Reconciliation – the act of comparing financial records for accuracy – is a crucial yet tedious task for businesses of all sizes. Manual reconciliation consumes valuable time and resources, while also introducing the risk of human error. To combat these challenges, many businesses are turning to automated reconciliation software.

With a variety of reconciliation software options flooding the market, selecting the ideal solution for your business can be overwhelming. This article delves into two popular options: Cointab and Xero. Let’s explore their features, similarities, and key differences to empower you to make an informed decision.

Shared Focus on Automation:

Both Cointab and Xero aim to streamline reconciliation by automating repetitive tasks. These features free up your finance team’s time for more strategic initiatives, while also minimizing errors and improving efficiency.

Cointab

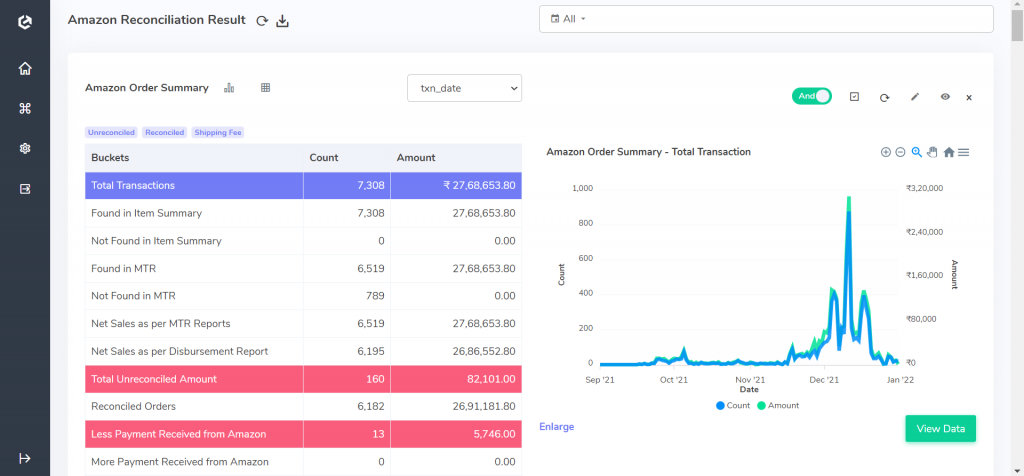

Cointab revolutionizes the reconciliation process for businesses seeking a customizable and automated solution. This software empowers your finance team to achieve superior efficiency and data accuracy.

Effortless Data Management:

- Automated Data Loading: Eliminate manual data entry and streamline workflows. Cointab seamlessly integrates with various platforms (SFTP, API, email) to automatically load data regardless of file format (PDF, CSV, XLSX).

- Customizable Matching Rules: Ensure precise data matching tailored to your specific business needs. Cointab’s user-defined rules engine empowers you to configure logic conditions that perfectly align with your unique accounting policies and processes.

Streamlined Efficiency for Your Finance Team:

- Automated Reconciliation Scheduling: Free your team from manual setup tasks. Schedule reconciliations to run automatically in real-time, hourly, weekly, or monthly – guaranteeing results are always readily available.

- Customized Report Generation: Gain clear and actionable insights with customizable report views. Cointab allows you to select specific data fields, columns, and even export formats to match your reporting requirements.

- Detailed Transaction Visibility: Dive deeper into individual transactions for a comprehensive understanding. Cointab provides a centralized view of all relevant details for a specific transaction across various reports, eliminating the need to navigate multiple sources.

