Cred is an app used to pay Credit card bills as we all know. Cred offers its users a top-notch experience when it comes to easily pay their bills and also offers multiple offers and rewards while doing so. Due to this Cred has quite a large user base. Cred utilizes this user base by offering sellers a marketplace on its platform. By doing so Cred offers sellers a great reach to sell their products. Cred also offers various other services as a marketplace which are of great use to sellers to sell their products and grow their business.

For offering such services, Cred charges sellers some fees for every order a seller sells using its marketplace. Cred deducts these charges from the net sale of the product and then settles the amount with the seller. Since a business sells several products daily, keeping track of and verifying these charges and payments becomes a hassle. This process is very important to a business to know the charges are levied correctly and payments are done accurately.

A solution created by Cointab can be quite useful in this situation. Because of how fast and easily this system handles all of these data management and handling responsibilities. The system calculates, verifies, and systematically displays the results once the data has been uploaded. This outcome is very simple to read and comprehend. Then, all that is required of a corporation is to analyze this data and correct any errors or discrepancies.

REQUIRED FILES:

- Cred Payment Files

- Cred Refund Files

- EasyEcom

- Shopify

- Fee Card

Configuration Process:

At first, we take the Cred Payment and refund files and create a master file containing data from these two files. We then look up the data in the client’s OMS that needs verification. The system takes the amount and calculates the net amount from the payments and refunds. The system then reconciles the data and shows the differences in the net transaction amounts from the OMS and Cred reports respectively.

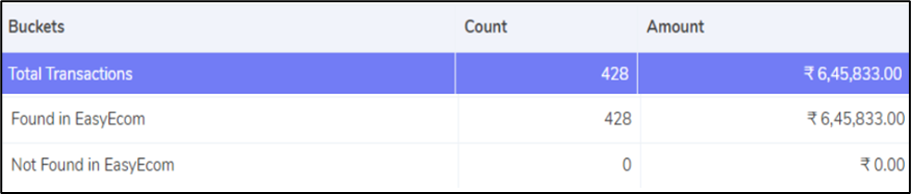

The Following Summary is created:

- Found in EasyEcom

- The data received from EasyEcom is compared to the Cred Master file. The data that matches between these two files are recorded as Found in EasyEcom.

- Missing in EasyEcom

- The data received from EasyEcom is compared to the Cred Master file. The data found in the master file but missing in the EasyEcom is recorded here.

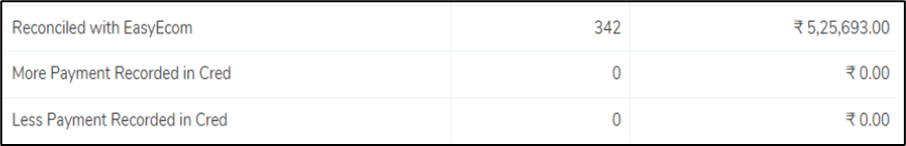

Payment Reconciliation with EasyEcom (OMS)

- Reconciled with EasyEcom

- Here the system compares the transaction amounts between the reports from Cred and the client’s OMS. If there is no difference between these amounts. It is recorded as Reconciled.

- More Payments Recorded in Cred

- Here the system Compares the transaction Amounts between the reports from Cred and the client’s OMS. If the recorded amount is more than the OMS amount, it is then recorded as More payment recorded in Cred.

- Less Payment Recorded in Cred

- Here the system Compares the transaction Amounts between the reports from Cred and the client’s OMS. If the recorded amount is less than the OMS amount, it is then recorded as Less payment recorded in Cred.

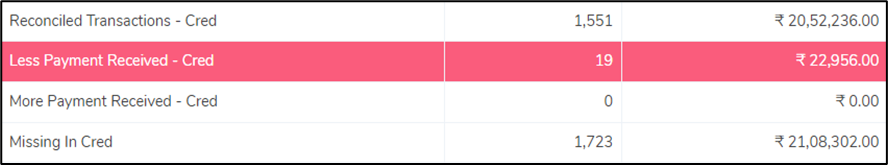

EasyEcom vs Cred Reconciliation

- Reconciled Transaction – Cred

- Here the system Compares the transaction Amounts between the client’s OMS reports and the Cred reports. If there is no difference between these amounts. It is recorded as Reconciled.

- Less Amount received – Cred

- Here the system Compares the transaction Amounts between the client’s OMS reports and the Cred reports. If the OMS amount is more than the recorded amount, it is then recorded as More payment recorded in Cred.

- More Amount received – Cred

- Here the system Compares the transaction Amounts between the client’s OMS reports and the Cred reports. If the OMS amount is less than the recorded amount, it is then recorded as Less payment recorded in Cred.

- Missing In Cred

- If the amount is found in the client’s OMS system but not found in Cred reports it is highlighted as missing in Cred.

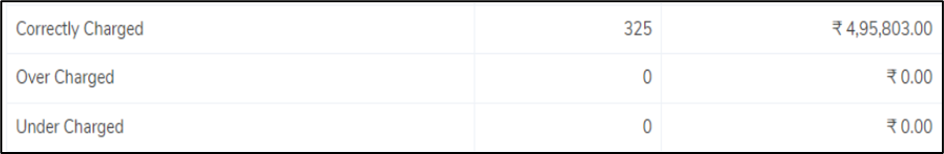

Charge Verification:

Here we verify the charges charged by Cred with the charges expected to be charged by them. Calculation of these charges is done by the system based on the rates provided by Cred. Which is mentioned in the contract discussed between the seller and Cred. After this calculation, the calculated fees are compared with the fees charged by Cred and displayed.

The result is as follows:

- Correctly Charged

- The system compares the applied charged amount and expected charged amount based on the rate card. If the fees are correctly matching it is recorded as correctly charged.

- Cred – Over Charged

- The system compares the applied charged amount and expected charged amount based on the rate card. If the charged fee is greater than the expected fee, we consider it overcharged.

- Cred – Under Charged

- The system compares the applied charged amount and expected charged amount based on the rate card. If the charged fee is less than the expected charge, we consider it Undercharged.

This is the overall process Cointab does to reconcile a company’s data. As per the results, we can see how easy to read and use this system can be. If you want to automate your Cred Reconciliation and make this process of verification and reconciliation easy, Contact Us.