysis: Gain deeper insights with metrics and graphs generated from your reconciliation results. Utilize these reports to support informed financial decisions.

- Seamless Integration: Reconcile transactions seamlessly while accessing and managing your cash flow through other integrated Xero services like the Xero cashbook.

5. Onestream

OneStream goes beyond basic reconciliation software. It’s a comprehensive financial platform that includes a robust reconciliation tool designed to streamline the process, empower informed decision-making, and ensure data integrity.

Key Benefits of OneStream Reconciliation:

- Effortless Matching: Eliminate time-consuming spreadsheets and manual data entry. OneStream automates transaction matching, analysis, and reporting for a seamless and efficient process.

- Data-Driven Insights: Gain valuable insights from your reconciliation data. OneStream provides managers with a statistical view of financial information, empowering them to analyze trends, identify potential issues, and make informed financial decisions.

- Enhanced Security and Control: Maintain complete control over your financial data. OneStream maintains a comprehensive audit trail that tracks all changes to the reconciliation process. Additionally, import data directly from your bank accounts for a centralized view of your finances, including high-risk transactions.

- Real-Time Monitoring: Stay informed with built-in alert features that notify you of any changes to the trial balance, ensuring you never miss a critical update.

Choosing the Perfect Reconciliation Partner: A Strategic Decision

Selecting the ideal reconciliation software isn’t a one-size-fits-all proposition. By carefully evaluating the strengths and weaknesses of various solutions presented here, alongside a clear understanding of your specific business needs and goals, you can make an informed decision that optimizes your financial close process.