Cointab goes far beyond basic bank reconciliation, offering a comprehensive solution for automating various processes:

- Payment gateway reconciliation

- Bank reconciliation

- Cash-on-delivery (COD) remittance reconciliation

- Marketplace reconciliation (Amazon, Flipkart, Myntra, and many more)

- Fee verification

- Enterprise Resource Planning (ERP) reconciliation

- Order Management System (OMS) reconciliation

Xero

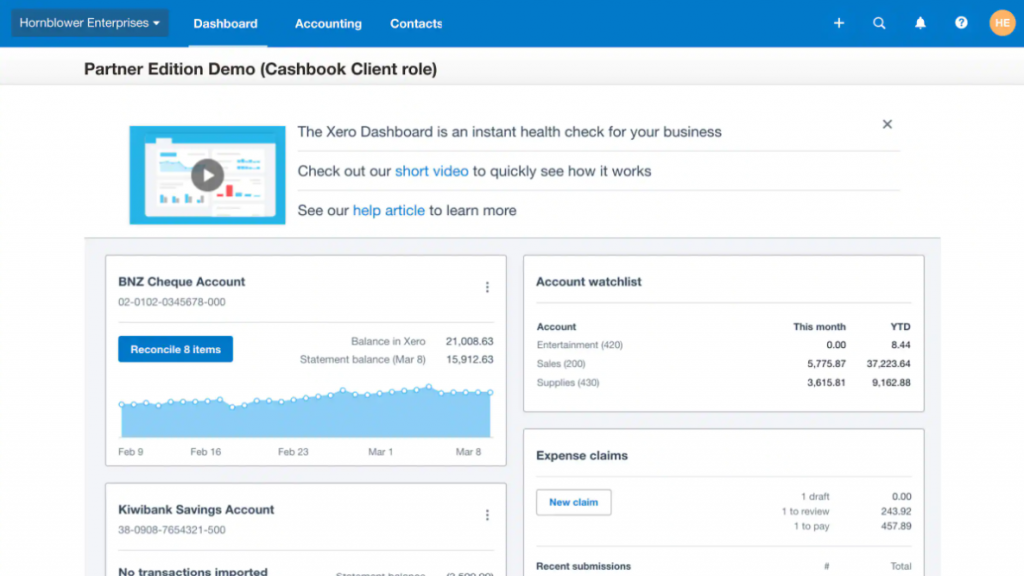

Xero positions itself as a comprehensive financial accounting software, managing various daily tasks beyond just reconciliation. It offers a suite of services encompassing bill payments, expense claims, payment acceptance, project tracking, payroll processing, and of course, bank reconciliation. Additionally, Xero provides accountant and bookkeeper-specific tools like Xero HQ, cashbook, ledger, and a practice manager.

Focusing on Bank Reconciliation:

While Xero offers a broader range of accounting functionalities, let’s delve specifically into its bank reconciliation capabilities:

- Direct Bank Feed and Reconciliation: Xero simplifies the process by directly importing transactions from your bank account. These imported transactions are then automatically reconciled with your Xero cashbook, ensuring your records are up-to-date.

- Mobile App Convenience: Xero prioritizes user convenience by offering a mobile app for on-the-go bank reconciliation capabilities.

- Suggested Matches and Automation: Xero leverages intelligent automation to streamline reconciliation. The software suggests potential matches for transactions and automatically categorizes them, minimizing manual effort. Additionally, Xero can apply user-defined rules for further automation.

- Enhanced Data Matching: Xero offers flexibility by allowing you to match bank transactions with invoices, bills, or even create entirely new transactions directly within your cashbook, ensuring accurate record-keeping. Settlements can also be added for complete reconciliation.

By leveraging Xero’s bank reconciliation tools, you can:

- Maintain Accurate Records: Minimize errors and discrepancies through automated data import and matching.

- Save Time: Streamline the reconciliation process with features like suggested matches and mobile app access.

- Gain Real-Time Insights: Access up-to-date reconciled data for informed decision-making.

Choose the reconciliation tool that suits your needs

Xero and Cointab, while both reconciliation powerhouses, target different businesses. Xero, ideal for SMBs with its accounting suite, simplifies bank reconciliation. Cointab tackles a wider range of reconciliations (marketplace, ERP) and scales for larger businesses. Choose Xero for basic bank reconciliation and a broader accounting suite, or Cointab for robust reconciliation across platforms.

By carefully considering these factors, you can make an informed decision and select the reconciliation automation tool that aligns best with your organization’s unique needs, driving efficiency, accuracy, and financial control.

To learn more about Cointab and how it can streamline your reconciliation processes, visit www.cointab.net.